New Delhi: The Supreme Court rejects MSME plea to entertain a petition by micro, small, and medium enterprises challenging a rule under the Income Tax Act that restricts them from extending credit to buyers beyond 45 days.

Background

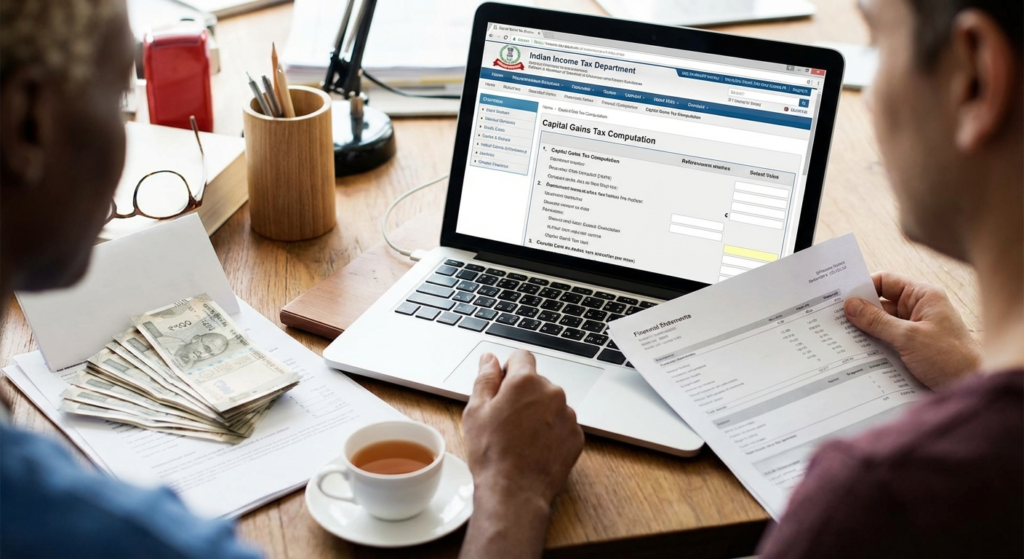

Section 43B(h) of the Income Tax Act is aimed at regulating credit extension practices among MSMEs. This rule ensures timely payments and addresses working capital shortages in the sector. According to this provision, if an MSME registered under the Micro, Small, and Medium Enterprises Development Act, 2006 (MSMED Act) allows a credit period of over 45 days to a buyer when selling goods or services, it faces penalties. These penalties include compounded interest penalties at three times the bank rate set by the Reserve Bank of India (RBI). Moreover, businesses risk losing the ability to deduct payments made to MSMEs from their taxable income.

Concerns Raised

Some MSMEs have expressed concerns that this provision might lead larger buyers to bypass small and medium suppliers and instead opt to purchase from unregistered enterprises. The Federation of All India Vyapar Mandal filed a plea on behalf of the MSMEs. However, the apex court allowed them to withdraw the petition and approach the high court.

In February, the Confederation of All India Traders (CAIT) representatives met finance minister Nirmala Sitharaman. They requested a one-year postponement of the clause’s implementation until April 2025. CAIT expressed support for the government’s decision, emphasizing the importance of ensuring timely payments to the MSME sector within 45 days to maintain uninterrupted cash flow for traders.

Court’s Decision

The Supreme Court declined to hear the challenge by MSMEs against Section 43B(h) of the Income Tax Act. The court maintained that the rule aims to regulate credit practices in the MSME sector and ensure timely payments to address working capital issues these businesses often face. The petitioners argued that this rule could lead larger buyers to avoid registered small suppliers and instead purchase from unregistered enterprises to bypass the 45-day limit. However, the Supreme Court declined to admit the petition challenging Section 43B(h), thus keeping the tax provision in force.

Conclusion

The government’s objective behind the 45-day credit limit is to improve MSME working capital by discouraging delays in payments from buyers. However, some businesses argue that this provision imposes excessive regulatory restrictions. The court’s decision not to hear the challenge means that Section 43B(h) of the Income Tax Act remains in effect, requiring MSMEs to adhere to the 45-day payment rule to claim tax benefits.

Please Rate this post

Click to rate