Introduction to GST Registration in 2026

The Goods and Services Tax (GST) has fundamentally transformed the Indian economic landscape by unifying various indirect taxes into a single, streamlined system. As we move into 2026, the digital infrastructure supporting this tax regime has become more robust, making it essential for every entrepreneur to understand how to register for GST online in India. Whether you are a startup founder, a freelancer, or an established business owner expanding into new territories, obtaining a GST Identification Number (GSTIN) is the first step toward formalizing your operations and unlocking a world of nationwide trade opportunities.

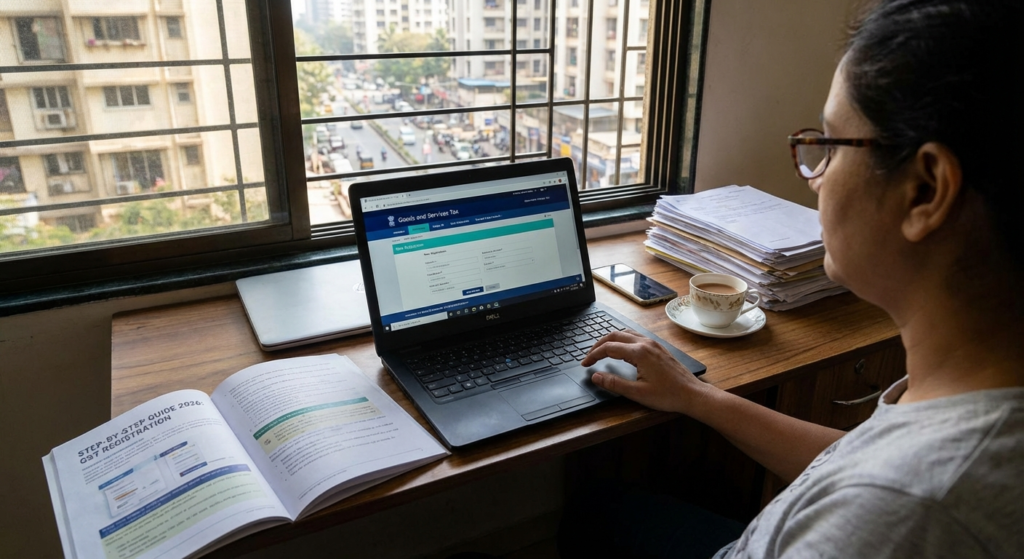

In the current fiscal environment, the government has simplified the interface of the GST portal to encourage compliance. However, the legal nuances remain stringent. Navigating the portal requires precision, as even a minor discrepancy in your documentation can lead to delays or rejection. This guide provides a comprehensive, expert-backed roadmap to ensure your registration process is smooth, compliant, and efficient.

Understanding the GST Framework in 2026

Before diving into the technicalities, it is vital to understand who is mandated to register. The thresholds for GST registration have evolved to accommodate small-scale industries while ensuring that significant revenue-generating entities are within the tax net. Generally, businesses with an annual turnover exceeding ₹40 lakhs (for goods) or ₹20 lakhs (for services) must register. For North-Eastern and hill states, these limits are often lower, typically ₹10 lakhs.

Beyond turnover, certain categories of taxpayers must register regardless of their income. This includes e-commerce aggregators, casual taxable persons, and those involved in inter-state supply. If you are just starting out, you might also want to register a small business in India to ensure you have the legal standing required for professional tax compliance.

Preparing for How to Register for GST Online in India

Preparation is the cornerstone of a successful GST application. The most common cause for application rejection is the submission of invalid or blurred documents. To avoid this, you must compile a digital dossier of all necessary credentials. The GST portal operates on a zero-tolerance policy for data mismatch; ensure that the name on your PAN card exactly matches the name on your Aadhaar and bank records.

In 2026, the integration between the Income Tax department and the GST portal has become seamless. This means that your PAN details are verified in real-time. If you find the process daunting, seeking professional GST Registration Services can save you significant time and prevent potential legal hurdles down the line.

Technical Prerequisites for How to Register for GST Online in India

To initiate the process, you need a stable internet connection and access to the official GST Common Portal. Additionally, for companies and LLPs, a Class 2 or Class 3 Digital Signature Certificate (DSC) is mandatory for signing the application. Sole proprietors can generally use the Aadhaar-based e-KYC (e-Sign) method, which is much faster and more cost-effective.

Identity Proofs

PAN Card of the business and the authorized signatory. Aadhaar cards are essential for the e-KYC verification process to avoid physical visits.

Address Proof

Electricity bill, rent agreement, or property tax receipt for the principal place of business. A No Objection Certificate (NOC) is required if the premises are rented.

Bank Details

A cancelled cheque or a bank statement clearly showing the account holder’s name, branch details, and IFSC code for future tax refunds.

Business Constitution

Partnership deed, Incorporation certificate, or Registration certificate under various statutes depending on the business type.

Detailed Steps on How to Register for GST Online in India

The registration process is divided into two distinct phases: Part A and Part B. Understanding this distinction is crucial for managing your time effectively, as Part A generates a Temporary Reference Number (TRN) that is valid for 15 days.

Phase 1: Generating the TRN (Part A)

- Navigate to the GST Portal and select ‘New Registration’ under the Services tab.

- Select ‘Taxpayer’ as your user type and enter your legal name as per PAN.

- Input your PAN, email address, and mobile number.

- Verify the details using the One-Time Passwords (OTPs) sent to your mobile and email.

- Upon successful verification, you will receive a 15-digit TRN.

Phase 2: Filling the Main Application (Part B)

Once you have the TRN, log back into the portal to complete the detailed application. This is where you provide specific business details, including your trade name, constitution of business, and the date of commencement. You will also need to specify the reasons for liability to register (e.g., crossing the threshold or voluntary registration).

One of the most critical sections is the ‘Principal Place of Business.’ You must upload clear scans of your address proof here. If your business operates from multiple locations within the same state, you can add ‘Additional Places of Business’ in the subsequent tabs. Finally, you will need to list the top 5 goods or services your business deals with, using their respective HSN or SAC codes.

Verification Step

After filling all fields, navigate to the ‘Verification’ tab. Check the declaration box and select the authorized signatory. Sign the form using DSC or EVC.

ARN Generation

Once submitted, an Application Reference Number (ARN) is generated. This allows you to track the status of your application on the portal dashboard.

Why You Should Know How to Register for GST Online in India

Registering for GST is not just about legal compliance; it is a strategic business move. In the modern Indian economy, many large-scale corporations refuse to deal with unregistered vendors because they cannot claim Input Tax Credit (ITC) on purchases made from them. By registering, you become part of a transparent supply chain, making your business more attractive to B2B clients.

Furthermore, GST registration allows you to legally collect tax from your customers and pass on the credit of the taxes you paid on your inputs. This reduces the “cascading effect” of taxes—essentially tax on tax—which lowers the overall cost of your products or services. According to the Central Board of Indirect Taxes and Customs (CBIC), the GST regime has significantly improved the ease of doing business by replacing multiple complex levies with a single destination-based tax.

Common Hurdles When Learning How to Register for GST Online in India

Despite the digital-first approach, many applicants face “Show Cause Notices” (SCN) from tax officers. The most frequent reason is the submission of illegible documents. For instance, if an electricity bill is uploaded where the address is not clearly visible or does not match the application exactly, the officer will likely raise a query. You usually have 7 working days to respond to an SCN with the rectified information.

Another hurdle is the jurisdictional mapping. Selecting the wrong ward or circle can lead to administrative delays. It is imperative to use the ‘Know Your Jurisdiction’ tool on the GST portal to identify the correct office based on your business’s pin code.

Post-Registration Responsibilities

Once your GSTIN is granted, your journey has just begun. You are now required to issue GST-compliant invoices. Each invoice must contain your GSTIN, the customer’s GSTIN (if registered), a unique invoice number, and the breakdown of CGST, SGST, and IGST. Furthermore, you must file regular returns (GSTR-1 and GSTR-3B) even if you have zero business activity during a particular month. Failure to file returns leads to heavy late fees and the eventual blocking of your E-Way Bill generation facility.

Conclusion

Mastering how to register for GST online in India is a vital milestone for any business operating in 2026. While the process is designed to be user-friendly, the precision required in documentation and data entry cannot be overstated. By following this guide, you ensure that your business starts on the right side of the law, ready to scale and contribute to the national economy. Remember, GST is more than just a tax; it is a digital identity that validates your business’s credibility in the eyes of the government, partners, and customers alike.

“The implementation of GST is a testament to India’s commitment to a ‘One Nation, One Tax’ philosophy, fostering a more competitive and organized market for everyone.”

FAQs

No, it is mandatory only if your annual turnover exceeds the prescribed limits (₹40L/₹20L) or if you engage in inter-state supply, e-commerce, or other specific categories defined by the government.

Typically, if the documents are in order and no clarification is sought, the GSTIN is granted within 7 to 10 working days after the ARN is generated.

You must have a physical ‘Principal Place of Business.’ If you work from home, you can use your residential address, provided you have the necessary electricity bill and an NOC from the owner.

Offenders may face a penalty of 10% of the tax amount due, subject to a minimum of ₹10,000. In cases of intentional tax evasion, the penalty can be as high as 100% of the tax amount.

Yes, you can file an ‘Amendment of Registration’ for core and non-core fields. Core fields like business name or address require approval from a tax officer, while non-core fields are updated instantly.

Read Also:

- ROC Annual Filing 2026: Understanding the Critical AOC-4 MGT-7 Filing Due Date 2026 and Penalty Structure

- Will Paytm Payments Bank Banned: There is turmoil after RBI’s move

- FCRA Registration for NGOs: Eligibility and Application Process

- How to Change Business Address in GST Registration Online: The Definitive Guide