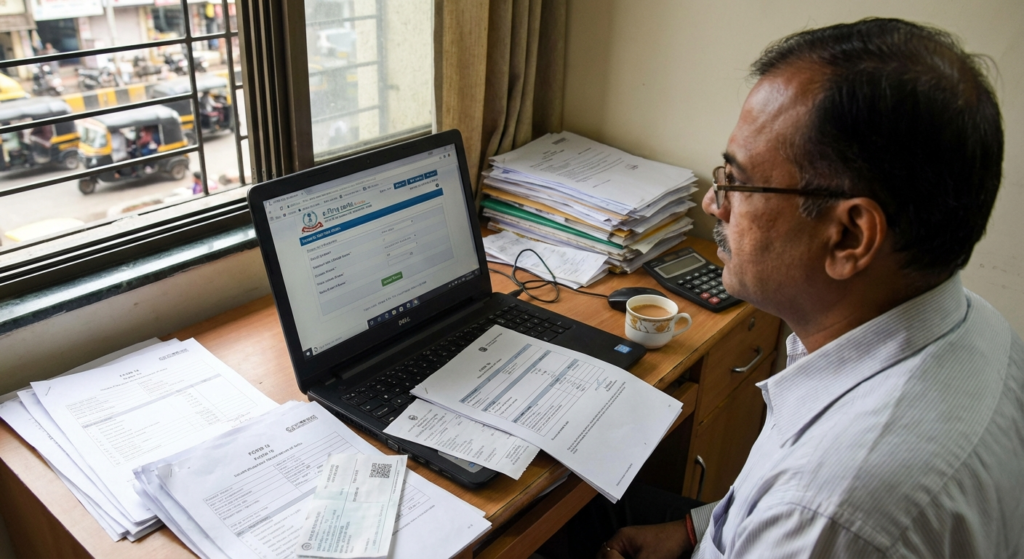

Navigating the complex landscape of indirect taxation in India requires a solid understanding of the gst return filing process. For business owners, chartered accountants, and tax professionals, ensuring timely and accurate compliance is not just a legal obligation but a cornerstone of financial health. Since the implementation of the Goods and Services Tax (GST), the government has streamlined the workflow, yet many still find the intricacies of the portal and the frequency of returns challenging.

Whether you are a seasoned entrepreneur or a startup founder, mastering the gst return filing process is essential to avoid cascading tax liabilities, penalties, and blocked working capital. This comprehensive guide will walk you through the nuances of filing your returns, the types of forms involved, and the best practices to maintain a pristine compliance record.

Understanding the Basics of the GST Return Filing Process

The gst return filing process is the mechanism by which a taxpayer furnishes details of their income, sales, expenses, and purchases to the tax administrative authorities. Under the GST regime, a registered dealer is required to file specific returns based on the nature of their business and their turnover. This digital-first approach ensures transparency and allows the government to track the flow of goods and services across the economy.

At its core, the process involves declaring your outward supplies (sales) and inward supplies (purchases) to calculate the net tax liability. Once the liability is determined, you offset it against the Input Tax Credit (ITC) available to you and pay the balance to the government.

Types of GST Returns

To navigate the gst return filing process effectively, you must identify which forms apply to your business structure. Here is a visual breakdown of the most common return types:

GSTR-1

Purpose: Reporting details of outward supplies (Sales).

Frequency: Monthly or Quarterly (based on turnover).

Key Action: Uploading invoice-wise details of sales to registered dealers and consolidated details for unregistered dealers.

GSTR-3B

Purpose: Summary return for self-declaration of tax liability.

Frequency: Monthly.

Key Action: Summarizing sales, claiming ITC, and making the final tax payment.

GSTR-9

Purpose: Annual Return.

Frequency: Annually.

Key Action: Consolidating all monthly/quarterly returns filed during the financial year.

Step-by-Step Guide to the GST Return Filing Process

Executing the gst return filing process correctly requires attention to detail. A single mismatch between your GSTR-1 and GSTR-3B can lead to notices from the department. Before you begin, ensure you have your digital signature certificate (DSC) ready and valid login credentials for the GST Common Portal.

If you are new to this ecosystem, it is vital to first ensure your business is legally recognized. You can read more about the GST registration process guide to ensure your foundations are strong.

Prerequisites for a Seamless GST Return Filing Process

Before diving into the portal, ensure you have the following:

- Valid GSTIN: Your 15-digit Goods and Services Tax Identification Number.

- Invoices: Organized data of B2B and B2C sales.

- Input Tax Credit Data: Details of purchases and tax paid on them.

- Active Bank Account: For net banking payments.

Follow these steps to complete the cycle:

- Login to the GST Portal: Visit the official GST Portal. Enter your username, password, and the captcha code.

- Navigate to the Return Dashboard: Once logged in, go to the ‘Services’ tab, select ‘Returns’, and click on ‘Returns Dashboard’. Select the financial year and the return filing period.

- Prepare GSTR-1 (Outward Supplies):

- Click on the GSTR-1 tile.

- You can either prepare the return online by entering invoices manually or use the offline utility to upload a JSON file generated from your accounting software.

- Verify the data, submit the form, and file it using DSC or EVC (Electronic Verification Code).

- Review Auto-Populated GSTR-2A/2B: These are read-only forms that auto-populate based on the GSTR-1 filed by your suppliers. Reviewing this is a critical part of the gst return filing process to ensure you are claiming the correct Input Tax Credit.

- File GSTR-3B (Monthly Summary):

- Navigate to the GSTR-3B tile.

- The values for outward supplies may auto-populate from your GSTR-1.

- Enter details of inward supplies liable to reverse charge and eligible ITC.

- The system will calculate your tax liability.

- Payment of Tax: If your tax liability exceeds your available ITC, you must pay the balance via Challan (Net Banking, NEFT/RTGS, or OTC).

- Final Submission: Once the liability is offset, click on ‘File GSTR-3B’ to complete the process.

Common Mistakes to Avoid in the GST Return Filing Process

Even with a streamlined digital interface, errors occur. Minimizing these errors is vital for maintaining a good compliance rating.

1. Incorrect Invoice Data: Entering the wrong GSTIN of the receiver in GSTR-1 is a frequent error. This prevents the receiver from claiming ITC, leading to commercial disputes. Always double-check GSTINs.

2. Mismatch Between GSTR-1 and GSTR-3B: The tax liability declared in GSTR-1 (Sales return) must match the liability paid in GSTR-3B. Significant deviations can trigger data analytics flags within the GST department’s system, leading to scrutiny.

3. Categorizing Zero-Rated Supplies Incorrectly: Exports and SEZ supplies must be categorized correctly to avail of relevant exemptions or refunds.

If your business has had no transaction during a specific month, you are still required to file. Ignoring this is a common mistake. For such scenarios, refer to our comprehensive nil GST return guide to handle zero liability compliance easily.

Penalties for Delaying the GST Return Filing Process

The government enforces strict timelines to ensure discipline in the tax regime. Delaying the gst return filing process attracts late fees and interest.

Late Fees

For GSTR-1 and GSTR-3B, the late fee is typically ₹50 per day (₹25 CGST + ₹25 SGST) for regular returns. For Nil returns, it is reduced to ₹20 per day. The maximum cap varies based on turnover.

Interest on Late Payment

If you delay the tax payment associated with the return, an interest of 18% per annum is levied on the net tax liability (tax to be paid in cash) from the due date until the date of payment.

Furthermore, if you fail to file returns for two consecutive tax periods, your E-Way Bill generation facility may be blocked, paralyzing your ability to move goods. In severe cases, the GST registration itself can be cancelled by the proper officer.

Benefits of a Timely GST Return Filing Process

Adhering to the schedule is not just about avoiding punishment; it offers tangible business benefits. A seamless gst return filing process enhances your business’s credibility.

- Better Credit Score: Banks and NBFCs rely heavily on GST returns to assess the creditworthiness of a business when processing loan applications.

- Seamless Input Tax Credit: When you file on time, your suppliers see you as a compliant partner. Similarly, your timely filing ensures your customers get their ITC on time, fostering better business relationships.

- Avoidance of Litigation: Regular compliance reduces the risk of audits, scrutiny assessments, and legal notices from the Central Board of Indirect Taxes and Customs (CBIC).

Automating Your GST Compliance

As businesses grow, manual filing becomes prone to errors. Many enterprises are now moving towards GST Suvidha Providers (GSPs) and specialized accounting software that automates the gst return filing process. These tools can directly fetch data from your ERP, validate it against GST rules, identify mismatches in ITC, and upload returns in bulk.

Conclusion

The gst return filing process is the backbone of the Indian indirect tax system. While it may seem repetitive, it serves as a critical check on the financial transparency of your business. By understanding the types of returns, adhering to the step-by-step filing procedure, and ensuring data accuracy, you can turn a mandatory compliance activity into a strategic advantage. Remember, in the world of tax, consistency is key. Stay updated with the latest notifications, file on time, and keep your business growing without regulatory hurdles.

Frequently Asked Questions (FAQs)

No, the current GST return filing process does not allow for the revision of returns once they are filed. However, any errors made in a previous month’s return can be rectified in the return of the subsequent month under the appropriate tables.

If you miss the due date, you will be liable to pay a late fee for every day of delay. Additionally, you must pay interest at 18% per annum on the outstanding tax liability. You cannot file the subsequent month’s return until the previous one is cleared.

Yes. Composition dealers have a simplified process. They are required to file Form CMP-08 quarterly to declare details of payment and GSTR-4 annually, unlike regular dealers who file GSTR-1 and GSTR-3B monthly or quarterly.

Yes, filing is mandatory even if there is no business activity. In this case, you must file a ‘Nil Return’ to inform the government that you have no liability for that period.

You primarily need details of outward supplies (sales invoices), inward supplies (purchase invoices), debit/credit notes, and details of tax payments. You do not need to upload physical scanned copies of invoices, but the data must be entered accurately.