Understanding the Mandate: Why Director KYC Filing is Essential

In the evolving landscape of corporate governance, transparency and accountability are paramount. For every individual holding a Director Identification Number (DIN) in India, an annual compliance requirement stands as a non-negotiable mandate: the Director KYC filing.

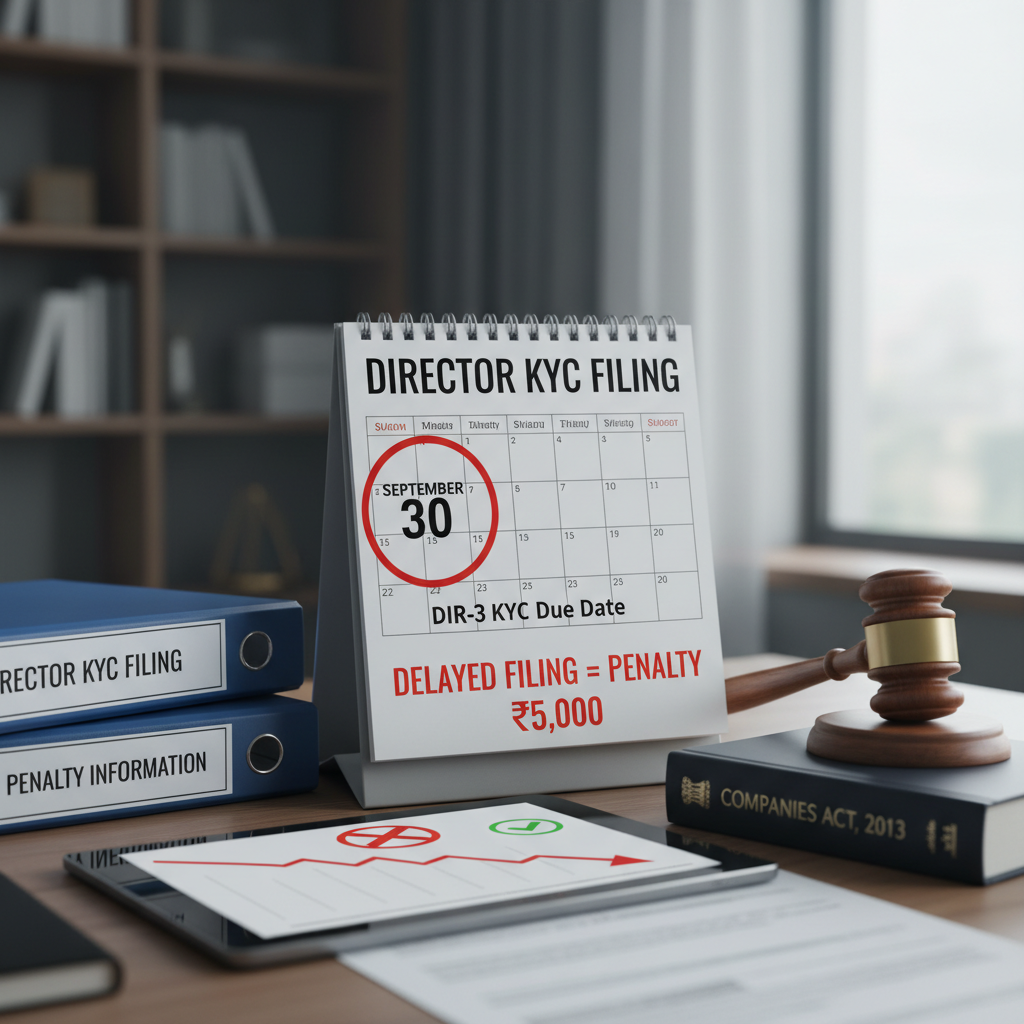

This filing, executed through the DIR-3 KYC form, ensures that the Ministry of Corporate Affairs (MCA) maintains an updated and verified database of all directors. Failing to adhere to the designated DIR-3 KYC filing due date and penalty provisions can lead to significant operational hurdles and financial repercussions for both the director and the associated company.

This comprehensive guide delves into the specifics of the DIR-3 KYC requirement, focusing on the anticipated deadlines and consequences for the 2026 compliance cycle, ensuring you remain compliant and avoid the steep late fees.

Who Needs to File DIR-3 KYC?

The requirement applies universally to all individuals who have been allotted a DIN, irrespective of whether they are currently active directors in a company or not. Even if a DIN holder is disqualified or has resigned, the annual KYC process must still be completed to keep the DIN active in the MCA records. This mandate is crucial for maintaining the integrity of corporate data.

The Critical DIR-3 KYC Filing Due Date and Penalty 2026

The annual compliance cycle for DIR-3 KYC generally follows a consistent pattern. Understanding this timeline is the first step toward proactive compliance planning and avoiding the heavy financial burden associated with non-filing.

The standard annual deadline for filing the DIR-3 KYC form is September 30th of every financial year. Therefore, for the compliance cycle relevant to the year 2026, directors must ensure their submission is completed on or before September 30, 2026.

Standard Due Date

The deadline for annual DIR-3 KYC submission is consistently September 30th.

Applicable Form

Existing directors who have already filed the e-form once can utilize the simplified DIR-3 KYC Web service.

Filing Fee (Timely)

If filed on or before the September 30th deadline, there is generally no government fee applicable.

Navigating the Consequences: DIN Deactivation and Steep Penalties

The consequences of missing the DIR-3 KYC filing due date and penalty structure are severe and designed to ensure strict adherence to the mandate. The MCA takes a firm stance on non-compliance, primarily through the deactivation of the Director Identification Number.

What Happens When the Deadline is Missed?

If a director fails to submit the DIR-3 KYC form by September 30th, the MCA marks the associated DIN as ‘Deactivated due to Non-filing of DIR-3 KYC’. This deactivation has immediate and profound effects:

- Inability to File: The director will be unable to sign and file any documents, returns, or forms with the MCA, crippling the company’s ability to maintain its annual compliance.

- Disqualification Risk: While not immediate disqualification, a deactivated DIN significantly complicates the director’s status and raises red flags regarding compliance history.

- Penalty Imposition: To reactivate the DIN, the director must file the overdue DIR-3 KYC form along with a substantial late fee.

The Penalty for Late DIR-3 KYC Filing

The penalty for late filing is standardized and significant. There is no slab-based system; instead, a fixed late fee is imposed for any submission made after the due date. This fee must be paid before the DIN can be reactivated.

The prescribed penalty for filing DIR-3 KYC after the due date is currently ₹5,000.

This penalty is mandatory and must be paid online upon submission of the delayed form. Compared to the zero government fee for timely submission, this steep fine serves as a powerful incentive for proactive compliance. As one expert noted, “Corporate compliance is not just about avoiding penalties; it’s about ensuring the legitimacy and operational continuity of the entity. The ₹5,000 late fee is a direct cost to negligence.”

Step-by-Step Guide to the DIR-3 KYC Online Filing Process

The process for filing DIR-3 KYC has been streamlined by the MCA, although it requires precision and the involvement of a certified professional. Directors must differentiate between the e-form (DIR-3 KYC) and the web-based service (DIR-3 KYC Web).

Distinction Between DIR-3 KYC eForm and Web Service

DIR-3 KYC eForm (Mandatory for First-Time Filers)

- Required for directors filing DIR-3 KYC for the first time or those updating personal details (e.g., address, passport number).

- Requires a Digital Signature Certificate (DSC) and professional attestation (CA/CS/CWA).

- Involves uploading identity and address proof documents.

DIR-3 KYC Web (Simplified Annual Update)

- Used by directors who have already submitted the e-form previously and have no changes in their personal details (mobile, email, address).

- Completed entirely online via the MCA portal without the need for DSC or professional attestation.

- Faster and less documentation-intensive, provided all details remain the same.

Key Prerequisites for Filing

Before initiating the filing process, ensure you have the following ready:

- Valid DIN: The Director Identification Number must be active.

- Personal Mobile Number and Email ID: These must be unique and verified via OTP during the filing process.

- Digital Signature Certificate (DSC): Mandatory for the e-form submission.

- Self-Attested Documents: Proof of identity (e.g., PAN, Passport) and Proof of Address. These must be attested by a practicing professional (CA/CS/CWA).

Ensuring Data Integrity: Documents and Verification

The core objective of the DIR-3 KYC mandate is data verification. Therefore, the accuracy and proper attestation of supporting documents are crucial. The documents must be submitted in PDF format and uploaded along with the e-form.

Identity Proof (Mandatory)

PAN Card (for Indian Nationals) and Passport (mandatory for Foreign Nationals). Ensure names match DIN records.

Address Proof (Recent)

Utility bill, bank statement, or Aadhaar card (not older than two months). Must clearly show the director’s current address.

Attestation Requirement

All copies must be self-attested by the director and then certified by a practicing Chartered Accountant, Company Secretary, or Cost Accountant.

Verification via OTP and Submission

A critical step in the filing process involves the verification of the director’s mobile number and email ID. An OTP (One-Time Password) is sent to both during the form filling process. Only upon successful verification can the form be submitted. This step significantly enhances the security and veracity of the data submitted to the MCA.

Addressing the DIR-3 KYC Filing Due Date and Penalty: Reactivation Process

If you have missed the deadline and your DIN is deactivated, immediate action is necessary to restore compliance. The process of reactivation involves curing the default by submitting the overdue form and paying the associated penalty.

To reactivate a DIN, the director must follow these steps:

- Download the e-Form DIR-3 KYC from the MCA portal.

- Fill in all required details, ensuring the mobile and email OTP verification is successful.

- Attach the necessary attested documents.

- Get the form certified by a practicing professional.

- Upload the form to the MCA portal. The system will automatically prompt the payment of the late filing fee of ₹5,000.

- Upon successful payment and processing, the DIN status is updated from ‘Deactivated’ to ‘Active’.

Timely adherence to Director Compliance is foundational to corporate integrity. Services specializing in Director Compliance can help manage these stringent annual requirements efficiently, ensuring no deadline is missed.

Strategic Compliance Management and Best Practices

Successful management of the DIR-3 KYC filing due date and penalty risks requires foresight and clear internal processes. Companies should treat the September 30th deadline with the same seriousness as Annual General Meeting (AGM) requirements.

Integrating KYC into Annual Compliance Schedules

It is best practice for companies to initiate the KYC process for all their directors early, ideally in July or August, giving ample time for document collection, professional attestation, and addressing any potential discrepancies in the MCA database. This proactive approach prevents last-minute crises often associated with mass filing near the deadline.

Maintain Updated Records

Ensure that the director’s details (especially mobile number and email) are updated in the company records and match the MCA database. Discrepancies lead to OTP failure.

Professional Certification

Always rely on practicing professionals for the certification of the e-form. This ensures legal validity and reduces the chances of rejection upon submission.

Proactive Monitoring

Regularly check the status of DINs on the MCA portal. Do not wait until the annual filing is due to confirm if a DIN is active or deactivated.

Address Changes Promptly

If a director changes their address, ensure this is updated immediately via the e-form DIR-3 KYC, even if it falls outside the standard annual cycle.

The requirement for annual verification reflects the government’s commitment to curb shell companies and enhance corporate transparency. For directors who are also considering converting your business structure, ensuring all director compliance is up-to-date is a prerequisite for seamless transition and regulatory approval.

For official rules and regulations regarding the DIR-3 KYC filing, directors should always refer to the official Ministry of Corporate Affairs (MCA) website. Furthermore, understanding the broader context of director responsibilities under the Companies Act, 2013, helps in appreciating the importance of this annual compliance ritual. Reputable publications often summarize these compliance obligations, such as detailed guides provided by institutions like the Institute of Company Secretaries of India (ICSI).

Conclusion

The mandatory annual filing of DIR-3 KYC is a cornerstone of modern corporate compliance in India. While the process itself is straightforward, adherence to the DIR-3 KYC filing due date and penalty structure is critical for avoiding the ₹5,000 late fee and the operational disruption caused by a deactivated DIN. By prioritizing the September 30th deadline, utilizing the simplified DIR-3 KYC Web service when applicable, and ensuring professional attestation for the e-form, directors can easily maintain their active status and contribute to the overall transparency of the corporate sector.

FAQs

The standard due date for the annual DIR-3 KYC filing remains September 30th of the relevant financial year. Therefore, for the 2026 compliance cycle, the deadline is September 30, 2026.

If the deadline is missed, the associated DIN will be marked as ‘Deactivated’. To reactivate the DIN and file the overdue form, a mandatory late fee (challan) of ₹5,000 must be paid to the Ministry of Corporate Affairs (MCA).

If you are filing the full e-Form DIR-3 KYC (required for first-time filers or those changing details), a DSC is mandatory. However, if you are using the simplified web-based service (DIR-3 KYC Web) for subsequent annual filing with no changes in details, a DSC is generally not required.

Yes. As long as you possess an allotted Director Identification Number (DIN), the annual DIR-3 KYC compliance is mandatory to keep that DIN active, regardless of your current directorial status in any company.

The eForm (downloadable form) is used for the initial filing or when there are changes in personal details. It requires professional certification and DSC. The Web service is a simplified annual compliance update used only when the director’s details (mobile, email, address) remain unchanged from the previous filing.