For businesses operating in the dynamic Indian economy, maintaining a healthy cash flow is paramount. One significant aspect of financial management that often gets overlooked—or feared due to its perceived complexity—is the GST refund process India. With the implementation of the Goods and Services Tax (GST), the government promised a seamless flow of tax credits and easier refunds. However, navigating the bureaucratic corridors to claim what is rightfully yours requires a clear understanding of the rules and procedures.

Whether you are an exporter, a supplier to SEZ units, or a business that has accidentally paid excess tax, understanding the nuances of the GST refund process India is crucial. Delays in refunds can block working capital, affecting your day-to-day operations and growth potential. In this comprehensive guide, we will demystify the entire procedure, from eligibility criteria to the final credit in your bank account, ensuring you have the knowledge to navigate the system confidently.

Understanding the Basics of GST Refund Process India

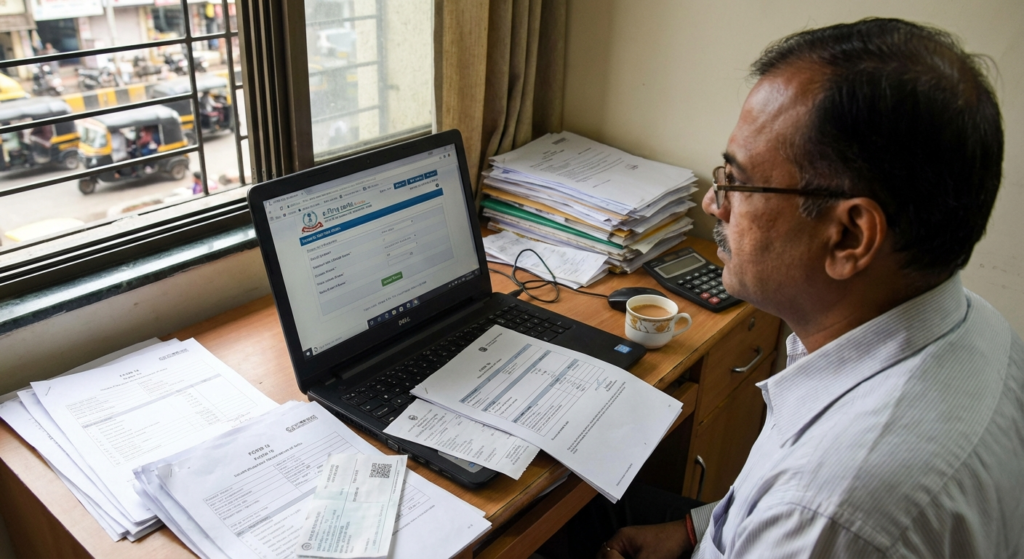

At its core, a GST refund arises when the tax liability of a registered taxpayer is less than the tax they have already paid. The government has structured the GST refund process India to be primarily online, reducing physical interface and increasing transparency. The standardized procedure ensures that claims are processed efficiently, provided the taxpayer adheres to the strict documentation and timeline requirements.

The process is governed by Section 54 of the CGST Act, 2017. While the system is digitized, the logic behind refunds is based on specific scenarios where tax accumulation is unjustified. Understanding these basics is the first step toward a successful claim.

Key Scenarios for Initiating the GST Refund Process India

Not every business is eligible for a refund. The Central Board of Indirect Taxes and Customs (CBIC) has defined specific situations where a taxpayer can initiate the GST refund process India. Knowing which category you fall into is essential for selecting the correct form and supporting documents.

Exports (Zero-Rated Supplies)

Exporters of goods or services can claim a refund of IGST paid on exports or a refund of accumulated Input Tax Credit (ITC) if they exported under a Letter of Undertaking (LUT) without payment of tax.

Inverted Duty Structure

This occurs when the tax rate on inputs is higher than the tax rate on output supplies. The result is an accumulation of unutilized ITC, which can be claimed as a refund.

Excess Payment of Tax

If a taxpayer has paid tax by mistake or in excess of the liability, they are entitled to a refund. For detailed steps on this specific scenario, check out our guide on the GST refund claim process for excess payment.

Supplies to SEZ

Supplies made to Special Economic Zone (SEZ) units or developers are treated similarly to exports (zero-rated), making them eligible for refunds of taxes paid or accumulated ITC.

Step-by-Step Guide: How to File GST Refund Process India Online

The digitization of the tax system means you no longer need to stand in long queues. The GST refund process India is executed via the GST Common Portal. Here is a detailed walkthrough of how to file your claim.

Step 1: Log in to the GST Portal

Access the official GST Portal using your valid credentials. Navigate to the ‘Services’ tab, select ‘Refunds’, and then click on ‘Application for Refund’.

Step 2: Select the Refund Type

You will be presented with various options based on the scenarios mentioned above (e.g., Refund of ITC on Exports, On account of Assessment, etc.). Selecting the correct category is critical as it determines the subsequent fields in Form RFD-01.

Step 3: Fill Form RFD-01

Form RFD-01 is the primary application form for the GST refund process India. You will need to fill in details regarding the financial year, the tax period, and the amount of refund claimed. The portal will auto-populate certain data based on your GSTR-1 and GSTR-3B returns, but manual verification is necessary.

Step 4: Upload Supporting Documents

Depending on the refund type, you must upload specific statements and declarations. Ensure your documents are in PDF format and within the size limits specified by the portal.

Step 5: Verification and Submission

Once the form is filled, verify the details using a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC). After successful submission, an Application Reference Number (ARN) will be generated. Keep this ARN safe for tracking your application.

Documents Required for a Smooth GST Refund Process India

Documentation is the backbone of any tax claim. A lack of proper evidence is the number one reason for rejection in the GST refund process India. While requirements vary by refund type, the standard documents include:

- Statement of Invoices: A comprehensive list of invoices related to the refund claim.

- Export Proof: Shipping bills, Bills of Export, or Bank Realization Certificates (BRC) / Foreign Inward Remittance Certificates (FIRC) for service exporters.

- Declarations: Self-declaration that the applicant has not been prosecuted for any offense under the Act where tax evaded exceeds Rs. 2.5 Crores.

- Certificate from CA/CMA: If the refund amount exceeds Rs. 2 Lakhs, a certificate proving that the incidence of tax has not been passed on to any other person (Unjust Enrichment clause) is required.

For businesses involved in e-commerce, maintaining these records is vital. You can read more about broader compliance in our GST compliance guide for e-commerce sellers.

Time Limits Associated with GST Refund Process India

Time is of the essence when dealing with tax authorities. The GST law prescribes strict timelines for filing refund applications. Generally, the application for a refund must be filed within two years from the ‘relevant date’.

The definition of ‘relevant date’ changes based on the situation:

- For Exports: The date on which the ship leaves India or the truck crosses the land frontier.

- For Services: The date of receipt of payment in convertible foreign exchange.

- For Inverted Duty Structure: The due date for furnishing the return for the period in which such claim for refund arises.

Furthermore, once the application is submitted, the proper officer has 15 days to issue an acknowledgment (Form RFD-02) if the application is complete. The provisional refund (90% of the claim for exporters) is usually granted within 7 days of acknowledgment, while the final order (Form RFD-06) must be issued within 60 days of the application date.

Processing and Sanction of the Refund

Once you have initiated the GST refund process India, the application moves to the jurisdictional tax officer. The officer scrutinizes the claim against the returns filed and the documents submitted.

Provisional Refund

To ensure exporters do not face a cash crunch, the government allows for a provisional refund of 90% of the total claim amount. This is generally sanctioned via Form RFD-04 promptly, provided the applicant has a clean compliance record.

Final Settlement

After detailed verification, if the officer is satisfied, they issue a payment advice (Form RFD-05), and the amount is electronically credited to the taxpayer’s bank account. If there are discrepancies, a Show Cause Notice (Form RFD-08) may be issued, giving the applicant a chance to explain.

Common Challenges in the GST Refund Process India

Despite the digitized nature of the GST refund process India, taxpayers often face hurdles. Being aware of these can help you avoid pitfalls.

Mismatch in Data

Discrepancies between GSTR-1, GSTR-3B, and the shipping bills filed with customs (ICEGATE) are the most common cause for delays.

Bank Account Validation

If the bank account details provided are not validated or if the name does not match the PAN exactly, the disbursement will fail.

Incorrect Head of Tax

Applying for a refund under the wrong tax head (e.g., claiming CGST instead of IGST) leads to immediate rejection.

Conclusion

Mastering the GST refund process India is not just about compliance; it is a strategic financial practice. By understanding the eligibility criteria, adhering to the timelines, and ensuring meticulous documentation, businesses can unlock valuable working capital that is otherwise stuck in government coffers. While the process involves several steps—from filing Form RFD-01 to tracking the ARN—the digital infrastructure provided by the GSTN has made it significantly more transparent than previous tax regimes.

Always remember to double-check your data across all filings and keep your bank details updated. If you find the process overwhelming, consulting with a tax professional is always a wise investment to ensure your claims are processed without hiccups.

FAQs

According to GST laws, the refund should be sanctioned within 60 days from the date of receipt of a complete application. For exporters, 90% of the claim is often granted provisionally within 7 days.

Yes, you can track the status of your application on the GST Portal. Navigate to Services > Refunds > Track Application Status and enter your ARN (Application Reference Number).

No refund shall be paid to an applicant if the amount of refund is less than Rs. 1,000. This limit applies to each tax head separately.

Generally, the process is fully online. However, the jurisdictional tax officer may request physical documents for verification if there are significant discrepancies or if the claim involves a large amount.

If the government fails to sanction the refund within 60 days, they are liable to pay interest at a rate not exceeding 6% (as notified by the government) for the period of delay.