Running a successful business is about more than just generating revenue; it is about managing the money you keep. One of the most critical yet often overlooked aspects of financial management is cash flow tax planning. Many business owners fall into the trap of looking at their bank balance and assuming that money is theirs to spend, only to be blindsided by a substantial tax bill at the end of the year. This lack of foresight can cripple operations, stall growth, and lead to unnecessary debt.

Effective cash flow tax planning is the art of forecasting your tax liabilities and arranging your financial affairs to minimize taxes while ensuring you have sufficient liquidity to meet obligations when they arise. It is not about evading taxes; it is about strategic timing and utilizing legal provisions to keep more cash working in your business for longer. By integrating tax planning into your daily cash flow management, you transform tax from a scary annual event into a manageable, predictable expense.

Why Cash Flow Tax Planning is Critical for Business Survival

Cash is the oxygen of any business. Without it, you cannot pay employees, purchase inventory, or keep the lights on. Cash flow tax planning serves as a bridge between your accounting profits and your actual bank balance. A company can be profitable on paper but insolvent in reality if it cannot manage the timing of its cash outflows, specifically tax payments.

When you proactively manage your tax obligations, you avoid the panic of scrambling for funds. This strategic approach allows you to reinvest surplus cash into growth opportunities rather than hoarding it vaguely for “tax season.” Furthermore, understanding your tax position in real-time prevents the erosion of working capital due to penalties and interest resulting from underpayment or late payment.

Enhanced Liquidity

By accurately forecasting tax payments, you prevent unexpected withdrawals from your operating capital, ensuring smooth day-to-day operations.

Investment Opportunities

Knowing exactly what you owe allows you to safely invest excess cash into inventory, marketing, or expansion without fear of a tax shortfall.

Reduced Stress

Eliminate the anxiety of tax season. With a plan in place, tax payments become just another routine planned expense rather than a crisis.

Key Strategies for Effective Cash Flow Tax Planning

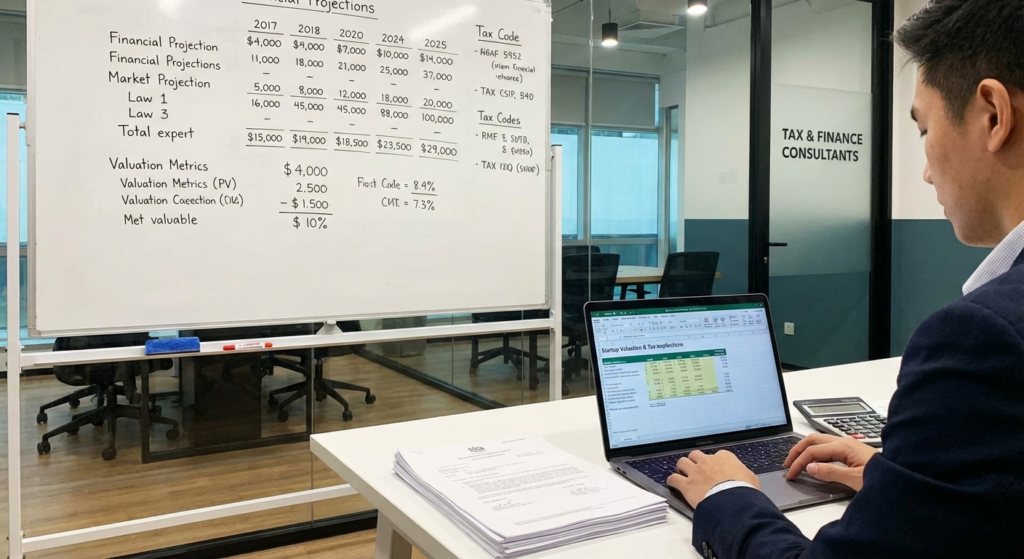

To master cash flow tax planning, you must move beyond reactive accounting. This involves looking ahead and making decisions today that will impact your tax bill tomorrow. Here are several core strategies used by successful CFOs and tax experts.

1. Deferring Income and Accelerating Expenses

One of the most fundamental concepts in cash flow tax planning is timing. If you operate on a cash basis, you might consider deferring the receipt of income until the next financial year if you are projecting a lower tax bracket or simply want to delay the tax outflow. Conversely, accelerating deductible expenses—such as purchasing necessary equipment or stocking up on supplies before year-end—can reduce your current year’s taxable income.

2. Strategic Inventory Management

Your inventory valuation method affects your Cost of Goods Sold (COGS) and, consequently, your taxable income. Reviewing whether your inventory is valued correctly and identifying obsolete stock that can be written off is a vital part of cash flow tax planning. Writing off dead stock reduces your profit on paper, thereby lowering your immediate tax liability and preserving cash.

Integrating Cash Flow Tax Planning with GST and TDS

In many jurisdictions, indirect taxes like GST (Goods and Services Tax) and withholding taxes like TDS (Tax Deducted at Source) have a massive impact on daily liquidity. These are not taxes on your profit, but taxes on your transactions. Failing to plan for these can freeze your bank account faster than income tax issues.

Managing GST Refunds and Payments

GST is a cash flow neutral tax in theory, but in practice, there is often a time lag between paying GST on purchases and collecting GST on sales. If you export goods or have an inverted duty structure, your working capital might get stuck in the form of accumulated input tax credit. Efficient cash flow tax planning involves filing for refunds promptly. For businesses facing issues with blocked capital, understanding the GST refund claim process is essential to release these funds back into the business cycle.

TDS Compliance and Liquidity

Tax Deducted at Source (TDS) is another area where cash flow can be squeezed. If you are a service provider, your clients may deduct a percentage of your payment, reducing your immediate cash inflow. Conversely, if you fail to deduct and deposit TDS on time for your vendors, you face heavy penalties and interest, which are non-deductible expenses. These penalties are a direct hit to your cash reserves. To avoid this leakage, ensure strict adherence to timelines. You can learn more about the consequences of delays in our guide on TDS late filing penalties and interest.

The Role of Accounting Software in Cash Flow Tax Planning

Modern cash flow tax planning is impossible without accurate data. Cloud-based accounting software allows you to generate real-time profit and loss statements and balance sheets. By keeping your books up to date, you can estimate your tax liability on a monthly or quarterly basis rather than waiting for the year-end audit.

Using technology allows you to run scenarios: “What happens to my tax bill if I buy this asset now versus next month?” or “How does this large contract impact my GST liability?” This predictive capability is the cornerstone of proactive planning.

Scenario Analysis

Use software to forecast different revenue scenarios. If you have a high-profit quarter, calculate the estimated tax immediately and set that cash aside in a separate high-yield savings account.

Automated Reminders

Set automated alerts for advance tax deadlines, GST filings, and TDS deposits. Missing a deadline results in interest payments that are essentially wasted cash.

Common Mistakes in Cash Flow Tax Planning to Avoid

Even seasoned entrepreneurs make mistakes when it comes to taxes. The most common error is treating tax money as operating capital. When you collect GST from a customer, that money does not belong to you; you are merely a custodian for the government. Spending this money on rent or salaries creates a massive cash crunch when the payment deadline arrives.

Another mistake is ignoring the impact of business structure on taxes. For instance, a sole proprietorship is taxed differently than a private limited company. Sometimes, restructuring your business can lead to significant tax savings. For non-profits or specific entities, understanding registrations like Section 8 company registration can open doors to exemptions, though this requires specific eligibility.

Furthermore, failing to plan for “Advance Tax” is a frequent oversight. Most tax systems require you to pay tax as you earn. Waiting until the end of the year results in interest charges under sections like 234B and 234C in India, or similar underpayment penalties in the US. Proper cash flow tax planning accounts for these quarterly outflows.

Leveraging Retirement Plans and Employee Benefits

A sophisticated method of cash flow tax planning involves utilizing retirement plans. Contributions to employee provident funds, 401(k)s, or superannuation funds are often tax-deductible for the business. By contributing to these plans, you lower your current taxable income. While cash leaves the business, it goes toward a long-term benefit for you or your employees, rather than vanishing as a tax payment.

According to Investopedia, tax planning is an essential component of a financial plan, allowing you to maximize the efficiency of your retirement contributions. Similarly, authoritative sources like the IRS Small Business Center (or equivalent local authorities) emphasize that deducting employee benefit costs can significantly lower business tax liability.

Conclusion

Cash flow tax planning is not a once-a-year activity; it is a continuous process that should be embedded in your business strategy. By understanding the timing of your income and expenses, leveraging technology, and staying compliant with GST and TDS regulations, you can significantly improve your business’s liquidity.

Remember, the goal is to ensure that you have the cash you need, when you need it, without the looming shadow of unexpected tax debts. Start reviewing your tax position quarterly, consult with a tax professional, and stop letting taxes dictate your cash flow. Instead, let your cash flow strategy dictate your tax efficiency.

Frequently Asked Questions

Tax planning is the legal process of arranging your financial affairs to minimize tax liability using deductions, credits, and exemptions provided by law. Tax evasion is the illegal act of not paying or underpaying taxes that are owed, often by hiding income or inflating expenses.

By accurately forecasting tax liabilities, you avoid sudden cash outflows. This preserves working capital, allowing you to reinvest surplus funds into inventory, marketing, or hiring, thereby fueling business growth.

Yes, but indirectly. By managing your Input Tax Credit (ITC) efficiently and filing for refunds on time, you can prevent working capital from getting blocked in the tax system. However, you should never delay GST payments to the government as a source of cash, as penalties are severe.

It is recommended to review your tax plan at least quarterly. This aligns with quarterly advance tax payment deadlines and allows you to adjust your strategy based on actual profit performance throughout the year.

Depreciation is a non-cash expense that reduces your taxable income. By claiming depreciation on assets, you lower your tax bill without an immediate cash outflow, effectively retaining more cash in the business.