In today’s fast-paced business landscape, staying compliant with the latest regulations is crucial for the success and sustainability of any enterprise. One such regulatory requirement that holds significant importance for businesses is GST registration. The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services throughout India. In this article, we’ll delve into the key aspects of GST registration and why it’s imperative for businesses to ensure compliance.

Understanding GST: A Brief Overview

GST, implemented in July 2017, replaced a complex web of indirect taxes, bringing uniformity and simplicity to the taxation system. It subsumed various central and state taxes, resulting in a seamless nationwide tax structure.

The Significance of GST Registration

GST registration is not just a legal obligation; it’s a strategic move that offers numerous benefits to businesses of all sizes. Registering for GST provides a unique Goods and Services Tax Identification Number (GSTIN), which is essential for participating in the tax ecosystem.

Advantages of GST Registration for Businesses

3.1 Streamlined Tax Processes

GST registration ensures that businesses comply with the standardized tax procedures, making it easier to manage tax filings, invoicing, and returns.

3.2 Input Tax Credit

Registered businesses can claim input tax credit on taxes paid for their purchases. This mechanism prevents the cascading effect of taxes and reduces the overall tax liability.

3.3 Improved Credibility

GST registration enhances a business’s credibility in the eyes of vendors, customers, and financial institutions, as it signifies adherence to regulatory norms.

3.4 Legal Recognition

A GST-registered business gains legal recognition and can engage in inter-state trade without restrictions, fostering expansion opportunities.

Mandatory GST Registration: When and Why

Certain criteria mandate GST registration, such as crossing the threshold turnover limit or engaging in inter-state supplies. Failing to register can result in penalties.

Eligibility Criteria for GST Registration

5.1 Threshold Turnover Limit

Businesses with an annual turnover exceeding the prescribed limit must register for GST. This threshold varies for different states.

5.2 Inter-State Transactions

Entities engaged in supplying goods/services across state borders must obtain GST registration, regardless of their turnover.

5.3 E-commerce Operators

E-commerce platforms need to register under GST, ensuring tax compliance within their ecosystem.

Step-by-Step Guide to GST Registration

6.1 Preparing Documents

Collect necessary documents, including PAN, Aadhaar, business address proof, and bank account details.

6.2 Online Application Submission

Submit the application through the GST portal, providing accurate information about your business activities.

6.3 Verification Process

Undergo the verification process, which may involve an officer’s visit to your business premises.

6.4 GSTIN Allotment

Upon successful verification, you’ll receive your unique GSTIN, enabling you to commence GST-related operations.

Importance of Proper Documentation

Accurate documentation is crucial for successful GST registration and subsequent compliance. Ensure all documents are up-to-date and accessible.

Avoiding Penalties and Legal Consequences

Failure to register under GST or non-compliance with its regulations can lead to hefty fines and legal troubles. Prioritize adherence to avoid such issues.

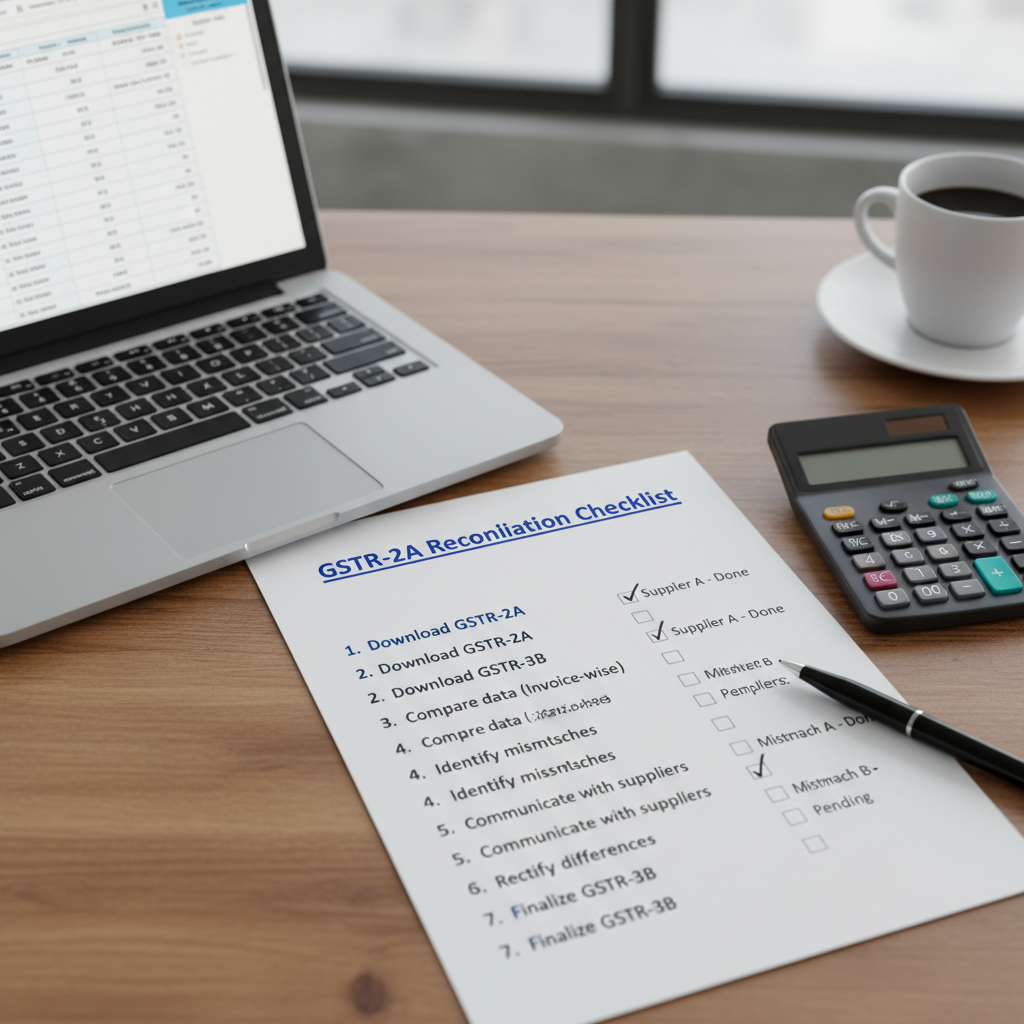

GST Compliance: Ongoing Responsibilities

Post-registration, businesses must file regular returns and maintain accurate records of transactions to ensure ongoing compliance.

Effect of GST Registration on Pricing Strategies

GST impacts pricing strategies due to the tax implications it carries. Businesses must factor in GST while determining product prices.

Implications for Small and Medium Enterprises (SMEs)

SMEs can benefit from GST registration as it provides them with equal opportunities to expand and compete on a larger scale.

GST and E-commerce: Navigating the Landscape

E-commerce businesses must navigate complex GST rules, especially concerning tax collection at source and registration for sellers on their platforms.

GST Registration vs. Voluntary Registration

Even businesses falling below the turnover threshold can opt for voluntary GST registration to avail the benefits of input tax credit and enhance their market presence.

The Future of GST: Potential Developments

The GST framework is subject to continuous enhancements. Future developments may include broader tax coverage, simpler procedures, and reduced compliance burdens.

Conclusion: Embracing GST Registration for Business Growth

In conclusion, GST registration is not just a regulatory requirement; it’s a strategic decision that offers manifold advantages. From streamlining tax processes to improving credibility and expanding market reach, GST registration is a gateway to sustainable business growth.

FAQs

No, it’s mandatory for businesses exceeding the turnover threshold or involved in inter-state transactions. Voluntary registration is also an option.

Yes, businesses can apply for GST registration through the online portal provided by the government.

Input tax credit allows businesses to offset the taxes paid on purchases against their tax liability on sales, reducing the overall tax burden.

Non-compliance can lead to penalties ranging from monetary fines to legal consequences, affecting the business’s reputation and operations.

Depending on the type of business, GST returns need to be filed monthly, quarterly, or annually.

Please Rate this post

Click to rate