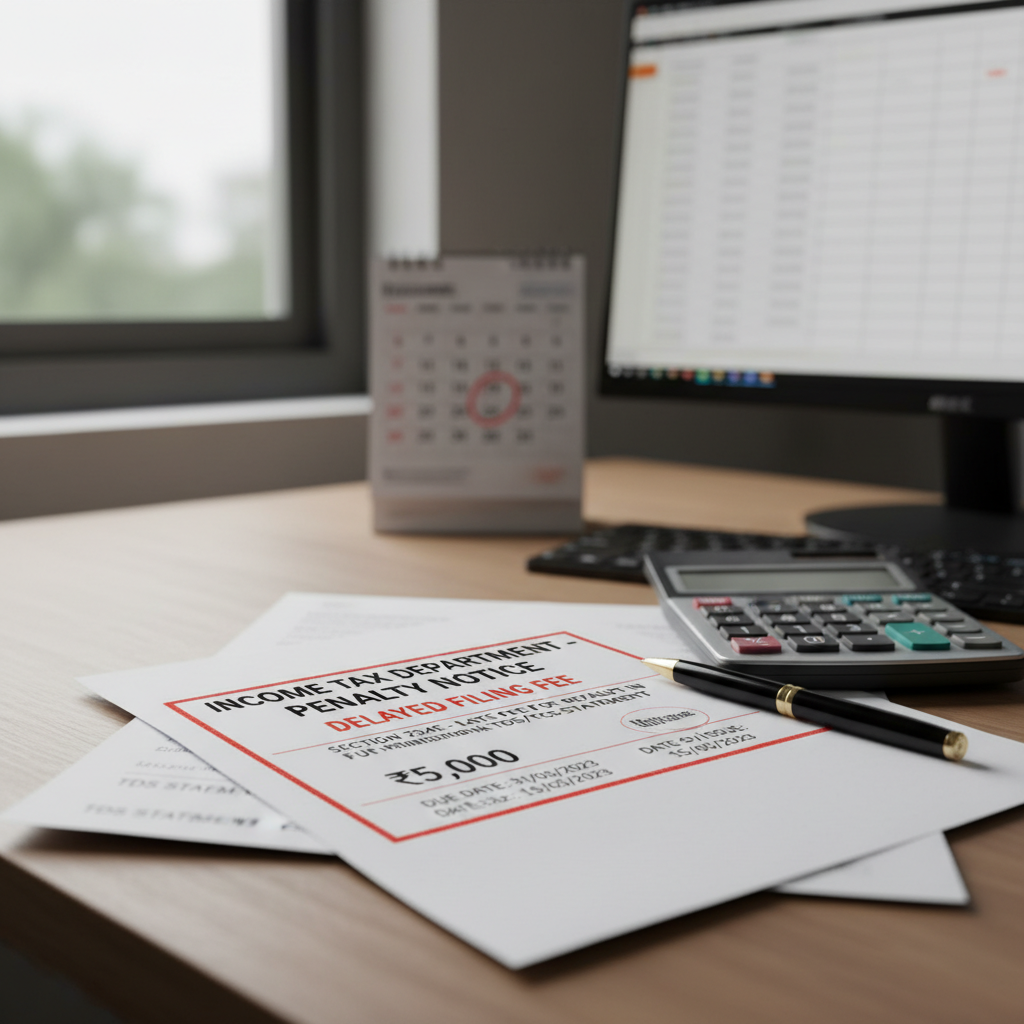

Introduction to TDS Compliance and the Critical Need to Avoid the TDS late filing penalty

Tax Deducted at Source (TDS) is a fundamental mechanism of the Indian Income Tax system, ensuring that tax collection occurs at the source of income generation. While compliance seems straightforward, the stringent deadlines set by the Income Tax Department mean that even minor delays can trigger significant financial repercussions. For every deductor—whether an individual, a company, or a partnership firm—timely deposit of the deducted tax and the subsequent filing of TDS returns (e.g., Form 24Q, 26Q, 27Q) are non-negotiable legal obligations.

Failing to meet these deadlines leads directly to the imposition of the TDS late filing penalty. This isn’t just a single charge; rather, it’s a combination of fees, interest, and punitive penalties designed to ensure strict adherence to the tax calendar. Understanding these consequences is the first step toward effective tax management and compliance.

Who is Responsible for TDS Compliance?

The responsibility for TDS compliance falls upon the ‘deductor’ or the person making the specified payment (like salary, rent, professional fees, or interest). The deductor must perform three critical actions:

- Deduct the appropriate tax rate at the time of payment.

- Deposit the deducted tax amount with the government within the prescribed due date.

- File periodic TDS statements (returns) detailing the deductions made.

It is the failure to complete the final step—filing the return on time—that primarily attracts the major TDS late filing penalty provisions.

Decoding the Two Major Penalties for Late Filing

When a deductor misses the deadline for submitting their quarterly TDS statement, they immediately become liable for two distinct types of monetary charges: the Late Filing Fee (Section 234E) and Interest (Section 234A, though late filing primarily attracts 234E, late deposit interest under 234B and 234C must also be considered).

Fee under Section 234E: The Daily Penalty for Late Submission

Section 234E of the Income Tax Act, 1961, introduced a specific fee for delays in furnishing the TDS or TCS statement. This is perhaps the most immediate and common financial consequence faced by late filers.

Daily Charge Rate

The penalty is levied at Rs. 200 per day for every day the default continues.

Maximum Liability Limit

The total fee imposed under Section 234E cannot exceed the total amount of TDS/TCS for that specific quarter.

Applicability

This fee is mandatory and applies from the day immediately following the due date until the date the statement is actually filed.

Example: If the due date for filing a quarterly TDS return was July 31st, and the deductor files it on August 31st (31 days late), the penalty will be 31 days * Rs. 200 = Rs. 6,200, provided this amount does not exceed the total tax deducted for that quarter.

It is crucial to note that this fee must be paid before filing the late TDS return. The system will not accept the return without the corresponding payment of the 234E fee.

Interest under Section 234A, 234B, and 234C: Penalty for Late Tax Deposit

While Section 234E addresses the late filing of the statement, other sections deal with the failure to deposit the tax itself on time. Timely deposit of the tax collected is often a prerequisite to timely filing of the return. If the tax deducted is not deposited into the government treasury on time, interest is charged:

- Section 234B (Late Deposit): Interest is charged at 1.5% per month (or part of the month) on the tax amount that was deducted but not deposited by the due date. This applies from the date the tax was deductible until the date of actual deposit.

- Section 234A (Late Filing of ITR, relevant if the deductor is an assessee): While primarily relating to self-assessment tax, the principle of interest for delay in tax deposit remains a separate and equally serious charge.

This interest is punitive and accrues rapidly. Unlike the Section 234E fee, there is no upper limit on the interest charged; it continues to accumulate until the tax is fully paid. For detailed guidance on timely submissions, please refer to our guide on TDS Return Filing.

The Financial Impact of the TDS late filing penalty

The combination of these fees and interest provisions ensures that procrastination is fiscally punishing. The longer the delay, the higher the cumulative cost.

Charge 1: Section 234E Fee

Nature: Late Filing Fee (Fixed daily rate).

Rate: ₹200 per day.

Max Limit: Total TDS amount for the quarter.

Trigger: Failure to submit the TDS return statement by the due date.

Charge 2: Section 234B Interest

Nature: Late Deposit Interest (Compounding monthly).

Rate: 1.5% per month or part thereof.

Max Limit: None (continues until full payment).

Trigger: Failure to deposit the deducted tax into the government account by the 7th of the next month (or specific due dates).

Experts often stress that awareness of these compounding charges is essential. As stated by a leading tax consultant, "The penalty structure is designed not just to recover lost revenue, but to enforce discipline. A small delay can quickly erode the profitability of a transaction."

Specific Consequences Beyond Monetary Charges: What Happens If You Ignore the TDS late filing penalty?

While the fees under Section 234E and the interest under 234B are automatic, chronic or intentional non-compliance invites far more severe, non-automatic penalties under Section 271H.

Penalty for Failure to Furnish TDS Statements (Section 271H)

Section 271H is invoked when the delay in filing the TDS statement is deemed substantial or when incorrect information is furnished. This is where the TDS late filing penalty transitions from an administrative fee to a potentially heavy punitive fine.

- Minimum Penalty: ₹10,000

- Maximum Penalty: ₹1,00,000

Crucially, this penalty is applicable even if the tax has been deposited on time. The delay in filing the statement alone is sufficient grounds for Section 271H to be imposed by the Assessing Officer (AO).

Relief and Immunity under Section 271H

There is a narrow window of relief. If the deductor files the TDS statement before the expiry of one year from the specified due date, and the tax deducted (along with the requisite fees and interest) has been paid to the credit of the Central Government, the penalty under Section 271H may not be levied. However, relying on this immunity is risky and should not be a substitute for timely compliance.

Practical Implications on Deductees

When a deductor fails to file the TDS return promptly, it directly impacts the deductee (the person whose tax was deducted). The primary consequence is that the TDS credit will not reflect in the deductee’s Form 26AS. Without this credit, the deductee cannot claim the tax refund or utilize the tax paid, potentially leading to demands for double payment or delays in their own tax processing.

This failure can lead to severe operational friction, as the deductee will often pressure the deductor to rectify the issue by filing the return immediately, thereby incurring the full cumulative TDS late filing penalty.

Understanding the Due Dates for TDS Return Filing

Timeliness is defined by the prescribed quarterly deadlines. Missing any of these dates triggers the clock for the late filing fees.

Quarter 1 (April – June)

Due Date: July 31st

Quarter 2 (July – September)

Due Date: October 31st

Quarter 3 (October – December)

Due Date: January 31st

Quarter 4 (January – March)

Due Date: May 31st

Note that if the last date falls on a public holiday, the due date automatically shifts to the next working day. It is essential to track these dates meticulously. You can find official circulars and updated due dates on the Income Tax Department’s official portal. (Source: Income Tax India official website).

Actionable Steps to Avoid the TDS late filing penalty

Preventing penalties is always simpler and cheaper than managing them. Proactive compliance is the best defense against the escalating costs associated with the TDS late filing penalty.

Step 1: Dedicate Resources

Ensure that a responsible person or team handles the TDS process exclusively. Relying solely on external accountants without internal oversight often leads to procedural delays.

Step 2: Reconcile Monthly

Reconcile the TDS deducted (as per books) with the amount deposited (challans) monthly, not just quarterly. This ensures that any discrepancies are caught early, reducing interest liability under Section 234B.

Step 3: Leverage Software

Use robust TDS compliance software that automatically tracks due dates, validates PANs, and generates the necessary FVU files required for timely submission.

Step 4: Verify PAN and Details

Ensure every deductee’s PAN is valid and correct. Errors in PAN details or challan numbers can lead to the return being rejected, effectively treating it as non-filed until correction, thereby incurring the daily penalty.

Furthermore, prompt attention to notices received from the Income Tax Department regarding non-filing is vital. Ignoring such notices exponentially increases the risk of the Section 271H penalty being levied.

The Process of Rectifying a Late Filed TDS Return

If you have already missed the deadline, the primary objective is to minimize the ongoing penalty by filing the return immediately. The process involves:

- Calculating the total late filing fee due under Section 234E (Rs. 200 per day) up to the proposed filing date.

- Calculating any unpaid interest under Section 234B (1.5% per month) if the tax deposit was also delayed.

- Paying the calculated fee and interest using the appropriate challan (Challan No. 281).

- Preparing the TDS statement (e.g., Form 24Q) and incorporating the challan details for the penalty and interest payments.

- Submitting the statement to the relevant Tax Information Network (TIN) Facilitation Centre.

It is worth exploring the procedures for TDS return rectification if errors are discovered after filing, as incorrect filing is treated similarly to non-filing for certain penalty provisions.

Conclusion

The TDS late filing penalty structure in India is designed to be rigorous and unforgiving. The automatic daily fee under Section 234E, coupled with compounding interest under 234B, creates a significant financial burden that is easily avoidable through meticulous adherence to deadlines. Beyond monetary costs, prolonged non-compliance invites the severe punitive penalties of Section 271H, potentially crippling small and medium enterprises. Prioritizing timely deposit and submission is not merely an administrative task; it is a critical component of sound financial governance and risk mitigation.

FAQs

The maximum penalty under Section 234E is capped at the total amount of TDS/TCS required to be deducted and reported in that particular quarterly statement. For instance, if the total TDS for the quarter was ₹15,000, the fee cannot exceed ₹15,000, regardless of how long the delay continues.

The fee under Section 234E is mandatory and automatic. Once the due date for filing the TDS statement is missed, the fee of ₹200 per day starts accruing immediately. It is an administrative fee that must be paid before the return can be accepted by the system.

Yes. Section 234E is an automatic fee for late filing, whereas Section 271H is a punitive penalty (ranging from ₹10,000 to ₹1,00,000) levied by the Assessing Officer for severe or prolonged failure to furnish the statement. They address different aspects of non-compliance and can be applied concurrently, especially if the delay is substantial.

Interest under Section 234B is calculated at 1.5% per month or part of the month. If the tax was due on May 7th but paid on June 15th, the interest will be calculated for two full months (May and June) at 1.5% per month on the unpaid tax amount.

If the TDS return contains incorrect information (e.g., wrong PANs, incorrect challan details), the return may be deemed defective or treated as not filed correctly until rectified. This can attract the late filing fee (234E) for the period until the correction is successfully submitted, and potentially the Section 271H penalty if the errors are substantial and uncorrected.