Running a successful business in India involves more than just generating revenue; it requires strict adherence to financial regulations and statutory compliances. Among the most critical of these is the tax audit. For many entrepreneurs and professionals, understanding the intricate tax audit requirements India mandates can be the difference between smooth operations and hefty penalties. Whether you are a seasoned business owner or a freelancer scaling up your operations, knowing when and how to audit your accounts is essential.

The Income Tax Act, 1961, specifically Section 44AB, lays down the framework for these audits. The primary objective is to ensure that taxpayers maintain proper books of accounts and that their income computation is accurate. In this comprehensive guide, we will decode the tax audit requirements India enforces, the turnover limits for the current financial year, and the consequences of non-compliance.

Understanding Section 44AB and Tax Audit Requirements India

A tax audit is essentially an examination of a taxpayer’s books of account. It is conducted by a practicing Chartered Accountant (CA) to ensure that the taxpayer has complied with the various provisions of the Income Tax Act. The auditor issues a report (Form 3CA/3CB and 3CD) certifying the accuracy of the financial statements.

The core of tax audit requirements India lies in Section 44AB. This section stipulates that certain persons carrying on business or profession must get their accounts audited if their turnover or gross receipts exceed specified limits. This process helps the Income Tax Department verify the correctness of the Income Tax Returns (ITR) filed by the taxpayer.

Turnover Limits and Tax Audit Requirements India for FY 2024-25

One of the most common questions regarding tax audit requirements India is: “What is the turnover limit?” The limits differ for businesses and professionals, and recent amendments have introduced higher thresholds to encourage digital transactions.

For Businesses

Standard Limit: If total sales, turnover, or gross receipts exceed ₹1 Crore in the financial year.

Digital Transaction Limit: The limit increases to ₹10 Crores if cash receipts and cash payments are both less than 5% of the total receipts and payments respectively.

For Professionals

Standard Limit: If gross receipts from the profession exceed ₹50 Lakhs in the financial year.

Presumptive Taxation (44ADA): If you declare income lower than 50% of gross receipts, an audit is mandatory regardless of turnover, provided total income exceeds the basic exemption limit.

It is crucial to note that if you are opting for the Presumptive Taxation Scheme under Section 44AD and your turnover is below ₹2 Crores, you are generally exempt from audit. However, if you claim that your profits are lower than the prescribed rate (8% or 6%) and your income exceeds the basic exemption limit, the tax audit requirements India stipulates will apply to you.

Presumptive Taxation vs. Tax Audit Requirements India

Many small business owners confuse presumptive taxation with audit exemptions. Under Section 44AD, eligible businesses can declare 8% of their turnover (or 6% for digital transactions) as profit and skip maintaining detailed books. However, if you wish to declare a profit lower than these percentages, you fall back into the net of tax audit requirements India. This ensures that businesses cannot arbitrarily underreport income without verification.

For those just starting, ensuring you have the right structure is vital. If you are looking to formalize your setup to handle these compliances better, you might want to read about easy business registration in India to get started on the right foot.

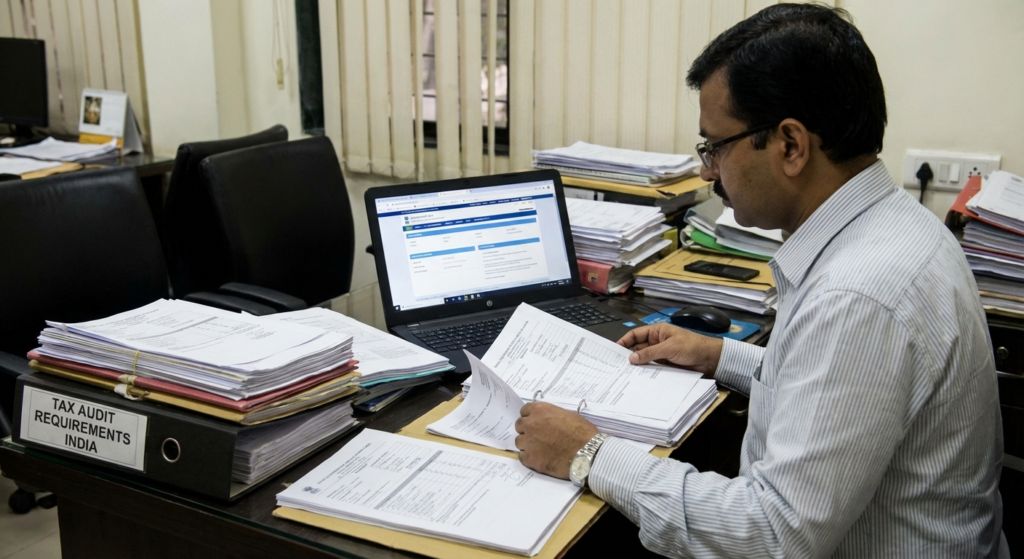

Essential Documents Checklist for Tax Audit Requirements India

Preparing for an audit can be daunting. To ensure a smooth process, you must have your financial documents in order. The auditor will need to verify various aspects of your business before signing the audit report.

- Books of Accounts: Cash book, bank book, ledgers, and journals.

- Invoices and Bills: Copies of all sales and purchase invoices.

- Bank Statements: Statements for the entire financial year for all business accounts.

- Expense Proofs: Vouchers and receipts for all claimed expenses.

- Asset Register: Details of fixed assets purchased and sold.

- Stock Records: Valuation of opening and closing stock.

- Statutory Compliance Proofs: GST returns, TDS returns, and challans.

Having these documents ready not only speeds up the audit process but also minimizes the risk of adverse remarks in the audit report. For salaried individuals who also have business income, the process is different compared to a standard salary return. You can check our guide on how to file ITR-1 online to understand the baseline for salaried filing, though business audits require ITR-3.

The Audit Forms: 3CA, 3CB, and 3CD

The outcome of the audit is a set of forms filed electronically. Understanding which form applies to you is a key part of tax audit requirements India.

Form 3CA

This form is used when the accounts of the business or profession have already been audited under any other law (e.g., Companies Act 2013). It is essentially a concise report referencing the statutory audit.

Form 3CB

This form is applicable when the accounts are NOT required to be audited under any other law. This is common for proprietorships, partnerships, and freelancers falling under the tax audit net.

Form 3CD

This is a detailed statement of particulars. It contains over 40 clauses where the auditor reports on various compliances like TDS, loans, depreciation, and quantitative details of stock.

Penalties for Non-Compliance with Tax Audit Requirements India

Ignoring the tax audit requirements India has set forth is a costly mistake. The Income Tax Department takes non-compliance seriously. If a taxpayer who is required to get their accounts audited fails to do so, or fails to furnish the audit report by the specified due date (usually September 30th of the assessment year), penalties apply under Section 271B.

The penalty is the lower of the following two amounts:

- 0.5% of the total sales, turnover, or gross receipts.

- ₹1,50,000.

However, the penalty may be waived if the taxpayer can prove a “reasonable cause” for the failure, such as a natural calamity, resignation of the auditor, or medical emergencies, subject to the satisfaction of the Assessing Officer.

How to File the Audit Report: Navigating Tax Audit Requirements India

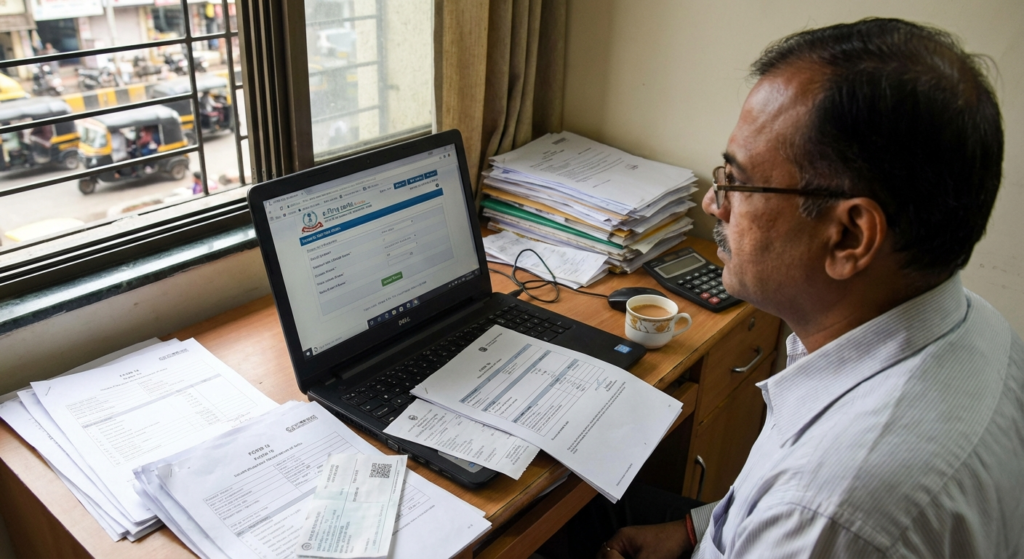

The filing process is fully digital. The Chartered Accountant prepares the audit report and uploads it to the Income Tax e-filing portal using their Digital Signature Certificate (DSC). Once uploaded, the taxpayer must login to their own portal account and “Accept” the audit report. Only after this acceptance is the filing process considered complete. This digital handshake ensures that both the auditor and the taxpayer acknowledge the data being submitted.

For authoritative details on filing procedures, you should always refer to the Income Tax Department of India official portal. Additionally, the Institute of Chartered Accountants of India (ICAI) provides guidance notes that auditors follow, which can be insightful for understanding the depth of scrutiny involved.

Conclusion

Navigating the tax audit requirements India mandates can seem complex, but it is a fundamental aspect of running a transparent and compliant business. By understanding the turnover limits—specifically the ₹1 Crore and ₹10 Crore thresholds—and maintaining impeccable books of accounts, you can ensure a stress-free audit season. Remember, the goal of a tax audit is not just compliance, but also to provide a clear financial picture of your business, which aids in future growth and creditworthiness.

Always consult with a qualified Chartered Accountant to determine your specific audit applicability. Staying ahead of these requirements prevents penalties and builds your reputation as a responsible taxpayer in the Indian economic ecosystem.

FAQs

The due date for filing the tax audit report is typically September 30th of the relevant Assessment Year. For example, for FY 2023-24, the audit report must be filed by September 30, 2024. However, the government may extend this date in certain situations.

Yes, if your total sales or turnover exceeds the prescribed limit (₹1 Crore or ₹10 Crores), a tax audit is mandatory regardless of profit or loss. Furthermore, if you declare a loss while opting out of the presumptive taxation scheme (and your income exceeds the basic exemption limit), an audit is required.

No, a tax audit report under Section 44AB cannot be filed by the taxpayer. It must be conducted and filed by a practicing Chartered Accountant (CA). The taxpayer only has the authority to approve/accept the report uploaded by the CA.

No, the enhanced limit of ₹10 Crores applies only if the aggregate of all amounts received in cash (including sales) does not exceed 5% of the total amount, and the aggregate of all payments made in cash does not exceed 5% of the total payments.

Filing the report after the due date attracts a penalty under Section 271B, which is 0.5% of the turnover or ₹1,50,000, whichever is lower. While you can still file the ITR, the penalty proceedings may be initiated by the Assessing Officer.