Running a business involves more than just generating revenue and managing operations; it also requires navigating the complex landscape of statutory compliance. One of the most critical aspects of financial compliance for businesses and professionals is understanding the tax audit requirements in India. Whether you are a startup founder, a seasoned entrepreneur, or a practicing professional, missing these requirements can lead to hefty penalties and unnecessary scrutiny from the Income Tax Department.

In this comprehensive guide, we will break down the intricacies of Section 44AB of the Income Tax Act, 1961. We will explore who needs to get their accounts audited, the specific turnover thresholds, and the documentation needed to ensure a smooth filing process. By the end of this article, you will have a clear roadmap to mastering the tax audit requirements in India for the current financial year.

Understanding the Core Tax Audit Requirements in India

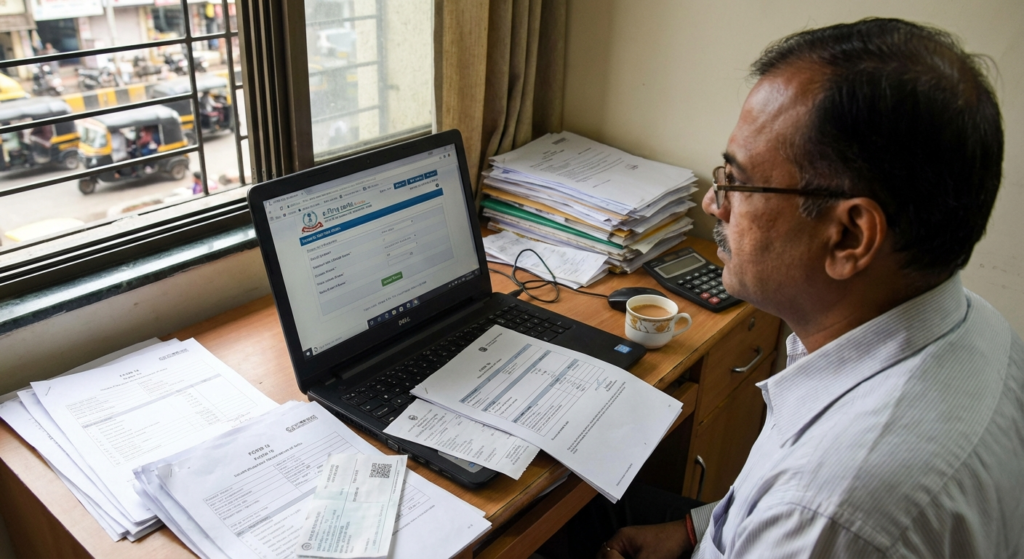

A tax audit is essentially an examination of a taxpayer’s books of accounts to ensure that the income tax returns filed are in alignment with the actual financial records. The primary objective is to verify the accuracy of financial statements and ensure compliance with various provisions of the Income Tax Act. When we talk about tax audit requirements in India, we are primarily referring to the mandates laid out under Section 44AB.

The government introduced these audits to check tax evasion and ensure that books of accounts are maintained properly. It is not merely a formality but a thorough review conducted by a practicing Chartered Accountant (CA). The CA issues a report (Form 3CA or Form 3CB) along with a statement of particulars (Form 3CD), which certifies that the financial information provided by the taxpayer is accurate.

Meeting the tax audit requirements in India is crucial because it validates your business’s financial health to external stakeholders, including banks and investors. Furthermore, it simplifies the assessment process for the Income Tax Officers.

Turnover Limits and Tax Audit Requirements in India

The most common question business owners ask is: “Do I need a tax audit?” The answer largely depends on your total sales, turnover, or gross receipts during the previous year. The tax audit requirements in India have evolved, especially with the government’s push towards digital transactions.

Here is a breakdown of the thresholds that trigger a mandatory audit:

For Businesses

General Rule: Audit is mandatory if total sales or turnover exceeds ₹1 Crore.

Digital Transaction Relief: If cash receipts and payments are less than 5% of total transactions, the limit increases to ₹10 Crores.

For Professionals

General Rule: Audit is mandatory if gross receipts exceed ₹50 Lakhs.

Presumptive Scheme (44ADA): If opting for presumptive taxation and declaring less than 50% profit, an audit is required.

It is important to note that these limits apply to different business structures. Whether you are running a sole proprietorship or require clarity on LLP vs Partnership differences, the turnover criteria under the Income Tax Act remain a pivotal compliance checkpoint.

Specific Tax Audit Requirements in India for Professionals

For professionals such as doctors, engineers, architects, and technical consultants, the tax audit requirements in India are slightly different. If your gross receipts for the financial year exceed ₹50 Lakhs, you must get your accounts audited. However, the Finance Act has provided relief for those opting for the presumptive taxation scheme under Section 44ADA, provided their receipts are up to ₹75 Lakhs (subject to the 5% cash transaction rule).

If a professional claims that their profits are lower than the prescribed 50% of gross receipts, they fall back into the audit net, regardless of the turnover being lower than the threshold limits. This ensures that income is not under-reported.

Penalties for Non-Compliance with Tax Audit Requirements in India

Ignoring the tax audit requirements in India is not an option for serious businesses. The Income Tax Department imposes strict penalties for failure to get accounts audited or failure to furnish the audit report by the specified due date (usually September 30th of the assessment year).

Under Section 271B, the penalty for non-compliance is the lower of the following:

- 0.5% of the total sales, turnover, or gross receipts.

- ₹1,50,000.

While this might seem like a manageable cost to some, the reputational damage and the subsequent scrutiny from tax authorities can be far more damaging. Additionally, proper audits often align with other compliances. For instance, reconciling your turnover for income tax is often done alongside checks for GST compliance and relief measures, ensuring consistent reporting across different government portals.

Documentation Checklist for Tax Audit Requirements in India

To successfully navigate the tax audit requirements in India, preparation is key. Your Chartered Accountant will require a specific set of documents to verify your accounts. Having these ready can expedite the process significantly.

Here is a checklist of essential documents:

- Books of Accounts: Cash book, bank book, ledgers, and journals.

- Invoices and Bills: Copies of all sales and purchase invoices.

- Expense Vouchers: Proof of business expenses (rent, electricity, salaries, etc.).

- Bank Statements: Statements for all business bank accounts for the financial year.

- Previous Year’s Returns: Copies of ITR and audit reports from the previous year.

- Asset Register: Details of fixed assets purchased or sold during the year.

For detailed statutory guidelines, you can always refer to the Income Tax Department of India website, which provides the official acts and latest notifications.

Forms 3CA, 3CB, and 3CD Explained

When discussing tax audit requirements in India, you will frequently hear about Forms 3CA, 3CB, and 3CD. Understanding the difference is vital.

Form 3CA

This form is used when the books of accounts of the business or profession have already been audited under any other law (like the Companies Act, 2013).

Form 3CB

This form is used when the books of accounts have not been audited under any other law. This applies to most proprietorships and partnership firms.

Form 3CD

This is a detailed statement of particulars containing 44 clauses that the auditor must fill out, detailing various compliance aspects.

Choosing the Right Auditor

Fulfilling the tax audit requirements in India is the exclusive domain of Chartered Accountants. A business cannot hire just anyone; the auditor must be a practicing CA holding a valid Certificate of Practice. Furthermore, the ICAI imposes a limit on the number of tax audits a single CA can undertake in a year (currently 60), ensuring that the quality of the audit is maintained. You can verify a CA’s credentials on the Institute of Chartered Accountants of India (ICAI) website.

Conclusion

Navigating the tax audit requirements in India does not have to be a stressful ordeal. With a clear understanding of the turnover limits, necessary documentation, and filing deadlines, you can ensure your business remains compliant and avoids unnecessary penalties. Remember, a tax audit is more than a statutory obligation; it is an opportunity to review your financial systems and improve the overall health of your business. Always consult with a qualified Chartered Accountant to assess your specific applicability and ensure your Form 3CD is filed accurately and on time.

FAQs

The due date for filing the tax audit report is usually September 30th of the relevant assessment year. However, the filing of the Income Tax Return (ITR) for audit cases is typically due by October 31st.

Yes, you can file the report after the due date, but you may be liable to pay a penalty under Section 271B. The penalty can be 0.5% of the turnover or ₹1.5 Lakhs, whichever is lower.

If your turnover exceeds the prescribed limit (₹1 Crore or ₹10 Crores), a tax audit is mandatory regardless of profit or loss. Also, if you declare profit less than the presumptive taxation limits (8% or 6% under 44AD) and your income exceeds the basic exemption limit, an audit is required.

Freelancers usually fall under the category of professionals. If their gross receipts exceed ₹50 Lakhs within a financial year, they must get their accounts audited. If they opt for Section 44ADA and declare less than 50% of receipts as income, an audit is also required.

No, a Chartered Accountant who is a relative or an employee of the assessee cannot be appointed as a tax auditor to ensure independence and impartiality in the audit report.