Picture this: You have a world-changing idea to tackle a social problem. The passion is there. The plan is forming. But then you hit a wall of legal jargon—Trust Deeds, Memorandums, Articles of Association. Suddenly, your mission feels buried under a mountain of paperwork. You’re stuck on one critical question: Section 8 Company vs Trust vs Society… which path do you take?

Choosing the wrong legal structure is one of the most common, yet avoidable, mistakes new non-profits make. It can cripple your fundraising efforts, create administrative nightmares, and limit your ability to scale. It’s a decision that echoes for years.

But it doesn’t have to be that complicated. In this definitive 2026 guide, we’ll cut through the noise. We’ll break down these three NGO structures with real-world scenarios, practical comparisons, and the kind of insider knowledge you won’t find in a textbook. By the end, you’ll know exactly which framework aligns with your vision, not just for today, but for the future of your impact.

At a Glance: Section 8 vs. Trust vs. Society

Before we dive deep, let’s get a high-level overview. Think of these as three different vehicles for social change. Each one will get you there, but they have very different engines, passenger capacities, and rules of the road. Based on our experience helping hundreds of non-profits launch, this initial choice is everything.

| Feature | Public Charitable Trust | Registered Society | Section 8 Company |

|---|---|---|---|

| Governing Law | Indian Trusts Act, 1882 / State Acts | Societies Registration Act, 1860 | Companies Act, 2013 |

| Regulating Body | Charity Commissioner / Sub-Registrar | Registrar of Societies (State Level) | Ministry of Corporate Affairs (MCA) |

| Best For | Family endowments, property-based charity | Membership-based local initiatives | Scalable, national/global social enterprises |

| Credibility & Trust | Moderate | Moderate to High (State-dependent) | Highest |

| Ease of Registration | Relatively Simple | Moderately Complex | Complex |

🎯 Key Takeaway

Your long-term vision dictates your structure. For small, tightly-controlled initiatives, a Trust is simple. For democratic, community-led projects, a Society works well. But for ambitious, scalable non-profits seeking major grants and corporate funding, the Section 8 Company is the undisputed modern standard.

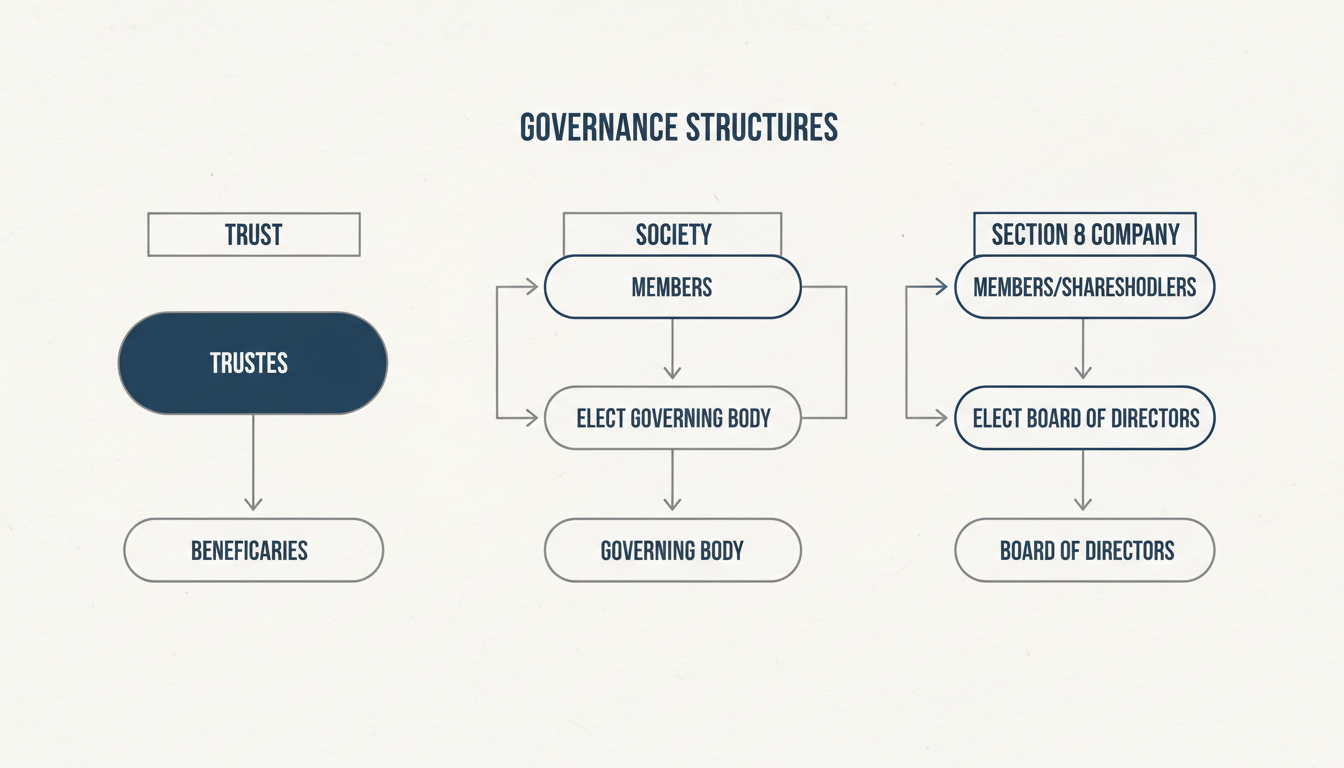

The Deep Dive: Governance, Control, and Who’s in Charge

The fundamental difference in the Section 8 Company vs Trust vs Society debate comes down to power and decision-making. Who calls the shots? How are new leaders brought in? Let’s break it down.

Public Charitable Trust: The Founder’s Fortress

A Trust is managed by a Board of Trustees. The foundational document, the Trust Deed, is king. It lays out the objectives, powers of the trustees, and rules for succession.

- Control: It’s a closed shop. The original founders (settlors) appoint trustees, and changing them can be difficult unless the deed explicitly allows it. This offers immense stability and protects the founder’s original vision.

- Downside: It can feel autocratic. There’s no democratic process for members to vote or elect leaders, which can be a red flag for some large institutional donors who prefer more distributed governance.

Registered Society: The Democratic Collective

A Society is a membership-based organization. Think of it like a club. It requires a minimum of seven members to get started. Management is handled by a Governing Body or Managing Committee, which is elected by the general body of members during an annual general meeting (AGM).

- Control: It’s democratic and participatory. Every member gets a say, which fosters a strong sense of community ownership.

- Downside: Democracy can be messy. I’ve seen internal politics and disputes over leadership derail a society’s mission. It’s less suited for a singular, founder-driven vision.

Section 8 Company: The Corporate Boardroom

This is where things get serious. A Section 8 Company operates under the same rules as a for-profit company, governed by a Board of Directors and members (shareholders, though they don’t receive dividends). Its operations are regulated by the Ministry of Corporate Affairs (MCA).

- Control: It offers a highly structured, professional governance model. The roles of directors and members are clearly defined by the Companies Act, 2013. This structure provides limited liability protection to its members, a huge plus.

- Downside: The compliance is rigorous. You can’t just wing it. You need to maintain statutory registers, file annual returns, and hold board meetings just like a major corporation.

💡 Pro Tip

Don’t just think about who’s in charge now; think about succession. A Section 8 Company’s corporate structure makes it far easier to attract professional, independent directors to your board, which significantly boosts credibility with grant-makers.

Compliance, Transparency, and Following the Money

Here’s the real kicker: your choice of legal structure directly impacts your ability to raise funds. Why? Because big donors—especially corporations with CSR budgets and international foundations—are obsessed with transparency and accountability. They want to know their money is being used effectively and legally.

This is where the high compliance burden of a Section 8 Company transforms from a headache into a superpower.

| Compliance Factor | Trust | Society | Section 8 Company |

|---|---|---|---|

| Annual Filings | Income Tax Return. State-specific filings may apply. | Annual list of managing body & audited accounts with Registrar of Societies. | Mandatory filing of financial statements (AOC-4) and annual return (MGT-7) with ROC. |

| Public Transparency | Low. Documents are not easily accessible to the public. | Moderate. Records are available at the state Registrar’s office. | High. All key documents and financial data are publicly available on the MCA portal. |

| Statutory Audit | Required if income exceeds the threshold. | Mandatory. | Mandatory, regardless of income. |

| Attractiveness for CSR | Lower | Moderate | Highest |

From real-world campaigns, we’ve consistently seen that corporate donors fast-track applications from Section 8 Companies. Their due diligence teams can verify everything online in minutes. For a Trust or Society, they often have to request physical documents, slowing the process down and creating friction.

⚠️ Watch Out

All three entities can apply for 12A (tax exemption for the NGO) and 80G (tax deduction for donors) certificates from the Income Tax Department. However, don’t assume this is automatic. The process is detailed, and since recent changes, these registrations require renewal every five years. Lapsing on this is a fundraising catastrophe.

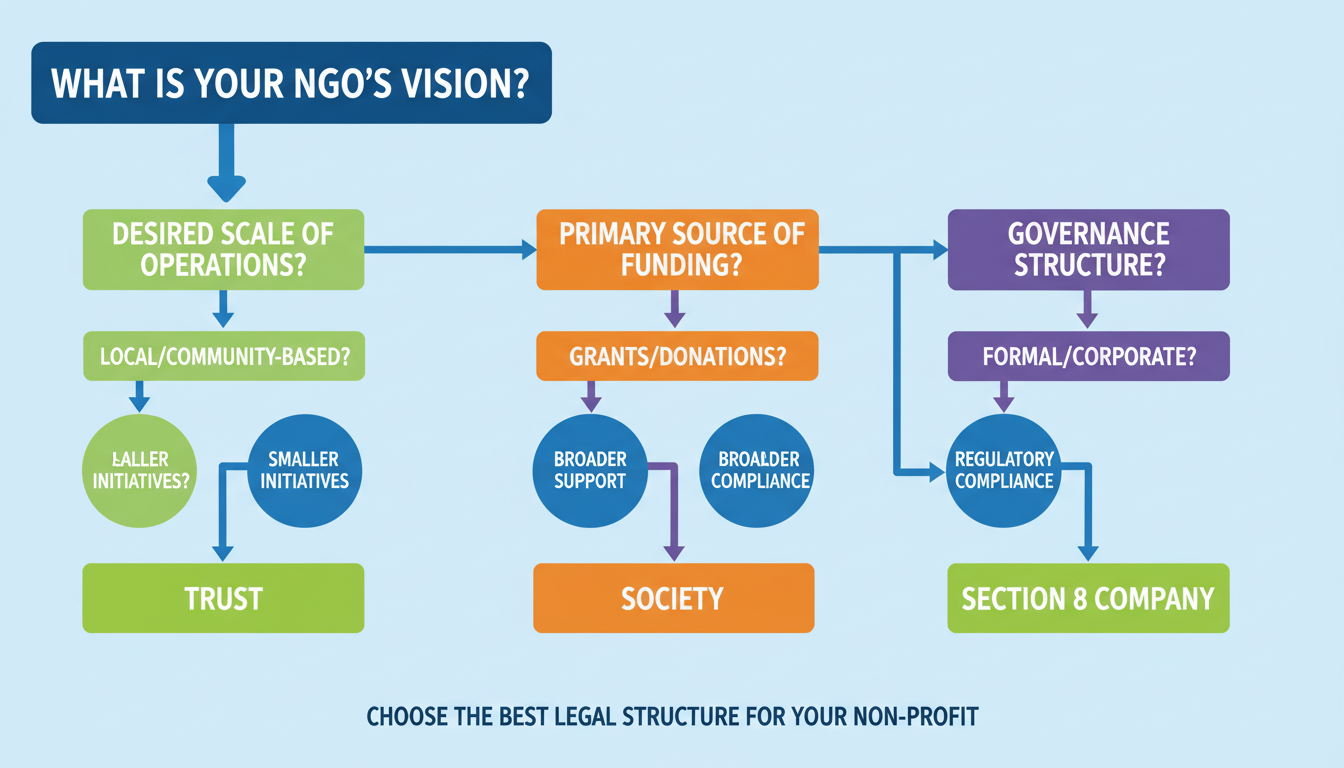

The Decision Framework: A Step-by-Step Guide to Choosing

Feeling overwhelmed? Let’s make this practical. Answer these questions honestly to find your perfect fit. Section 8 Company Registration Guide (2026): Benefits, Process & Fees

- What is your ultimate scale?

- Local Community: A small park, a local festival, a neighborhood library. → Lean towards a Society.

- Family Legacy: Managing a specific property or fund for a charitable purpose. → A Trust is ideal.

- National or Global: Building a scalable model for education, healthcare, or environmental change. → A Section 8 Company is almost non-negotiable.

- Who are your target donors?

- Local Community & Friends: People who know and trust you personally. → Trust or Society will work.

- Corporates (CSR) & Large Foundations: Organizations that require rigorous due diligence. → Section 8 Company gives you a massive advantage.

- Foreign Funding (FCRA): International donors who need absolute confidence in your governance. → Section 8 is strongly preferred.

- What is your tolerance for administrative work?

- “I want it simple.” Low compliance is a priority. → A Trust is the leanest option.

- “I can handle some paperwork.” Willing to do annual state-level filings. → A Society is manageable.

- “I’ll invest in professional help for maximum credibility.” Ready for corporate-level compliance. → A Section 8 Company requires this mindset.

⚠️ Watch Out

Don’t choose a Trust just because it seems “easier.” We’ve seen organizations get stuck a few years down the line when a major funding opportunity arises that requires the transparency of a Section 8 Company. Converting from a Trust to a Section 8 Company is incredibly complex and often not feasible. It’s better to plan for the organization you want to become, not just the one you are today. The Complete Guide to ITR e Verification Steps: Methods, Benefits, and Troubleshooting

The End Game: Altering Objectives and Dissolution

What happens if your mission evolves or you need to close down? This is another area where the structures differ significantly.

- Trust: Altering the core objectives laid out in the Trust Deed is extremely difficult, often requiring court intervention. Dissolution is also dictated by the deed.

- Society: Objectives can be changed with the approval of a supermajority of members. Dissolution requires a vote by at least three-fifths of the members and is a formal process with the Registrar.

- Section 8 Company: Changing objectives requires passing a special resolution and getting approval from the Registrar of Companies. Dissolution is a formal winding-up process under the Companies Act. Crucially, any leftover assets must be transferred to another Section 8 Company with similar objects. This “no-profit-passthrough” rule is a cornerstone of its trustworthiness.

💡 Pro Tip

When registering your NGO on the government’s NGO Darpan portal, which is mandatory for many government grants, having a Section 8 Company registration often streamlines the verification process. The system integrates more smoothly with MCA data, signaling a higher level of formal recognition.

Conclusion: Your Vision Demands the Right Vehicle

So, in the great debate of Section 8 Company vs Trust vs Society, there’s no single “best” answer—only the right answer for your mission.

Let’s boil it down. If your goal is small-scale, local, and tightly controlled, the simplicity of a Trust or the democratic nature of a Society has its merits. They are time-tested structures that have done immense good.

But if you’re a social entrepreneur with a vision that’s big, scalable, and built to attract serious funding, the choice is clear. The Section 8 Company is the gold standard for modern non-profits in 2026. Its robust governance, unparalleled transparency, and corporate-level credibility are no longer just “nice-to-haves”; they are prerequisites for making a significant, sustainable impact.

Your next step? Don’t just read this article. Sit down with your founding team and map out your five-year plan. Where do you see your organization? Who will be funding it? Answering those questions will make your choice crystal clear. You’re not just registering a non-profit; you’re building a foundation for change. Build it to last.

❓ Frequently Asked Questions

Which NGO structure is cheapest to register in 2026?

A Public Charitable Trust is generally the most economical to set up. It involves lower government fees and professional costs compared to a Society, and significantly less than a Section 8 Company, which requires compliance with the extensive Companies Act, 2013.

Can I convert a Trust or Society into a Section 8 Company later?

While technically possible, it’s a legally complex, time-consuming, and expensive process. It often involves setting up a new Section 8 Company and then transferring the assets and liabilities of the existing entity. It’s far more efficient to choose the right structure from the start based on your long-term goals.

How many people are needed to start each type of NGO?

A Trust requires a minimum of two trustees. A Society needs a minimum of seven members for a state-level registration. A Section 8 Company requires a minimum of two directors and two members (they can be the same people).

Is a Section 8 Company better for getting foreign funding (FCRA)?

Yes, overwhelmingly. While all three structures can apply for an FCRA license, international donors and the Ministry of Home Affairs (which grants the license) view Section 8 Companies more favorably. Their transparent financial records, publicly available on the MCA portal, make the due diligence process much smoother and build greater trust.

Do the directors of a Section 8 Company have personal liability?

No, and this is a major advantage. A Section 8 Company is a separate legal entity, and it offers limited liability to its directors and members. This means their personal assets are protected from the company’s debts and legal obligations, provided they have not engaged in fraud or negligence.

Can a Section 8 Company make a profit?

Yes, it can generate a surplus (profit). However, according to the Companies Act, 2013, this profit cannot be distributed as dividends to its members. It must be reinvested back into the organization to promote its social objectives. This is the core principle of a non-profit company.