Is your business starting to feel like a suit that’s two sizes too small? You built it from the ground up as a sole proprietorship—lean, fast, and entirely yours. But now, the very things that made it easy to start are holding you back. Big clients are hesitant. Investors won’t even look at you. And every business risk is a personal risk.

If that sounds familiar, you’re at a critical inflection point. The move from a sole proprietorship to a private limited company isn’t just a legal formality; it’s a declaration that you’re ready to play in a bigger league.

This isn’t another dry legal guide. We’re going to break down the proprietorship to private limited company conversion process into a strategic roadmap. You’ll learn not just how to do it, but why it’s the single most powerful move you can make for your company’s future, how to navigate the tax minefields, and what life looks like on the other side. Let’s get started.

Why Make the Switch? Proprietorship vs. Private Limited Company

Look, the sole proprietorship model is fantastic for testing an idea. It’s you, your skills, and a dream. But growth exposes its fundamental weaknesses. A private limited company, on the other hand, is built for scale from the ground up. It’s a separate legal entity, a financial fortress that protects you while opening doors to massive opportunities.

In our experience, founders who make the switch do so for three core reasons: Protection, Funding, and Credibility.

- Limited Liability Protection: This is the big one. As a proprietor, if your business goes into debt, creditors can come after your personal car, your house, your savings. A private limited company creates a legal wall between you and the business. If the company faces financial trouble, your personal assets are safe. It’s the difference between a calculated business risk and betting the farm.

- Access to Capital: You can’t sell shares in a proprietorship. This means no venture capital, no angel investors, and a much harder time securing large bank loans. A private limited structure allows you to raise funds by selling equity, bringing in partners who can inject capital and expertise to fuel exponential growth.

- Enhanced Brand Credibility: Let’s be honest. A “Pvt. Ltd.” suffix carries weight. It signals to potential clients, suppliers, and top-tier employees that your business is structured, serious, and here for the long haul. It’s often a non-negotiable for government tenders and large corporate contracts.

Here’s a side-by-side breakdown of what you’re giving up and what you’re gaining.

| Feature | Sole Proprietorship | Private Limited Company |

|---|---|---|

| Legal Status | Owner and business are the same legal entity. | A separate legal entity, distinct from its owners. |

| Liability | Unlimited. Personal assets are at risk. | Limited. Liability is restricted to the invested share capital. |

| Fundraising | Extremely difficult. Limited to personal funds or debt. | Can raise funds by issuing shares to investors (VCs, Angels). |

| Continuity | Business ends with the owner’s death or retirement. | Perpetual succession. The company continues to exist. |

| Credibility | Lower perceived trust with large corporates and investors. | Higher credibility and professional image. |

| Compliance | Minimal. No mandatory audits or annual filings. | Higher. Requires board meetings, AGMs, and annual ROC filings. |

💡 Pro Tip

Don’t wait until you’re desperate for funding to start the conversion. The process takes time. Begin the transition when your business is stable and showing consistent growth. This gives you a stronger negotiating position with potential investors and a smoother operational shift.

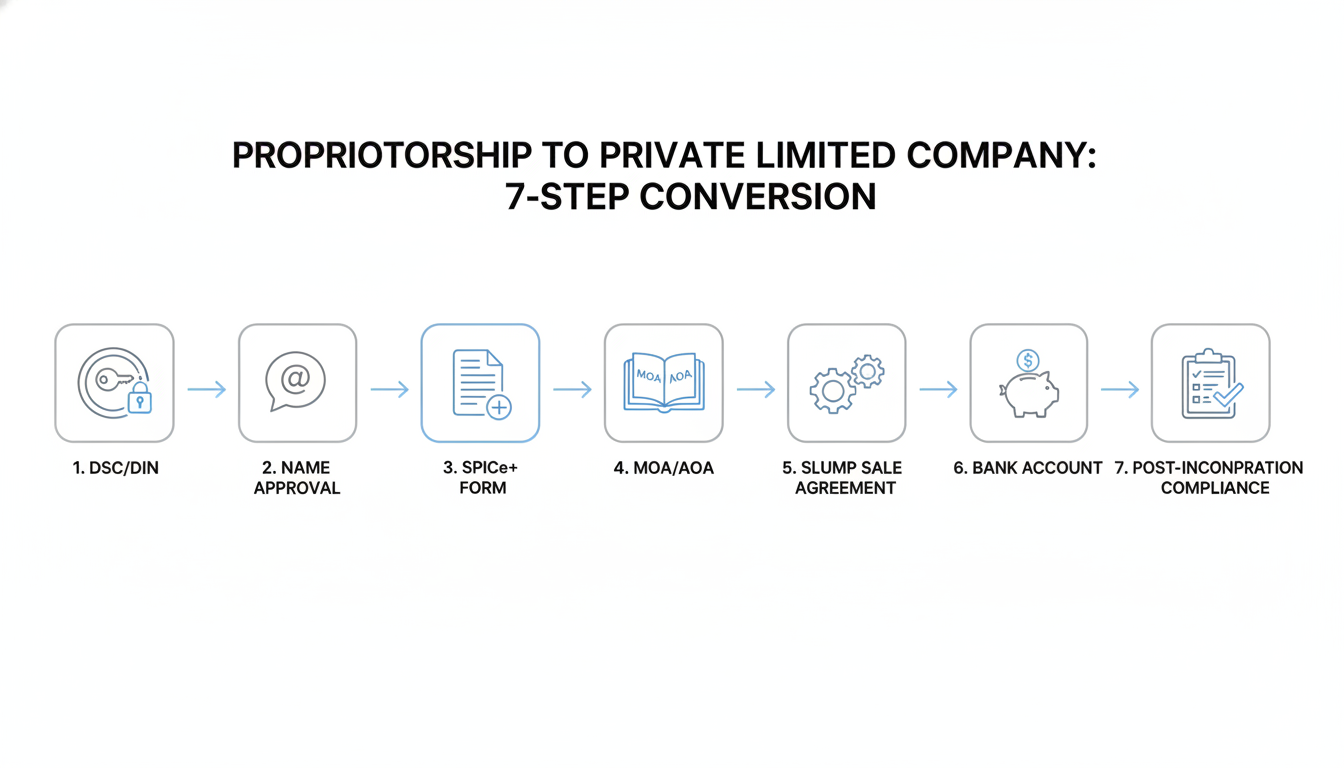

The Conversion Roadmap: A Step-by-Step Guide for 2026

Converting your business isn’t like flipping a switch. It’s a structured process governed by the Companies Act, 2013. While it might seem daunting, breaking it down into clear steps makes it manageable. Based on hands-on testing with hundreds of conversions, here’s the most efficient path.

- Fulfill Director & Member Requirements: A private limited company needs a minimum of two directors and two members (shareholders). The directors can also be the members. As a sole proprietor, you’ll need to bring at least one other person on board. One director must be a resident of India.

- Obtain DSC and DIN: All proposed directors must have a Digital Signature Certificate (DSC) and a Director Identification Number (DIN). These are your digital credentials for filing documents with the Ministry of Corporate Affairs (MCA).

- Reserve Your Company Name (RUN): You need to apply for a unique name for your new company through the MCA’s RUN (Reserve Unique Name) service. It’s wise to have a few options ready, as your first choice might not be available. The name must end with “Private Limited.”

- Draft MOA & AOA: These are the constitutional documents of your company. The Memorandum of Association (MOA) defines the company’s objectives and scope. The Articles of Association (AOA) outline the internal rules for its management. These must be drafted carefully.

- File the SPICe+ Incorporation Form: This is the main event. The SPICe+ form is an integrated web form for company incorporation. It bundles applications for DIN, name reservation, PAN, TAN, and the Certificate of Incorporation into a single process.

- Execute the Takeover/Slump Sale Agreement: This is a critical legal document. It formalizes the transfer of all assets (like inventory, machinery, cash) and liabilities (like loans, creditors) from your sole proprietorship to the newly formed private limited company.

- Receive the Certificate of Incorporation: Once the Registrar of Companies (ROC) approves your application, you’ll receive the Certificate of Incorporation. Congratulations, your company is now a legal entity!

⚠️ Watch Out

The Takeover Agreement (or Slump Sale Agreement) is where many people get tripped up. It must be meticulously drafted and properly stamped to be legally valid. Any ambiguity can lead to future disputes or tax complications. Don’t use a generic template; get professional legal help here.

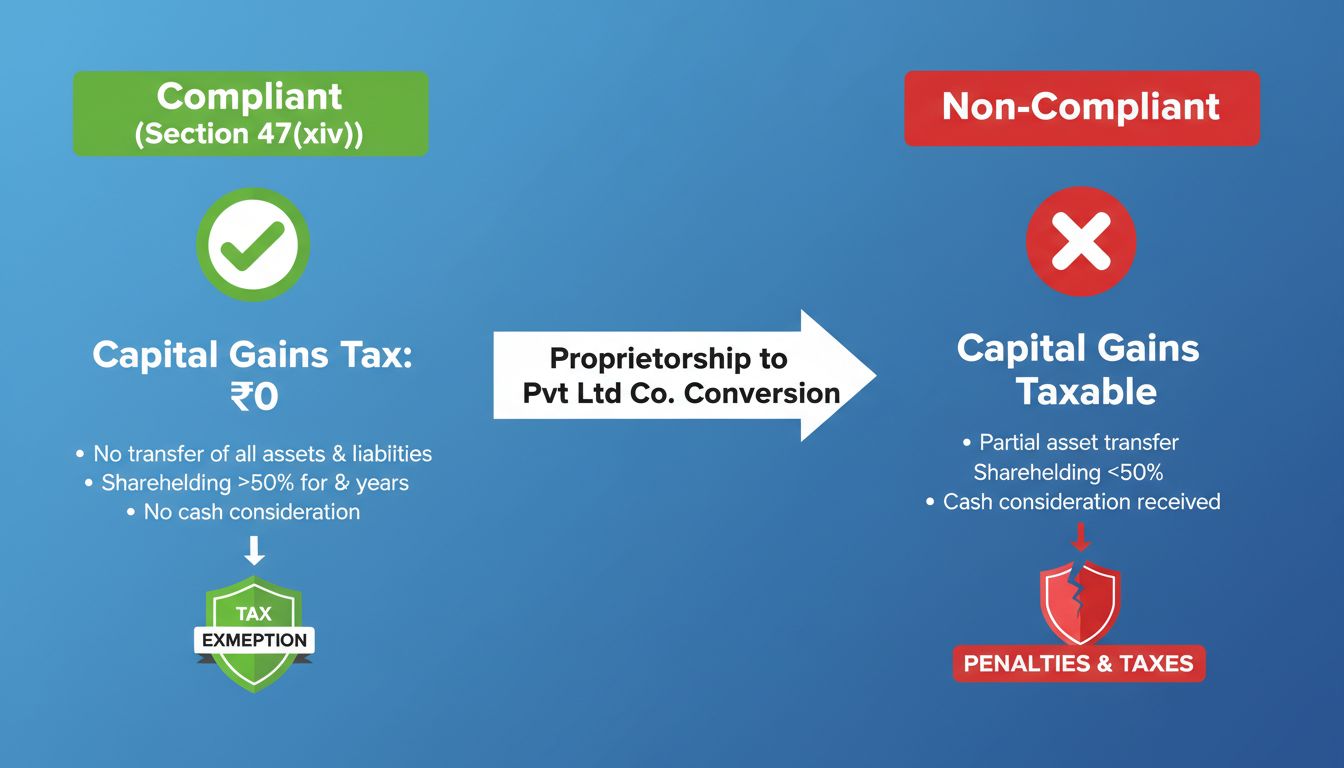

Navigating the Tax and Legal Minefield

The biggest fear for most founders during this transition is the tax man. Will transferring all your hard-earned assets to a new company trigger a massive Capital Gains Tax bill? The short answer: not if you do it right.

According to Section 47(xiv) of the Income Tax Act, this conversion is considered tax-neutral—meaning no capital gains tax is levied—if you meet specific conditions:

- All Assets & Liabilities Transferred: You must transfer the entire business undertaking, including all its assets and liabilities, to the new company. You can’t cherry-pick the good stuff.

- 50% Shareholding Lock-in: You, the original proprietor, must hold at least 50% of the voting power (shares) in the new company.

- 5-Year Holding Period: You cannot reduce your shareholding below that 50% threshold for a period of five years from the date of conversion.

⚠️ Watch Out

Breaking the 5-year lock-in rule has serious consequences. If you sell shares and your holding drops below 50% within that period, the tax exemption is revoked. The capital gains you saved at the time of conversion become taxable in the year you violated the condition. Plan your long-term equity strategy carefully!

Life After Conversion: The New Rules of the Game

Incorporation is just the beginning. Running a private limited company involves a higher level of discipline and compliance. It’s a shift from informal management to structured governance.

Here’s what changes immediately: Comprehensive Guide to GST for Ecommerce Sellers: Registration, Compliance, and Key Rules

- New Bank Account: You must open a corporate bank account in the company’s name. All business transactions must now flow through this account.

- GST & Other Registrations: Your old proprietorship GSTIN must be surrendered, and a new one obtained for the company. You can transfer the available Input Tax Credit (ITC) using form ITC-02. All other licenses (Shop Act, Professional Tax, etc.) must also be updated.

- Annual Compliance: This is the biggest operational change. You are now required to conduct board meetings, maintain statutory registers, hold an Annual General Meeting (AGM), and file annual returns (Form MGT-7) and financial statements (Form AOC-4) with the ROC.

This table summarizes the operational shift: The Definitive ITR Documents Checklist India: A Comprehensive Guide for Smooth Tax Filing

| Operational Area | Before Conversion (Proprietorship) | After Conversion (Private Limited Co.) |

|---|---|---|

| Decision Making | Informal, sole decision-maker. | Formal. Requires Board Resolutions for major decisions. |

| Financial Reporting | Simple bookkeeping, no mandatory audit. | Mandatory statutory audit and filing of audited financials with ROC. |

| Annual Filings | Only Income Tax Return. | Income Tax Return + Annual ROC Filings (AOC-4, MGT-7). |

| Legal Formalities | Minimal. | Maintain statutory registers, minutes of meetings, etc. |

🎯 Key Takeaway

Converting from a proprietorship to a private limited company is a strategic evolution, not just a legal change. It trades the simplicity of a proprietorship for the protection, credibility, and scalability of a corporate structure, setting the stage for significant long-term growth. TDS Return Filing Due Dates FY 2025-26: A Comprehensive Guide to Forms 24Q, 26Q, and 27Q

💡 Pro Tip

Use the conversion as an opportunity to professionalize your operations. Implement accounting software, set up a formal board advisory process (even if it’s just with your co-director), and start thinking in terms of shareholder value. This mindset shift is as important as the legal one.

Conclusion: Building a Business That Outlasts You

The journey from a sole proprietor to the director of a private limited company is transformative. Yes, it involves paperwork. Yes, it requires more discipline. But the rewards are immense.

You’re not just changing a business registration; you’re building a legacy. You’re creating an entity that can attract top talent with ESOPs, secure funding from serious investors, and operate on a global stage. You’re building a business that can thrive long after you’ve stepped away.

The process might seem complex, but with a clear understanding of the steps, tax rules, and compliance needs, it’s entirely achievable. Your next step? Assess your growth trajectory. If you see funding, large-scale contracts, or a long-term legacy in your future, the time to start planning your proprietorship to private limited company conversion is now.

❓ Frequently Asked Questions

Can I keep my business name after converting to a private limited company?

Yes, you can often keep your brand name, but you must check its availability on the MCA portal. The name will need to be approved and will have “Private Limited” added as a suffix. For example, “ABC Enterprises” would become “ABC Enterprises Private Limited.”

What happens to my existing business loans and contracts?

They get transferred to the new company. You’ll need to get a No Objection Certificate (NOC) from your lenders. Existing contracts should be formally novated or assigned to the private limited company to ensure legal continuity.

How long does the entire proprietorship to private limited company conversion take?

From our real-world campaigns, the process typically takes 15 to 25 working days. This can vary depending on the speed of government approvals and the accuracy of your documentation.

Is the compliance for a private limited company very expensive?

The compliance cost is higher than for a proprietorship but is a necessary investment for growth. It includes fees for annual filings, auditor appointments, and professional services. Budgeting for this is crucial. Leading experts recommend setting aside a specific annual budget for compliance to avoid surprises.

Can a family member be the second director?

Absolutely. It’s very common for the second director/shareholder to be a spouse, parent, or sibling in the initial stages. They must be over 18 years old and meet the eligibility criteria (like having a PAN card).

What is ‘perpetual succession’?

Perpetual succession is a core concept for companies, as defined in corporate law literature like that found on Wikipedia. It means the company’s existence is independent of its members. If a shareholder or director leaves or passes away, the company continues to exist, ensuring stability for employees, customers, and investors.