Introduction: Unraveling the Complexity of Professional Tax in India

When looking at your salary slip, you often see a deduction labeled “Prof Tax” or “P-Tax.” For many employees and business owners, this remains a confusing component of the payroll structure. Despite its name, professional tax in India is not just a tax on professionals like doctors or lawyers; it is a levy on all kinds of professions, trades, and employment.

Unlike the income tax which is collected by the Central Government, professional tax is a state-level tax. This means the rules, rates, and compliance requirements change depending on whether you are working in Maharashtra, Karnataka, West Bengal, or Tamil Nadu. Understanding these nuances is vital for avoiding penalties and ensuring smooth financial compliance.

In this comprehensive guide, we will break down everything you need to know about professional tax in India, including eligibility, slab rates, exemptions, and how it impacts your overall tax liability.

What is Professional Tax in India?

Professional Tax is a direct tax levied by the State Government on individuals who earn an income through salary, or by practicing a profession like accountancy, law, or medicine, or by carrying out some form of trade. The power to levy this tax is granted to states under Article 276 of the Constitution of India.

While the tax is levied on income, it is distinct from the Income Tax. However, there is a cap. Under the Constitution, the maximum amount of professional tax that a state can levy on any person is capped at ₹2,500 per annum. While some states charge this maximum amount, others may charge less or have different slab structures.

Who is Liable to Pay Professional Tax in India?

The liability for paying professional tax in India depends on your employment status. It is crucial to distinguish between salaried individuals and self-employed professionals.

Salaried Employees

For salaried employees, the employer is responsible for deducting the professional tax from the monthly salary and depositing it with the respective State Government. The employer must obtain a Registration Certificate (RC) to do this legally.

Self-Employed / Business

Self-employed individuals (doctors, lawyers, freelancers) and business owners are responsible for paying the tax themselves. They must obtain an Enrolment Certificate (EC) and pay the tax based on the state’s slab rates.

If you are running a business, ensuring you are compliant with local taxes is as important as adhering to national regulations. For instance, just as you must understand tax audit requirements in India, you must also ensure your professional tax filings are up to date to avoid legal complications.

State-Wise Breakdown of Professional Tax in India

Not all states in India levy professional tax. For example, states like Delhi, Haryana, and Uttar Pradesh do not currently have a professional tax. However, states like Maharashtra, Karnataka, West Bengal, and Telangana enforce it strictly.

Here is a general overview of how professional tax in India varies by major states (Note: Rates are subject to periodic revision by state governments).

1. Maharashtra

Maharashtra has one of the most structured professional tax systems. For men earning over ₹7,500 and women earning over ₹10,000, the tax is generally ₹200 per month, with ₹300 deducted in February to round off the total to ₹2,500 annually.

2. Karnataka

In Karnataka, the professional tax is levied on those earning a gross salary above ₹15,000 per month. The tax is typically ₹200 per month. No tax is levied for salaries below this threshold.

3. West Bengal

West Bengal follows a slab system where earners below ₹10,000 pay nothing. The rates increase progressively, capped at the constitutional limit of ₹2,500 per year.

Is Professional Tax Deductible Under Income Tax?

Yes, this is a significant relief for taxpayers. The professional tax in India paid by an employee is allowed as a deduction from their gross salary under Section 16(iii) of the Income Tax Act, 1961.

When you are planning your taxes or looking at the Interim Budget 2024 for new tax regimes, remember that professional tax deduction applies to the Old Tax Regime. It is one of the few deductions that directly reduces your taxable salary income.

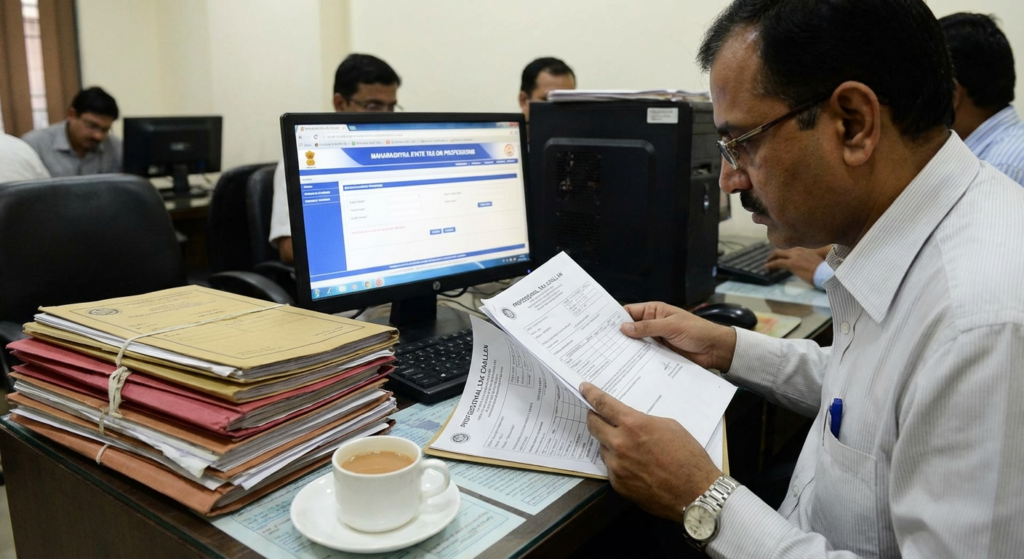

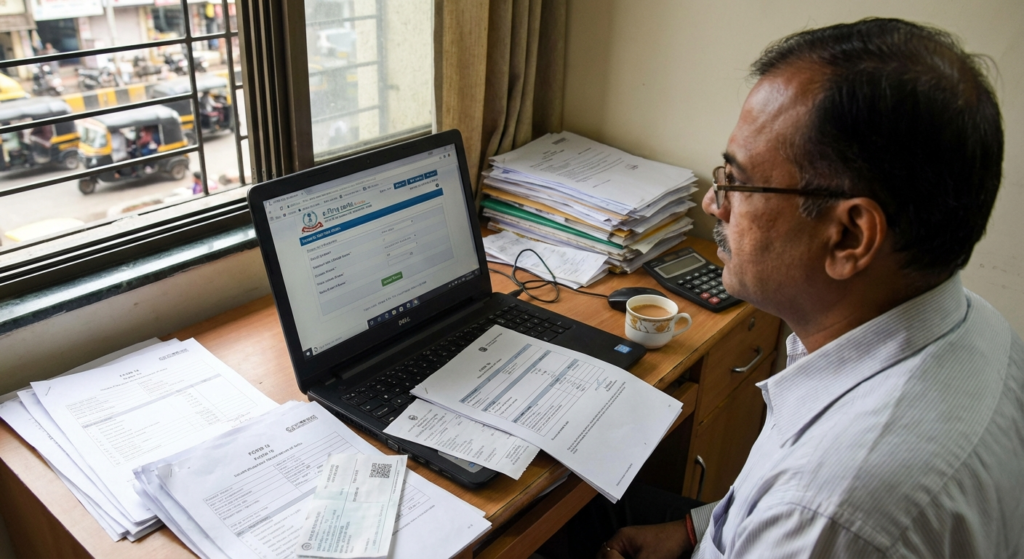

Registration and Compliance for Businesses

For businesses operating in states where professional tax in India is applicable, compliance is two-fold:

- Professional Tax Registration Certificate (PTRC): This is required for the employer to deduct tax from employees’ salaries and pay it to the government.

- Professional Tax Enrolment Certificate (PTEC): This is required for the business entity itself (or the professional) to pay its own professional tax.

Failing to register can lead to heavy penalties. The process has become largely digital in most states, aligning with the Digital India initiative.

Exemptions from Professional Tax

While the rules vary by state, certain categories of individuals are generally exempt from paying professional tax in India. These often include:

- Senior Citizens: Individuals above 65 years of age (varies by state).

- Parents of children with permanent disabilities.

- Members of the armed forces (Army, Navy, Air Force) and members of the auxiliary forces or reservists serving in the state.

- Physically challenged individuals (including blindness and deafness) subject to state-specific certification.

- Badli workers in the textile industry.

Always check the official notification of your specific state government to confirm these exemptions, as they are not uniform across the country.

Consequences of Non-Payment of Professional Tax in India

Ignoring professional tax in India can lead to financial consequences that accumulate over time. Since this is a state-regulated matter, the penalties vary, but they generally fall into three categories:

Penalty for Non-Registration

Failure to obtain the Registration or Enrolment Certificate within the stipulated time can result in a lump sum penalty or a daily fine.

Interest on Late Payment

If you fail to pay the tax by the due date, states typically charge simple interest ranging from 1.25% to 2% per month on the outstanding amount.

Penalty for Non-Filing

Failing to file the return on time can attract a separate penalty, often ranging from ₹1,000 to ₹2,000 per return.

It is advisable to consult official resources like the National Portal of India or specific state commercial tax websites to stay updated on penalty clauses.

How to Pay Professional Tax Online

Most states have moved to an online payment system for professional tax in India. Here is a generalized step-by-step process:

- Visit the Commercial Tax Department website of your specific state (e.g., Mahavat for Maharashtra, e-Prerana for West Bengal).

- Log in using your Registration Certificate (RC) or Enrolment Certificate (EC) number.

- Select the period for which you want to pay the tax (Monthly, Quarterly, or Annually).

- Enter the tax amount based on the employees’ slab or your professional standing.

- Make the payment via Net Banking, Credit Card, or Debit Card.

- Download the challan or receipt for your records.

For detailed legal frameworks, you can refer to the Legislative Department of India which hosts central and state acts.

Conclusion

Professional tax in India is a mandatory contribution for many, yet it remains one of the most affordable taxes compared to Income Tax or GST. Whether you are a business owner ensuring compliance or an employee checking your salary slip, understanding the basics of this tax helps in better financial planning. While the maximum amount is capped at ₹2,500 annually, the penalties for non-compliance can far exceed the tax itself. Always ensure timely registration and payment to keep your financial record clean.

Frequently Asked Questions (FAQs)

No, Professional Tax is not applicable in all states. States like Delhi, Haryana, Uttar Pradesh, and Rajasthan do not currently levy this tax. It is primarily applicable in states like Maharashtra, Karnataka, West Bengal, Tamil Nadu, and Gujarat.

Professional Tax is not refundable. However, it can be claimed as a deduction from your gross salary under Section 16(iii) of the Income Tax Act, which reduces your total taxable income.

Freelancers fall under the category of self-employed professionals. Therefore, they are personally responsible for registering for an Enrolment Certificate (EC) and paying the professional tax directly to the state government.

As per Article 276 of the Constitution of India, the maximum professional tax that can be levied by any state is currently capped at ₹2,500 per annum per person.

If an employer deducts the tax but fails to deposit it, they are liable for penalties and interest. As an employee, you should ensure your Form 16 reflects the deduction, which serves as proof of payment for your income tax filing.