Starting a business is an exhilarating journey, and sharing that journey with a partner can make the road to success much smoother. In the dynamic economic landscape of 2024, forming a partnership is one of the most popular ways for entrepreneurs to combine resources, skills, and capital. However, to ensure your venture is legally protected and credible, understanding the nuances of partnership firm registration India is crucial.

While the Indian Partnership Act, 1932, technically allows firms to remain unregistered, the legal disadvantages of doing so are significant. A registered firm enjoys the power to sue for dues, enhanced credibility with banks, and a clear legal structure. In this comprehensive guide, we will walk you through the entire landscape of partnership firm registration India, ensuring you have the actionable insights needed to formalize your business identity.

Why Prioritize Partnership Firm Registration India?

Many new entrepreneurs ask, "Is registration really necessary?" The short answer is: absolutely. While an unregistered firm is not illegal, it is a "toothless tiger" in the eyes of the law. The process of partnership firm registration India bestows your business with legal rights that are essential for long-term survival and growth.

Here are the core benefits of formalizing your partnership, presented in a clear breakdown:

Legal Protection

Only a registered firm can file a lawsuit against third parties or other partners to enforce rights arising from a contract. Unregistered firms cannot take legal action to recover debts.

Credibility & Trust

Banks and financial institutions require a registration certificate to open current accounts or sanction loans. It signals to investors that your business is compliant and serious.

Tax Advantages

Registered firms can claim tax deductions on partner salaries and interest paid to partners, provided these are mentioned in the partnership deed, optimizing your overall tax liability.

Essential Documents for Partnership Firm Registration India

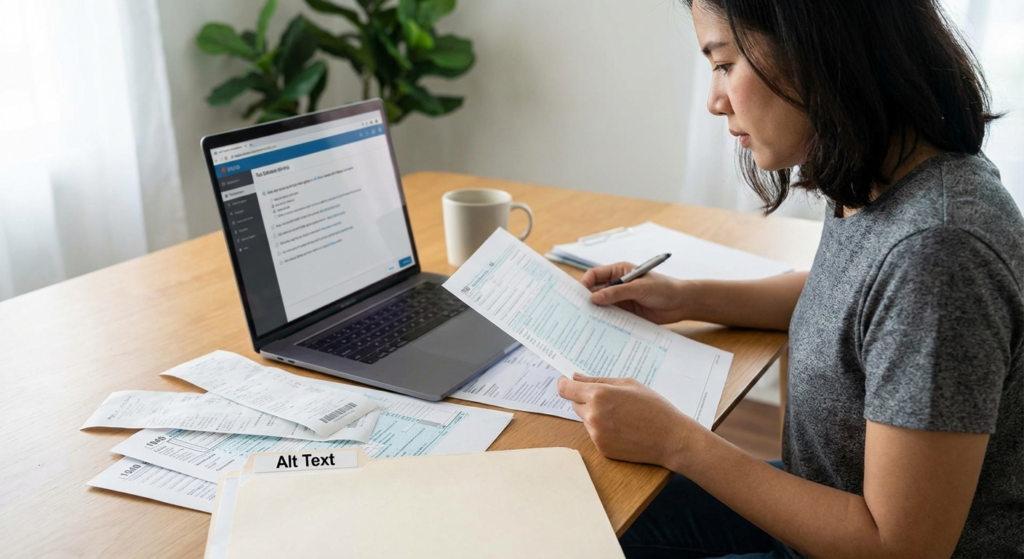

Before you approach the Registrar of Firms (RoF), you must have your paperwork in immaculate order. The documentation process is the backbone of partnership firm registration India. Missing a single document can lead to rejection or unnecessary delays.

To ensure a smooth workflow, gather the following:

- Application for Registration (Form 1): This must be filled out precisely with the firm’s name, main place of business, and details of all partners.

- Partnership Deed: The most critical document. It acts as the constitution of your firm.

- Proof of Address of the Firm: Ownership deed (if owned) or a Rent Agreement with an NOC from the landlord (if rented).

- Identity Proofs of Partners: PAN Card is mandatory. Additionally, Aadhar Card, Voter ID, or Passport are required. If you haven’t sorted this yet, you should learn how to apply for PAN card online immediately.

- Affidavits: A declaration certifying that all details provided in the partnership deed and documents are correct.

The Role of the Partnership Deed

Within the context of partnership firm registration India, the Partnership Deed is king. This agreement outlines the rights, duties, profit-sharing ratios, and dispute resolution mechanisms between partners. It must be printed on judicial stamp paper of appropriate value (which varies by state) and signed by all partners.

Step-by-Step Guide to Partnership Firm Registration India

Now that we have covered the why and the what, let’s dive into the how. The procedure for partnership firm registration India is governed by the Registrar of Firms of the respective state where your head office is located. While some states have moved to online systems, others may still require physical submission.

Step 1: Choosing a Unique Name

Your firm’s name should be unique and not resemble existing trademarks. Avoid words that imply government patronage (like "Crown," "Empire," or "State") unless you have specific government approval.

Step 2: Drafting the Partnership Deed

As mentioned earlier, draft the deed carefully. Ensure it covers:

- Name and address of the firm and partners.

- Nature of the business.

- Date of commencement.

- Capital contribution by each partner.

- Profit and loss sharing ratio.

- Salaries or interest on capital payable to partners.

Step 3: Filing the Application with the Registrar

Submit Form 1 along with the required documents and the prescribed fees to the Registrar of Firms. This is the core administrative step in partnership firm registration India. All partners must sign the application.

Step 4: Scrutiny and Issuance of Certificate

The Registrar will review your application. If everything complies with Section 58 of the Indian Partnership Act, an entry will be made in the Register of Firms, and a Certificate of Registration will be issued. This certificate is conclusive proof of your partnership firm registration India.

Comparison: Registered vs. Unregistered Firms

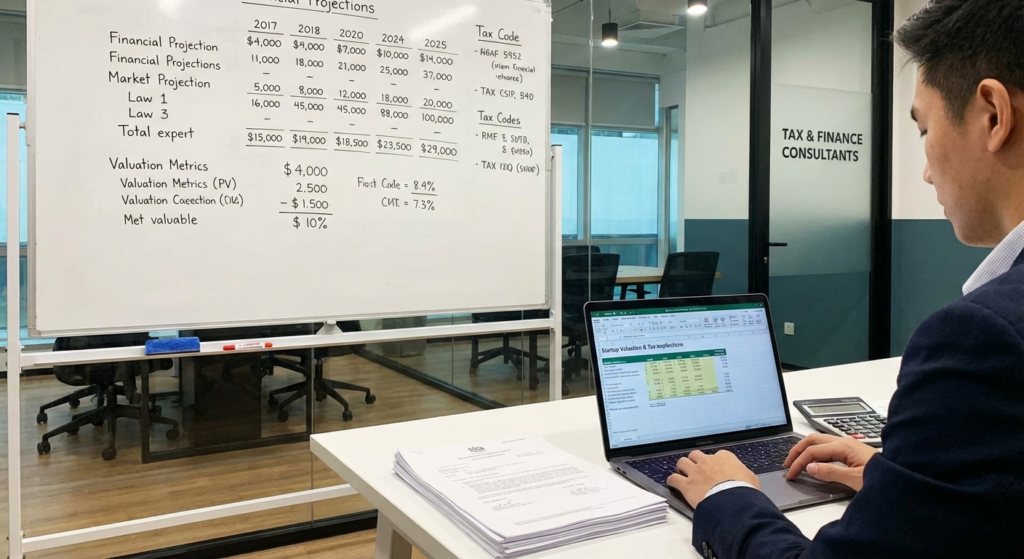

To further highlight the importance of partnership firm registration India, let’s look at a direct comparison. This visual breakdown helps in understanding the risks associated with non-registration.

Feature

Suit by Firm

Suit Against Firm

Set-off Claims

Registered Firm

Can sue third parties for dues.

Third parties can sue the firm.

Can claim set-off in legal disputes.

Unregistered Firm

Cannot sue third parties.

Third parties can still sue the firm.

Cannot claim set-off > ₹100.

Post-Registration Compliance and Growth

Once you have successfully completed your partnership firm registration India, the journey doesn’t end. You must maintain compliance to keep your business in good standing.

- Open a Current Bank Account: Use your Registration Certificate and Partnership Deed to open a bank account in the firm’s name.

- Apply for MSME Registration: To avail of government subsidies and priority lending, it is highly recommended to obtain Udyam Registration. You can learn more about MSME registration services to unlock these benefits.

- GST Registration: If your turnover exceeds the threshold limit (usually ₹40 lakhs for goods and ₹20 lakhs for services), GST registration becomes mandatory.

- Annual Compliances: Unlike LLPs or Private Limited Companies, partnership firms have fewer annual filings, but income tax returns must be filed on time.

Common Challenges in Partnership Firm Registration India

Even with a straightforward process, applicants often face hurdles during partnership firm registration India. Being aware of these can save you time:

- Incomplete Documentation: The most common reason for rejection is missing signatures or incorrect details in the deed.

- Name Rejection: If the proposed name infringes on a trademark or is too similar to an existing company, the Registrar will reject it.

- State-Specific Rules: Stamp duty rates for the partnership deed vary significantly from Maharashtra to Delhi to Karnataka. Using the wrong stamp paper value renders the deed invalid.

For more detailed insights on general business structures and compliance, you might find resources like the Ministry of Corporate Affairs or Startup India helpful for understanding the broader ecosystem.

Conclusion

Navigating the partnership firm registration India process is a fundamental step toward building a resilient and legally secure business. While the paperwork may seem tedious, the protection it offers your assets and your brand is invaluable. A registered firm commands respect from vendors, customers, and financial institutions alike.

By following the steps outlined above—drafting a solid deed, gathering the right documents, and submitting your application accurately—you set a strong foundation for your venture. Don’t leave your business vulnerable; prioritize registration today and focus on what you do best: growing your business.

Frequently Asked Questions (FAQs)

No, registration is not mandatory under the Indian Partnership Act, 1932. However, it is highly recommended because unregistered firms cannot sue third parties to recover dues, though they can still be sued by others.

The timeline varies by state and the workload of the Registrar of Firms. generally, it takes between 10 to 15 working days after the submission of the application and documents, provided there are no objections.

Yes, many states in India, such as Maharashtra and Delhi, offer online facilities for partnership firm registration India. However, some states may still require the physical submission of the deed and documents after the online filing.

The government fees for registration are nominal and vary by state. However, the major costs involve the Stamp Duty for the Partnership Deed (which depends on capital contribution) and professional fees if you hire a CA or lawyer.

Yes, as your business grows, you can convert your partnership firm into a Limited Liability Partnership (LLP) or a Private Limited Company to enjoy limited liability protection and better scalability.