Understanding the Importance of Timely TDS Return Due Dates

Tax Deducted at Source (TDS) is a fundamental component of India's direct tax system. It ensures that tax is collected at the very source of income. While the process of deducting tax and depositing it with the government is straightforward, the subsequent step—filing the quarterly TDS return—is where many businesses face challenges. Adhering strictly to the TDS return due dates is not just a matter of good practice; it is a mandatory legal requirement that prevents hefty financial penalties and legal repercussions.

For every person (deductor) responsible for making certain payments specified under the Income Tax Act, 1961, there is an obligation to deduct tax and submit a comprehensive quarterly statement. Knowing and respecting the official TDS return due dates ensures smooth operations and maintains compliance standing with the Income Tax Department. Missing these deadlines can disrupt your financial workflow and negatively impact the recipients (deductees) who rely on these filings to claim tax credits.

The Difference Between TDS Payment and Return Filing Deadlines

It is crucial to differentiate between two key compliance milestones:

- TDS Payment Due Date: This is the date by which the deducted tax must be remitted to the government treasury. Generally, this is the 7th day of the succeeding month in which the deduction was made (with exceptions for March, which is usually April 30th).

- TDS Return Due Dates: This is the date by which the consolidated statement detailing all deductions made during the quarter must be filed electronically. These are quarterly deadlines.

Failure to meet either deadline triggers specific penalty provisions outlined in the Income Tax Act.

Penalty for Late TDS Return Filing (Section 234E)

A mandatory late filing fee of ₹200 per day applies for every day the default continues, until the fee equals the amount of TDS deductible for that quarter. This fee is levied even if the tax has already been deposited on time.

Interest for Late TDS Payment (Section 201)

Interest is charged at 1% per month or part thereof if TDS was deducted but not deposited on time, and 1.5% per month or part thereof if TDS was not deducted at all or was deducted at a lower rate.

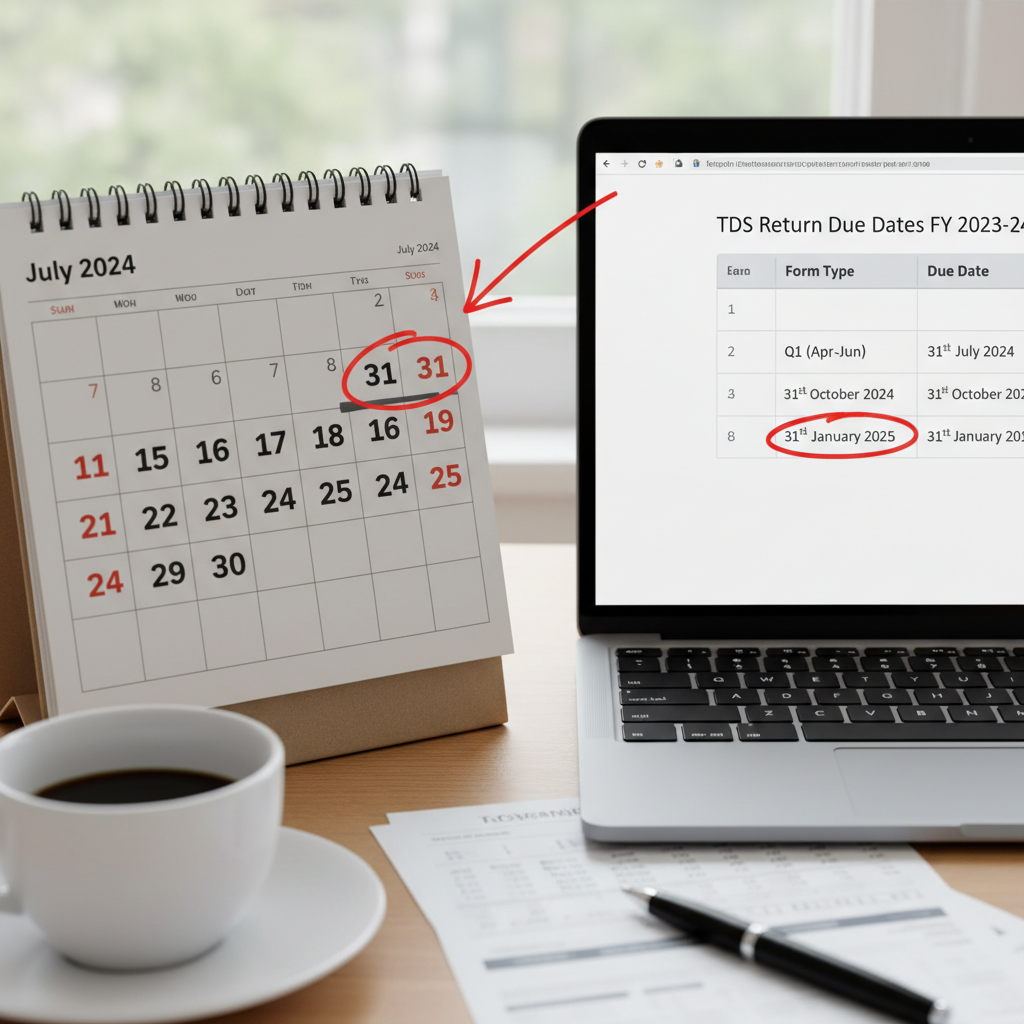

Quarterly TDS Return Due Dates: A Detailed Breakdown

The Income Tax Department has clearly defined quarterly deadlines for filing TDS returns, depending on the nature of the transaction and the form used. These deadlines are standardized across the board, regardless of whether you are filing Form 24Q (salaries), Form 26Q (non-salary payments to residents), or Form 27Q (payments to non-residents).

The table below provides a clear overview of the standard TDS return due dates for the financial year, categorized by quarter:

| Quarter | Period Covered | TDS Return Due Date (Forms 24Q, 26Q, 27Q) | TCS Return Due Date (Form 27EQ) |

|---|---|---|---|

| Q1 | April 1st to June 30th | July 31st | July 15th |

| Q2 | July 1st to September 30th | October 31st | October 15th |

| Q3 | October 1st to December 31st | January 31st | January 15th |

| Q4 | January 1st to March 31st | May 31st | May 15th |

It is important to note the slight adjustment for the final quarter (Q4). While the tax deduction period ends on March 31st, the deadline for filing the return is extended to May 31st. This two-month window allows deductors sufficient time to reconcile annual accounts and ensure all deductions, particularly those made in March, are accurately reported. The deadlines for Tax Collected at Source (TCS) returns (Form 27EQ) are generally earlier, falling on the 15th of the month following the end of the quarter, except for Q4.

Specific Compliance Requirements for Different TDS Forms

While the quarterly cycle remains constant, the preparation process differs based on the form used. Understanding which form applies to your deductions is the first step toward timely compliance with TDS return due dates.

Form 24Q: Salary Payments

Form 24Q is mandatory for reporting tax deducted on salary payments (Section 192). This form requires detailed information about the employees' salaries and the tax calculation. For the first three quarters, summary details suffice, but the Q4 return must include comprehensive salary details and declarations for the entire financial year.

Form 26Q: Non-Salary Payments to Residents

This is arguably the most common TDS return form, covering deductions made under various sections for payments like commission, interest, professional fees, rent, etc. (e.g., Section 194C, 194I, 194J). Compliance with the TDS return due dates for Form 26Q is essential for businesses dealing extensively with vendors and contractors. If you are paying rent, understanding the nuances of TDS on rent payment (Section 194I) ensures accurate reporting within Form 26Q.

Form 27Q: Payments to Non-Residents

Used for reporting TDS deducted on payments made to non-residents (excluding salary), this form often involves complex tax treaty analysis and specific reporting requirements. Given the international implications, strict adherence to the January 31st and October 31st deadlines, among others, is vital to avoid complications with foreign remittances.

After compiling all necessary data and ensuring accuracy, the process of TDS Return Filing requires meticulous attention to detail, including validating the Challan Identification Number (CIN) and ensuring the PAN numbers of deductees are correctly quoted. Incorrect or mismatched PANs are a primary reason for processing delays and deficiency notices.

The Critical Role of Form 16 and Form 16A Issuance Deadlines

A timely TDS return is directly linked to the timely issuance of TDS certificates (Form 16 for salaries and Form 16A for non-salary payments). These certificates are mandatory for the deductee to claim credit for the tax deducted.

Form 16 Issuance Deadline (Salary)

Form 16, summarizing tax deducted on salary, must be issued by June 15th, following the financial year in which the tax was deducted. This is dependent on the Q4 TDS return being filed by May 31st.

Form 16A Issuance Deadline (Non-Salary)

Form 16A must be issued within 15 days from the date of filing the quarterly TDS return. For instance, if the Q1 return is filed by July 31st, Form 16A must be issued by August 15th.

Delay in issuing these certificates can lead to further penalties for the deductor under Section 272A and severely inconvenience the deductee during their annual income tax filing. Timely filing of the quarterly returns ensures the data is processed quickly by the CPC-TDS, allowing for prompt certificate generation.

Actionable Tips for Meeting TDS Return Due Dates

Maintaining compliance requires more than just knowing the calendar; it demands efficient internal processes and reconciliation. A proactive approach significantly reduces the risk of incurring the significant fees imposed under Section 234E.

As noted by the Central Board of Direct Taxes (CBDT), "Accurate and timely filing is the backbone of the self-assessment system. Deductors must implement rigorous reconciliation practices to ensure compliance." The official Income Tax portal offers detailed guidelines on compliance procedures.

Implementing a TDS Compliance Checklist

Monthly Deposit Verification

Ensure that all deducted amounts are deposited using the correct Challan number (ITNS 281) by the 7th of the following month. Mismatching Challan details is a leading cause of return rejection.

PAN Validation

Validate the Permanent Account Number (PAN) of all deductees before processing payments. Incorrect PANs lead to higher deduction rates and return corrections, delaying the process significantly.

Form 26AS Reconciliation

Regularly check Form 26AS to confirm that the amounts deposited reflect accurately against your TAN. Any discrepancy must be rectified immediately, long before the TDS return due dates approach.

Use of RPU Utility

Utilize the Return Preparation Utility (RPU) provided by the NSDL (or similar government-approved software) for preparing the file. This utility helps identify format errors before submission, preventing rejection.

Managing Corrections and Revisions

Even with the best preparation, errors can occur. If a deductor realizes after filing that the original return contained errors (e.g., incorrect PAN, wrong amount, or incorrect challan mapping), a correction statement must be filed. It is essential to file the correction statement as soon as possible, as the penalties continue to accrue until a valid return is accepted. The prompt filing of the original return, even if slightly imperfect, is often better than waiting past the TDS return due dates.

Furthermore, businesses should maintain robust records of all payments and deductions. This documentation is critical for smooth auditing and necessary for accurate annual submissions. Efficient record-keeping often relies on modern accounting software that automatically tracks payment dates and deduction applicability. Understanding regulations, such as those governing TDS on salary and non-salary payments, minimizes errors from the outset.

FAQs

If you miss the deadline, you are liable to pay a late filing fee of ₹200 per day under Section 234E until the date of filing. This fee is capped at the amount of TDS deductible for that quarter. Additionally, you may face interest charges (up to 1.5% per month) if the TDS amount was not deposited on time.

Yes, the standard quarterly due dates are July 31st (Q1), October 31st (Q2), January 31st (Q3), and May 31st (Q4) for Forms 24Q, 26Q, and 27Q. However, the due dates for the TCS return (Form 27EQ) are generally earlier (15th of the month following the quarter end).

While TDS deducted in the first 11 months must be deposited by the 7th of the next month, TDS deducted during March can be deposited by April 30th. However, the return for Q4 (January to March) is still due by May 31st.

Yes, the Central Board of Direct Taxes (CBDT) occasionally extends the due dates for filing TDS returns, particularly during extraordinary circumstances like the COVID-19 pandemic or technical glitches. However, taxpayers should always plan to meet the statutory deadlines unless an official notification for extension is issued.

No, generally, it is not mandatory to file a NIL TDS return (Form 24Q, 26Q, 27Q) if no tax was deductible or deducted during that quarter. However, if you are liable to collect tax, a NIL TCS return (Form 27EQ) might still be required depending on your specific compliance obligation and status as a collector.

Conclusion

For any business operating in India, mastering the calendar of TDS return due dates is indispensable for achieving full financial compliance. The deadlines of July 31st, October 31st, January 31st, and May 31st are fixed pillars in the corporate tax cycle. By implementing robust internal controls, ensuring accurate PAN validation, and reconciling deposits promptly, deductors can easily avoid the severe monetary penalties and interest charges imposed by the Income Tax Department. Proactive planning and the utilization of reliable preparation tools are the keys to successful and stress-free TDS compliance year after year.