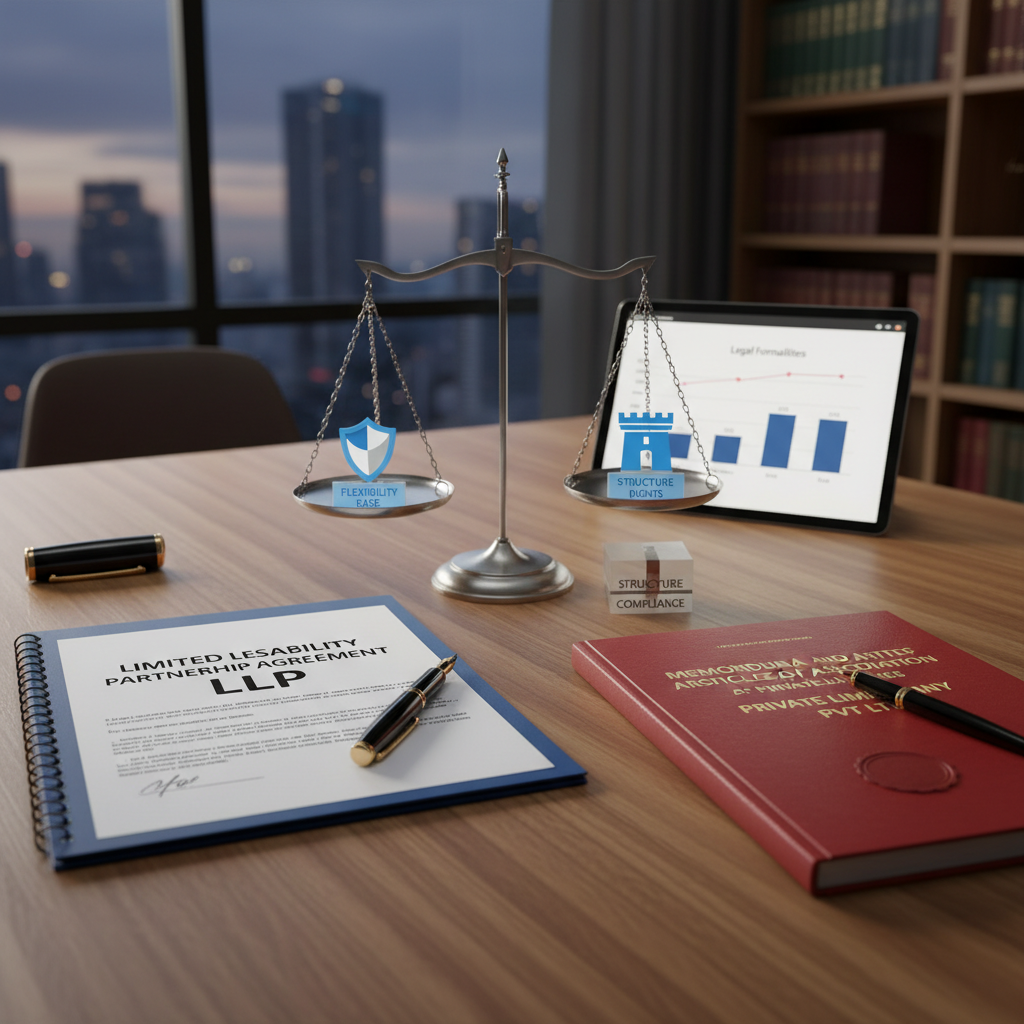

Thinking about starting a business in India? Have you looked into the benefits of being a Limited Liability Partnership (LLP)? If yes, knowing the LLP registration process in 2024 is key. But what do you really get from forming an LLP and following its rules? Let’s look at the main steps to make your LLP a success.

The Limited Liability Partnership (LLP) is a top choice for entrepreneurs in India. It blends the perks of a partnership and a company, giving partners limited liability and flexibility. With the process taking about 15-18 working days, it’s vital to know what’s needed and how to follow the rules for a smooth start.

Key Takeaways

- The LLP registration process in India takes about 15-18 working days on average.

- Minimum 2 partners are mandatory for LLP registration, with at least one partner required to be an Indian citizen.

- LLP Agreement must be filed within 30 days of completing the LLP registration process to avoid additional fees.

- DSC (Digital Signature Certificate) is mandatory for all designated partners during the LLP registration process.

- Acquiring a DIN (Director Identification Number) is required for all designated partners of the LLP.

Understanding Limited Liability Partnerships (LLPs)

An LLP is a special business type that blends the perks of a partnership with those of a company. It’s a flexible and affordable way for entrepreneurs and experts to run their businesses in India.

What is an LLP?

An LLP is like a company with its own legal identity. The partners’ liability is limited to what they put into the business. This means their personal stuff is safe, which is a big plus over traditional partnerships.

Features and Benefits of LLPs

- Flexible Structure: LLPs need at least two partners but can have many more. This makes it easier to manage and grow the business.

- Limited Liability: Each partner’s risk is capped at their investment. This protects their personal assets from business problems.

- Low Cost and Compliance: Starting an LLP is cheaper, and the rules are simpler than for a company. There’s no need for a big initial investment.

So, the separate legal entity, limited liability, and reduced compliance make LLPs a great choice for professionals, startups, and small businesses in India. They offer a strong and adaptable structure.

| Feature | Benefit |

|---|---|

| Separate Legal Entity | LLP has a distinct identity, separate from its partners |

| Limited Liability of Partners | Partners’ liability is limited to their agreed contribution |

| Low Cost and Compliance | LLP formation and annual compliance are more cost-effective |

| No Minimum Capital Requirement | LLPs can be formed without a mandatory minimum capital investment |

“LLPs offer the best of both worlds – the flexibility of a partnership and the legal protection of a corporate entity.”

Prerequisites for LLP Registration

Before starting the LLP registration process, the proposed LLP’s partners must meet some key requirements. They need to get digital signature certificates (DSCs) and apply for Designated Partner Identification Numbers (DPINs).

Obtaining Digital Signature Certificates (DSCs)

All documents for LLP registration must be filed online and signed digitally. The partners need to get their digital signature certificates from approved agencies. The cost of a class 3 category DSC for LLP changes with the agency but is essential for registration.

Applying for Designated Partner Identification Numbers (DPINs)

Those who will be or plan to be partners of the LLP must apply for a Designated Partner Identification Number (DPIN). This application is done with Form DIR-3, signed by a Company Secretary, Chartered Accountant, or Cost Accountant. The form must include scanned copies of Aadhaar and PAN. Remember, only natural persons can get a DPIN, not artificial legal entities.

By fulfilling these requirements, partners can move forward with the LLP registration process confidently.

For more details on GST registration for businesses, check out our detailed guide.

LLP Registration Process 2024

Name Reservation and Approval

The first step in the LLP registration process is to reserve the name of the proposed LLP. You need to file the RUN-LLP (Reserve Unique Name-Limited Liability Partnership) form for this. This form is checked by the Central Registration Centre.

Before picking a name, check the MCA portal’s free name search facility. This ensures the name you choose isn’t already taken. The registrar will only approve the name if it’s unique and doesn’t match any existing company or LLP.

Filing the Incorporation Application

The form for incorporating the LLP is called FiLLiP (Form for incorporation of Limited Liability Partnership). You must file it with the Registrar in the state where the LLP’s office is located. This form also lets you apply for a DPIN if a future partner doesn’t have one.

You need to pay the fees listed in Annexure ‘A’ with the form.

Submitting the LLP Agreement

The LLP agreement sets the rules for partners’ rights and duties, and between the LLP and its partners. You must file the LLP Agreement in Form 3 online on the MCA Portal within 30 days after starting the LLP. This agreement must be on Stamp Paper, and the cost varies by state.

“The LLP registration process is straightforward and can be completed within 15-20 working days with the right guidance and support.”

Key Documents for LLP Registration

Starting a Limited Liability Partnership (LLP) in India means you need to submit important documents. These documents are key for the LLP registration process. They make sure the LLP follows the law and give the needed info to the Registrar of Companies.

Here are the main documents you’ll need for LLP registration:

- PAN Card/ID Proof and Residence Proof for each partner

- Photographs of the partners

- Passport (notarized or apostilled) for foreign nationals or NRIs becoming partners

- Proof of the registered office address, such as a rent agreement and a no-objection certificate from the landlord

- A digital signature certificate obtained by one of the designated partners, as all documents and applications will be digitally signed by the authorized signatory

You must send the partner documents for LLP within 30 days after the LLP starts. You can use voter’s ID, passport, driver’s license, utility bills not older than 2 months, or Aadhaar card as residence proof. If your documents are in another language, you’ll need a notarized or apostilled translation for foreign nationals or NRIs.

The LLP registered office address proof is crucial. It can be a rent agreement, a no-objection certificate from the landlord (if the office is rented), and utility bills like gas, electricity, or telephone bills not older than 2 months.

The digital signature certificate for LLP is a must for one of the partners. It’s used to sign all documents and applications during the registration.

By sending these key documents on time, you can finish the LLP registration smoothly and follow the rules.

Conclusion

The LLP registration process in India is easy and efficient for entrepreneurs and small businesses. It helps you set up your business smoothly. You just need to follow the steps and get the right documents ready.

There are many benefits to registering as an LLP. You get limited liability protection, meet legal requirements, and have more flexibility in management and taxes. You also gain credibility and can easily get financing. The online filing makes it cheaper and ensures your business can continue even after you’re gone.

For both new and current business owners, registering as an LLP is a great move. It gives you legal recognition, protects you from liability, and offers flexibility. By using the LLP benefits, you can start your business with confidence in the competitive Indian market.

FAQ

Q: What is the minimum capital required for LLP formation?

A: You don’t need to put in any minimum capital to start an LLP.

Q: Is Form 3 mandatory for LLP?

A: Yes, you must file the LLP agreement in Form 3 within 30 days after starting.

Q: What is the turnover limit for LLP?

A: There’s no set limit on how much money an LLP can make.

Q: What is the maximum profit for LLP?

A: An LLP can earn as much profit as it wants, with no limit.

Q: What is the cost of LLP dissolution?

A: The cost to end an LLP depends on the state and how complex it is.

Q: What is the fee for Form 24 LLP?

A: The fee for Form 24 (for changes in partners/designated partners) is based on how many partners there are.

Q: Can LLP be opened by a single person?

A: No, you need at least two partners to start an LLP in India.

Please Rate this post

Click to rate