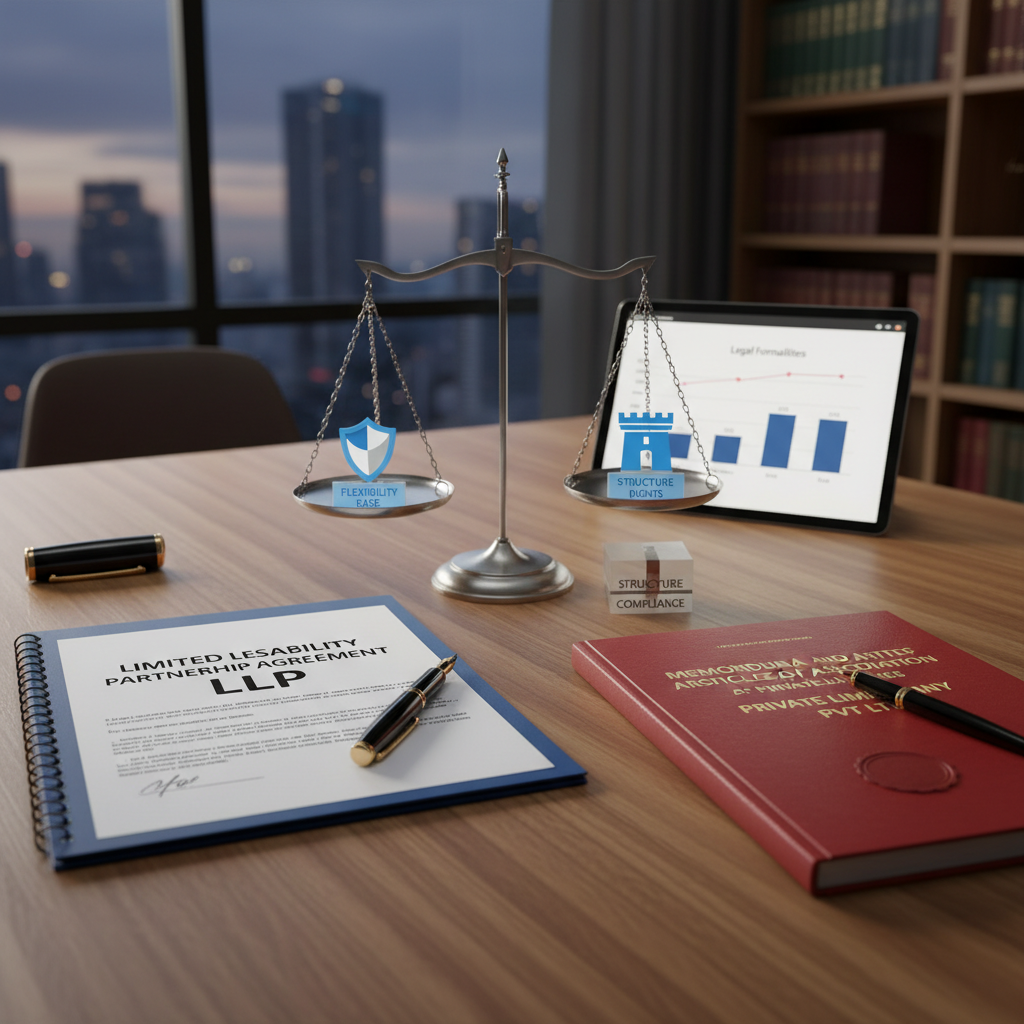

Ever thought about mixing a partnership’s flexibility with a corporation’s liability protection? Limited Liability Partnerships (LLPs) do just that. They’re becoming more popular in India, especially among professionals. Let’s dive into what makes LLP registration special and why it might be right for your business.

LLPs were introduced by the Limited Liability Partnership Act of 2008. They offer a unique blend of partnership ease and corporate liability safety. This mix is especially appealing to professional service firms, giving them the best of both worlds.

One big plus of forming an LLP is the protection of personal assets. Partners get limited liability, which means their personal wealth is safe from business debts. This makes LLPs a great choice for entrepreneurs looking to reduce personal risk while expanding their business.

LLPs also have a flexible management setup. This lets partners adjust their roles based on their skills. With tax perks and easier compliance, LLPs are becoming a top pick for businesses in India.

Key Takeaways

- LLPs combine partnership flexibility with corporate liability protection

- Partners have limited liability, protecting personal assets

- Flexible management structure allows customized roles

- Tax benefits make LLPs financially attractive

- Simplified compliance processes reduce administrative burden

- Ideal for professional service firms and startups

Understanding Limited Liability Partnerships (LLPs)

Limited Liability Partnerships (LLPs) are a special business setup. They mix the good parts of partnerships and corporations. This mix is popular with professionals and small to medium-sized businesses in India.

Definition of LLPs

An LLP is a business where partners’ risk is only to their money they put in. This makes it different from regular partnerships. In an LLP, partners are safe from losing their personal stuff if the business owes money or loses money.

How LLPs Differ from Traditional Partnerships

LLPs stand out because they protect personal assets. Unlike regular partnerships, where partners can lose everything, LLPs keep personal stuff safe. This is a big reason why many professionals and entrepreneurs choose LLPs.

| Feature | LLP | Traditional Partnership |

|---|---|---|

| Liability | Limited to capital contribution | Unlimited personal liability |

| Legal Entity | Separate from partners | Not separate from partners |

| Perpetual Existence | Yes | No |

| Taxation | Pass-through entity | Pass-through entity |

| Flexibility | High | High |

LLPs need at least two partners, who can be people or companies. This setup lets partners work together in many ways. It keeps the good parts of limited liability. The LLP agreement outlines how partners share profits and what each partner must do, making the business run smoothly.

Feature of LLP: Combination of Partnership and Corporate Advantages

Limited Liability Partnerships (LLPs) mix the good parts of partnerships and corporations. Introduced in India in 2008, they offer flexibility and protection. This makes LLPs a great choice for small and medium businesses.

LLPs have unique features. They limit partners’ financial risk to their investment. This is like a corporation but keeps the partnership’s flexibility. They also have a separate legal identity and can keep going even if partners change.

LLPs also have tax benefits. They don’t face double taxation like corporations do. This means partners can manage money better and might earn more.

“LLPs facilitate enterprises involved in Biotechnology, Intellectual Property, Information Technology, and knowledge-based fields.”

Here are 10 key features of Limited Liability Partnership registration:

- Separate legal entity status

- Limited liability protection for partners

- Flexible management structure

- No maximum limit on number of partners

- Perpetual succession

- Pass-through taxation

- Fewer compliance requirements compared to companies

- Ability to own and dispose of property

- Requirement of at least two designated partners

- Mandatory use of “LLP” in the business name

| Aspect | LLP | Traditional Partnership |

|---|---|---|

| Legal Status | Separate legal entity | No distinct legal status |

| Liability | Limited to investment | Unlimited personal liability |

| Maximum Partners | No limit | 100 partners |

| Compliance | Fewer requirements | More stringent |

Separate Legal Entity Status

Limited Liability Partnerships (LLPs) are unique legal entities, separate from their partners. This LLP legal entity status offers big benefits to businesses in India. Let’s look at the main points of this special corporate structure.

LLPs as Distinct Legal Entities

An LLP has its own legal status, different from traditional partnerships. This means your LLP can own property, make contracts, and take legal actions in its name. The LLP’s identity stays the same, even if the partnership changes.

Implications of Separate Legal Status

The separate legal status of an LLP brings many benefits:

- Protection of personal assets

- Perpetual succession

- Ability to sue and be sued in its own name

- Ownership of property and assets

This setup acts as a shield between your personal money and business debts. It makes LLPs a great choice for professionals and entrepreneurs.

“The LLP structure combines the benefits of a partnership with the limited liability protection of a company, offering a unique advantage in the business world.”

| Feature | LLP | Traditional Partnership |

|---|---|---|

| Legal Entity Status | Separate | Not Separate |

| Liability | Limited | Unlimited |

| Perpetual Succession | Yes | No |

| Asset Ownership | In LLP’s Name | In Partners’ Names |

Knowing about LLPs’ separate legal status is key for smart business choices. This special feature makes LLPs different from other business types. It offers a mix of flexibility and safety.

Limited Liability Protection for Partners

LLP liability protection is a key feature of Limited Liability Partnerships. It sets them apart from traditional partnerships. In an LLP, partner liability is limited to their agreed contribution. This offers significant benefits to business owners.

Extent of Partners’ Liability in LLPs

In an LLP, your personal assets are safe. You’re only responsible for your agreed contribution to the partnership. This means if the LLP faces financial troubles, creditors can’t go after your personal savings or property.

This is a crucial feature that makes LLPs attractive for professionals and businesses with potential legal risks.

Comparison with Traditional Partnerships

Unlike traditional partnerships, LLPs offer enhanced protection. In a regular partnership, you could be on the hook for all the company’s debts. But with an LLP, your liability is capped.

This limited liability benefit provides peace of mind and financial security.

Here’s a quick comparison:

| Feature | Traditional Partnership | Limited Liability Partnership |

|---|---|---|

| Personal Asset Risk | High | Low |

| Liability Extent | Unlimited | Limited to Contribution |

| Partner Protection | Minimal | Substantial |

Remember, while LLPs offer strong protection, partners remain liable for their own actions. This balance of protection and responsibility makes LLPs a popular choice for many businesses in India.

Flexible Management Structure

LLP management combines the flexibility of partnerships with the structure of corporations. In an LLP, partners are actively involved in the business. This hands-on approach leads to quick decision-making and flexible governance.

LLPs have a customized agreement that outlines partner roles. This agreement defines responsibilities, powers, and how profits are shared. It makes LLPs unique, allowing for governance tailored to each business’s needs.

LLP governance requires at least two partners, with one being an Indian resident. This ensures local presence while allowing for international partnerships. The number of partners can grow without limit.

“LLPs offer the perfect balance between partnership flexibility and corporate protection, making them ideal for professional services and family-owned businesses.”

Here are ten key features of LLP registration:

- Minimum of two partners required

- No maximum limit on partners

- Limited liability protection for all partners

- Flexible profit distribution

- Pass-through taxation

- No need for articles of association

- No mandatory board or general meetings

- Separate legal entity status

- Perpetual succession

- Customizable management structure

These features make LLPs a great choice for businesses wanting flexibility and protection. They are especially popular among professional firms like accountants, solicitors, and medical practitioners.

Perpetual Succession

LLP perpetual succession is a key feature that sets Limited Liability Partnerships apart. It ensures business continuity in LLP, even with changes in partnership composition.

Continuity Despite Partnership Changes

Unlike traditional partnerships, LLPs keep going even when partners change. This stability is key for long-term planning and growth. Changes like retirement or death of partners don’t stop the LLP’s operations.

Advantages for Business Continuity

Perpetual succession brings many benefits:

- Stability in operations

- Simplified asset ownership

- Streamlined contract management

- Enhanced credibility with stakeholders

The Limited Liability Partnership Act of 2008 brought this concept to India. It changed business structures. LLPs can have more partners than traditional partnerships, offering more flexibility and growth.

| Feature | LLP | Traditional Partnership |

|---|---|---|

| Perpetual Succession | Yes | No |

| Maximum Partners | Unlimited | 100 |

| Dissolution Process | Voluntary or by NCLT order | Multiple methods (mutual consent, court order, etc.) |

| Arrangements with Creditors | Possible | Not possible |

This structure’s enduring nature makes LLPs appealing. They are great for professionals and businesses looking for stability and growth.

Taxation of LLPs

LLP taxation offers big benefits for businesses in India. The tax setup of Limited Liability Partnerships (LLPs) makes them stand out. This makes them a great choice for many entrepreneurs.

Pass-through Taxation for LLPs

LLPs get pass-through tax benefits. This means the entity itself doesn’t get taxed. Instead, profits go to partners who then pay taxes on their own. This avoids the double taxation problem corporations face.

In India, LLPs are taxed at a flat rate of 30% (plus applicable surcharge and cess) on total income. This rate is lower than some other business structures. So, LLPs have tax advantages.

Tax Advantages Compared to Corporations

LLPs have several tax benefits over corporations:

- Exemption from dividend distribution tax

- Partners taxed only on distributed profits or remuneration

- No surcharge over the 30% tax rate for income up to 1 crore

- 12% surcharge if total income exceeds 1 crore

These tax benefits make LLPs financially appealing for many businesses. They are especially attractive when compared to the high tax rates for high-net-worth individuals (HNIs). The highest tax bracket for HNIs can reach around 42.74% for dividend income under the new tax regime.

| Entity Type | Tax Rate | Surcharge |

|---|---|---|

| LLP | 30% | 12% (income > 1 crore) |

| Private Limited Company | 25-30% | Varies |

| HNI (Highest Bracket) | 30% | 27% |

With these tax benefits, LLPs offer a balanced approach to business taxation. They combine the best of partnerships and corporations.

Easy Formation and Compliance Requirements

The LLP registration process in India is easy and clear. Starting an LLP has many benefits over other business types. Let’s look at what makes LLPs great for entrepreneurs and professionals.

LLP compliance is much simpler than other corporate forms. Here are 10 key features of Limited Liability Partnership registration:

- Simplified formation process

- Limited liability protection for partners

- Easy transferability of ownership

- No Dividend Distribution Tax

- Fewer compliance requirements

- Flexible partnership agreement

- Easier winding up process

- No restrictions on borrowing powers

- No mandatory audit for smaller LLPs

- No requirement for Company Secretary appointment

To form an LLP, you need Digital Signature Certificates, a DPIN, name approval, and filing documents. LLPs must file an annual return within 60 days after the financial year ends.

| Compliance Requirement | LLP | Private Limited Company |

|---|---|---|

| Annual Compliances | 3 | 8+ |

| Mandatory Audit | Only above certain threshold | Compulsory |

| Partner/Director Meetings | Not mandatory | Mandatory AGM and Board Meetings |

LLP formation and compliance are simple. This makes it a good choice for small and medium businesses. They get a formal structure with limited liability protection.

Ability to Raise Capital

LLPs provide unique investment options for businesses wanting to grow. Introduced in India in April 2009, LLPs have become popular among entrepreneurs. They look to expand their financial possibilities.

Options for Raising Funds in LLPs

LLPs can raise capital in several ways. Partners can contribute in various forms, such as:

- Tangible property (movable or immovable)

- Intangible property

- Cash agreements

- Service contracts

- Promissory notes

- Monetary contributions

The LLP Rules, 2009 require all contributions to be disclosed. This ensures accountability for the funds received. Partners must meet minimum contribution standards, as stated in section 33(1) of the LLP Act 2008.

Attracting Investors to LLPs

LLPs can draw investors by offering partnership stakes. The limited liability aspect makes them attractive. Yet, venture capitalists might be hesitant due to the need to become partners.

LLPs can also get funding through loans from financial institutions. This is because they have a separate legal entity status. Partners can increase their contribution limit by passing resolutions and amending the LLP agreement.

| Funding Method | Advantages | Considerations |

|---|---|---|

| Partner Contributions | Flexible, various forms accepted | Minimum contribution standards apply |

| Adding New Partners | Increases capital, brings expertise | Requires agreement amendments |

| Bank Loans | Leverages separate legal status | May require collateral or guarantees |

LLPs offer a balanced approach to raising capital. They combine flexibility with accountability. This structure is beneficial for entrepreneurs seeking various funding options while keeping control over operations.

Suitable for Professional Services Firms

LLPs for professionals have gained popularity since 2000. They offer special benefits for service sector businesses. This makes them a great choice for many professional services firms.

Benefits of LLPs for Professionals

Professional services LLPs give big advantages to their members. Partners get limited liability protection, keeping their personal assets safe. This is key for risky jobs like law and accounting.

LLPs also let partners manage their work freely. They can share costs and resources but still work on their own. This setup is very flexible and beneficial.

Common Professions Adopting the LLP Structure

Many service sector jobs use the LLP structure. Accountants, solicitors, architects, consultants, and surveyors often pick it. It lets them work together but still keep their independence.

LLPs need at least two members. They can also include companies as partners. This adds more flexibility.

LLPs are perfect for professional services firms because of their special features:

- No maximum limit on the number of partners

- Annual turnover limit of Rs. 40 Lakhs for tax audit requirement

- No Dividend Distribution Tax

- Perpetual succession, ensuring business continuity

- Low capital contribution requirements, making it accessible for entrepreneurs

Choosing an LLP lets professionals focus on their skills. They get a flexible and safe business model.

Differences Between LLPs and Limited Liability Companies (LLCs)

Choosing between LLP and LLC requires understanding their main differences. Both offer protection from personal liability. Yet, they have unique features that can affect your business choice.

LLPs are often chosen by professional services firms. LLCs, however, are more flexible for different types of businesses. LLPs need partners to actively manage the business. LLCs can have members who don’t participate in management.

Some states only allow LLPs for certain professions like accountants and lawyers. This limits their use in other fields.

Tax rules differ for LLPs and LLCs. LLCs can be taxed as a sole proprietorship, partnership, or corporation. LLPs, however, are always taxed as partnerships. This can greatly affect your business’s finances.

| Feature | LLP | LLC |

|---|---|---|

| Minimum Members | Two partners | One member |

| Management Structure | Partnership agreement | Member or manager-managed |

| Liability Protection | From partners’ negligence | Personal asset protection |

| State Recognition | Not all states | All states |

| Annual Compliance | Simpler, cost-effective | More complex, higher costs |

When deciding between LLP and LLC, think about your business type and management style. LLPs are good for professional partnerships. LLCs offer more flexibility for various business structures.

Conclusion

The Limited Liability Partnership (LLP) structure is great for businesses in India. It was introduced by the Limited Liability Partnership Act of 2008. Since then, it has become a top choice for entrepreneurs and professionals.

LLPs mix the good parts of partnerships and corporations. They protect partners’ assets, limiting their liability. This setup is flexible, needing only two partners and one must be from India.

LLPs in India have many benefits. They keep going even when partners change, thanks to perpetual succession. They also avoid double taxation, making things simpler for businesses. Plus, there’s no limit on the number of partners, fitting both small and big teams.

In short, the LLP structure in India is a strong choice for businesses. It offers flexibility, limited liability, and tax perks. Whether you’re a professional service or a growing company, knowing these benefits can help you decide on the best structure for your business in India’s fast-changing economy.

FAQ

Q: What is an LLP?

A: An LLP, or Limited Liability Partnership, is a mix of a partnership and a corporation. It has the flexibility of a partnership but the protection of a corporation. Partners in an LLP have limited liability, meaning their personal assets are safe from business debts.

Q: How are LLPs different from traditional partnerships?

A: In traditional partnerships, partners face unlimited personal liability. But in LLPs, partners have limited liability, keeping their personal assets safe. LLPs also continue to exist even if partners change, offering perpetual succession.

Q: What are the advantages of forming an LLP?

A: LLPs offer many benefits. They protect partners’ personal assets, have flexible management, and enjoy tax benefits. They are easy to form and comply with, and can raise capital while keeping a partnership structure.

Q: What is meant by a separate legal entity status for LLPs?

A: LLPs have their own legal identity, separate from their partners. This means they can own property, make contracts, and sue or be sued in their name. This protection keeps partners’ personal assets safe from business liabilities.

Q: How is partners’ liability limited in LLPs?

A: In LLPs, partners’ liability is capped at their agreed contribution. They are not responsible for other partners’ actions or negligence. This provides liability protection similar to corporations.

Q: How is the management structure in LLPs different from corporations?

A: LLPs have a flexible management structure. Partners can actively manage the business, unlike shareholders in corporations. They can define their roles and responsibilities through the LLP agreement.

Q: What is perpetual succession in the context of LLPs?

A: Perpetual succession means the LLP continues to exist even with changes in partners. This ensures the business can keep going, providing stability for long-term planning.

Q: How are LLPs taxed?

A: LLPs are taxed like partnerships, not the entity itself. Profits are distributed to partners, who then pay taxes on their share. This avoids the double taxation corporations face.

Q: What are the advantages of LLPs for professional services firms?

A: LLPs are great for professional services firms like law and accounting. They offer liability protection, crucial for high-risk professions. This allows professionals to work together while keeping their individual autonomy.

Q: How do LLPs differ from Limited Liability Companies (LLCs)?

A: LLPs are mainly for professional services, while LLCs are more versatile. LLPs require active management from partners, whereas LLCs can have passive members. Tax treatment and compliance also differ between the two.

Please Rate this post

Click to rate