Income Tax Update:-

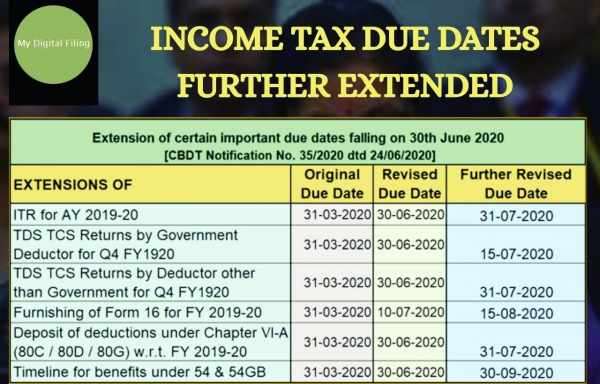

CBDT has issued a notification today further extending few of the time limits of compliance under Taxation & Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 as under:

➡️ Due date for filing Income Tax Return for F.Y 2018-19 has been extended to 31st July, 2020

➡️ Waiver of interest u/s 234A in cases where self assessment tax is upto Rs 1 lac

➡️ Deductions under Ch-VIA like Sec 80C, 80D, 80G, etc can now be made upto 31st July, 2020

➡️ The date for furnishing of TDS/TCS statements for the quarter ending on 31st March, 2020 has been extended to 31st July, 2020

Please Rate this post

Click to rate

0.0

/

0 votes

Submitting...