Filing your taxes is more than just a legal obligation; it is a fundamental step toward financial discipline and nation-building. For many, the concept of income tax return filing India brings to mind complex paperwork and confusing terminologies. However, with the digitalization of the tax infrastructure, the process has become significantly smoother, faster, and more user-friendly. Whether you are a salaried employee, a freelancer, or a business owner, understanding the nuances of filing your return is crucial for maintaining financial health.

In this comprehensive guide, we will demystify the process of income tax return filing India. We will walk you through the necessary documents, the differences between tax regimes, and the step-by-step procedure to file your returns online. By the end of this article, you will be equipped with the knowledge to file your taxes confidently and accurately.

Why is Income Tax Return Filing India Mandatory and Beneficial?

Many individuals believe that if their income is below the taxable limit or if tax has already been deducted at source (TDS), they do not need to file a return. This is a common misconception. Engaging in income tax return filing India offers several long-term benefits beyond mere compliance.

Firstly, filing your ITR is the only way to claim a refund if excess tax has been deducted from your income. Secondly, it serves as a robust proof of income, which is indispensable when applying for loans, visas, or high-value insurance policies. Financial institutions rely heavily on your ITR history to assess your creditworthiness.

Loan Approvals

Banks often require the last 2-3 years of ITR receipts to process home or car loans. Consistent income tax return filing India smooths this path.

Visa Processing

Foreign consulates ask for ITR proofs to ensure you have strong financial ties to India and a legitimate source of income.

Carry Forward Losses

If you have incurred losses in the stock market or business, you can only carry them forward to future years if you file your return on time.

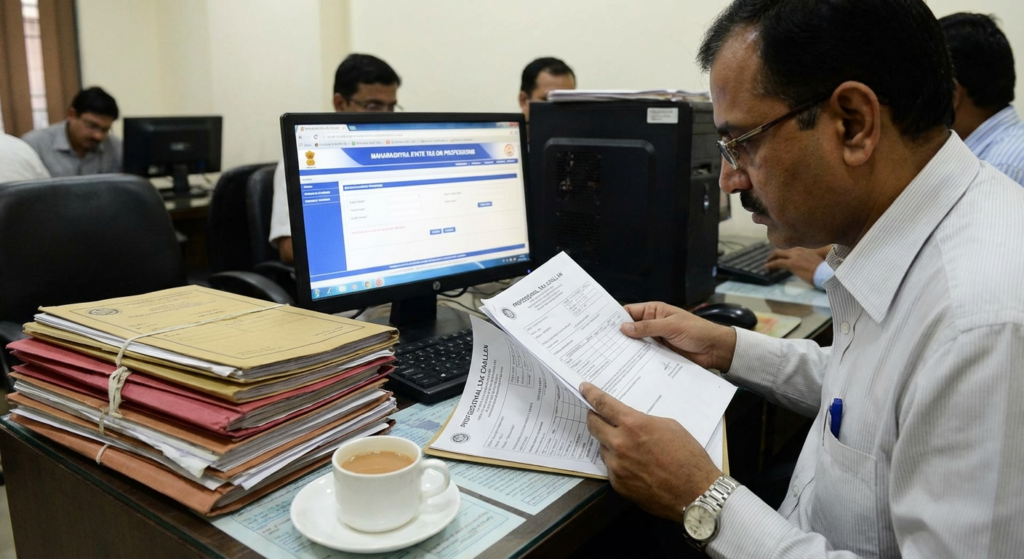

Essential Documents for Income Tax Return Filing India

Preparation is key to a hassle-free filing experience. Before you log in to the portal, gather all necessary financial documents. The accuracy of your income tax return filing India depends entirely on the data you provide from these documents.

1. Proof of Income

For salaried individuals, Form 16 is the holy grail. It details your salary breakup and the TDS deducted by your employer. If you have income from other sources, such as interest from savings accounts or fixed deposits, keep your bank statements and interest certificates handy. Freelancers should have their invoices and bank statements ready to compute gross receipts.

2. Tax Saving Investments

To lower your tax liability, you likely invested in various schemes. Ensure you have proofs for investments under Section 80C (like PPF, LIC, ELSS). Additionally, if you are claiming exemptions for house rent, understanding the calculations is vital. You can read more about HRA exemption calculation rules to ensure you are claiming the correct amount.

3. Form 26AS and AIS/TIS

Form 26AS is your tax passbook. It contains details of all tax deducted on your behalf by deductors. The Annual Information Statement (AIS) is even more comprehensive, showing high-value transactions, share trading details, and mutual fund transactions. It is critical to reconcile your documents with the AIS before finalizing your income tax return filing India.

Choosing the Correct Form for Income Tax Return Filing India

Selecting the wrong ITR form is one of the most common reasons for defective returns. The Income Tax Department has categorized taxpayers into different groups, each requiring a specific form. Making the right choice is the first technical step in income tax return filing India.

- ITR-1 (Sahaj): For resident individuals with a total income of up to ₹50 Lakh, having income from salary, one house property, and other sources (like interest).

- ITR-2: For individuals and HUFs not having income from profits and gains of business or profession. This applies if you have capital gains or more than one house property.

- ITR-3: For individuals and HUFs having income from profits and gains of business or profession.

- ITR-4 (Sugam): For individuals, HUFs, and firms (other than LLP) being a resident having a total income up to ₹50 Lakh and having income from business and profession computed under presumptive taxation sections (44AD, 44ADA, 44AE).

Step-by-Step Process for Online Income Tax Return Filing India

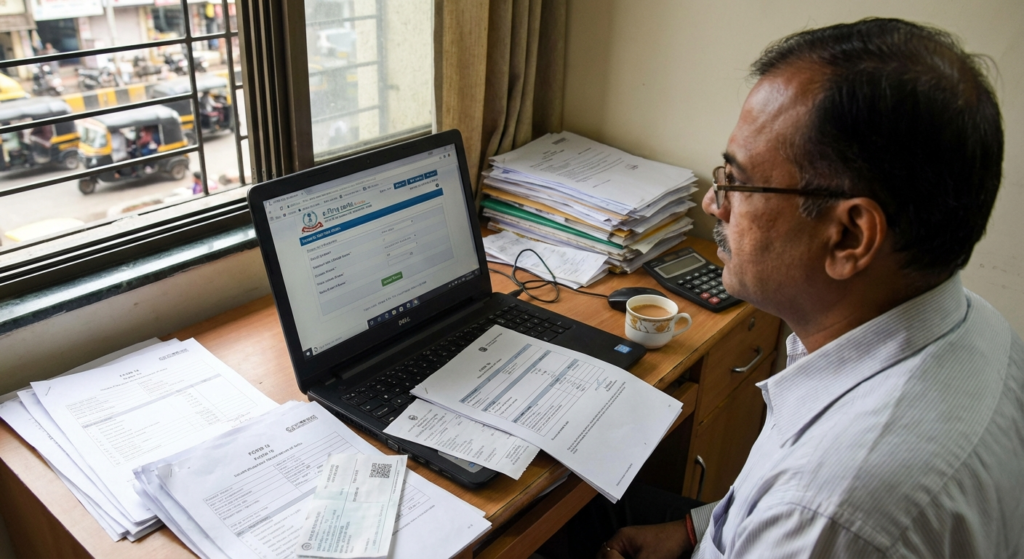

Gone are the days of standing in long queues. The e-filing portal has revolutionized income tax return filing India. Follow these steps to file your return seamlessly.

Step 1: Register or Login to the e-Filing Portal

Visit the official Income Tax e-Filing portal. If you are a new user, register using your PAN. If you are already registered, log in using your User ID (PAN) and password.

Step 2: Verify Your Bank Account

Ensure your bank account is pre-validated and nominated for refund. This is mandatory to receive any tax refunds directly into your account.

Step 3: Access the ‘File Income Tax Return’ Option

Navigate to the ‘e-File’ menu, click on ‘Income Tax Returns’, and select ‘File Income Tax Return’. Select the current Assessment Year (e.g., AY 2025-26 for income earned in FY 2024-25).

Step 4: Select Your Status and ITR Form

Choose your status as ‘Individual’. The system may help you select the ITR form, or you can select the one you identified earlier. Most salaried individuals will choose ITR-1.

Step 5: Validate Pre-filled Data

A significant advantage of modern income tax return filing India is pre-filled data. The portal pulls information from your Form 26AS, AIS, and previous returns. Carefully review your personal information, gross total income, and tax deductions. Correct any discrepancies.

Step 6: E-Verify the Return

Once you have submitted the data, the final step is verification. You can e-verify instantly using Aadhaar OTP, Net Banking, or a Bank Account EVC. Without verification, your return is considered invalid. For those managing business taxes alongside personal filing, staying updated on TDS return filing due dates is also essential to avoid mismatches in tax credits.

New vs. Old Tax Regime: Making the Right Choice

One of the biggest decisions during income tax return filing India is choosing between the New and Old Tax Regimes. The New Regime offers lower tax rates but disallows most exemptions (like HRA and 80C). The Old Regime retains higher rates but allows you to claim various deductions.

New Tax Regime

Pros: Simplified structure, lower tax slab rates, no need to lock funds in tax-saving instruments.

Cons: Cannot claim HRA, LTA, 80C, 80D, or interest on education loans.

Old Tax Regime

Pros: Ideal for those with high expenses in rent, insurance, and long-term savings (PPF/EPF).

Cons: Higher tax rates if you do not have sufficient investments to lower taxable income.

Common Mistakes to Avoid in Income Tax Return Filing India

Even seasoned taxpayers make errors. Avoiding these pitfalls ensures your income tax return filing India process is smooth and does not invite a notice from the tax department.

- Ignoring Interest Income: Many forget to report interest earned on savings accounts. Up to ₹10,000 is exempt under Section 80TTA, but it must be reported first.

- Mismatched Data: If the income reported in your ITR is lower than what appears in the AIS or Form 26AS, you will likely receive a notice.

- Selecting the Wrong Assessment Year: Ensure you select the correct Assessment Year (AY). For income earned between April 2024 and March 2025, the AY is 2025-26.

- Not E-Verifying: Filing is incomplete without verification. You have 30 days from the date of submission to e-verify your return.

Conclusion

Mastering income tax return filing India is an empowering skill. It ensures compliance, builds your financial reputation, and keeps you clear of legal hassles. By organizing your documents, choosing the right regime, and following the online process diligently, you can file your returns effortlessly. Remember, the deadline is usually July 31st (for non-audit cases), so start early to avoid the last-minute rush.

Frequently Asked Questions (FAQs)

If you file after the due date (usually July 31st) but before December 31st, a late fee of up to ₹5,000 may be levied. For small taxpayers with income up to ₹5 Lakh, the penalty is restricted to ₹1,000.

Yes, you can file a Revised Return under Section 139(5) if you discover any omission or wrong statement. This must be done before the end of the Assessment Year or before the assessment is made, whichever is earlier.

Generally, no. However, filing is mandatory if you have deposited more than ₹1 crore in current accounts, spent more than ₹2 lakh on foreign travel, or paid more than ₹1 lakh in electricity bills, regardless of income.

You can check the status by logging into the e-filing portal and viewing the ‘Filed Returns’ section. It will show stages like ‘Successfully e-verified’, ‘Processed’, or ‘Defective’.

ITR filing is an annexure-less process, meaning you do not need to attach or upload any documents like Form 16 or investment proofs. However, you must retain them safely in case the tax department asks for proof later.