Introduction to International Trade and the Role of IEC

In the era of globalization, expanding a business beyond national borders is no longer just an option for large corporations—it is a strategic move for small and medium enterprises as well. To facilitate this, the Government of India has streamlined the import export code IEC registration online process. Whether you are a budding entrepreneur or an established manufacturer, obtaining your IEC is the first legal step toward entering the international market. Without this 10-digit code, which is now integrated with your PAN, engaging in commercial import or export activities is virtually impossible.

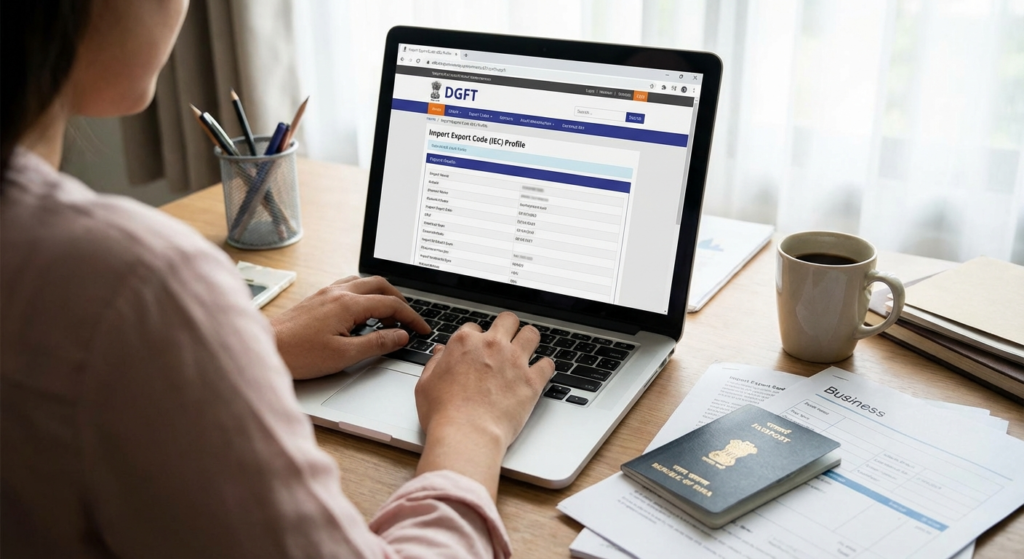

The Directorate General of Foreign Trade (DGFT), under the Ministry of Commerce and Industry, oversees the issuance of this code. In recent years, the transition to a fully digital ecosystem has made it easier than ever to secure your credentials. However, understanding the nuances of the application, the documentation required, and the post-registration compliance is crucial for a smooth operational experience. If you are also looking to formalize your business entity, you might consider professional IEC Registration services to ensure all legal checkboxes are ticked from the start.

What is an Import Export Code (IEC)?

The Import Export Code (IEC) is a unique identification number that acts as a primary license for anyone looking to start an import-export business in India. It is issued by the DGFT and has no expiry date; it lasts for the lifetime of the business entity. Since the implementation of the Goods and Services Tax (GST), the IEC has been harmonized with the Permanent Account Number (PAN) of the entity. This means that for most businesses, the IEC number is identical to their PAN, although a separate registration process via the DGFT portal is still mandatory to activate it for foreign trade purposes.

As per the official guidelines from DGFT, no person or entity shall make any import or export except under an IEC number granted by the DGFT. This code is required when clearing customs, making international bank transfers for trade, and claiming various export incentives provided by the government.

Why You Need Import Export Code IEC Registration Online

Obtaining an import export code IEC registration online is not just a regulatory hurdle; it is a gateway to numerous business advantages. The primary reason is legal compliance. According to the Foreign Trade Policy, it is mandatory for every importer or exporter to obtain an IEC. Customs authorities will not clear your shipments, and banks will not process foreign remittances without a valid code.

Beyond compliance, the IEC allows businesses to tap into global markets, reaching customers in hundreds of countries. It also enables exporters to benefit from various government schemes, such as the Merchandise Exports from India Scheme (MEIS) or Service Exports from India Scheme (SEIS), which provide duty credit scrips and other financial incentives. Furthermore, once you have your IEC, there is no requirement to file monthly or annual returns specifically for the code, making it a low-maintenance yet high-value asset for your company.

Global Market Reach

Unlock the ability to sell products and services to international clients, expanding your brand’s footprint across the globe.

Government Benefits

Avail yourself of subsidies, tax refunds, and incentives provided by the DGFT and Customs to promote Indian exports.

Lifetime Validity

The IEC is issued for the lifetime of the entity, meaning you don’t have to worry about frequent renewals or expiry dates.

No Compliance Burden

Unlike GST or Income Tax, the IEC does not require the filing of periodic returns, reducing administrative overhead.

Step-by-Step Import Export Code IEC Registration Online Process

The import export code IEC registration online process is conducted entirely through the DGFT’s digital platform. The government has focused on a “contactless, paperless, and transparent” environment to help businesses get started quickly. Here is a detailed breakdown of the steps involved:

- Visit the DGFT Portal: Navigate to the official DGFT website and click on the ‘Apply for IEC’ link. You will need to register a user profile using your email ID and mobile number.

- OTP Verification: Once registered, you will receive an OTP on your mobile and email. Verify these to log in to your dashboard.

- Fill the Application Form: Select the ‘Apply for New IEC’ option. You will be required to provide details such as the entity’s name, PAN, date of incorporation, and nature of business.

- Upload Documents: The system will prompt you to upload digital copies of necessary documents. Ensure they are in the prescribed format (usually PDF or JPEG) and are clearly legible.

- Payment of Fees: Pay the requisite application fee through the integrated payment gateway using Net Banking, Debit/Credit Card, or UPI.

- Submission and Verification: After payment, submit the application. The system will perform automated checks. In most cases, the IEC is generated instantly and can be downloaded from the portal.

Essential Documents for Import Export Code IEC Registration Online

To ensure your import export code IEC registration online is successful without any rejections, you must have the following documents ready. Accuracy is key, as any discrepancy between the application and the documents can lead to delays.

- PAN Card: A copy of the Permanent Account Number card of the individual (for proprietorship) or the entity (for companies/firms).

- Identity and Address Proof: Aadhaar card, Voter ID, or Passport of the applicant.

- Business Address Proof: Sale deed, rent agreement, or electricity bill of the business premises.

- Bank Details: A cancelled cheque or a bank certificate showing the account holder’s name and account number.

- Digital Signature: While not always mandatory for all categories, having a Class 3 Digital Signature Certificate (DSC) is recommended for secure authentication.

The Role of GST in Import Export Code IEC Registration Online

One of the most significant changes in the import export code IEC registration online landscape was its integration with the Goods and Services Tax (GST) framework. Previously, the IEC was a separate identity. Now, the PAN serves as the IEC, but the registration on the DGFT portal remains a prerequisite to “activate” that PAN for international trade. If a business is registered under GST, the GSTIN is used for all customs and taxation purposes, but the IEC remains the foundational identifier for the DGFT.

It is important to note that while GST registration is mandatory for most businesses with a certain turnover, some small-scale exporters might be exempt. However, having a GSTIN often simplifies the process of claiming Integrated GST (IGST) refunds on exports. For those just starting, understanding the revised MSME classification can help in determining if you qualify for additional benefits alongside your IEC.

Common Errors to Avoid During Application

Even though the import export code IEC registration online is designed to be user-friendly, many applicants face rejections due to minor errors. One common mistake is the mismatch between the name on the PAN card and the name entered in the application. Always use the exact spelling as per the PAN database. Another frequent issue is uploading blurred or illegible documents, especially the cancelled cheque. Ensure the MICR and IFSC codes are clearly visible.

Furthermore, ensure that the bank account linked to the application is active. The DGFT system validates bank details in real-time through the Public Financial Management System (PFMS). If the validation fails, your application will be stalled. Double-checking your business address and ensuring it matches the utility bills provided will also save you from unnecessary queries from the regional DGFT office.

Pro-Tip: Document Clarity

Use a high-quality scanner for all documents. If the text is unreadable, the application is automatically flagged for manual review.

Pro-Tip: PAN Consistency

Ensure your PAN is linked to your mobile number for easy E-verification during the final submission step.

Post-Registration: Updating Your IEC Annually

While the IEC has lifetime validity, the DGFT introduced a mandatory annual update requirement. Every IEC holder must confirm or update their details on the DGFT portal between April and June every year. Even if there are no changes to your business details, you must log in and “confirm” that the information is correct. Failure to do so can result in your IEC being deactivated, which would halt all your import and export operations immediately. This “annual maintenance” ensures that the government has an accurate database of active traders in the country.

For more information on trade regulations and business growth, authoritative resources like Invest India provide excellent insights into the evolving landscape of Indian commerce. Staying updated with these changes is essential for long-term success in the global arena.

Conclusion

Securing an import export code IEC registration online is the definitive first step for any Indian business looking to leave a mark on the global stage. The process has become remarkably efficient, shifting from a tedious manual application to a streamlined digital experience. By preparing your documents carefully, following the DGFT guidelines, and ensuring annual updates, you can maintain a seamless flow of international trade. Remember, the IEC is more than just a code; it is your business’s passport to the world. Start your journey today and unlock the vast potential of international markets.

FAQs

No, GST is not strictly mandatory for obtaining an IEC. However, for most commercial transactions, GST registration is required. If you are exempt from GST, you can still apply for an IEC using your PAN.

In most cases, the IEC is generated instantly upon successful payment and submission of the application. You can download the e-IEC certificate from the DGFT portal immediately.

Yes, individuals who are sole proprietors of a business can apply for an IEC using their personal PAN. The process remains the same as it is for companies or firms.

If you fail to update or confirm your IEC details on the DGFT portal between April and June, your IEC will be placed in the ‘deactivated’ list. You will not be able to clear customs or process trade-related bank transactions until it is reactivated.

The official government fee for a new IEC application is currently ₹500. There are no other official hidden costs, though you may incur professional fees if you hire a consultant to handle the filing for you.

Read Also:

- Breaking: MSMEs’ Plea Against 45-Day Payment Rule Rejected by Supreme Court

- व्हीलचेयर टेनिस पैरालंपिक्स: खेल का उत्सव

- Trade License Registration: State-wise Requirements and Process in India

- Section 194C: TDS on Contractor Payments Explained with Examples

- 5 Essential Types of Business Structure India: 2025 Selection Guide

- Income Tax Filing Due Date 2025: 7 Critical Timelines You Cannot Ignore