Navigating the GST Return Filing Due Dates 2026

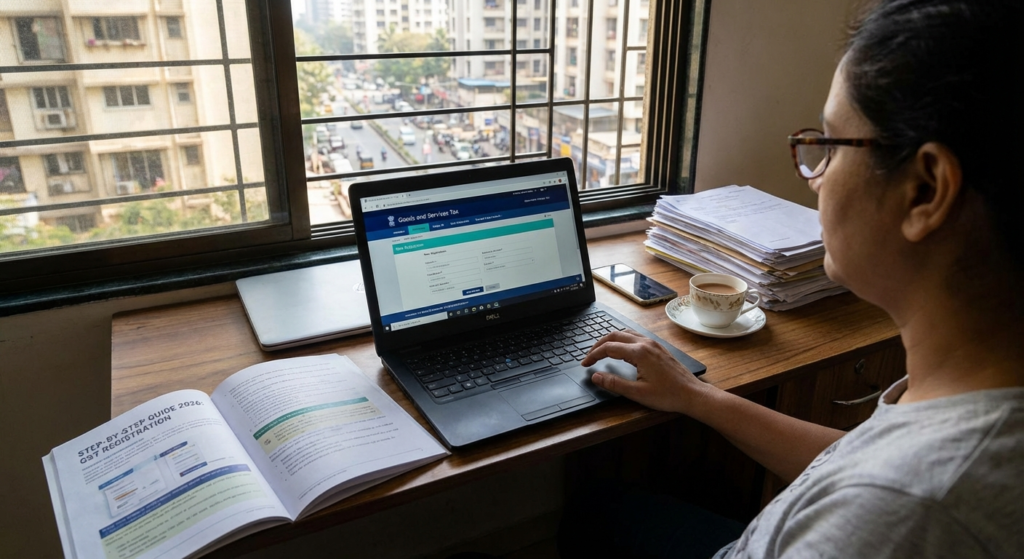

For every business owner and tax professional in India, staying updated with the GST return filing due dates 2026 is not just a matter of legal adherence but a core component of financial health. As the Goods and Services Tax (GST) ecosystem matures, the emphasis on timely compliance has become more rigorous. Missing a deadline can trigger a chain reaction of late fees, interest, and blocked Input Tax Credit (ITC), which can severely hamper your working capital. Whether you are a small retailer or a large manufacturing unit, understanding the specific timelines for GSTR-1, GSTR-3B, and other forms is essential for a seamless GST Return Filing process.

In 2026, the GST Council continues to streamline the process, yet the fundamental structure of monthly and quarterly filings remains the backbone of the system. This guide provides a comprehensive breakdown of the GST return filing due dates 2026, helping you plan your tax calendar effectively. By aligning your accounting cycles with these dates, you ensure that your business remains in the good books of the tax authorities while maintaining transparency with your vendors and customers.

Monthly Filers

Regular taxpayers with a turnover above ₹5 crores must file GSTR-1 and GSTR-3B every month. Accuracy in these filings is paramount for ITC matching.

QRMP Scheme Filers

Small taxpayers with a turnover up to ₹5 crores can opt for the Quarterly Return Monthly Payment (QRMP) scheme, filing returns quarterly while paying taxes monthly.

Composition Dealers

Taxpayers under the Composition Scheme file GSTR-4 annually but pay taxes quarterly through Form CMP-08, simplifying their compliance burden.

Why Tracking GST Return Filing Due Dates 2026 is Crucial for Your Business

The importance of keeping a close watch on the GST return filing due dates 2026 cannot be overstated. The GST system is built on a reciprocal model where one person’s output tax becomes another person’s input credit. If you fail to file your GSTR-1 on time, your B2B customers will not see the credit in their GSTR-2B, leading to strained business relationships. Furthermore, the automated nature of the GST portal means that late fees are calculated the moment you cross the deadline, leaving no room for manual intervention or excuses.

Consistent compliance also boosts your GST Compliance Rating. A high rating is often viewed favorably by financial institutions during loan processing and by large corporations when selecting vendors. By strictly following the GST return filing due dates 2026, you demonstrate professional reliability. Moreover, it is always wise to how to check GST return filed or not by vendor to ensure that your own ITC claims are valid and protected from future audits.

Monthly Breakdown of GST Return Filing Due Dates 2026

To help you stay organized, here is the month-wise schedule for the primary GST returns. Note that while these are the standard dates, the Official GST Portal may occasionally issue extensions due to technical glitches or festive holidays.

January to March 2026: The Final Quarter of FY 2025-26

- January 2026: GSTR-1 (Monthly) is due on Jan 11; GSTR-3B (Monthly) is due on Jan 20. QRMP filers must use the IFF by Jan 13.

- February 2026: GSTR-1 (Monthly) is due on Feb 11; GSTR-3B (Monthly) is due on Feb 20. This is a critical month for reconciling any discrepancies before the financial year ends.

- March 2026: GSTR-1 (Monthly) is due on March 11; GSTR-3B (Monthly) is due on March 20. Quarterly GSTR-1 and GSTR-3B for the Jan-Mar period are due by April 13 and April 22/24 respectively.

April to June 2026: Starting the New Financial Year

The start of the new financial year often brings changes in tax laws or threshold limits. It is vital to observe the GST return filing due dates 2026 closely during this transition.

- April 2026: GSTR-1 (Monthly) due on April 11. Annual GSTR-4 for Composition dealers for the previous FY is usually due by April 30.

- May 2026: GSTR-1 (Monthly) due on May 11; GSTR-3B due on May 20.

- June 2026: GSTR-1 (Monthly) due on June 11; GSTR-3B due on June 20. Quarterly returns for the April-June period follow in July.

July to September 2026: Mid-Year Compliance

As businesses enter the second quarter of the fiscal year, the focus shifts to internal audits and ensuring that the e-way bill data matches the filed returns.

- July 2026: GSTR-1 (Monthly) due on July 11; GSTR-3B due on July 20.

- August 2026: GSTR-1 (Monthly) due on Aug 11; GSTR-3B due on Aug 20.

- September 2026: This is a landmark month. September 20 is the deadline for GSTR-3B. More importantly, this is usually the last chance to claim ITC for the previous financial year (FY 2025-26) or make amendments to previous year’s invoices.

October to December 2026: The Festive Rush

With major festivals occurring during this period, transaction volumes typically peak. Managing the GST return filing due dates 2026 during the festive rush requires advanced planning to avoid last-minute errors.

- October 2026: GSTR-1 (Monthly) due on Oct 11; GSTR-3B due on Oct 20.

- November 2026: GSTR-1 (Monthly) due on Nov 11; GSTR-3B due on Nov 20.

- December 2026: GSTR-1 (Monthly) due on Dec 11; GSTR-3B due on Dec 20. Also, the deadline for the Annual Return (GSTR-9) and Reconciliation Statement (GSTR-9C) for the previous financial year is typically Dec 31.

Understanding Penalties for Missing GST Return Filing Due Dates 2026

The legal framework governing GST is strict regarding delays. According to Section 47 of the CGST Act, late fees are applicable if you miss the GST return filing due dates 2026. For a standard return like GSTR-3B or GSTR-1, the late fee is ₹50 per day (₹25 for CGST and ₹25 for SGST) for taxpayers with tax liability. For ‘Nil’ returns, the fee is reduced to ₹20 per day. However, these fees are capped at specific limits based on the turnover of the business.

In addition to late fees, interest at the rate of 18% per annum is charged on the net tax liability paid after the due date. If the delay is intentional or involves fraud, the penalties can be much higher, including the possibility of registration cancellation. Therefore, marking the GST return filing due dates 2026 on your calendar is a proactive way to safeguard your business from unnecessary financial leakage.

Late Fee Structure

₹50/day for regular returns and ₹20/day for Nil returns. Always file on time even if there is no business activity.

Interest Charges

Interest at 18% p.a. is applicable on the tax amount that is paid after the statutory deadline.

ITC Reversal

Failure to file returns for six consecutive months can lead to the cancellation of GST registration and loss of ITC.

How QRMP Scheme Affects GST Return Filing Due Dates 2026

The Quarterly Return Monthly Payment (QRMP) scheme is a boon for small taxpayers. Under this scheme, you only need to file GSTR-1 and GSTR-3B once every three months. However, the GST return filing due dates 2026 for QRMP filers involve a monthly tax payment through Form PMT-06 by the 25th of the succeeding month. Additionally, the Invoice Furnishing Facility (IFF) allows you to upload B2B invoices monthly (between the 1st and 13th) so your customers can claim ITC without waiting for the quarter to end.

Key Reconciliation Steps Before GST Return Filing Due Dates 2026

Before the GST return filing due dates 2026 arrive, performing a thorough reconciliation is vital. You should compare your purchase register with the GSTR-2B generated on the portal. GSTR-2B is a static statement that tells you exactly how much ITC is available based on your suppliers’ filings. If a supplier hasn’t filed their return, you cannot claim that credit. This “matching concept” is the most challenging part of GST compliance. Experts recommend using automated tools or consulting the Central Board of Indirect Taxes and Customs (CBIC) guidelines to ensure your reconciliation is error-free.

Practical Tips for Timely GST Compliance in 2026

Managing tax deadlines doesn’t have to be stressful. Here are some actionable insights to ensure you never miss the GST return filing due dates 2026:

- Automate Your Accounting: Use GST-compliant software that automatically calculates tax liability and generates JSON files for easy upload.

- Set Reminders: Use digital calendars to set alerts three days before the actual GST return filing due dates 2026.

- Maintain a Buffer: Never wait for the last day. The GST portal often experiences heavy traffic on the 20th of every month, leading to slow loading times or payment failures.

- Review GSTR-2B Regularly: Don’t wait until the end of the month to check your ITC. Reviewing it weekly allows you to follow up with defaulting vendors early.

- Verify E-way Bills: Ensure that all e-way bills generated during the month are accounted for in your GSTR-1 to avoid scrutiny from the department.

“Compliance is not a one-time event but a continuous process of financial discipline. In the world of GST, time is literally money.” – This sentiment is shared by top tax consultants across India who emphasize that the cost of compliance is always lower than the cost of non-compliance.

Conclusion: Staying Ahead of the Curve

Mastering the GST return filing due dates 2026 is essential for any business aiming for long-term sustainability in India’s regulated market. By following this monthly compliance calendar, you can avoid heavy penalties, maintain excellent vendor relationships, and ensure a smooth flow of Input Tax Credit. Remember that the GST landscape is dynamic; while the dates provided here are the standard timelines, staying connected with a professional consultant or regularly checking official notifications is the best way to stay fully compliant. Start planning your 2026 tax strategy today to turn compliance into a competitive advantage.

FAQs

For monthly filers, the GSTR-1 due date is the 11th of the following month. For those under the QRMP scheme, the quarterly GSTR-1 is due on the 13th of the month following the end of the quarter.

Missing the deadline results in a late fee of ₹50 per day (₹20 for Nil returns) and interest at 18% per annum on the unpaid tax amount. Persistent delays can also lead to the blocking of E-way bill generation.

Yes, for QRMP filers, the GSTR-3B due date is staggered. It is either the 22nd or the 24th of the month following the quarter, depending on the state in which your business is registered.

No, you can only claim Input Tax Credit (ITC) if the vendor files their GSTR-1 and the details reflect in your GSTR-2B. This makes it crucial to monitor your vendors’ compliance regularly.

The annual return in Form GSTR-9 and the reconciliation statement in Form GSTR-9C for the financial year 2025-26 are typically due by December 31, 2026.