In the dynamic landscape of Indian taxation, staying on top of your compliance calendar is not just a regulatory requirement—it is a business necessity. For entrepreneurs, accountants, and tax professionals, mastering the gst return due dates is crucial to avoid hefty penalties, interest accumulations, and the blockage of Input Tax Credit (ITC). Since the implementation of the Goods and Services Tax (GST) in 2017, the timeline for filing returns has evolved, with the government introducing schemes like QRMP (Quarterly Return Monthly Payment) to ease the burden on small taxpayers.

Whether you are a startup founder or a seasoned CFO, missing a deadline can disrupt your cash flow and compliance rating. This comprehensive guide details everything you need to know about gst return due dates for the fiscal year 2025-26, covering various forms like GSTR-1, GSTR-3B, and annual returns. Let’s dive deep into the calendar that dictates your tax compliance journey.

Why Monitoring GST Return Due Dates is Critical for Business

Many business owners view tax filing as a mere administrative hurdle, but in the GST regime, the timing of your filing directly impacts your vendor relationships and working capital. Adhering to gst return due dates ensures a seamless flow of credit across the supply chain.

If a supplier fails to file their GSTR-1 by the due date, the recipient cannot view the credit in their GSTR-2B. Consequently, the recipient cannot claim the Input Tax Credit (ITC) for that month. This mechanism makes strict adherence to gst return due dates a collaborative responsibility. Furthermore, consistent late filing can lead to the cancellation of your GST registration by the authorities, effectively shutting down your ability to trade legally.

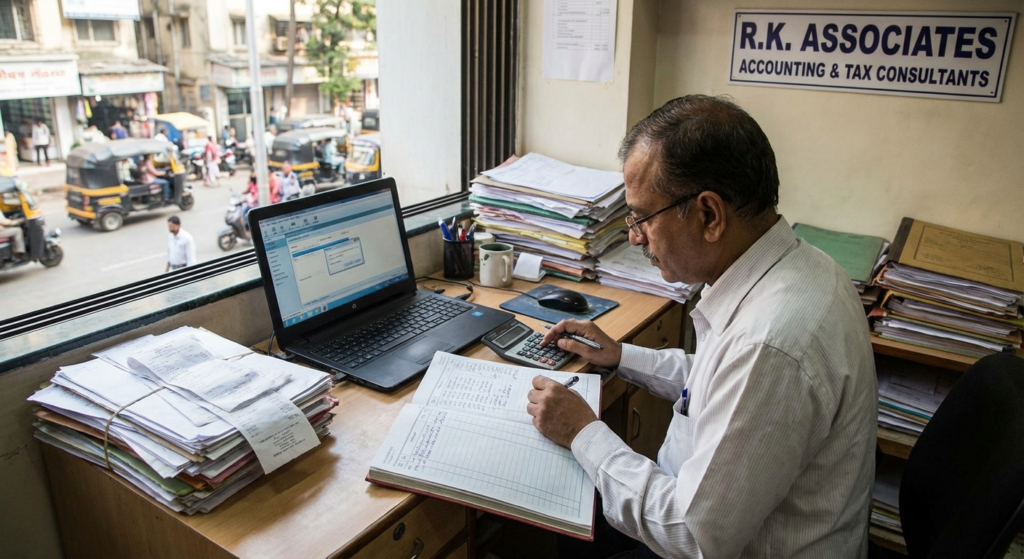

For small businesses, specifically those registered under the MSME registration for small business, maintaining a clean compliance record is vital for obtaining loans and government tenders. Banks often scrutinize GST returns to verify turnover before sanctioning credit limits.

Breakdown of Key GST Return Due Dates by Form Type

The GST framework involves various forms depending on the nature of the business and the registration scheme chosen. Understanding which form applies to you and its corresponding deadline is the first step toward compliance. Below, we have categorized the primary gst return due dates that affect the majority of taxpayers in India.

GSTR-1 (Sales Return)

Frequency: Monthly or Quarterly

Who Files: Regular Taxpayers

Deadline: 11th of the next month (Monthly) or 13th of the month following the quarter (QRMP).

GSTR-3B (Summary Return)

Frequency: Monthly or Quarterly

Who Files: Regular Taxpayers

Deadline: 20th of the next month (Monthly) or 22nd/24th following the quarter (State-dependent).

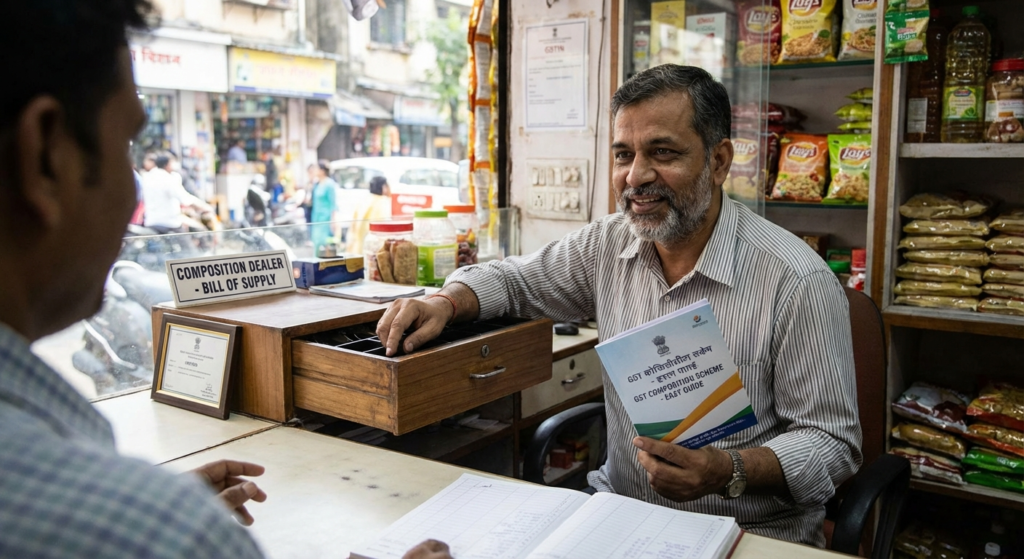

GSTR-4 (Composition)

Frequency: Annually

Who Files: Composition Dealers

Deadline: 30th April of the following financial year.

GSTR-1 and GSTR-3B: The Monthly Compliance Cycle

For most regular taxpayers, the compliance cycle revolves around GSTR-1 and GSTR-3B. GSTR-1 contains details of outward supplies (sales), while GSTR-3B is a self-declared summary return where tax liability is paid. The gst return due dates for these forms must be synchronized.

If your aggregate turnover exceeds INR 5 Crores, you must file monthly. The GSTR-1 must be filed by the 11th of the subsequent month. Once GSTR-1 is filed, the data auto-populates into the buyer’s GSTR-2B. Subsequently, you must file GSTR-3B and pay the tax by the 20th. Missing the GSTR-1 deadline creates a ripple effect, often delaying the GSTR-3B filing, which attracts interest penalties.

Penalties and Late Fees for Missing GST Return Due Dates

The government is stringent regarding adherence to gst return due dates. Failing to file on time attracts late fees and interest. It is important to distinguish between the two: late fees are a penalty for the act of filing late, while interest is a charge on the delayed payment of tax.

Currently, the late fee structure is rationalized based on turnover and tax liability:

- Nil Tax Liability: INR 20 per day (INR 10 CGST + INR 10 SGST).

- With Tax Liability: INR 50 per day (INR 25 CGST + INR 25 SGST).

The maximum late fee is capped based on the turnover of the entity, ensuring that smaller businesses are not burdened disproportionately. However, habitual offenders risk having their GSTIN suspended. For those dealing with Tax Deducted at Source (TDS), ensuring timely filing of GSTR-7 is equally important. You can learn more about verifying payments in our guide on TDS challan verification steps.

Interest Calculation on Late Payments

While late fees are capped, interest is not. If you miss the gst return due dates for GSTR-3B and have an outstanding tax liability, you are liable to pay interest at 18% per annum. This interest is calculated on the Net Tax Liability (tax to be paid in cash after adjusting ITC).

For example, if your tax liability is INR 1,00,000 and you have an ITC of INR 80,000, you must pay INR 20,000 in cash. If you file 10 days late, interest is calculated on INR 20,000 for 10 days at 18% per annum. This makes adhering to gst return due dates financially prudent.

The QRMP Scheme and Its Impact on Due Dates

The Quarterly Return Monthly Payment (QRMP) scheme was introduced to simplify compliance for small taxpayers with a turnover of up to INR 5 Crores. Under this scheme, taxpayers file returns quarterly but pay taxes monthly via a simple challan (PMT-06). This shifts the standard gst return due dates significantly.

QRMP Schedule

- IFF (Optional): Upload B2B invoices by the 13th of Month 1 and Month 2 of the quarter.

- PMT-06 (Payment): Pay tax by the 25th of Month 1 and Month 2.

- GSTR-1 (Quarterly): File by the 13th of the month following the quarter.

- GSTR-3B (Quarterly): File by the 22nd or 24th of the month following the quarter.

Under QRMP, while the return filing is quarterly, the tax payment obligation remains monthly. Taxpayers must use the Invoice Furnishing Facility (IFF) to pass on credit to their buyers in the first two months of the quarter. Missing the IFF deadline (13th) means you cannot upload invoices for that month until the quarterly GSTR-1 is filed, potentially upsetting your buyers.

How to Track and File on Time

Keeping track of multiple gst return due dates can be challenging. The most authoritative source for the official schedule is the GST Common Portal. The portal displays a scrolling ticker and a dedicated ‘News and Updates’ section that highlights upcoming deadlines and any extensions granted by the Central Board of Indirect Taxes and Customs (CBIC).

To ensure you never miss a deadline:

- Maintain Digital Records: Use accounting software that auto-syncs with the GST portal.

- Set Reminders: Mark your calendar for the 11th and 20th of every month.

- Reconcile Weekly: Don’t wait until the due date to reconcile purchase data with GSTR-2B.

- Check Cash Ledger: Ensure you have sufficient funds in your bank account for tax payments before the 20th.

Conclusion

Navigating the labyrinth of gst return due dates is a fundamental aspect of running a compliant business in India. From the monthly cadence of GSTR-1 and GSTR-3B to the annual reconciliations, every deadline serves a specific purpose in the nation’s tax architecture. Missing these dates results in financial penalties and hampers your business reputation and credit score.

By leveraging schemes like QRMP and utilizing technology for reconciliation, businesses can turn compliance from a burden into a streamlined process. Stay updated, file on time, and ensure your business contributes to and benefits from the seamless flow of tax credits. Remember, in the world of GST, punctuality is synonymous with profitability.

Frequently Asked Questions (FAQs)

A: Technically, a return is considered invalid if the full tax liability is not discharged. However, if you file GSTR-3B without paying, the system may allow it, but you will be liable to pay interest at 18% per annum on the outstanding tax amount from the due date until the date of actual payment.

A: Yes, the government (CBIC) has the power to extend gst return due dates via official notifications. This usually happens in cases of technical glitches on the portal or natural calamities affecting specific regions. Always check the official GST portal for notifications.

A: No, the gst return due dates for Nil returns are the same as regular returns (e.g., 11th for GSTR-1 and 20th for GSTR-3B). However, Nil returns can be filed quickly via SMS.

A: The standard due date for filing GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) is usually the 31st of December of the financial year following the relevant financial year.

A: Generally, if a due date falls on a public holiday or weekend, the deadline is not automatically extended to the next working day unless specifically notified. It is advisable to file before the holiday to avoid last-minute rush.