For any business operating in a dynamic economy, working capital is the lifeline that keeps operations running smoothly. One of the significant challenges businesses face under the Goods and Services Tax (GST) regime is the blockage of funds in the form of accumulated input tax credits or excess cash payments. Understanding the gst refund process India is not just a compliance requirement; it is a critical financial strategy to maintain liquidity.

Whether you are an exporter sending goods overseas or a manufacturer dealing with an inverted duty structure, the ability to reclaim your funds promptly can define your business’s agility. While the government has streamlined the system significantly since the inception of GST in 2017, many taxpayers still find the procedural nuances daunting. This comprehensive guide will demystify the gst refund process India, breaking it down into actionable steps, required documentation, and expert tips to ensure your claims are processed without unnecessary delays.

Understanding the GST Refund Process India

The gst refund process India refers to the mechanism through which registered taxpayers can claim back the excess amount of GST paid to the government or the accumulated Input Tax Credit (ITC) that remains unutilized. The primary objective of this process is to facilitate trade by ensuring that taxes do not stick to the cost of exports or burden the manufacturing sector where the tax on inputs is higher than the tax on outputs.

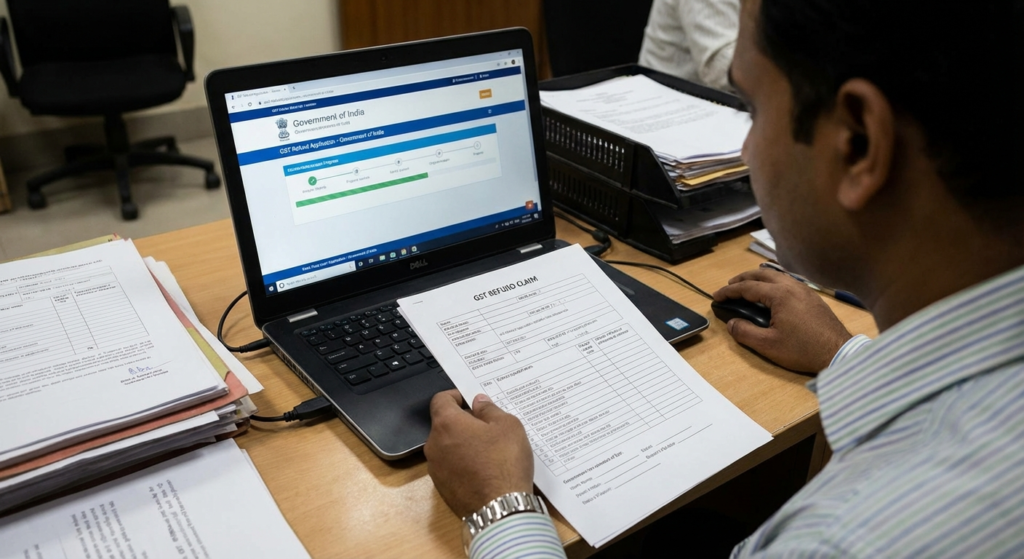

The process is primarily digital, managed through the common GST portal. This shift to an online interface was designed to reduce human interface, minimize corruption, and speed up the disbursement of funds. However, to navigate the gst refund process India successfully, one must be meticulous with return filings. Before applying for a refund, ensure your compliance is up to date. You can check the latest GST return filing due dates to ensure you are eligible to file your refund application.

Why is the Refund Process Crucial?

Efficient refund processing boosts the ‘Ease of Doing Business.’ For exporters, specifically, the refund of IGST paid on exports or the refund of accumulated ITC is vital for keeping their products competitive in the international market. A delayed refund acts as a direct cost to the business.

Eligibility for the GST Refund Process India

Not every excess balance in the electronic ledger is eligible for a refund. The gst refund process India is specific to certain scenarios defined under Section 54 of the CGST Act. Identifying the correct category is the first step toward a successful claim.

Exports (Zero-Rated Supplies)

Exporters of goods or services can claim a refund of IGST paid on exports or a refund of unutilized ITC if exports are made under a Bond/LUT without payment of tax.

Inverted Duty Structure

This occurs when the tax rate on inputs is higher than the tax rate on outward supplies, resulting in the accumulation of credit (e.g., footwear or textile industries).

Excess Cash Balance

Refunds can be claimed for excess amounts deposited in the Electronic Cash Ledger due to mistakes or miscalculations during payment.

Step-by-Step Guide to the GST Refund Process India

Navigating the technicalities can be tricky. Here is a simplified breakdown of the gst refund process India to help you file your application correctly.

1. Filing Form GST RFD-01

The journey begins on the GST Portal. You must log in and navigate to Services > Refunds > Application for Refund. Here, you will select the reason for the refund (e.g., ‘Refund of ITC on Export of Goods & Services without Payment of Tax’). Once the relevant data is filled in, the system generates Form GST RFD-01. A crucial part of the gst refund process India is ensuring that the details in your refund application match your GSTR-1 and GSTR-3B returns perfectly.

2. Generation of ARN and Acknowledgement

Once you submit the application with the Digital Signature Certificate (DSC) or EVC, the system generates an Application Reference Number (ARN). This ARN is your tracking ID. If the system finds the application complete, an acknowledgement in Form GST RFD-02 is issued electronically.

3. Scrutiny by the Proper Officer

The application is then forwarded to the jurisdictional tax officer. They will scrutinize the claim against the supporting documents. If there are missing documents or discrepancies, the officer will issue a deficiency memo in Form GST RFD-03. This is a critical juncture in the gst refund process India; if you receive a deficiency memo, you must rectify the errors and file a fresh application.

4. Provisional Refund (For Exporters)

To ensure liquidity for exporters, the government has mandated that 90% of the claimed amount can be granted provisionally within 7 days of acknowledgement. This is issued via Form GST RFD-04. This provision is a significant relief mechanism embedded in the gst refund process India.

5. Final Sanction Order

After detailed verification, if the officer is satisfied, they will issue the final sanction order in Form GST RFD-06. The amount is then credited directly to the bank account registered with the GST portal.

Documents Required for the GST Refund Process India

Documentation is the backbone of any tax claim. The gst refund process India requires specific proofs depending on the type of refund. Generally, you should be ready with:

- Statement of Invoices: A detailed list of invoices related to the refund claim.

- Export Proofs: Shipping bills, Bills of Export, and EGM (Export General Manifest) for goods.

- FIRC/BRC: Foreign Inward Remittance Certificate or Bank Realization Certificate for service exporters to prove receipt of foreign currency.

- Declaration: A declaration that the applicant has not passed on the tax burden to another person (Unjust Enrichment clause).

- GSTR-2A/2B: Evidence that the inputs have been reflected in your auto-populated returns.

Ensuring your business structure is compliant is vital. If you are just starting, understanding business registration fees in India and proper setup can prevent compliance headaches later when claiming refunds.

Common Challenges in the GST Refund Process India

Even with digitization, taxpayers face hurdles. Being aware of these can help you avoid rejection.

Mismatch in Data

The most common reason for rejection in the gst refund process India is a mismatch between the values declared in GSTR-1, GSTR-3B, and the shipping bills filed with customs. Regular reconciliation is the only cure.

Bank Account Validation

Refunds are only credited to validated bank accounts. If your bank account details on the GST portal do not match the bank’s records (e.g., IFSC code changes due to bank mergers), the disbursement will fail.

Navigating Time Limits

A crucial aspect of the gst refund process India is the ‘Relevant Date.’ You must file the refund application within two years from the relevant date. For exporters, this date is usually when the ship leaves India or when payment is received. Missing this window effectively forfeits your right to the money.

Tracking Your Refund Status

Transparency is a key feature of the modern tax regime. You do not need to visit the tax office to know where your money is. By logging into the GST Common Portal, you can track the status of your application using the ARN. The status moves from ‘Acknowledged’ to ‘Provisional Order Issued’ to ‘Final Order Issued’ and finally ‘Disbursed’.

For detailed guidelines and circulars, referencing the Central Board of Indirect Taxes and Customs (CBIC) website is highly recommended to stay updated on the latest notifications regarding refund rules.

Conclusion

Mastering the gst refund process India is an essential skill for business owners and finance professionals. It ensures that your working capital is not unnecessarily locked up in government coffers. By understanding the eligibility criteria, maintaining impeccable documentation, and adhering to timelines, you can ensure a smooth flow of refunds.

Remember, the key to a successful refund claim lies in consistency across your GST returns and supporting documents. While the process may seem complex initially, the move towards a fully automated environment is progressively making it faster and more transparent for honest taxpayers.

FAQs

You must file the refund application within 2 years from the “relevant date.” The definition of the relevant date varies depending on the nature of the refund (e.g., date of export for goods, date of payment receipt for services).

According to GST laws, the refund order (RFD-06) should be issued within 60 days from the date of receiving a complete application. If delayed beyond 60 days, the government is liable to pay interest on the withheld amount.

Yes, if the tax rate on your inputs is higher than the tax rate on your outward supplies (e.g., raw materials taxed at 18% and finished goods at 5%), you can claim a refund of the accumulated unutilized Input Tax Credit.

Form GST RFD-01 is the primary form used to apply for a refund online on the GST portal. It covers various scenarios like exports, excess balance in cash ledger, and inverted duty structure.

If your application is rejected, the officer will issue a notice explaining the reasons. You can reply to this notice. If a final rejection order is passed, the amount debited from your electronic credit ledger is re-credited, and you may appeal against the order if you believe the rejection was unjust.