Managing taxes can be a daunting task for small business owners. The complexity of regular GST compliances often takes time away from core business activities. Recognizing this challenge, the government introduced the GST Composition Scheme India as a relief mechanism. It is designed to simplify taxation for small taxpayers, allowing them to pay GST at a fixed turnover rate and file fewer returns.

Whether you are a local trader, a manufacturer, or a restaurant owner, understanding the GST Composition Scheme India is crucial for optimizing your tax liabilities. This guide will walk you through everything you need to know, from eligibility criteria and tax rates to the pros and cons of opting for this scheme.

What is the GST Composition Scheme India?

The GST Composition Scheme India is an alternative method of tax levy under the Goods and Services Tax law. It is specifically designed for small taxpayers whose aggregate turnover does not exceed a prescribed limit. The core objective is to reduce the compliance burden for smaller businesses that may not have the resources to maintain detailed records and file monthly returns.

Under this scheme, instead of calculating tax on every single invoice and managing input tax credits, the registered person pays a nominal percentage of their turnover as tax. This makes the GST Composition Scheme India a popular choice for startups and small enterprises aiming for ease of business.

Turnover Limits for the Scheme

To be eligible, the aggregate turnover of the business in the preceding financial year must not exceed the following limits:

- Rs. 1.5 Crore: For manufacturers and traders in most states.

- Rs. 75 Lakhs: For businesses located in Special Category States (such as Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, and Uttarakhand).

- Rs. 50 Lakhs: For service providers opting for the composition scheme under the specific notification for services.

Who is Eligible for GST Composition Scheme India?

Not every business can apply for this benefit. The GST Composition Scheme India has strict eligibility criteria to ensure it aids the intended demographic—small businesses. Generally, taxpayers with a turnover below Rs. 1.5 Crore can opt in. However, it is vital to check if your business type falls under the exclusion list.

If you are planning to register a new small business, understanding the difference between various registration types is key. For instance, knowing the distinction between MSME vs Udyam registration can help you structure your business correctly before applying for GST.

Who Cannot Opt for the Scheme?

The following categories of registered persons are not eligible for the GST Composition Scheme India:

- Manufacturers of ice cream, pan masala, or tobacco.

- Businesses making inter-state outward supplies of goods.

- Casual taxable persons or non-resident taxable persons.

- Businesses supplying goods through an e-commerce operator who collects TCS.

- Suppliers of services (other than restaurant services) exceeding the Rs. 50 Lakh limit.

Manufacturers

Manufacturers are eligible provided they do not produce notified goods like tobacco or aerated water. They enjoy a low tax rate but cannot claim Input Tax Credit on raw materials.

Traders

Retailers and wholesalers benefit significantly from the GST Composition Scheme India as they deal with high volumes but lower margins, making the reduced compliance burden highly advantageous.

Current Tax Rates Under GST Composition Scheme India

One of the most attractive features of the GST Composition Scheme India is the lower tax rate compared to the standard GST rates of 5%, 12%, 18%, or 28%. Here is the breakdown of the applicable rates:

Manufacturers & Traders

1% GST

Split as 0.5% CGST and 0.5% SGST on turnover.

Restaurants

5% GST

Split as 2.5% CGST and 2.5% SGST (No ITC allowed).

Service Providers

6% GST

Split as 3% CGST and 3% SGST (For turnover up to 50 Lakhs).

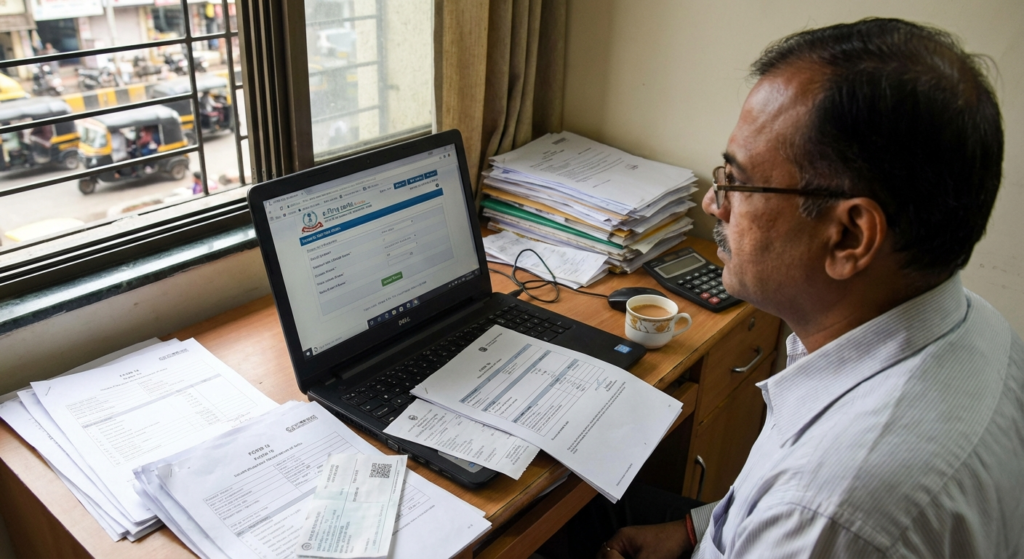

How to Apply for GST Composition Scheme India

Applying for the GST Composition Scheme India is a streamlined process handled via the GST Portal. Taxpayers can opt for this scheme either at the time of initial registration or by switching from the regular scheme before the commencement of a financial year.

- New Registrations: While filling out Part B of the registration form (GST REG-01), select the option to pay tax under Section 10 (Composition Levy).

- Existing Taxpayers: If you are already registered under the regular scheme, you must file form CMP-02 on the GST portal prior to the beginning of the financial year for which you want to exercise the option.

Additionally, you must file a statement in form ITC-03 for details of stock and inward supplies from unregistered persons within 60 days of commencement.

Key Forms and Returns

Compliance is lighter, but strict adherence to timelines is mandatory. Missing deadlines can lead to penalties. For a broader understanding of compliance calendars, you might find this guide on return filing due dates helpful to stay organized.

- CMP-08: A quarterly statement for payment of self-assessed tax. It must be filed by the 18th of the month following the quarter.

- GSTR-4: The annual return filed by composition taxpayers. It must be filed by the 30th of April following the end of the financial year.

Advantages and Disadvantages of GST Composition Scheme India

Before opting in, every business owner must weigh the pros and cons. While the GST Composition Scheme India offers simplicity, it comes with trade-offs regarding Input Tax Credit (ITC).

Advantages

- Lower Compliance: Fewer returns (quarterly payment, annual return).

- Reduced Tax Liability: Lower rates (1% to 6%) on turnover.

- High Liquidity: Since tax rates are low, less working capital is blocked in taxes.

- Ease of Doing Business: Simple calculation of tax based on turnover.

Disadvantages

- No Input Tax Credit (ITC): You cannot claim credit for tax paid on purchases.

- Limited Territory: You cannot sell goods outside your state (Inter-state supply restricted).

- No Tax Collection: You cannot charge GST from customers. The tax must be paid from your own pocket.

- E-commerce Restriction: Cannot sell goods through platforms like Amazon or Flipkart.

Rules for Issuing Bills under the Scheme

A crucial aspect of the GST Composition Scheme India is invoicing. Unlike regular taxpayers, composition dealers cannot issue a “Tax Invoice” because they are not allowed to charge tax from their customers. Instead, they must issue a Bill of Supply.

The Bill of Supply must prominently mention the words: “Composition taxable person, not eligible to collect tax on supplies.” This ensures transparency and informs the buyer that they cannot claim ITC on this purchase.

Regular Scheme vs. Composition Scheme

Choosing between the regular and the GST Composition Scheme India depends on your business model (B2B vs B2C). If your customers are businesses (B2B), they will likely want a tax invoice to claim ITC, which you cannot provide under the composition scheme. Therefore, the composition scheme is generally better suited for B2C businesses.

For more detailed official regulations, you can refer to the Central Board of Indirect Taxes and Customs (CBIC) website.

Conclusion

The GST Composition Scheme India is a boon for small businesses, offering a shelter from the complex procedural requirements of the standard GST regime. By opting for this scheme, small traders, manufacturers, and service providers can focus on growth rather than paperwork. However, the inability to claim Input Tax Credit and restrictions on inter-state sales are significant factors to consider.

If your business operates locally and sells primarily to end consumers, this scheme can save you time and money. Always evaluate your projected turnover and supply chain before making the switch. For authoritative updates and portal access, always visit the official GST Portal.

Frequently Asked Questions (FAQs)

No, businesses supplying goods through e-commerce operators who are required to collect Tax Collected at Source (TCS) are not eligible for the composition scheme.

No, a composition dealer is not allowed to collect tax from customers. The applicable tax rate must be paid out of the business’s own pocket based on turnover.

You primarily need to file Form CMP-08 (quarterly statement for payment of tax) and Form GSTR-4 (annual return).

No, businesses registered under the Composition Scheme cannot claim Input Tax Credit on the goods or services they purchase.

Yes, you can make inter-state purchases (inward supplies), but you are strictly prohibited from making inter-state sales (outward supplies).