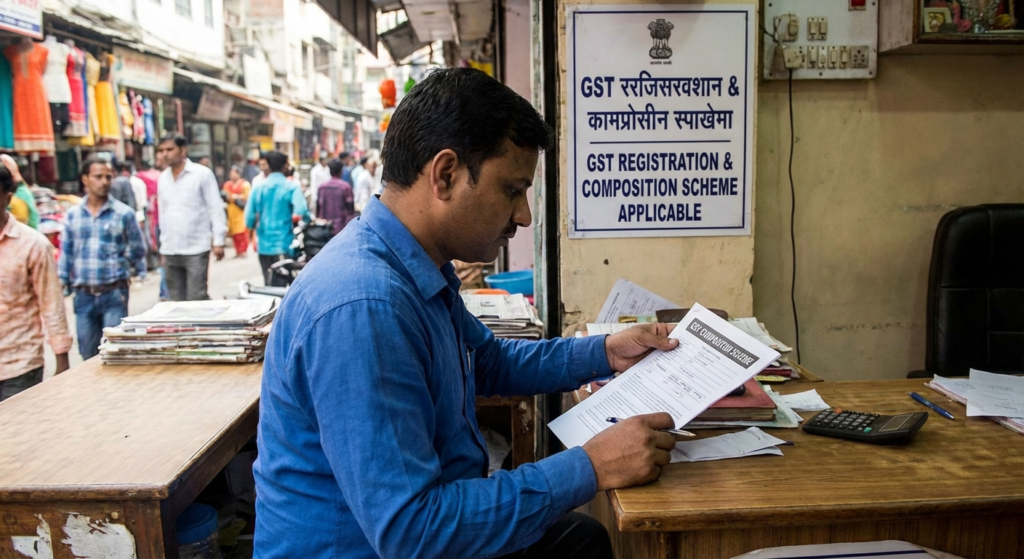

Navigating the complex waters of taxation can be daunting for small business owners and startups. However, the government introduced a relief mechanism specifically designed to ease this burden: the GST Composition Scheme India. If you are a small taxpayer looking for a simpler way to manage your Goods and Services Tax compliance, this scheme might be the golden ticket you have been searching for. By reducing the formalities and offering a fixed tax rate, it allows entrepreneurs to focus more on business growth rather than getting tangled in paperwork.

In this comprehensive guide, we will deep dive into every aspect of the GST Composition Scheme India. From eligibility criteria and tax rates to the pros and cons that every business owner must weigh, we cover it all. Whether you are a manufacturer, a trader, or a restaurant owner, understanding this scheme is crucial for optimizing your tax strategy in 2024.

What is the GST Composition Scheme India?

The GST Composition Scheme India is a simplified tax regime introduced under the GST law for small taxpayers. Its primary objective is to bring relief to small businesses by reducing the compliance burden. Instead of filing monthly returns and maintaining detailed records of every invoice, businesses registered under this scheme pay tax at a nominal, fixed rate on their turnover.

Think of it as a subscription model for taxes—simple, predictable, and less administratively intensive. However, it is vital to note that opting for the GST Composition Scheme India is voluntary. A registered taxpayer who qualifies for the scheme can choose to pay tax under this regime or stick to the regular GST scheme.

Simplicity

Reduced paperwork and fewer returns to file compared to regular taxpayers.

Fixed Rates

Lower tax liability with rates ranging from 1% to 6% of turnover.

Cash Flow

Higher liquidity as taxes are paid at a lower rate on total turnover.

Eligibility Criteria for GST Composition Scheme India

Not everyone can join this club. The government has set specific turnover limits to ensure that only small businesses benefit from the GST Composition Scheme India. As of the latest amendments, the aggregate turnover limit is the deciding factor.

Turnover Thresholds

For most states in India, the turnover limit to opt for the scheme is ₹1.5 Crores. However, for Special Category States (such as North-Eastern states and Himachal Pradesh), the limit is reduced to ₹75 Lakhs. If your annual turnover falls below these benchmarks, you are eligible to apply.

Furthermore, there is a specific provision for service providers. Initially, the scheme was limited to traders and manufacturers. However, seeing the need for the service sector, the government introduced a composition scheme for service providers with a turnover of up to ₹50 Lakhs.

Who Cannot Opt for the GST Composition Scheme India?

While the scheme is attractive, it comes with a list of exclusions. Understanding who is not eligible is just as important as knowing who is. You cannot opt for the GST Composition Scheme India if you fall into any of the following categories:

- Inter-state Suppliers: If you sell goods or services from one state to another, you are ineligible. You must be a regular taxpayer.

- E-commerce Sellers: Businesses selling goods through e-commerce operators who collect TCS (Tax Collected at Source) cannot opt for this scheme. For more details on digital selling, you might want to read about strategies for e-commerce success under GST.

- Manufacturers of Specific Goods: Manufacturers of ice cream, pan masala, tobacco, and aerated waters are excluded.

- Casual Taxable Persons: Individuals who occasionally supply goods or services in a territory where they have no fixed place of business.

- Non-Resident Taxable Persons: Foreigners supplying goods/services in India.

Current GST Rates Under the Composition Scheme

One of the most attractive features of the GST Composition Scheme India is the low tax rate. Unlike the standard 5%, 12%, 18%, or 28% slabs, composition dealers pay a much smaller percentage. Here is a breakdown of the current rates:

Manufacturers & Traders

1% GST (0.5% CGST + 0.5% SGST) on turnover of taxable supplies.

Restaurants

5% GST (2.5% CGST + 2.5% SGST) on turnover. Note that this does not apply to restaurants serving alcohol.

Service Providers

6% GST (3% CGST + 3% SGST) for other service providers with turnover up to ₹50 Lakhs.

Key Benefits of the GST Composition Scheme India

Why do thousands of businesses rush to register under the GST Composition Scheme India? The benefits are tangible and directly impact the operational efficiency of a small enterprise.

Reduced Compliance Burden

Regular taxpayers must file monthly returns (GSTR-1 and GSTR-3B) and an annual return. In contrast, composition dealers typically file a quarterly statement (CMP-08) and one annual return (GSTR-4). This significant reduction in filing frequency saves time and professional fees.

Limited Tax Liability

With tax rates as low as 1%, the financial burden on the business is reduced. This is particularly beneficial for B2C (Business to Consumer) businesses where the end customer is price sensitive.

Higher Liquidity

Since the tax rate is lower and the dealer does not have to block working capital in the form of Input Tax Credit (ITC) waiting for utilization, businesses often enjoy better cash flow.

Limitations: The Flip Side of the Coin

It is not all sunshine and roses. The GST Composition Scheme India has strict limitations that might hinder business growth if not carefully considered.

No Input Tax Credit (ITC)

This is perhaps the biggest drawback. Composition dealers cannot claim credit for the GST paid on their purchases. This means the tax paid on raw materials or stock becomes a cost to the business, potentially raising the cost of production.

No Inter-State Sales

As mentioned earlier, you are restricted to selling within your state boundaries. If you plan to expand your business nationally, the GST Composition Scheme India will act as a barrier.

Cannot Collect Tax

Composition dealers cannot issue a tax invoice. Consequently, they cannot charge GST to their customers. The tax liability must be paid out of their own pocket. This makes composition dealers less attractive to B2B clients who want to claim ITC on their purchases.

Compliance: Filing Returns Under the Scheme

Even though compliance is reduced, it is not eliminated. Dealers under the GST Composition Scheme India must adhere to specific filing timelines to avoid penalties.

- CMP-08: This is a quarterly statement of self-assessed tax to be filed by the 18th of the month succeeding the quarter.

- GSTR-4: This is the annual return filed by composition taxpayers. It must be filed by the 30th of April following the end of the financial year.

Maintaining discipline in filing is essential. If you are transitioning from a regular scheme or looking into broader compliance, understanding the nuances of filing annual returns is beneficial for long-term planning.

How to Apply for the GST Composition Scheme India

Application procedures vary depending on whether you are a new applicant or an existing taxpayer transitioning to the scheme.

- New Registrations: You can opt for the scheme directly in Part B of the registration form GST REG-01.

- Existing Taxpayers: If you are already registered as a regular taxpayer, you must file form GST CMP-02 on the GST portal prior to the commencement of the financial year for which the option is exercised.

For official guidelines and to access the portal, always refer to the Goods and Services Tax Network (GSTN).

Is the GST Composition Scheme India Right for You?

Choosing between the regular scheme and the GST Composition Scheme India depends on your business model. If you are a small retailer, a local restaurant, or a grocery store owner selling primarily to end consumers (B2C) within your state, this scheme is excellent. It shields you from complex accounting.

However, if you are a B2B supplier, your clients will likely prefer a vendor who issues tax invoices so they can claim ITC. In that scenario, the composition scheme might make you uncompetitive.

Updates and Notifications

The GST council frequently updates rules. For instance, the inclusion of service providers was a major amendment. Always keep an eye on notifications from the Central Board of Indirect Taxes and Customs (CBIC) to stay compliant with the latest regulations regarding the GST Composition Scheme India.

Conclusion

The GST Composition Scheme India serves as a vital support mechanism for the MSME sector, fostering a more inclusive tax environment. It balances the need for tax revenue with the practical difficulties faced by small businesses. By opting for this scheme, eligible businesses can enjoy lower rates and reduced paperwork, provided they are willing to forego Input Tax Credit and inter-state sales.

Before making a decision, analyze your supply chain, your customer base (B2B vs B2C), and your expansion plans. A well-informed choice can lead to significant savings and smoother operations, allowing you to focus on what matters most: building your business.

Frequently Asked Questions (FAQs)

No, existing taxpayers can only opt for the Composition Scheme at the beginning of a financial year. You must file Form GST CMP-02 before 31st March to be eligible for the scheme starting 1st April.

No, a dealer registered under the GST Composition Scheme India cannot issue a tax invoice. Instead, they must issue a “Bill of Supply” which does not carry any tax amount.

If your turnover crosses the threshold limit of ₹1.5 Crores (or ₹75 Lakhs/₹50 Lakhs as applicable), you automatically cease to be eligible for the scheme. You must file Form GST CMP-04 within 7 days and start paying taxes under the regular scheme.

No, one of the primary conditions of the GST Composition Scheme India is that the taxpayer cannot claim any Input Tax Credit on purchases of goods or services.

Yes, service providers (other than restaurants, who were already eligible) can opt for the scheme if their annual turnover is up to ₹50 Lakhs. The tax rate for them is 6%.