Navigating the labyrinth of tax compliance in India can be daunting for businesses of any size. Among the various compliances, the Goods and Services Tax (GST) audit stands out as a critical checkpoint. Understanding gst audit applicability is not just about following the law; it is about ensuring the financial health and reputation of your enterprise. Whether you are a small startup or a large conglomerate, missing the nuances of these rules can lead to hefty penalties and unnecessary litigation.

In recent years, the government has significantly overhauled the audit regime to facilitate the ‘Ease of Doing Business.’ The shift from mandatory certification by Chartered Accountants to self-certification has changed the landscape entirely. In this comprehensive guide, we will decode the complexities of gst audit applicability, ensuring you are well-equipped to handle your annual returns and departmental inquiries with confidence.

The Evolution of GST Audit Applicability in India

To truly grasp the current scenario, one must look at how the regulations have evolved. Initially, under Section 35(5) of the CGST Act, every registered person whose turnover during a financial year exceeded the prescribed limit was required to get their accounts audited by a Chartered Accountant or a Cost Accountant. However, the Finance Act of 2021 brought a paradigm shift.

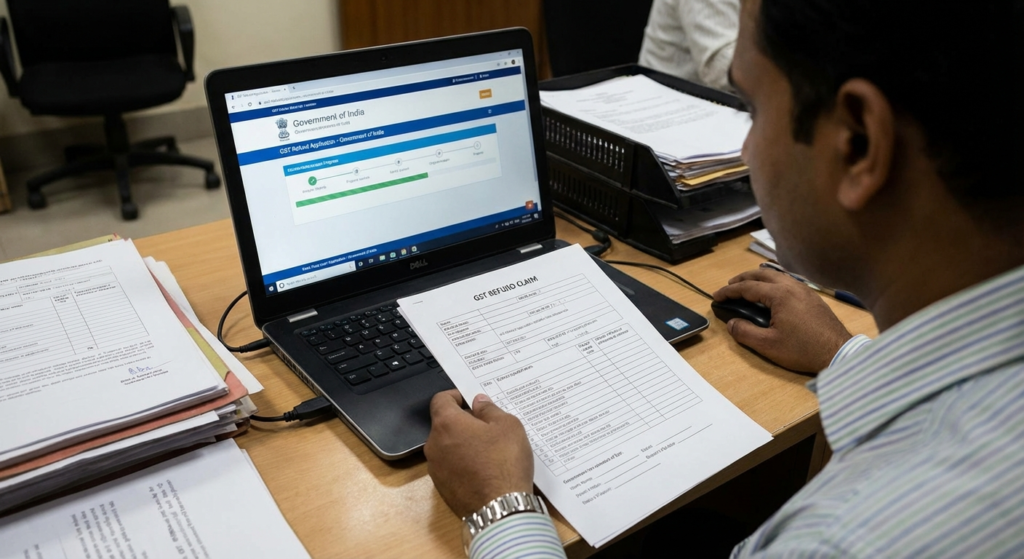

Effective from August 1, 2021, the mandatory requirement for a CA-certified reconciliation statement (GSTR-9C) was removed. Now, taxpayers can self-certify this reconciliation statement. This change was introduced to reduce the compliance burden on taxpayers. However, this does not mean the scrutiny has ended; it simply means the responsibility of accuracy has shifted entirely onto the taxpayer’s shoulders, making the understanding of gst audit applicability even more critical for internal compliance teams.

Current Turnover Thresholds for GST Audit Applicability

The core of gst audit applicability lies in the aggregate turnover of the registered entity. It is vital to calculate ‘Aggregate Turnover’ correctly, which includes taxable supplies, exempt supplies, exports, and inter-state supplies of persons having the same PAN, computed on an all-India basis.

For the current financial periods, the rules are as follows:

- Turnover up to ₹2 Crore: Filing of the Annual Return (GSTR-9) is optional for small taxpayers. If not filed, it is deemed to be filed.

- Turnover between ₹2 Crore and ₹5 Crore: Filing of GSTR-9 is mandatory, but the filing of the Reconciliation Statement (GSTR-9C) is not required.

- Turnover exceeding ₹5 Crore: It is mandatory to file both the Annual Return (GSTR-9) and the self-certified Reconciliation Statement (GSTR-9C).

Many new entrepreneurs make errors in calculating these limits. To avoid early compliance pitfalls, it is advisable to understand common GST registration mistakes that can affect your turnover calculation later.

Section 35(5) (Omitted)

Previously mandated that an external CA/CMA must audit accounts if turnover exceeded ₹2 Crore. This section has been omitted to simplify compliance.

Section 44 (Substituted)

Now requires taxpayers with turnover > ₹5 Crore to furnish a self-certified reconciliation statement (GSTR-9C) reconciling declared values with audited financial statements.

Types of Audits Under the GST Regime

While the self-certification covers the annual filing aspect, the gst audit applicability also extends to audits conducted by the tax authorities. The GST law envisages three primary types of audits/verifications. Understanding these helps businesses prepare for potential scrutiny.

1. Turnover-Based Audit (Self-Certification)

As discussed, this is the scrutiny performed by the taxpayer themselves. While technically not an “audit” by a third party anymore, it serves the same purpose of reconciling books of accounts with GST returns. If you are planning to register a small business in India, knowing when you cross the ₹5 Crore threshold is essential to plan for this compliance.

2. General Audit by Tax Authorities (Section 65)

The Commissioner or any officer authorized by them can undertake an audit of any registered person. This is a crucial aspect of gst audit applicability that businesses often overlook. The audit can be conducted at the business premises or the office of the authority.

Key features of Section 65 Audit:

- Notice: The registered person must be given a notice of at least 15 days in Form GST ADT-01.

- Duration: The audit must be completed within 3 months from the date of commencement (extendable by another 6 months).

- Scope: Verification of documents, deductions, input tax credits, and rate of tax applied.

3. Special Audit (Section 66)

This is applicable in specific scenarios where the complexity of the case warrants expert intervention. If an officer (not below the rank of Assistant Commissioner), during any scrutiny or investigation, believes that the value has not been correctly declared or the credit availed is not within normal limits, they may initiate a Special Audit.

In this scenario, the gst audit applicability is triggered by the officer’s opinion on the complexity of the accounts. The officer will direct the registered person to get their records audited by a Chartered Accountant or Cost Accountant nominated by the Commissioner.

Detailed Look at Departmental Audit Applicability

The Departmental Audit under Section 65 is not random; it is usually risk-based. The gst audit applicability here is determined by risk parameters set by the Directorate General of Analytics and Risk Management (DGARM). Factors that might trigger this audit include:

- Consistent mismatch between GSTR-1 and GSTR-3B.

- Mismatch between GSTR-2A/2B (Input Tax Credit) and credit claimed in GSTR-3B.

- Sudden spike in turnover or Input Tax Credit.

- High ratio of refund claims compared to tax paid.

Authorities like the Central Board of Indirect Taxes and Customs (CBIC) regularly issue guidelines to officers on how to select files for scrutiny to ensuring transparency.

When is a Special Audit Applicable under Section 66?

A Special Audit is distinct because it is mandated by the department but executed by an external CA. The gst audit applicability for a Special Audit arises when:

- The officer is of the opinion that the value has not been correctly declared.

- The credit availed is not within the normal limits.

It is important to note that a Special Audit can be ordered even if the taxpayer’s accounts have already been audited under any other law (like the Companies Act or Income Tax Act). Expenses for the examination and audit, including the auditor’s remuneration, are determined and paid by the Commissioner.

Trigger Point

Complexity in accounts or doubt regarding value/ITC during an ongoing scrutiny.

Auditor

A Chartered Accountant or Cost Accountant specifically nominated by the Commissioner.

Timeline

Report to be submitted within 90 days (extendable by another 90 days).

Checklist for GST Audit Readiness

Regardless of the type of gst audit applicability, businesses must maintain robust documentation. A well-maintained set of books is your first line of defense.

- Reconciliation: Ensure turnover in Audited Financial Statements matches GSTR-9.

- ITC Verification: Reconcile ITC claimed with GSTR-2B and purchase registers.

- Reverse Charge Mechanism (RCM): Check if RCM liability has been discharged on applicable expenses (e.g., legal fees, transport).

- E-Way Bills: Ensure E-way bills match the sales invoices declared.

- Job Work: Verify if goods sent for job work were returned within the stipulated time (1 year for inputs, 3 years for capital goods).

For detailed guidance on statutory audits beyond GST, you might find information on private company audit due dates helpful to align your financial calendars.

Consequences of Non-Compliance

Ignoring the rules of gst audit applicability or failing to furnish the required returns can lead to severe consequences. If a discrepancy is found during a Departmental or Special audit, the tax officer will issue a show-cause notice under Section 73 (non-fraud cases) or Section 74 (fraud cases).

Penalties can range from 10% of the tax amount (subject to a minimum of ₹10,000) for genuine errors, up to 100% of the tax evaded in cases of fraud or willful misstatement. Furthermore, interest at 18% per annum is applicable on the unpaid tax amount.

Conclusion

Understanding gst audit applicability is a dynamic process, as the GST council frequently updates rules to plug loopholes and ease compliance. The transition from mandatory CA audits to self-certification for GSTR-9C was a major relief, but it placed a higher moral and legal responsibility on business owners. Whether you are dealing with a routine turnover-based filing or a specific Departmental Audit under Section 65, the key to success lies in transparency, accurate record-keeping, and timely reconciliation.

Always consult with a qualified tax professional to assess your specific situation. For further reading on tax laws and updates, reputable sources like the Institute of Chartered Accountants of India (ICAI) provide valuable resources.

Frequently Asked Questions

For turnover between ₹2 Crore and ₹5 Crore, filing the annual return (GSTR-9) is mandatory, but the self-certified reconciliation statement (GSTR-9C) is not required. The mandatory audit by a CA for turnover above ₹2 Crore has been removed.

Currently, if your aggregate turnover exceeds ₹5 Crore in a financial year, you are required to file the self-certified reconciliation statement in Form GSTR-9C along with the Annual Return GSTR-9.

Yes, under Section 65 of the CGST Act, the Commissioner or an authorized officer can conduct a general audit at your business premises or their office after issuing a notice of at least 15 days.

For a Special Audit under Section 66, the Chartered Accountant or Cost Accountant is nominated and appointed by the Commissioner, not by the taxpayer.

Failure to file the reconciliation statement when applicable can attract a general penalty of up to ₹25,000 under the CGST Act, and an equal amount under the SGST Act, totaling ₹50,000, along with potential interest on unpaid taxes.