Introduction: Why Form 27Q Filing is Critical for Non-Resident Transactions

In the globalized economy, Indian entities frequently make payments to non-residents, whether for services, royalties, interest, or other income streams. The Income Tax Act mandates that Tax Deducted at Source (TDS) must be appropriately withheld on these payments, ensuring tax compliance even when the recipient is outside India. The document used to report this crucial deduction is Form 27Q.

If your organization makes payments falling under Section 195 of the Income Tax Act to foreign companies or non-resident individuals, mastering the Form 27Q filing guide is non-negotiable. This comprehensive guide breaks down the requirements, structure, and step-by-step process to ensure your compliance is flawless, thereby avoiding hefty penalties and scrutiny from the tax authorities. Form 27Q is not just a regulatory hurdle; it is the fundamental record linking the payer, the payee, and the Indian government regarding tax liability on cross-border income.

Understanding Non-Resident TDS and the Role of Form 27Q

Form 27Q is the quarterly TDS statement specifically designed for payments made to non-residents (excluding salaries). Unlike Form 26Q (for resident payees), Form 27Q requires meticulous detail regarding the non-resident status, the applicable tax treaty (DTAA), and the specific section under which the TDS was deducted.

Who Needs to File Form 27Q?

Any person (individual, company, partnership, etc.) responsible for deducting tax at source under Chapter XVII-B of the Income Tax Act on payments made to non-residents must file Form 27Q. This obligation arises primarily under Section 195, which covers most payments like professional fees, technical services, interest, dividends, and royalties, provided they accrue or arise in India.

The Core Function of Form 27Q

Form 27Q serves as the official declaration to the Income Tax Department regarding taxes withheld from payments made to non-residents. It provides proof that the tax has been collected and deposited to the government treasury, enabling the non-resident recipient to claim credit for that tax in their home country or while filing returns in India.

Key Differentiation: DTAA Impact

A crucial aspect of non-resident TDS is the application of Double Taxation Avoidance Agreements (DTAA). When a DTAA exists between India and the payee’s country, the lower tax rate (either the domestic rate specified in the Income Tax Act or the treaty rate) is usually applied. Form 27Q requires specific flags and details confirming whether a beneficial treaty rate was applied.

Mandatory Requirement: TAN

The deductor (the person making the payment) must possess a valid Tax Deduction and Collection Account Number (TAN) before making any deduction and subsequent filing of Form 27Q. Filing cannot be completed without a registered TAN.

Key Components and Structure of the Form 27Q Filing Guide

Filing Form 27Q is inherently more complex than filing domestic TDS returns due to the international elements involved. The form is divided into several mandatory sections, each requiring precise information.

Essential Data Required for Form 27Q Submission

To successfully complete the filing, you must gather specific information regarding both the deductor and the deductee. Accuracy in these details is paramount for successful processing and generation of Form 16A/27D.

Deductor Details

- TAN and PAN of the Deductor.

- Name and Address of the Deductor.

- Details of the person responsible for deduction (Designation, Contact).

- Quarter and Financial Year details.

Deductee (Non-Resident) Details

- Name and Address of the Non-Resident.

- Country of Residence.

- PAN/Aadhaar (if available) or unique identification number.

- Date of Payment/Credit.

- Amount Paid/Credited.

- Section under which tax was deducted (e.g., 195).

- Rate of TDS applied (Domestic or DTAA rate).

- CIN (Challan Identification Number) details.

“Effective international tax compliance relies on accurate reporting of source country tax, and Form 27Q is the gateway through which India reports its withholding obligation to non-residents.”

Step-by-Step Practical Form 27Q Filing Guide

The actual filing process for Form 27Q is done electronically using the prescribed utility software provided by the government’s authorized agency, NSDL/Protean. Following a systematic approach minimizes errors and ensures timely submission.

1. Preparation and Data Consolidation

Before beginning the electronic filing, ensure all tax payments have been deposited via Challan 281. Match the details of the challans (BSR code, date of deposit, challan serial number) precisely with the records of deduction.

2. Utilizing the RPU Utility

The e-TDS/TCS Return Preparation Utility (RPU) is essential for generating the required File Validation Utility (FVU) file. Input all the consolidated data into the RPU, paying special attention to the international fields, such as country codes and DTAA flags.

- Validate Data: The RPU will check for basic format errors. Correct any errors flagged by the utility immediately.

- Generate FVU: Once validated, the RPU generates the .fvu file. This is the final file that must be submitted.

3. Submission Process

The generated FVU file can be submitted in two ways:

- Online Submission: Upload the FVU file directly through the Income Tax e-filing portal (mandated for government deductors and large corporate deductors).

- Offline Submission: Submit the FVU file on a pen drive or CD at any Tax Information Network (TIN) Facilitation Centre.

For more detailed information on the broader requirements and procedures associated with quarterly submissions, you might want to review our comprehensive guide on TDS Return Filing.

Avoiding Common Errors in the Form 27Q Filing Guide

Due to the specific nature of international transactions, errors in Form 27Q are frequent. These errors can lead to short payment notices, interest levies, or rejection of the return.

Mismatched Challan Details

Ensure the Challan details (amount, date, BSR code) entered in the 27Q match the details recorded in the NSDL system. Mismatches are the leading cause of return rejection.

Incorrect Section Coding

Using the wrong section code (e.g., deducting tax under a business income section when it should have been royalty) invalidates the entry. Always verify the nature of the payment.

Missing or Invalid Non-Resident ID

While PAN is preferred, if the non-resident does not have one, ensure the identification number (e.g., passport number or tax ID from their country) is correctly quoted, along with the correct country code.

DTAA Documentation Failure

If a concessional DTAA rate is applied, the deductor must possess necessary documentation, including the Tax Residency Certificate (TRC) and Form 10F, which must be readily available upon request by the assessing officer. Failure to possess these documents means the domestic rate applies.

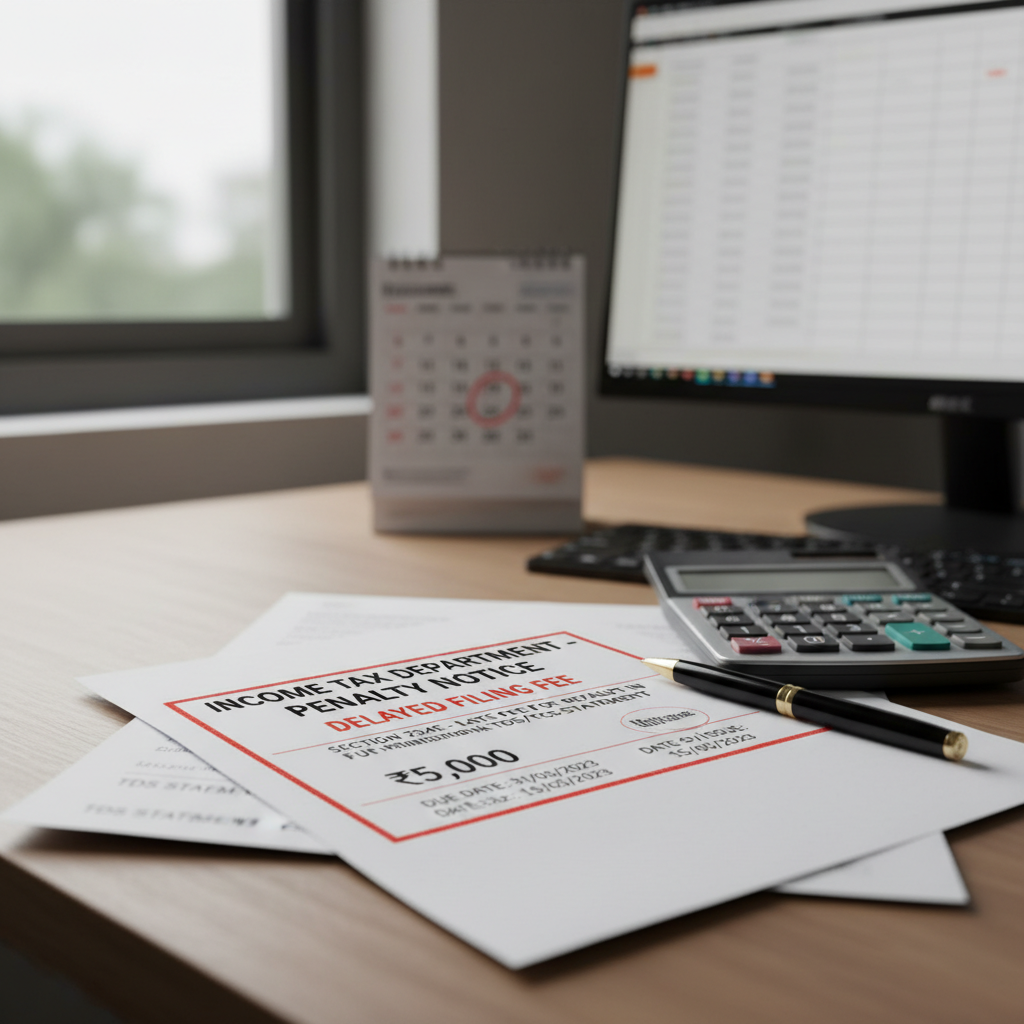

Quarterly Deadlines and Penalties for Late Form 27Q Filing

Adherence to quarterly deadlines is crucial. Non-compliance or delayed filing attracts specific penalties and interest charges under the Income Tax Act.

Quarterly Compliance Deadlines

The submission of Form 27Q is mandatory on a quarterly basis, following the end of the financial quarter. These deadlines are strictly enforced:

Q1 (April – June)

Due Date: July 31st

Q2 (July – September)

Due Date: October 31st

Q3 (October – December)

Due Date: January 31st

Q4 (January – March)

Due Date: May 31st

Understanding Penalties for Non-Compliance

Late filing of Form 27Q attracts significant penalties, underscoring the importance of adhering to the Form 27Q filing guide deadlines:

- Late Filing Fee (Section 234E): A fee of Rs. 200 per day is levied for every day of delay until the return is filed. This penalty cannot exceed the amount of TDS deductible.

- Penalty for Failure to File/Incorrect Information (Section 271H): If the return is not filed within one year from the due date, or if incorrect information is provided, a penalty ranging from Rs. 10,000 to Rs. 1,00,000 may be imposed.

- Interest for Delay in Deposit: If the TDS amount itself is deducted but deposited late, interest under Section 201(1A) applies (typically 1% or 1.5% per month, depending on the delay stage).

Ensuring timely submission is not just about avoiding penalties; it allows the non-resident payee to receive their necessary tax credit (Form 16A), which is vital for their own tax obligations globally. For official guidance on compliance updates and rules, consulting the official Income Tax Department portal is always recommended.

The Importance of Correct Tax Rate Determination

Determining the correct TDS rate is the most complex step in the Form 27Q process. The rate applied depends on a hierarchy of rules:

- The domestic rate prescribed in the Income Tax Act (currently 20% plus surcharge/cess for most non-specified payments).

- The beneficial rate specified in the applicable DTAA (if documentation like TRC and Form 10F is provided).

- The rate specified in a lower withholding order obtained from the Assessing Officer (Section 197).

If the non-resident fails to provide a PAN, the TDS rate defaults to 20% (plus surcharge and cess), even if the DTAA rate is lower. This specific requirement often catches deductors off guard, leading to short deduction notices.

The Central Board of Direct Taxes (CBDT) frequently issues circulars clarifying rates and procedures for non-residents. Staying updated on these circulars, such as those detailing compliance requirements for specific types of non-resident income, is part of a robust compliance strategy. Referencing authoritative sources like the CBDT website for the latest notifications is essential.

Conclusion: Mastering Your Form 27Q Compliance

Form 27Q is the backbone of cross-border tax compliance in India. While the requirements for non-resident TDS can be intricate, particularly concerning DTAA benefits and documentation, following a structured Form 27Q filing guide ensures smooth operation. Key takeaways include:

- Always verify the non-resident status and obtain necessary documentation (TRC, Form 10F).

- Ensure accurate Challan matching to avoid reconciliation failures.

- Adhere strictly to quarterly deadlines to prevent costly fees under Section 234E and 271H.

- Use the RPU utility for error-free file generation before submission.

By treating Form 27Q filing with the diligence it requires, your organization maintains compliance, avoids penalties, and facilitates the tax credit process for your non-resident partners.

FAQs

Form 26Q is filed for TDS deducted on payments made to residents of India (e.g., professional fees, rent, interest, commissions). Form 27Q is exclusively for TDS deducted on payments made to non-residents (foreign companies or non-resident individuals), excluding salary payments.

While not strictly mandatory for the payment itself, if the non-resident payee does not furnish their PAN to the deductor, tax must be deducted at the higher rate of 20% (plus applicable surcharge and cess), even if the applicable DTAA or domestic rate is lower. Furnishing a PAN or other identification and a TRC allows the application of the lower DTAA rate.

If you apply a lower rate based on a Double Taxation Avoidance Agreement (DTAA), you must obtain and retain two key documents from the non-resident: the Tax Residency Certificate (TRC) issued by the tax authority of their country, and Form 10F (self-declaration regarding status and income). These must be available for verification by the tax authorities.

Corrections to a filed Form 27Q must be done by filing a correction statement (revision return). This process requires the original Token Number of the submitted return. The revision is typically done using the RPU utility, specifying the type of correction (e.g., challan correction, deductee detail correction) and then generating a new FVU file for submission.

Failure to deposit the deducted tax on time attracts penal interest under Section 201(1A). Interest is calculated at 1.5% per month or part thereof from the date of deduction until the date of deposit. This is separate from penalties related to late filing of the return itself (Section 234E).