Introduction

Filing your income tax returns is an essential financial obligation for every Indian citizen. In this comprehensive guide, we will delve into the intricate process of e-filing income tax in India, ensuring that you are well-informed about the procedure and the relevant Indian Income Tax laws. From grasping the fundamentals to navigating the complexities of tax regulations, we’ve got you covered.

The Significance of E-filing Income Tax

Income tax plays a pivotal role in the nation’s economy. It serves as a vital source of revenue for the government, which is subsequently allocated for public welfare, infrastructure development, and various other essential services. Understanding its importance sets the stage for our exploration of e-filing income tax in India.

Income tax is a mandatory financial contribution that individuals and businesses make to the government. This tax is levied on the income earned during a financial year, and the government utilizes these funds to foster economic growth, fund public projects, and provide essential services such as healthcare and education.

Key Components of Indian E-filing Income Tax

- Income Tax Slabs: Indian Income Tax laws categorize individuals into different income groups, each with its tax slab. These slabs determine the rate at which your income will be taxed.

- Deductions and Exemptions: The laws also provide for various deductions and exemptions, reducing the taxable income. Understanding these can lead to significant tax savings.

- Filing Deadlines: Indian Income Tax laws stipulate specific deadlines for filing returns. Missing these deadlines can result in penalties.

- Penalties and Consequences: It’s crucial to be aware of the penalties for non-compliance with tax laws. Ignorance is not an excuse in the eyes of the law.

- Hire a Tax Professional: If your financial situation is complex, consulting a tax professional can help you identify additional deductions and credits you may be eligible for.

The E-filing Process: Step by Step

Now that we have a foundational understanding of income tax and Indian Income Tax laws, let’s delve into the step-by-step process of e-filing your income tax returns.

Step 1: Gather Required Documents

Before you begin, ensure you have all the necessary documents, including your PAN card, Form 16 (if you’re a salaried individual), bank statements, and investment proof.

Step 2: Choose the Right Portal

The Government of India offers various portals for e-filing, including the official Income Tax Department website and authorized third-party service providers. Select the one that suits your needs.

Step 3: Registration

Create an account on your chosen portal. You’ll need to provide your PAN, personal details, and contact information.

Step 4: Select the Appropriate Form

Choose the correct Income Tax Return (ITR) form based on your income sources and category.

Step 5: Fill in the Details

Enter your income details, deductions, and exemptions in the form. Double-check for accuracy to avoid errors.

Step 6: Verify and Submit

Review your filled-in form, verify the details, and submit it electronically. You’ll receive an acknowledgment in return.

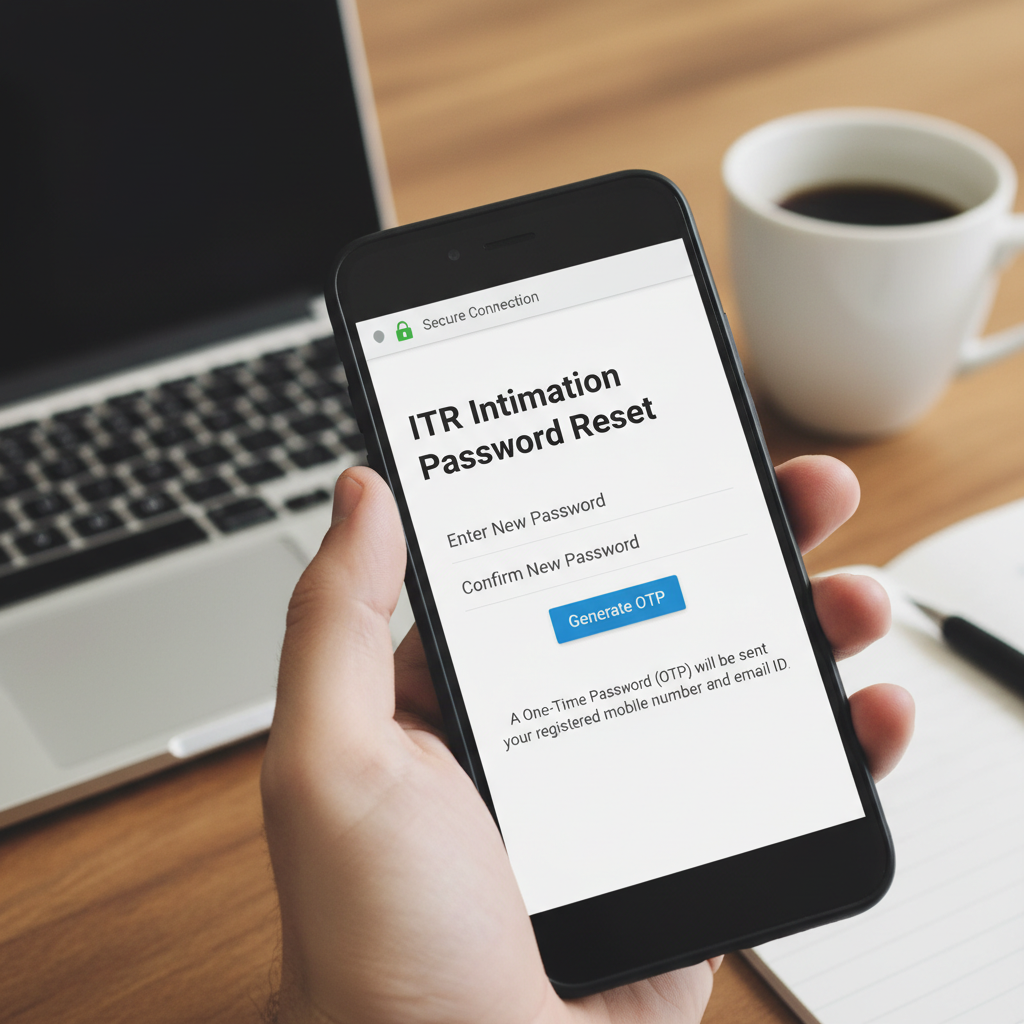

Step 7: Verification

After submission, you must verify your return. This can be done electronically using Aadhar OTP, net banking, or by sending a signed physical copy to the Central Processing Centre.

Conclusion

In conclusion, e-filing income tax in India is a modern, efficient, and convenient way to fulfill your tax obligations. By understanding the Indian Income Tax laws, following the step-by-step process, and staying informed about the FAQs, you can ensure a smooth and hassle-free tax filing experience. Remember, timely and accurate filing not only keeps you compliant with the law but also ensures you make the most of available deductions and exemptions. Happy e-filing!

Frequently Asked Questions (FAQs)

No, e-filing is not mandatory for everyone. However, it is mandatory for individuals with an annual income exceeding Rs. 5 lakhs.

Form 26AS is a statement that reflects the taxes paid on your behalf by deductors. It’s crucial for cross-verifying the TDS details in your return.

No, a PAN card is a mandatory requirement for e-filing income tax returns in India.

Late filing can result in penalties and interest on the outstanding tax amount. It’s essential to adhere to the deadlines.

Yes, you can file a revised return to correct any errors or omissions in your original return.

Yes, you can claim deductions under Section 80C for investments like LIC premiums, PPF contributions, and more while e-filing.

Please Rate this post

Click to rate