Scaling a business is an exciting journey, but the vehicle you started with might not be the one that takes you to the finish line. Many entrepreneurs begin their journey as a partnership firm due to its simplicity and ease of setup. However, as the business expands, the limitations of a partnership—such as unlimited liability and difficulty in raising capital—become apparent. This is where the Conversion of Partnership to Private Limited Company becomes a strategic necessity.

Transforming your business entity is not just a change in name; it is a fundamental shift in how your business operates, protects its owners, and attracts investment. If you are looking to unlock growth, limit your personal risk, and gain credibility, understanding the Conversion of Partnership to Private Limited Company is the first step toward a more robust corporate structure.

Why Consider the Conversion of Partnership to Private Limited Company?

Moving from a partnership to a private limited company (Pvt Ltd) is often triggered by the need for expansion. While partnerships rely heavily on the personal assets of partners, a Pvt Ltd company offers a distinct separation between ownership and management. Below are the compelling reasons why businesses opt for this transition.

Limited Liability Protection

In a partnership, partners are personally liable for debts. In a Pvt Ltd company, liability is limited to the unpaid share capital, protecting personal assets like homes and savings.

Easy Access to Capital

Investors and VCs prefer Pvt Ltd companies. The ability to issue equity shares makes fundraising significantly easier compared to partnerships.

Perpetual Succession

A company has a separate legal existence. Unlike a partnership, which may dissolve upon the death of a partner, a company continues to exist indefinitely.

These benefits highlight why the Conversion of Partnership to Private Limited Company is a pivotal moment for growing enterprises. It professionalizes the business image and instills confidence in stakeholders, suppliers, and customers.

Prerequisites for the Conversion of Partnership to Private Limited Company

Before diving into the paperwork, specific criteria must be met to ensure a smooth transition under Part IX of the Companies Act, 2013. Not every partnership is immediately eligible; you must prepare your firm for the shift.

- Registered Partnership: While unregistered partnerships can convert, it is often recommended to have the partnership deed registered with the Registrar of Firms.

- Minimum Members: There must be at least two partners to proceed with the conversion.

- Asset Transfer: All assets and liabilities of the firm must be transferred to the new company.

- Creditor Consent: A critical prerequisite is obtaining a No Objection Certificate (NOC) from the secured creditors of the partnership firm.

Ensuring these boxes are checked is vital for the successful Conversion of Partnership to Private Limited Company. Failing to meet these can lead to rejection by the Ministry of Corporate Affairs (MCA).

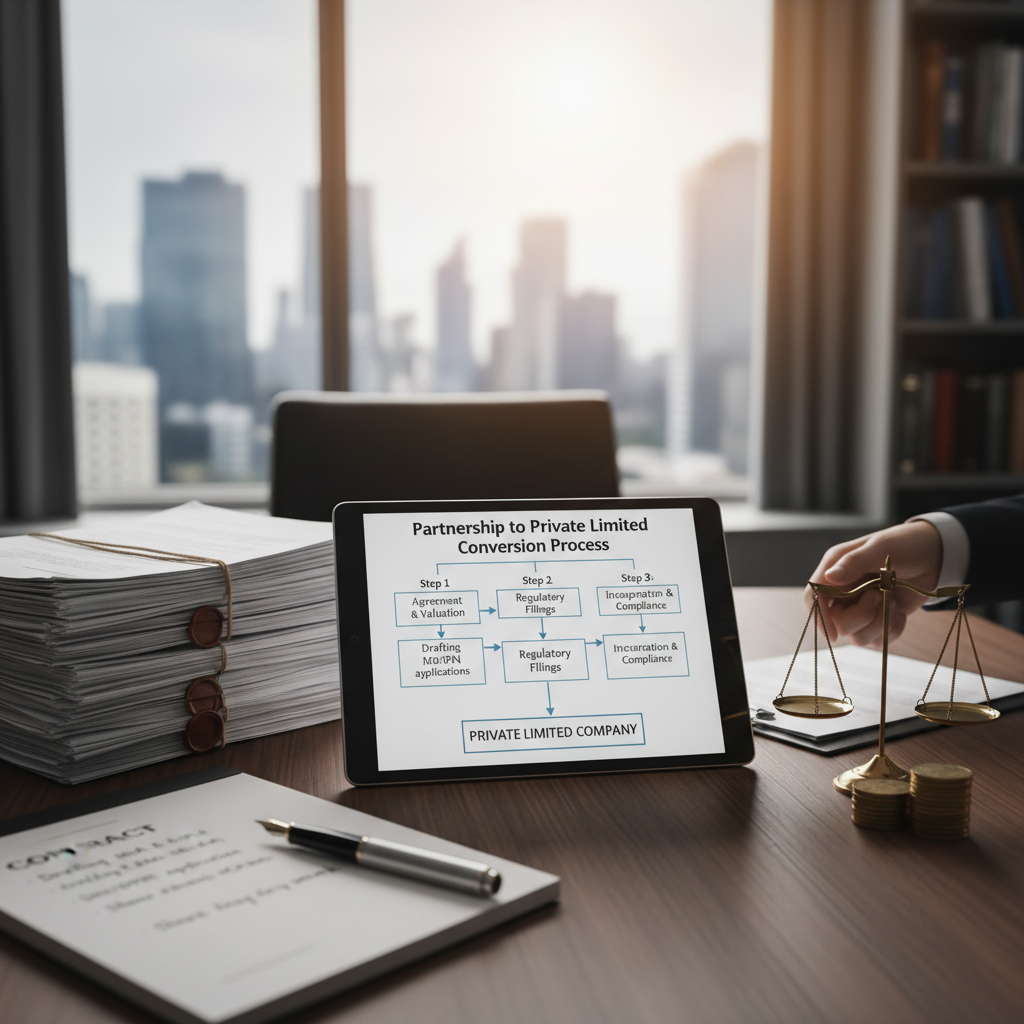

Step-by-Step Process for Conversion of Partnership to Private Limited Company

The process involves several regulatory steps to ensure transparency and legal compliance. It is more complex than a standard private limited company formation in India because it involves transferring an existing legacy.

1. Hold a Partnership Meeting

All partners must agree to the conversion. A formal meeting should be held, and a majority consent (preferably unanimous) must be recorded in writing.

2. Obtain Digital Signature Certificates (DSC) and DIN

All proposed directors must have a valid DSC and a Director Identification Number (DIN). If they do not have one, this is the first actionable step.

3. Name Approval (RUN)

Apply for the name of the proposed company through the Reserve Unique Name (RUN) service on the Ministry of Corporate Affairs (MCA) portal. The name usually remains the same as the partnership firm, with “Private Limited” added, subject to availability.

4. Filing Form URC-1

This is the core form for the Conversion of Partnership to Private Limited Company. It requires details of the firm, partners, and assets. You must attach:

- List of members showing names, addresses, and shares held.

- List of first directors.

- Affidavit from each person proposed as a first director.

- Copy of the Partnership Deed.

- Statement of accounts certified by a CA, not older than 15 to 30 days.

5. Filing SPICe+ Forms

Along with URC-1, you must file the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) forms. This includes the Memorandum of Association (MOA) and Articles of Association (AOA).

Tax Implications During the Conversion of Partnership to Private Limited Company

One of the biggest concerns during this transition is tax. Does the transfer of assets attract Capital Gains Tax? Fortunately, the Income Tax Act provides specific exemptions if conditions are met.

Under Section 47(xiii) of the Income Tax Act, 1961, the transfer of capital assets from the firm to the company is not regarded as a transfer, meaning no capital gains tax is levied, provided:

- All assets and liabilities of the firm become the assets and liabilities of the company.

- All partners become shareholders of the company in the same proportion as their capital accounts.

- The partners receive consideration only by way of share allotment (no cash payouts).

- The aggregate shareholding of the partners in the company remains at least 50% for five years post-conversion.

Staying updated with the latest income tax updates is crucial to ensure you do not inadvertently trigger a tax liability during this process.

Documents Checklist for Conversion of Partnership to Private Limited Company

Documentation is the backbone of the Conversion of Partnership to Private Limited Company. Missing a single document can delay the process by weeks. Here is a quick reference guide designed to keep you organized.

Identity Proofs

PAN Card (Mandatory for Indians) and Passport (for Foreign Nationals) of all partners/directors.

Address Proofs

Aadhar Card, Voter ID, or Driver’s License for all partners. Utility bills for the registered office.

Financial Documents

Latest Income Tax Return of the partnership firm and audited financial statements.

Legal Declarations

NOC from the landlord of the registered office and affidavits regarding non-acceptance of deposits.

Key Differences: Partnership vs. Private Limited

Understanding the “Before” and “After” states helps in visualizing the impact of the Conversion of Partnership to Private Limited Company.

Partnership Firm

- Liability: Unlimited (Personal assets at risk).

- Regulation: Low compliance burden.

- Status: Not a separate legal entity.

- Taxation: Flat rate, but salaries to partners are allowed deductions.

Private Limited Company

- Liability: Limited to share capital.

- Regulation: High compliance (MCA filings).

- Status: Separate Legal Entity.

- Taxation: Flat rate (often lower for new companies), dividends taxed differently.

Common Challenges and How to Overcome Them

While the Conversion of Partnership to Private Limited Company is beneficial, it is not without hurdles. Common challenges include stamp duty adjudication on the transfer of property and obtaining NOCs from banks.

Stamp Duty: The transfer of immovable property from the firm to the company may attract stamp duty, which varies by state. It is essential to consult with legal experts to assess this cost beforehand.

Bank Loans: If the partnership has existing credit lines, banks may require a fresh appraisal of the new company’s creditworthiness before transferring the loan accounts. Transparency with your financial institution is key.

Conclusion

The Conversion of Partnership to Private Limited Company is a significant milestone in a business’s lifecycle. It signifies maturity, ambition, and a readiness to scale. While the procedural compliance under Part IX of the Companies Act, 2013, is rigorous, the long-term benefits of limited liability, global credibility, and investment readiness far outweigh the initial effort.

By carefully planning the transition, ensuring tax neutrality through compliance with Section 47(xiii), and maintaining transparent documentation, you can seamlessly upgrade your business engine. For more detailed regulations, always refer to the Income Tax Department guidelines.

FAQs

Yes, a partnership firm can be converted into a Private Limited Company under Part IX of the Companies Act, 2013, provided it meets specific requirements like having at least two partners and obtaining creditor consent.

The cost varies depending on the authorized capital of the new company and the stamp duty applicable in the specific state. It includes government fees for forms URC-1 and SPICe+, DSC fees, and professional charges.

Generally, no. If the conversion satisfies the conditions of Section 47(xiii) of the Income Tax Act—such as all partners becoming shareholders and assets being transferred intact—capital gains tax is exempted.

No, you do not need to dissolve the firm separately. The conversion process itself results in the partnership firm ceasing to exist and the new Private Limited Company taking over its identity and assets.

The entire process typically takes 30 to 45 days, depending on the accuracy of the documents submitted and the processing time taken by the Registrar of Companies (ROC).