The Critical Importance of Flawless GST Registration

The Goods and Services Tax (GST) regime, introduced in India in 2017, standardized indirect taxation, bringing millions of businesses under a unified compliance umbrella. While the process is largely digitized, the complexity of compliance requirements often leads applicants astray. Failing to register correctly can result in delays, penalties, and future audit issues. Therefore, understanding and proactively addressing the pitfalls is essential for any business operating in India.

This comprehensive guide focuses on identifying the common mistakes in GST registration India and provides proven strategies to ensure your application is approved swiftly and accurately. Getting this foundational step right is crucial for accessing input tax credits (ITC) and maintaining legal operational status.

Why Getting GST Registration Right is Non-Negotiable

Many businesses view GST registration merely as a bureaucratic formality. However, it is the gateway to legitimate trade, enabling interstate sales and allowing businesses to pass on tax benefits to consumers. Errors made during the initial registration phase can haunt a business for years, leading to costly rectifications and potential show-cause notices from tax authorities. Addressing the common mistakes in GST registration India upfront saves significant time and resources later.

Impact of Delayed Registration

If your business crosses the turnover threshold and registration is delayed, you might be liable to pay tax from the date you became eligible, often resulting in heavy interest and penalties.

Loss of Input Tax Credit (ITC)

Unregistered businesses cannot claim ITC on purchases, increasing their operational costs significantly. Correct registration is key to optimizing tax liabilities.

Compliance and Reputation

A faulty registration status can damage vendor trust and lead to difficulties in securing contracts, especially with large corporations that require compliant suppliers.

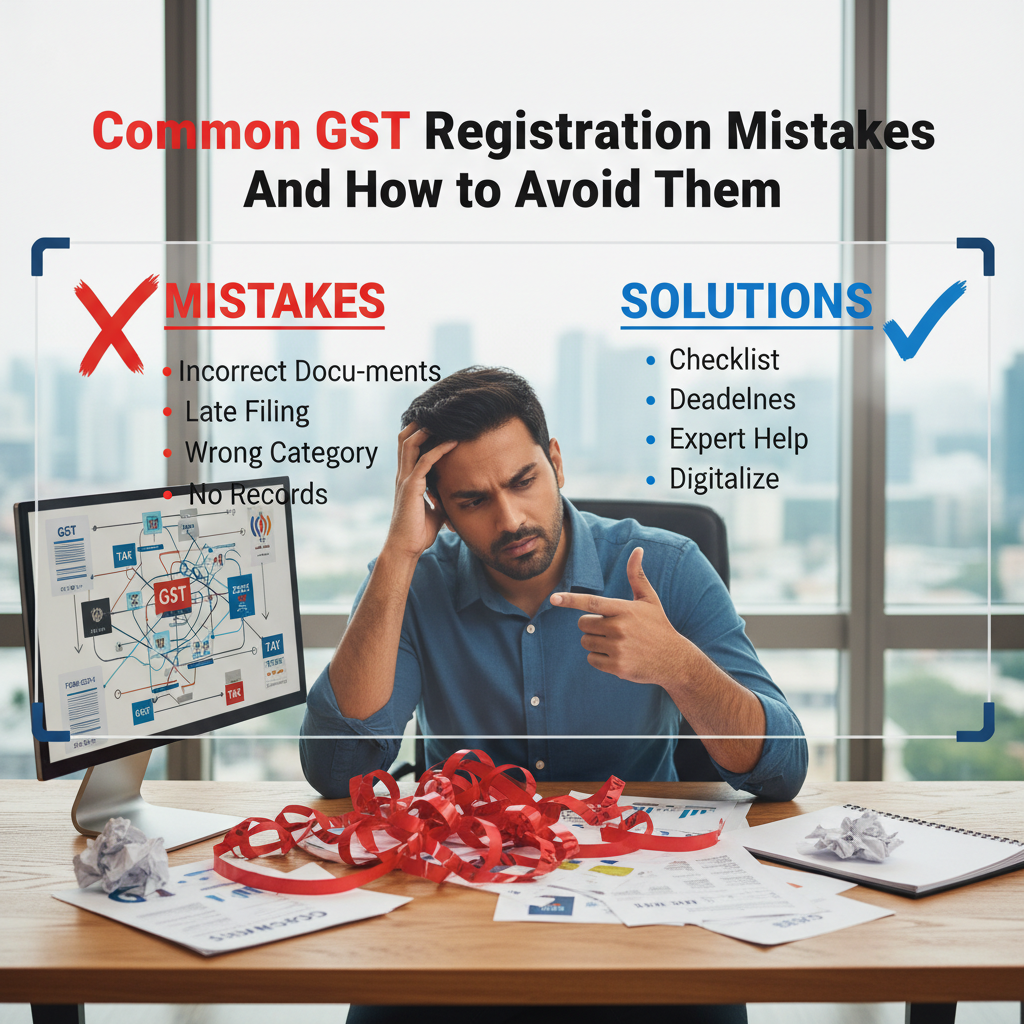

The 8 Most common mistakes in GST registration India

Based on observations of thousands of applications, certain errors surface repeatedly. Here are eight frequent and critical common mistakes in GST registration India that applicants must diligently avoid:

1. Incorrect Assessment of the Registration Threshold

One of the most frequent errors is miscalculating when registration becomes mandatory. The threshold varies based on the nature of supply (goods vs. services) and the state of operation (Special Category States vs. General Category States). Businesses often mistakenly calculate turnover based only on taxable supplies, forgetting to include exempt supplies, stock transfers, and exports.

- Avoidance Tip: Always include the aggregate value of all supplies (interstate, intrastate, exempt, taxable) across all PAN-linked businesses when calculating the threshold.

2. Mismatch in Business Details and Legal Name

The name and details provided in the GST application (Part B) must exactly match the Permanent Account Number (PAN) details and the details on the primary bank account proof. Even minor discrepancies in spelling, spacing, or abbreviations can lead to immediate rejection.

- Avoidance Tip: Cross-verify the legal name, address, and constitution of the business (e.g., Proprietorship, Partnership, Company) against the PAN database before initiating the application.

3. Document Upload Failures and Format Issues

The GST portal has strict requirements for document size, format (usually PDF or JPEG), and clarity. Uploading blurry scans, documents exceeding the size limit, or using outdated utility bills as address proof are key document-related common mistakes in GST registration India.

- Avoidance Tip: Ensure all documents (especially the identity proof of promoters and address proof of the principal place of business) are clear, recent (within 2 months for utility bills), and correctly sized.

4. Wrong Selection of Taxpayer Type (Regular vs. Composition)

Many small businesses eligible for the Composition Scheme mistakenly register as Regular taxpayers, or vice versa. The Composition Scheme offers simpler compliance but restricts ITC claims and interstate sales. Choosing the wrong type complicates future filing and operational strategy. Businesses should thoroughly understand the Presumptive Taxation Scheme eligibility before deciding.

- Avoidance Tip: Assess your expected turnover, customer base (B2B vs. B2C), and interstate supply requirements before selecting the scheme.

5. Failure to Verify PAN and Aadhaar During Application

The GST system relies heavily on PAN validation. If the PAN details are not correctly synchronized with the Income Tax database, the application will fail. Furthermore, mandatory Aadhaar authentication for proprietorships and authorized signatories significantly speeds up the process; skipping it often leads to physical verification and delays.

- Avoidance Tip: Complete the Aadhaar authentication for the authorized signatory immediately after generating the Temporary Reference Number (TRN).

6. Issues with Principal Place of Business Proof

The proof of the principal place of business (where records are maintained) is highly scrutinized. If the premises are rented, applicants often submit rental agreements that are expired or not registered. If the premises are self-owned, outdated property tax receipts are often submitted.

- Avoidance Tip: Use a registered rent/lease agreement or the latest municipal tax receipt/electricity bill (owned property) as proof. Consent letters (NOC) from the owner are mandatory if the business is not the sole owner.

7. Not Responding to Queries (SMC) Timely

If the GST officer finds discrepancies, they issue a clarification notice (Form GST REG-03), often referred to as a ‘Show Cause Memo’ (SMC). Applicants frequently miss the email notification or fail to respond within the stipulated time frame (usually 7 working days). Failure to respond results in automatic rejection of the application.

- Avoidance Tip: Monitor the email ID registered on the portal daily after submission. Respond to all queries concisely and upload the requested documents promptly.

8. Incorrect HSN/SAC Code Declaration

While HSN (Harmonized System of Nomenclature for Goods) and SAC (Service Accounting Code for Services) declarations are technically required during compliance, knowing the correct codes is sometimes necessary even during registration, especially for detailed business descriptions. Using the wrong code can lead to incorrect tax rate assumptions later. Businesses should refer to resources on how to find GST HSN codes.

- Avoidance Tip: Clearly define your top 5 products or services and identify their corresponding HSN/SAC codes accurately before filling out the business activity section.

Practical Steps to Prevent common mistakes in GST registration India

Preventing rejection requires meticulous preparation. By adopting a systematic approach, businesses can navigate the application process smoothly. These steps are crucial for mitigating the most pervasive common mistakes in GST registration India.

Pre-Application Checklist: Ensuring Data Consistency

Before logging into the portal, ensure all required data is aligned across all official documents. This step drastically reduces the chances of rejection due to data mismatch.

Verification Step 1: Identity & Legal Status

Ensure the PAN details of the business entity and all designated partners/directors are active and match their Aadhaar details exactly. Verify the Director Identification Number (DIN) status if applicable.

Verification Step 2: Address Proof Validity

For rented premises, the agreement must be currently valid and registered. For owned premises, the electricity bill or municipal tax receipt must be recent (not older than two months). The Central Board of Indirect Taxes and Customs (CBIC) provides detailed guidelines on acceptable documents.

Verification Step 3: Bank Account Readiness

Ensure the bank account is opened in the name of the business entity (not the proprietor’s personal name). Uploading a cancelled cheque or bank statement showing the business name and account number is required.

Understanding the Nuances of Inter-State Supply

If you engage in inter-state supply of goods, the registration threshold is immediately zero, meaning you must register regardless of turnover. This is a critical point missed by many new traders, leading to non-compliance. Even providing a service across state lines typically mandates immediate registration.

Leveraging Professional Assistance for Expert GST Registration

Given the detailed requirements for documentation, verification, and timely response to queries, many businesses, especially those new to large-scale compliance, find the process challenging. Engaging a professional service minimizes the risk of making common mistakes in GST registration India.

A specialized consultant not only handles the paperwork but also provides crucial advisory services, such as determining the correct tax scheme, identifying the appropriate HSN/SAC codes, and ensuring timely response to clarifications raised by the GST officer. Utilizing Expert GST Registration services ensures compliance from day one, allowing business owners to focus on core operations.

As noted by finance experts, “In complex regulatory environments like GST, the cost of error far outweighs the cost of professional advice.” By outsourcing the registration process, businesses buy peace of mind and guarantee regulatory adherence.

Benefit: Accuracy and Compliance

Professionals ensure every detail aligns with the PAN, bank records, and property documents, preventing rejections due to minor technical errors.

Benefit: Time Savings and Speed

They manage the entire timeline, including prompt response to any SMC (Show Cause Memo), often securing registration faster than self-applicants.

Benefit: Scheme Optimization

Consultants help determine if Regular or Composition Scheme is best suited for your business model, maximizing future tax benefits and minimizing compliance burden.

Benefit: Future-Proofing

Proper initial registration sets the stage for smooth future filings, ensuring eligibility for maximum Input Tax Credit (ITC) claims.

Understanding the Post-Registration Requirements

Successful registration is just the beginning. Once you receive your GST Identification Number (GSTIN), you must adhere to subsequent compliance requirements, including regular filing of returns (GSTR-1, GSTR-3B), maintaining proper records, and issuing GST-compliant invoices. Failure to understand these subsequent steps is often considered the next set of common mistakes in GST registration India compliance.

For businesses that also qualify as MSMEs, proper adherence to GST regulations is vital, especially when leveraging government support schemes. Ensuring synchronized data across all registrations, including MSME, strengthens the legal standing of the business. You can learn more about MSME registration for small business to see how it complements GST compliance.

It is also crucial to understand that tax laws are dynamic. Staying updated with the latest amendments and notifications issued by the government is vital for continuous compliance. For instance, recent changes often impact the applicability of e-invoicing thresholds or specific return filing deadlines. Keeping a pulse on the official government communication is paramount. The Income Tax Department portal is an authoritative source for related financial updates.

Conclusion: Zero Tolerance for Errors

GST registration is the fundamental legal step for any growing business in India. While the digital process simplifies submission, it demands absolute accuracy and consistency in documentation. By being aware of the eight common mistakes in GST registration India discussed—from threshold miscalculations to document failures and untimely responses—businesses can significantly streamline their application process.

Treat the registration process with the seriousness it deserves, use a meticulous checklist, and consider professional help to ensure a successful, hassle-free entry into the GST ecosystem. A successful registration today ensures smooth operations and maximized tax benefits tomorrow.

FAQs

Typically, the GST officer provides a 7-working-day window to respond to any clarification notice (Form GST REG-03). Failure to respond within this period will lead to the application being rejected automatically.

Generally, if a business deals exclusively in supplies that are wholly exempt from GST, they are not required to obtain GST registration. However, they still need to calculate their aggregate turnover to confirm they are not accidentally crossing the threshold based on other supplies, if any. Furthermore, if they engage in interstate sales, mandatory registration might apply.

If your application is rejected, you cannot appeal the decision directly. You must file a fresh application (Form GST REG-01) addressing the specific reasons for rejection cited by the officer. This emphasizes the importance of getting it right the first time.

No. The bank account details provided during GST registration must be in the name of the business entity (matching the PAN and legal name). Using a personal savings account is a common mistake and will lead to rejection, especially for partnerships, companies, or LLPs. Proprietorships must ensure the account is clearly linked to the business operations.

Aadhaar authentication is mandatory for the authorized signatory of the business, especially for proprietorships and partnerships. If the applicant opts out of Aadhaar authentication, the registration process typically involves mandatory physical verification by the GST officer, significantly increasing processing time.