Tax season often brings a mix of relief and anxiety. While the goal is to close the financial year cleanly, many taxpayers unknowingly commit errors that lead to defective returns, delayed refunds, or even scrutiny from the Income Tax Department. Understanding the most common income tax filing mistakes is the first step toward a stress-free financial life. Whether you are a salaried employee, a freelancer, or a business owner, precision is key.

Filing your Income Tax Return (ITR) is not just about filling in numbers; it is about ensuring those numbers align with the government’s data. A simple typo or a misunderstood clause can result in a notice. In this comprehensive guide, we will explore the critical income tax filing mistakes you must avoid to ensure a smooth processing experience this assessment year.

Why Avoiding Income Tax Filing Mistakes Matters

The Income Tax Department has become increasingly technologically advanced. With the integration of the Annual Information Statement (AIS) and TIS, the department has access to a granular level of your financial data. Consequently, the margin for error has shrunk significantly. Making income tax filing mistakes can lead to penalties, interest under sections 234A, 234B, and 234C, and the hassle of filing revised returns.

Furthermore, consistent errors can impact your financial credibility. If you plan to apply for loans or visas, a clean tax record is indispensable. By being proactive and double-checking your details, you safeguard your financial reputation.

Top Common Income Tax Filing Mistakes Taxpayers Make

Let’s dive into the specific errors that plague taxpayers every year. Being aware of these income tax filing mistakes can save you time and money.

1. Choosing the Wrong ITR Form

Using ITR-1 when you have capital gains or using ITR-4 without meeting presumptive taxation criteria renders your return defective. Always assess your income sources first.

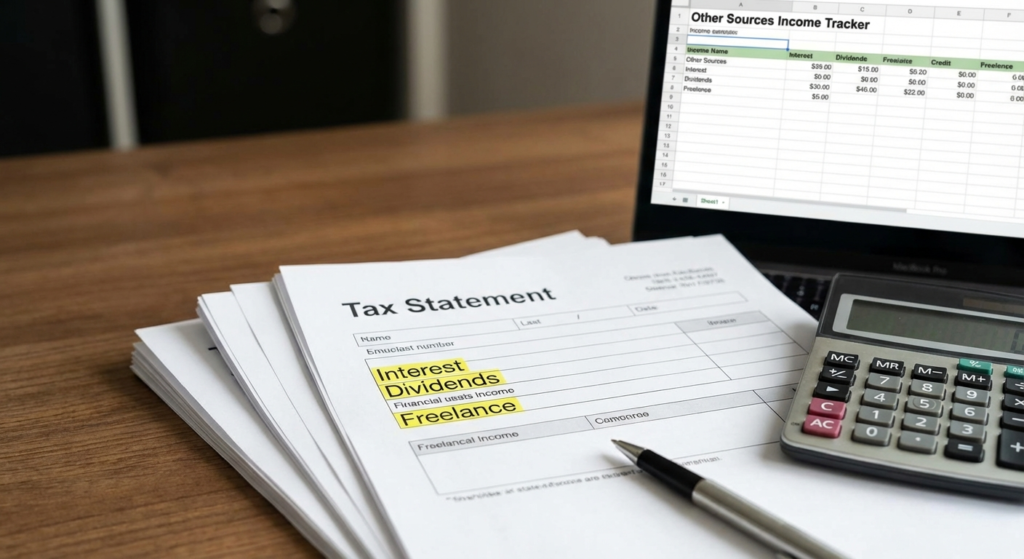

2. Ignoring Interest Income

Many believe savings bank interest is tax-free. While Section 80TTA offers a deduction, the income must still be reported under ‘Income from Other Sources’.

3. Mismatch with Form 26AS

If the TDS claimed in your ITR doesn’t match Form 26AS, you will get a notice. Always reconcile your data before hitting submit.

4. Failing to Verify ITR

Filing is only half the job. If you don’t e-verify within 30 days, your return is considered invalid, as if you never filed it at all.

Income Tax Filing Mistakes Related to Exempt Income

A prevalent misconception is that tax-free income doesn’t need to be reported. This is one of the subtle income tax filing mistakes. Income such as PPF interest, life insurance maturity proceeds (under Section 10(10D)), or agricultural income (up to a limit) is exempt from tax, but it must be disclosed in the ‘Exempt Income’ schedule of the ITR. Failing to report high-value transactions or exempt income can trigger inquiries regarding the source of funds.

The Cost of Income Tax Filing Mistakes: Penalties and Notices

The consequences of errors range from simple correction requests to heavy penalties. If you under-report income, the penalty can be anywhere from 50% to 200% of the tax payable. Furthermore, late filing fees under Section 234F can go up to ₹5,000.

It is also crucial to ensure your deductions are accurate. Many taxpayers claim deductions they don’t have proof for. To ensure you are claiming everything correctly, refer to a comprehensive list of Section 80C to 80U deductions. Misclaiming these is a red flag for the automated processing systems used by the tax department.

Common Income Tax Filing Mistakes in Personal Information

Believe it or not, simple clerical errors cause a massive number of rejections. These income tax filing mistakes include:

- Incorrect Bank Details: If your bank account number or IFSC code is wrong, your refund will fail. Ensure the bank account is pre-validated on the portal.

- Wrong Assessment Year (AY): Taxpayers often confuse the Financial Year (FY) with the Assessment Year (AY). For income earned in FY 2024-25, the correct AY is 2025-26.

- Personal Data Mismatch: Ensure your name, date of birth, and Aadhaar number match exactly with PAN database records.

How to Rectify Income Tax Filing Mistakes After Filing

Did you realize you made an error after hitting the submit button? Don’t panic. The Income Tax Act provides a provision to file a Revised Return under Section 139(5). You can file a revised return any number of times before the end of the assessment year or before the assessment is completed, whichever is earlier.

However, relying on a revised return is not ideal as it increases the likelihood of your file being picked for scrutiny. It is always better to avoid income tax filing mistakes in the original return. If your error involves TDS specifically for non-resident payments or complex scenarios, you might need to look into specific forms. For instance, understanding the guide on Form 27Q filing is essential if you are dealing with payments to non-residents, as errors here can lead to significant TDS defaults.

Strategies to Prevent Future Errors

To ensure you don’t fall victim to these pitfalls in the future, adopt a systematic approach:

- Download AIS/TIS: Before you start, download the Annual Information Statement from the tax portal. It contains details of your salary, interest, dividends, and high-value transactions.

- Link Aadhaar and PAN: Ensure they are linked; otherwise, your PAN may become inoperative, leading to higher TDS deductions and an inability to file ITR.

- Disclose All Bank Accounts: You are required to list all bank accounts held during the financial year, not just the one where you want the refund.

- Seek Professional Help: If you have multiple income sources (capital gains, F&O trading, foreign income), do not rely on DIY software alone.

For more detailed information on compliance and procedures, you can visit the official Income Tax e-Filing Portal. Additionally, for updates on financial regulations and market news that impact taxation, authoritative sites like Moneycontrol are excellent resources.

Conclusion

Filing your taxes is a civic duty that contributes to the nation’s growth, but it must be done with care. The landscape of taxation is shifting towards total transparency, and the tolerance for income tax filing mistakes is diminishing. By choosing the right form, reporting all income (including interest and dividends), and verifying your return on time, you can ensure a hassle-free experience.

Remember, the goal is not just to file, but to file correctly. Take the time to review your documents, reconcile your 26AS and AIS, and seek expert advice if needed. Avoiding these common pitfalls will ensure your refund lands in your account on time, and your financial history remains spotless.

FAQs

If you select the wrong ITR form, the Income Tax Department will treat your return as ‘Defective’ under Section 139(9). You will receive a notice giving you 15 days to rectify the error by filing a corrected return using the appropriate form. Failure to do so may result in the return being treated as invalid.

Yes, you can file a Revised Return under Section 139(5) to correct any errors or omissions. This must be done before December 31st of the Assessment Year or before the completion of the assessment, whichever is earlier.

Yes, interest from savings accounts is taxable under ‘Income from Other Sources’. However, you can claim a deduction of up to ₹10,000 under Section 80TTA (or ₹50,000 for senior citizens under Section 80TTB). Omitting this is one of the most common income tax filing mistakes.

If you do not e-verify your ITR within 30 days of filing, the return is considered invalid. You will have to file a fresh return. If this fresh filing is done after the due date, you may be liable for late filing fees under Section 234F and interest on tax payable.

Yes. Even though income like PPF interest or life insurance maturity proceeds is tax-free, it must be reported in the ‘Exempt Income’ schedule of your ITR for transparency and to explain the source of funds in your accounts.