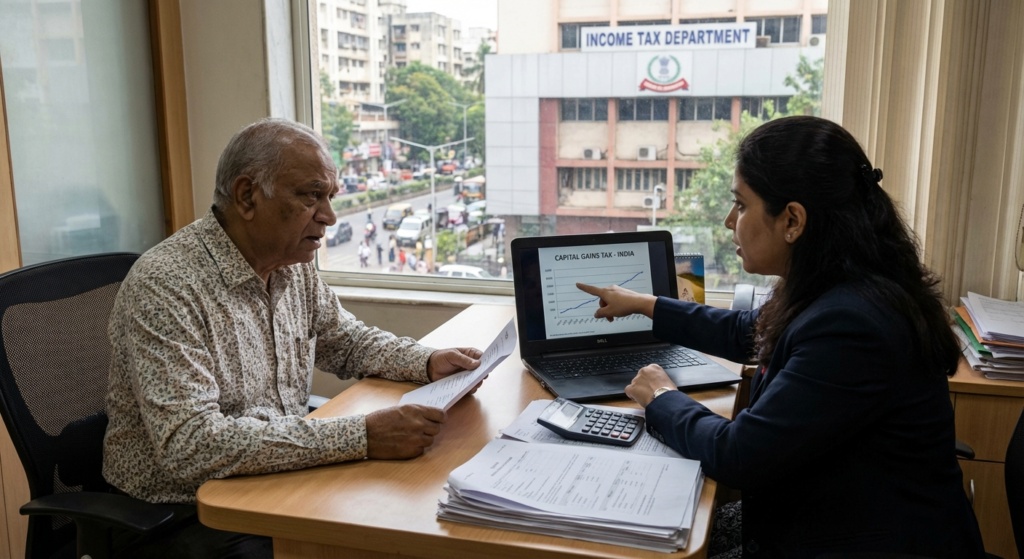

Investing in assets—whether it is real estate, gold, or the stock market—is one of the most effective ways to build wealth over time. However, simply watching your portfolio grow is only half the battle. The moment you decide to sell an asset for a profit, the Income Tax Department enters the picture. This is where navigating the complexities of capital gains tax India becomes essential for every prudent investor.

Many taxpayers are often caught off guard by the tax liability that arises from selling property or mutual funds. Understanding how these taxes work can make the difference between a lucrative exit and a surprisingly high tax bill. In this comprehensive guide, we will break down the mechanics of capital gains tax India, ensuring you stay compliant while maximizing your post-tax returns.

What Constitutes a Capital Asset?

Before diving into the tax rates, it is vital to understand what the government classifies as a “Capital Asset.” In the context of capital gains tax India, a capital asset is defined broadly but comes with specific exclusions. Generally, it includes property of any kind held by an assessee, whether connected with their business or not.

Common examples include:

- Land and Building: Residential houses, commercial spaces, and plots.

- Securities: Shares, debentures, and mutual funds.

- Jewelry: Gold, silver, and precious stones.

- Archaeological Collections: Drawings, paintings, and sculptures.

However, not everything you own is a capital asset. Stock-in-trade (goods held for business trading), personal effects (like furniture or clothes used for personal purposes), and agricultural land in rural India are typically excluded from this definition.

Classifying Capital Assets: Short-Term vs. Long-Term

The calculation of capital gains tax India hinges entirely on the “holding period” of the asset. The tax laws distinguish between Short-Term Capital Assets (STCA) and Long-Term Capital Assets (LTCA). This distinction dictates the tax rate you will pay.

Listed Equity & Equity Mutual Funds

Short-Term: Held for 12 months or less.

Long-Term: Held for more than 12 months.

Immovable Property (Land/Building)

Short-Term: Held for 24 months or less.

Long-Term: Held for more than 24 months.

Debt Mutual Funds & Unlisted Shares

Short-Term: Held for 24 months or less (Note: Recent amendments may treat some Debt funds as STCG regardless of tenure).

Long-Term: Held for more than 24 months.

Other Assets (Jewelry/Gold)

Short-Term: Held for 36 months or less.

Long-Term: Held for more than 36 months.

How to Calculate Capital Gains Tax India Correctly

Calculating your liability requires a systematic approach. The formula varies slightly depending on whether the gain is short-term or long-term. For Short-Term Capital Gains (STCG), the calculation is straightforward: strictly the Sale Price minus the Cost of Acquisition and Transfer Expenses.

However, when dealing with Long-Term Capital Gains (LTCG), the concept of “Indexation” often comes into play (though recent budget updates have modified this for certain asset classes). Indexation allows you to adjust the purchase price of the asset against inflation using the Cost Inflation Index (CII), thereby reducing your taxable profit.

Key Components of the Calculation

- Full Value of Consideration: The amount received from the sale.

- Cost of Acquisition: The original purchase price.

- Cost of Improvement: Expenses incurred to improve the asset (e.g., adding a floor to a house).

- Transfer Expenses: Brokerage fees, stamp duty, or legal fees directly related to the sale.

For those managing complex portfolios or handling sales involving non-residents, ensuring proper tax deduction at source is critical. You might find this guide on TDS for non-residents helpful if you are buying property from an NRI.

Current Rates for Capital Gains Tax India

The tax rates are subject to change with every Union Budget, making it imperative to stay updated. As of the latest fiscal landscape, here is how the rates generally apply to capital gains tax India.

Short-Term vs Long-Term Capital Gains Tax India Rates

Short-Term Capital Gains (STCG):

- Equity Shares/Equity Mutual Funds: Taxed at a flat rate of 20% (under Section 111A) if Securities Transaction Tax (STT) is paid.

- Other Assets: Added to your total income and taxed according to your applicable income tax slab rates. This applies to property, gold, and debt funds held for the short term.

Long-Term Capital Gains (LTCG):

- Equity Shares/Equity Mutual Funds: Taxed at 12.5% on gains exceeding ₹1.25 Lakh in a financial year (without indexation benefit).

- Property and Other Assets: Historically taxed at 20% with indexation. However, recent changes have introduced a 12.5% rate without indexation for certain asset classes, simplifying the structure but removing the inflation adjustment benefit for some.

Exemptions to Save on Capital Gains Tax India

The Income Tax Act provides several avenues to reduce your tax burden legally. If you have made a significant profit from selling a long-term asset, you don’t necessarily have to pay a huge chunk to the government if you reinvest wisely.

Section 54: Selling a House, Buying a House

If you sell a residential property and use the capital gains to purchase or construct another residential property, you can claim an exemption under Section 54. The new property must be purchased either one year before or two years after the sale, or constructed within three years.

Section 54EC: Capital Gains Bonds

Investors can save on capital gains tax India arising from the sale of land or building by investing the gains in specified bonds issued by NHAI or REC. The maximum investment limit is ₹50 Lakhs, and these bonds have a lock-in period of 5 years.

Section 54F: Selling Other Assets

If you sell a long-term asset other than a residential house (like gold or shares) and invest the net consideration (not just the gains) into a residential property, you can claim exemption under Section 54F.

For freelancers and professionals who often invest surplus income into assets, understanding these exemptions is as vital as filing returns correctly. You can learn more about general filing requirements in this ITR filing guide for freelancers.

Impact of Indexation on Capital Gains Tax India

One of the most debated topics recently regarding capital gains tax India is the removal or modification of indexation benefits. Indexation essentially inflates the purchase price of your asset to match current inflation levels, thereby reducing the “paper profit.”

For example, if you bought a house in 2005 for ₹20 Lakhs and sold it in 2024 for ₹80 Lakhs, your raw profit is ₹60 Lakhs. With indexation, your “adjusted” purchase price might be calculated as ₹55 Lakhs (hypothetically), making your taxable gain only ₹25 Lakhs. The shift towards lower tax rates (like 12.5%) without indexation aims to simplify the code but requires investors to calculate which regime benefits them where options exist.

Why Indexation Matters

It prevents you from paying tax on inflation. Without it, you are taxed on the nominal increase in value, not the real increase in purchasing power.

The New Regime Approach

Lower flat rates (e.g., 12.5%) are being introduced to offset the loss of indexation, aiming for a simpler, frictionless tax environment.

Filing Requirements and Compliance

Reporting your capital gains is mandatory when filing your Income Tax Return (ITR). Depending on your income sources, you may need to file ITR-2 or ITR-3. Failing to report these gains can lead to notices from the Income Tax Department.

It is also crucial to keep records of:

- Purchase Deeds and Sale Deeds.

- Brokerage notes and invoices.

- Proof of investments made for tax exemptions (like Capital Gains Bonds).

For authoritative details on tax slabs and filing forms, always refer to the Income Tax Department of India website. Additionally, for market-related regulations concerning securities, the Securities and Exchange Board of India (SEBI) provides essential guidelines.

Conclusion

Navigating capital gains tax India does not have to be a daunting task. By understanding the distinction between short-term and long-term assets, staying updated on the latest tax rates, and utilizing exemptions like Section 54 and 54EC, you can significantly reduce your tax liability. Remember, tax planning is an integral part of wealth creation. Always consult with a Chartered Accountant to tailor these general rules to your specific financial situation.

Frequently Asked Questions

For resident individuals, if your total income (including capital gains) is below the basic exemption limit (e.g., ₹2.5 Lakh or ₹3 Lakh depending on the tax regime and age), the remaining unutilized exemption can be adjusted against Long-Term Capital Gains. However, this adjustment is generally not available for Non-Residents.

No, there is no capital gains tax when you inherit a property. However, when you eventually decide to sell that inherited property, capital gains tax will apply. The cost of acquisition will be considered as the cost to the original owner.

Generally, no. Exemptions under Section 54 and 54F are available for reinvesting in residential property or specific government bonds (Section 54EC). There is no specific section that allows a blanket exemption for reinvesting capital gains from one stock directly into another stock to avoid tax.

Short-Term Capital Gains (STCG) on property (held for 24 months or less) are added to your total income and taxed according to your applicable income tax slab rate. There is no special flat rate for STCG on property.

The grandfathering clause applies to Long-Term Capital Gains on listed equity shares acquired before January 31, 2018. It ensures that gains made up to this date are tax-exempt, and only gains arising after this date are subject to tax.