April arrives, and for many, it brings the familiar anxiety of tax filings. However, smart financial planning isn’t just about scrambling to meet the March 31st deadline; it is about strategically placing your hard-earned money where it can grow while simultaneously reducing your tax liability. Finding the right tax saving investments India has to offer is crucial for every salaried employee and business owner aiming to maximize their take-home income.

In this comprehensive guide, we will navigate the complex landscape of the Indian tax system. We will explore high-growth options, safe government-backed schemes, and retirement-focused plans. Whether you are a conservative investor looking for safety or an aggressive investor seeking high returns, understanding the portfolio of tax saving investments India provides is the first step toward financial freedom.

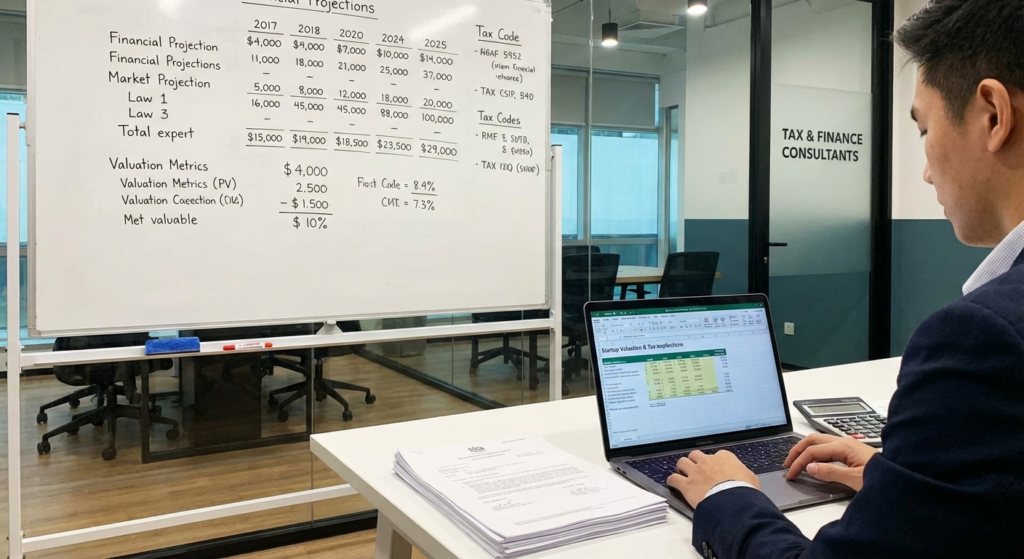

Understanding the Landscape of Tax Saving Investments India

The Indian Income Tax Act, 1961, provides several provisions that allow taxpayers to claim deductions on their total taxable income. The most popular among these is Section 80C, which allows for a deduction of up to ₹1.5 Lakh per financial year. However, the realm of tax saving investments India extends far beyond just this one section.

When selecting an investment avenue, you must consider three primary factors: Liquidity (lock-in period), Risk (safety of capital), and Return (ROI). A balanced portfolio often consists of a mix of equity-linked products for wealth generation and fixed-income products for stability.

For professionals managing their own filings, understanding these nuances is as critical as knowing the filing process itself. If you are a freelancer or consultant, you might also want to explore how these investments interact with other tax regimes, such as presumptive taxation filing guides to maximize your efficiency.

Top Equity-Linked Tax Saving Investments India (ELSS)

Equity Linked Savings Schemes (ELSS) have emerged as a favorite among millennials and aggressive investors. ELSS are mutual funds that invest primarily in the stock market but come with a specific tax benefit under Section 80C.

Why ELSS stands out among tax saving investments India

ELSS funds offer the shortest lock-in period among all Section 80C options—just three years. This makes them highly attractive compared to the 15-year lock-in of PPF or the 5-year lock-in of FDs. More importantly, because they are equity-linked, they have the potential to deliver inflation-beating returns over the long term, often ranging between 12% to 15% historically.

However, it is essential to remember that market risks apply. The returns are not guaranteed, and the principal amount fluctuates with market performance. For those willing to weather short-term volatility, ELSS remains one of the most potent tax saving investments India offers for wealth accumulation.

ELSS Funds

Lock-in: 3 Years

Returns: Market Linked (High)

Risk Profile: High

Tax Status: EEE (Up to limit)

Public Provident Fund

Lock-in: 15 Years

Returns: Fixed (Govt Decided)

Risk Profile: Zero (Sovereign)

Tax Status: EEE (Exempt-Exempt-Exempt)

Secure Government-Backed Tax Saving Investments India

Not everyone is comfortable with the volatility of the stock market. For conservative investors, the priority is capital protection. Fortunately, the government provides several sovereign-backed schemes that serve as excellent tax saving investments India.

Public Provident Fund (PPF)

The Public Provident Fund is arguably the most popular tax-saving instrument in India. It enjoys the ‘Exempt-Exempt-Exempt’ (EEE) status, meaning the investment amount, the interest earned, and the maturity amount are all tax-free. With a tenure of 15 years, it is a long-term commitment, but it acts as a brilliant debt component in your portfolio.

National Savings Certificate (NSC)

Available at post offices, the NSC is a fixed-income investment scheme with a tenure of 5 years. It is a safe option for those who want a shorter lock-in than PPF but the safety of a government bond. The interest rates are revised quarterly by the government.

Retirement-Focused Tax Saving Investments India: The NPS

The National Pension System (NPS) is a voluntary, long-term retirement savings scheme designed to enable systematic savings. It is regulated by the PFRDA and offers a unique advantage over other tax saving investments India provides.

Apart from the ₹1.5 Lakh limit under Section 80C, NPS subscribers can claim an additional deduction of up to ₹50,000 under Section 80CCD(1B). This brings the total potential tax deduction to ₹2 Lakhs. NPS allows you to choose your asset allocation between equity, corporate bonds, and government securities, giving you control over your risk exposure.

Insurance and Fixed Deposits as Tax Saving Investments India

While wealth creation is the goal, risk mitigation is the foundation. Life insurance premiums paid for yourself, your spouse, or your children are eligible for deduction under Section 80C.

Tax Saving Fixed Deposits

Banks offer specific 5-year Tax Saving Fixed Deposits. These are safer than equities but offer lower returns, generally barely beating inflation. The interest earned on these FDs is taxable, which often makes them less efficient for those in higher tax brackets compared to other tax saving investments India options like PPF or ELSS.

Beyond Section 80C: Health and Home

Smart tax planning looks beyond the crowded Section 80C.

- Health Insurance (Section 80D): You can claim a deduction of up to ₹25,000 for health insurance premiums for yourself and your family. If you pay for senior citizen parents, you can claim an additional ₹50,000.

- Home Loan Interest (Section 24b): If you have a home loan, the interest component allows for a massive deduction of up to ₹2 Lakhs per year for a self-occupied property.

For entrepreneurs looking to structure their assets, setting up the right business entity is vital. Sometimes, converting a partnership to a more formal structure can aid in financial planning. You might consider reading about the incorporation of LLP to understand how business structures influence tax liabilities.

Strategic Asset Allocation for Tax Saving

The key to utilizing tax saving investments India effectively is asset allocation. Do not put all your money into one basket. A 30-year-old might prefer a 70% allocation to ELSS and NPS for growth, whereas a 55-year-old might prefer 80% in PPF and Senior Citizen Savings Schemes (SCSS) for stability.

Quick Tip: The Power of Compounding

If you invest ₹1.5 Lakh in ELSS annually for 15 years at an assumed 12% return, you could amass approximately ₹63 Lakhs. In contrast, the same amount in a traditional 7% fixed instrument would yield only around ₹39 Lakhs. Choosing the right tax saving investments India can mean a difference of over ₹20 Lakhs in your corpus!

Conclusion

Navigating the world of taxes doesn’t have to be a burden. By proactively choosing the best tax saving investments India offers, you transform a statutory obligation into a wealth-building opportunity. From the high-growth potential of ELSS to the rock-solid security of PPF and the retirement benefits of NPS, there is an instrument for every financial goal and risk appetite.

Start your tax planning at the beginning of the financial year rather than the end. This allows your investments more time to grow and saves you from the last-minute stress of making poor financial decisions. Assess your financial goals, consult with a financial advisor if necessary, and start building your tax-efficient portfolio today.

For more detailed regulatory information, you can always refer to the official Income Tax Department of India website or check mutual fund data on the Association of Mutual Funds in India (AMFI).

FAQs

What is the maximum limit for tax saving investments in India under Section 80C?

The maximum deduction limit under Section 80C of the Income Tax Act is ₹1.5 Lakh per financial year. This includes investments in PPF, ELSS, EPF, LIC premiums, and principal repayment of home loans.

Can I save tax beyond the ₹1.5 Lakh limit of 80C?

Yes, you can save tax beyond the ₹1.5 Lakh limit. You can claim an additional ₹50,000 under Section 80CCD(1B) by investing in the National Pension System (NPS). Additionally, health insurance premiums under Section 80D and home loan interest under Section 24(b) offer separate deductions.

Which is better for tax saving: ELSS or PPF?

It depends on your goal. ELSS is better for wealth creation with a shorter lock-in period (3 years) and higher potential returns but comes with market risk. PPF is better for risk-averse investors seeking guaranteed tax-free returns with a longer lock-in period (15 years).

Are returns from tax saving investments taxable?

It varies by instrument. PPF returns are completely tax-free. ELSS capital gains exceeding ₹1 Lakh in a year are taxed at 10% (LTCG). Interest from Tax Saving Fixed Deposits and NSCs is fully taxable according to your income tax slab.

Is it mandatory to invest to save tax in the New Tax Regime?

No. The New Tax Regime generally does not allow for deductions under Section 80C, 80D, etc. (except for NPS contribution by employer). If you opt for the New Tax Regime, you benefit from lower tax rates but cannot claim these investment-based deductions.