Taxes are an inevitable part of financial life, but the burden of paying a lump sum at the end of the financial year can be overwhelming. This is where the concept of advance tax payment India comes into play. Often referred to as the “pay as you earn” scheme, advance tax allows taxpayers to pay their liabilities in installments throughout the year, rather than waiting until the final deadline. Whether you are a salaried individual with other income sources, a freelancer, or a business owner, understanding these rules is crucial for maintaining financial health and avoiding unnecessary penalties.

Navigating the complex corridors of the Income Tax Act can be daunting. However, mastering the nuances of advance tax payment India is not just about compliance; it is about smart financial planning. By adhering to the schedules set by the government, you ensure a smoother cash flow and avoid the sting of interest charges under sections 234B and 234C. In this comprehensive guide, we will break down everything you need to know, from eligibility and due dates to calculation methods and exemptions.

Understanding the Basics of Advance Tax Payment India

Advance tax is essentially the income tax that is paid in advance for the income earned in a particular financial year. Usually, tax is paid at the time of filing the Income Tax Return (ITR). However, under the advance tax laws, the payer has to estimate their income for the entire year and pay tax at specific intervals. This system helps the government maintain a steady flow of revenue throughout the year while reducing the year-end burden on the taxpayer.

The primary rule for advance tax payment India is simple: if your estimated tax liability for the year, after deducting TDS (Tax Deducted at Source), exceeds ₹10,000, you are liable to pay advance tax. This applies to all categories of taxpayers, including salaried employees, freelancers, professionals, and businesses.

While salaried individuals usually have their tax deducted by their employers via TDS, they may still fall under the ambit of advance tax payment India if they have significant earnings from other sources, such as capital gains, interest on fixed deposits, or rental income.

Who is Liable for Advance Tax Payment India?

Determining your eligibility is the first step in the compliance process. The Income Tax Department has laid down clear criteria regarding who must pay. Generally, the rule of thumb revolves around the ₹10,000 threshold mentioned earlier. However, let’s look at specific taxpayer personas to understand this better.

Salaried Individuals

Primarily, employers deduct TDS. However, if you earn income from dividends, rent, or capital gains, and your remaining tax liability exceeds ₹10,000, you must pay advance tax.

Freelancers & Professionals

Since professionals usually receive gross payments with only 10% TDS deducted (or none), the bulk of the tax liability falls on them. They are prime candidates for advance tax.

Businesses & Corporates

All companies, partnership firms, and LLPs are required to pay advance tax on their estimated current income, provided the tax liability crosses the threshold.

It is important to note that when calculating your liability, you can reduce the amount of TDS already deducted from your income. For a deeper understanding of how TDS credits work, you might want to read about mastering TDS return filing to ensure you aren’t overpaying.

Key Due Dates for Advance Tax Payment India

Missing a deadline is the most common reason taxpayers face penalties. The schedule for advance tax payment India is divided into four installments for most taxpayers. Adhering to these dates is non-negotiable for avoiding interest under Section 234C.

Here is the schedule you must follow for the Financial Year (FY):

- On or before 15th June: 15% of the estimated tax liability.

- On or before 15th September: 45% of the estimated tax liability (minus amount already paid).

- On or before 15th December: 75% of the estimated tax liability (minus amount already paid).

- On or before 15th March: 100% of the estimated tax liability (minus amount already paid).

Presumptive Taxation and Advance Tax Payment India

There is a slight variation for taxpayers who have opted for the Presumptive Taxation Scheme under Section 44AD or 44ADA. If you fall under this category (typically small businesses and professionals), you are not required to pay in four installments. Instead, the entire 100% of your advance tax payment India liability must be paid in a single installment on or before 15th March.

This relaxation significantly reduces the compliance burden for smaller entities, allowing them to focus on business operations throughout the year without the quarterly pressure of tax estimation.

How to Calculate Your Advance Tax Liability

The calculation process can seem tricky because it requires you to estimate your income before you have actually earned it. However, following a logical flow can simplify the process of advance tax payment India.

- Estimate Income: List all sources of income including salary, professional income, capital gains, interest, and rental income.

- Deduct Expenses: If you are a freelancer or business owner, deduct valid business expenses to arrive at the Net Taxable Income.

- Deduct Chapter VI-A Investments: Subtract investments eligible for deductions (like LIC, PPF, ELSS under Section 80C, Health Insurance under Section 80D, etc.).

- Calculate Tax: Apply the income tax slab rates applicable to you for the current financial year.

- Subtract TDS: Reduce the tax amount by the TDS that is likely to be deducted or has already been deducted.

- Result: If the remaining amount > ₹10,000, this is your advance tax liability.

Accuracy is key here. If your estimation is wildly off and you pay less than 90% of the assessed tax, you will be liable for interest penalties. It is often safer to slightly overestimate than to underestimate.

Exemptions: Senior Citizens and Advance Tax Payment India

The Income Tax Department provides relief to certain demographics. Specifically, resident senior citizens (individuals aged 60 years or above) are exempt from advance tax payment India under specific conditions.

To qualify for this exemption, the senior citizen must not have any income from business or profession. If a senior citizen only has income from pension, interest, or rent, they are not required to pay advance tax and can discharge their tax liability at the time of filing the ITR. This is a significant relief, simplifying financial management for the elderly. For those managing retirement funds, understanding the difference between Form 15G and Form 15H is also vital to prevent unnecessary TDS deductions on interest income.

Consequences of Missing Advance Tax Payment India

Failing to comply with the rules of advance tax payment India attracts interest under Sections 234B and 234C of the Income Tax Act. These are not penalties in the traditional sense but strictly enforced interest charges.

Section 234B

Applicable if you fail to pay advance tax entirely, or if the tax paid is less than 90% of the assessed tax. The interest charged is 1% per month or part of a month from 1st April of the assessment year.

Section 234C

Applicable if you fail to pay the tax installments on time (15th June, Sept, Dec, March). The interest is levied at 1% per month for the period of deferment on the shortfall amount.

It is worth noting that if you miss the March 15th deadline, any tax paid on or before March 31st is still treated as advance tax. This can help you minimize the interest burden under Section 234B, although Section 234C interest for the last installment may still apply.

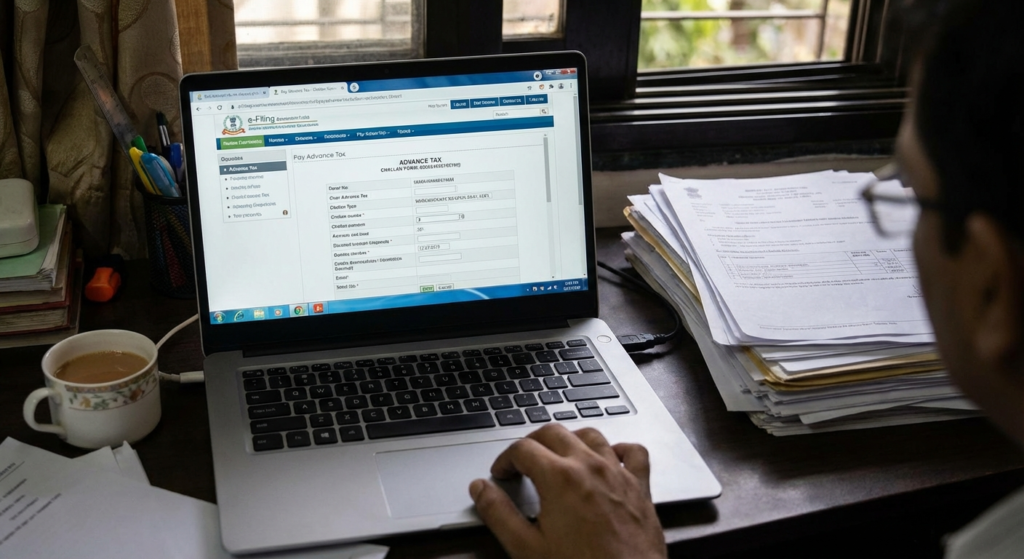

Step-by-Step Guide to Paying Online

The government has made the process of advance tax payment India seamless through the e-filing portal. Gone are the days of standing in queues at banks with physical challans. Here is how you can do it:

- Visit the official Income Tax e-Filing portal.

- Navigate to the ‘e-Pay Tax’ section.

- Enter your PAN and confirm it. Enter your mobile number to receive an OTP.

- Once verified, select the box that says ‘Income Tax’.

- Select the Assessment Year correctly. (For FY 2023-24, the AY is 2024-25).

- Select ‘Type of Payment’ as ‘Advance Tax (100)’.

- Enter the tax details and choose your payment method (Net Banking, Debit Card, UPI, or Payment Gateway).

- Upon successful payment, a Challan Receipt (CRN) will be generated. Download and save this receipt immediately, as you will need the BSR code and Challan serial number while filing your ITR.

Conclusion

Paying your taxes on time is a hallmark of a responsible citizen and a prudent business owner. The mechanism of advance tax payment India is designed to ease the financial load by spreading it across the year. By understanding the due dates, calculating your liability accurately, and utilizing the online payment facilities, you can ensure full compliance with the Income Tax Act.

Remember, while the immediate cash outflow might seem pinching, avoiding the cumulative interest of 1% per month is a significant saving in the long run. Stay organized, estimate your income wisely, and make your payments before the deadlines strike. For more insights on keeping your business compliant, explore our resources on business compliance strategies.

For official updates and detailed circulars, always refer to the Income Tax India Official Website.

FAQs

If you have paid more advance tax than your actual tax liability calculated at the end of the year, the Income Tax Department will refund the excess amount. You can claim this refund when you file your Income Tax Return (ITR). Furthermore, you may be eligible for interest on the refund amount under Section 244A.

Yes, any tax paid on or before 31st March is treated as advance tax. However, since the deadline for the final installment is 15th March, paying after this date may attract interest under Section 234C for the deferment of the last installment.

Yes, advance tax is applicable on capital gains. However, since capital gains cannot be predicted, the law allows you to pay the tax on capital gains in the remaining installments due after the gain has arisen. If the gain occurs after March 15th, you must pay the tax by March 31st.

Yes, Non-Resident Indians (NRIs) are liable to pay advance tax if they have any income accruing or arising in India (taxable in India) and their tax liability on such income exceeds ₹10,000.

If you made a mistake in the assessment year or minor head while paying, you might need to approach your assessing officer with an application for correction. Some banks also allow correction of challan details within a specific window (usually 7 days) after payment.