Introduction to Corporate Dissolution

Starting a business venture in India is often celebrated as a milestone of entrepreneurship. However, the lifecycle of a business may lead to a point where closure becomes the most strategic and responsible decision. Whether due to market shifts, lack of operational activity, or a shift in focus, knowing how to close private limited company India is as important as knowing how to start one. Leaving a company dormant without formal closure is not just a missed administrative step; it is a significant legal liability that can lead to heavy penalties and the disqualification of directors.

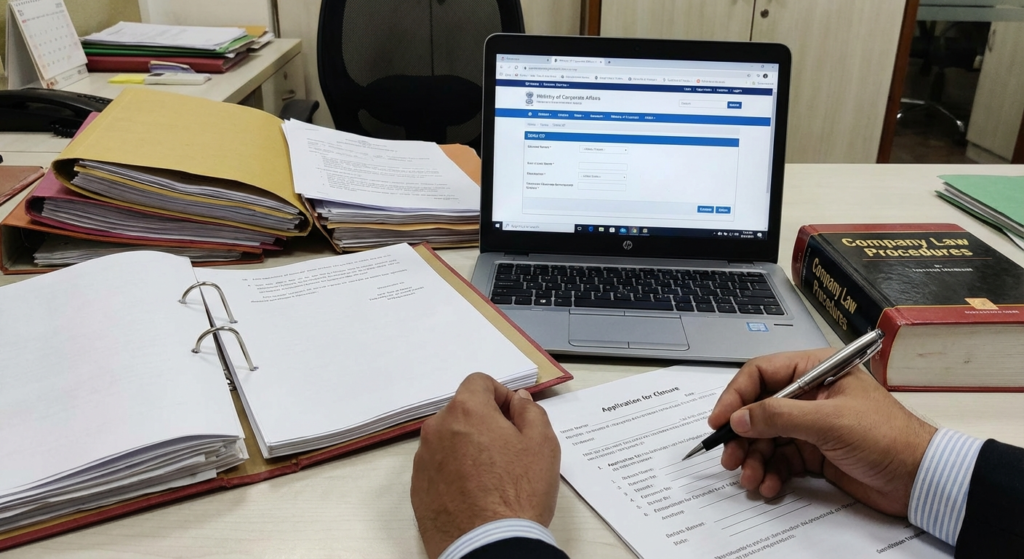

In the Indian legal landscape, governed by the Companies Act, 2013, a company is a separate legal entity. This means it does not simply ‘die’ when operations stop. It must be formally ‘struck off’ from the Register of Companies (ROC) maintained by the Ministry of Corporate Affairs (MCA). This guide provides a comprehensive roadmap for directors and shareholders who need to navigate the complexities of corporate dissolution with precision and legal compliance.

Reasons to Choose the Fast-Track Exit: How to Close Private Limited Company India

The most common and efficient way to shut down a non-operational business is through the Fast-Track Exit (FTE) scheme, primarily involving Form STK-2. This method is designed for companies that have no assets and no liabilities and have not commenced business for a specific period. Understanding how to close private limited company India through this route saves time, energy, and significant legal costs compared to a full-blown liquidation.

Before proceeding with closure, many entrepreneurs evaluate their business structure. If you are considering a different path for your next venture, you might find our LLP vs Private Limited Company India comparison useful for future planning. For those ready to exit, the STK-2 route is the gold standard for ‘clean’ closures where the company has remained inactive for at least two consecutive financial years.

Strike Off (STK-2)

Ideal for dormant companies with no assets or liabilities. It is the fastest and least expensive method to remove a company name from the ROC records.

Voluntary Winding Up

Required for solvent companies with assets that need to be liquidated and distributed to shareholders under the Insolvency and Bankruptcy Code (IBC).

Compulsory Winding Up

Initiated by the Tribunal (NCLT) due to non-payment of debts, unlawful activities, or failure to file financial statements for five consecutive years.

The Legal Framework for How to Close Private Limited Company India Under the Companies Act

The legal backbone of company closure in India resides in Sections 248 to 252 of the Companies Act, 2013. These sections empower the Registrar of Companies to strike off the name of a company from the register if it has failed to commence business within one year of incorporation or has not carried on any business for two years without applying for ‘Dormant’ status. When learning how to close private limited company India, it is vital to distinguish between a ‘Strike Off’ initiated by the ROC and a ‘Voluntary Strike Off’ initiated by the company itself.

A voluntary strike-off is proactive. It signals to the government and the public that the directors have acted in good faith, cleared all dues, and are closing the entity legally. This is essential for maintaining a clean record for directors, who might otherwise face disqualification from heading other companies for up to five years. For those looking to start fresh after a closure, professional Company Services can help you set up a new entity with the right compliance framework from day one.

Eligibility Requirements for How to Close Private Limited Company India

Not every company is eligible for the fast-track closure. To qualify for the STK-2 filing, the company must meet specific criteria defined by the MCA. Firstly, the company must have nil liabilities. This means all creditors, employees, and statutory dues must be paid in full. Secondly, the company must have been inactive for at least two years or must not have commenced business since incorporation.

Additionally, the company must have filed its latest financial statements and annual returns up to the date it ceased operations. If there are pending litigations or ongoing investigations by regulatory bodies like SEBI or the RBI, the company cannot opt for the strike-off route until those matters are resolved. Ensuring these criteria are met is the first major milestone in the journey of how to close private limited company India.

Step-by-Step Filing for How to Close Private Limited Company India

The process of closing a company is procedural and requires meticulous documentation. Following these steps ensures that the ROC does not reject your application, which could lead to further delays and costs.

- Board Meeting: The directors must convene a board meeting to pass a resolution for the closure and authorize a director to file the application.

- Extinguishing Liabilities: Before moving forward, the company must pay off all its debts. Proof of this will be required in the form of a ‘Statement of Accounts’.

- Shareholders’ Approval: A Special Resolution must be passed by the shareholders (75% majority) or consent obtained from 75% of members in terms of paid-up share capital.

- Closing Bank Accounts: The company’s bank accounts must be closed, and a certificate from the bank confirming the closure must be obtained.

- Preparation of Documents: This includes the Indemnity Bond (STK-3) and Affidavits (STK-4) signed by all directors.

- Filing Form STK-2: The application is filed electronically on the MCA portal with the prescribed fee.

Once the application is filed, the ROC will verify the documents and publish a public notice. This notice gives the public and authorities (like the Income Tax Department) 30 days to raise any objections. If no objections are received, the ROC will strike off the name and publish a notification in the Official Gazette.

Timeline Expectation

The preparation phase usually takes 15-30 days. Once filed, the ROC processing and public notice period typically take 3 to 6 months to finalize the strike-off.

Cost Considerations

Government fees for STK-2 are currently around ₹10,000. Professional fees for CA/CS services for document certification are additional but necessary.

Essential Documentation for How to Close Private Limited Company India

Documentation is the heart of the closure process. The ROC requires specific attachments to Form STK-2 to ensure that the closure is not being used to evade taxes or defraud creditors. The most critical document is the Statement of Accounts, which must be certified by a Chartered Accountant. This statement must be no older than 30 days from the date of the application and must show zero assets and zero liabilities.

Furthermore, an Indemnity Bond (Form STK-3) must be executed by every director. This bond essentially says that if any future liabilities arise after the company is closed, the directors will be personally responsible for them. This protects the interests of unknown creditors. An Affidavit (Form STK-4) is also required from each director, swearing that the company has no pending litigation and has been inactive for the required period. Without these, the procedure for how to close private limited company India cannot be completed.

Avoiding Penalties and Compliance Issues: How to Close Private Limited Company India

One of the biggest mistakes business owners make is simply walking away from a company. If a company is not formally closed, it is legally required to file annual returns (MGT-7) and financial statements (AOC-4) every year. Failure to do so results in a penalty of ₹100 per day per form. Over a few years, these penalties can accumulate to lakhs of rupees.

Moreover, the ROC has the power to strike off companies forcefully if they fail to file returns for two years. While this might sound like a ‘free’ closure, it comes with a heavy price. The directors of such companies are often ‘Blacklisted’ and disqualified. Their DIN (Director Identification Number) is deactivated, and they are barred from being appointed as directors in any other company for five years. Therefore, taking the proactive route and learning how to close private limited company India legally is the only way to safeguard your professional future.

Understanding the Timeline: How to Close Private Limited Company India Efficiently

While the goal is a fast exit, the timeline is dictated by statutory requirements. After filing Form STK-2, the ROC sends the information to the Income Tax Department to ensure there are no outstanding tax demands. This inter-departmental verification is why the process takes several months. If you are wondering how to close private limited company India quickly, the answer lies in having your paperwork perfectly in order before you hit the ‘submit’ button.

Typically, the ROC issues a notice (STK-5) which is posted on the MCA website and published in the newspapers. This is a transparency measure. If the company has any hidden debts or legal disputes, this is the time they will surface. If the 30-day window passes without incident, the ROC proceeds to the final strike-off (STK-7). Being patient and responsive to any ROC queries during this period is essential for a smooth transition.

Post-Closure Records

Even after the company is struck off, directors must preserve all company records for at least 8 years as per the Companies Act requirements.

Tax Clearances

Ensure that the final Income Tax Return (ITR) is filed for the period up to the date of closure to avoid future scrutiny from tax authorities.

Conclusion: A Clean Exit for a New Beginning

Closing a company is a significant legal undertaking that requires a clear understanding of the regulatory framework. By following the STK-2 fast-track route, directors can ensure a dignified and legally sound exit from their business venture. It protects the directors’ reputations, avoids compounding penalties, and ensures that all stakeholders are treated fairly. Whether you are moving on to a new startup or taking a break from the corporate world, following the correct procedure for how to close private limited company India provides the peace of mind needed for your next chapter. Always consult with a qualified professional to ensure that your specific case meets all the nuances of the law.

FAQs

No. A company can only be closed via the STK-2 route if it has nil liabilities. All bank loans, creditors, and statutory dues must be settled and closed before filing the application for strike-off.

The closure process generally requires the consent of the majority of shareholders and the participation of directors. If a director is uncooperative, the company may need to remove the director following the due process of the law before proceeding with the closure.

Yes, the company must be up-to-date with its filings until the date it ceased operations. However, the MCA sometimes provides relaxation for dormant companies, but generally, the last two years’ filings are scrutinized.

While the filing takes only a few days, the entire process—including the public notice period and ROC verification—usually takes between 4 to 7 months to receive the final strike-off notification.

Yes, an application can be made to the National Company Law Tribunal (NCLT) for the restoration of the company’s name within 20 years of the strike-off, provided there are valid grounds for revival.