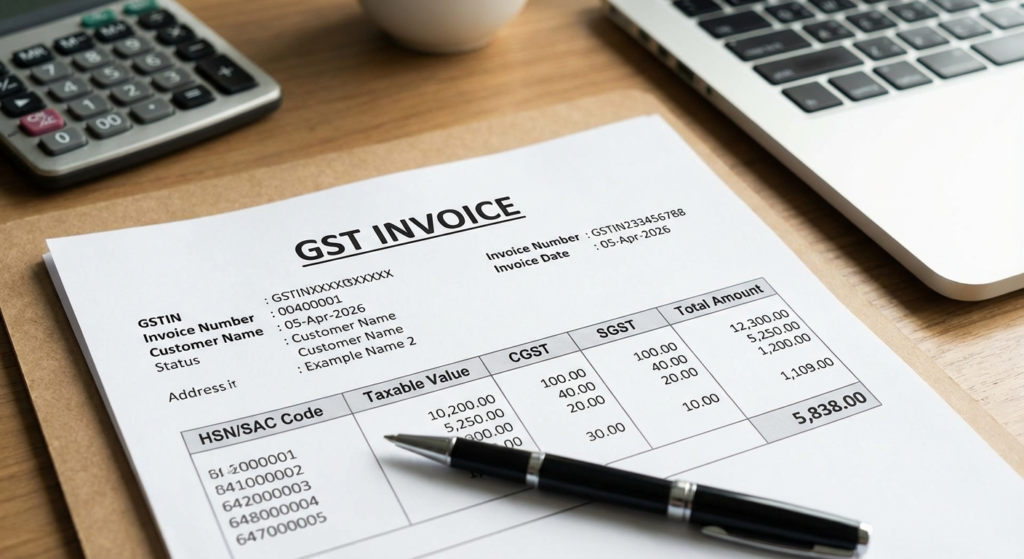

Imagine this: You just closed a massive deal with your dream client. The work is done, the client is thrilled, and you send over the invoice. A week later, you get a frantic call. Their accounts department rejected your invoice. Why? A single missing detail—an incorrect HSN code—made it invalid for them to claim their Input Tax Credit (ITC). The relationship sours, payment is delayed, and your reputation takes a hit.

This isn’t just a hypothetical scenario. In our experience, it’s a costly reality for countless Indian businesses. In 2026, a GST invoice isn’t just a request for payment; it’s a critical legal document that underpins the entire tax system. Getting it wrong is no longer an option.

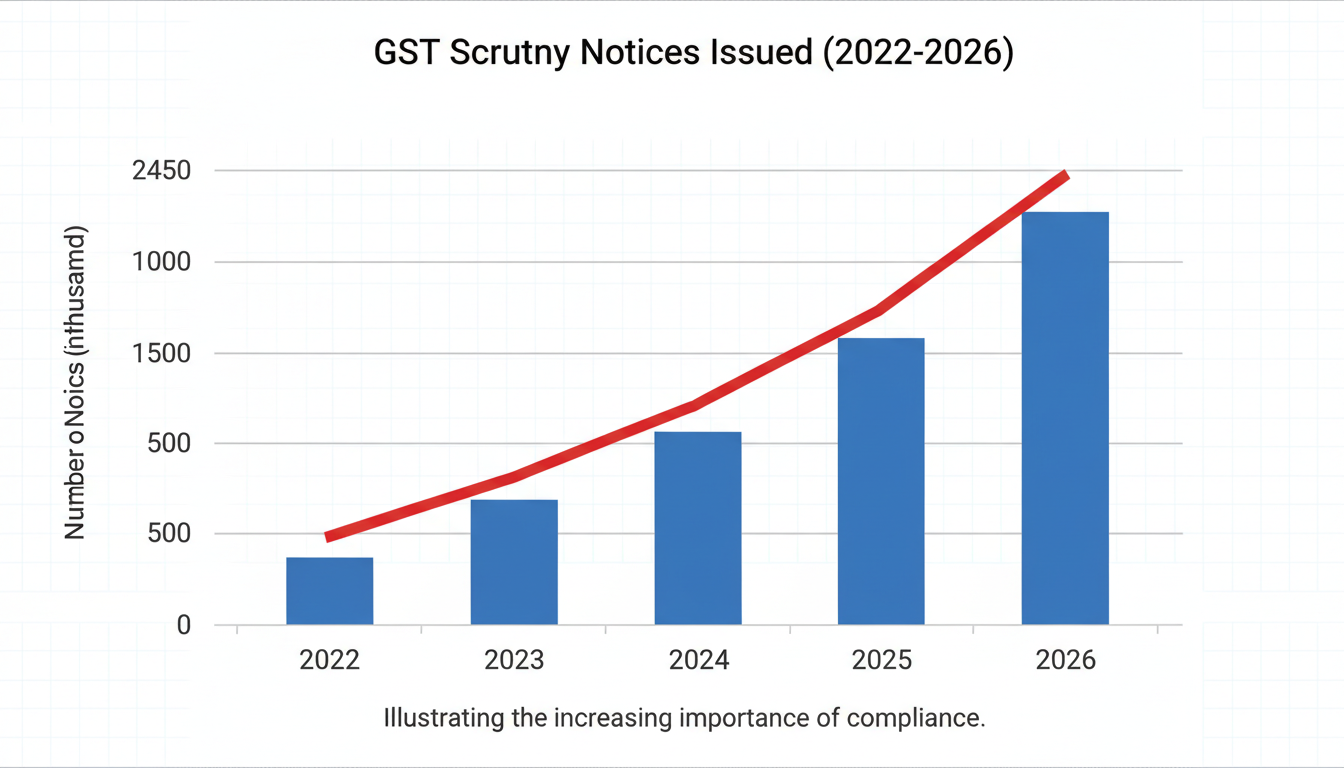

The tax authorities are smarter, their audits are automated, and the penalties for non-compliance are unforgiving. But here’s the good news: mastering the GST invoice format mandatory fields is entirely achievable. This article isn’t just another dry list of rules. It’s your battle-tested playbook for creating flawless, compliant invoices that build trust, ensure prompt payments, and keep you audit-ready. Always.

Why Your Invoice Is the Most Important Document in Your Business

Let’s get one thing straight. A GST invoice is the single most crucial piece of paper (or data) in your entire sales cycle. It’s the primary evidence of a transaction. For your customer, it’s the golden ticket to claiming Input Tax Credit (ITC), which directly reduces their tax liability. If your invoice is faulty, you’re not just causing a headache for your accounts team; you’re actively costing your client money.

Think about it. A non-compliant invoice can trigger a chain reaction:

- ITC Rejection: Your client can’t claim their ITC, making your product or service more expensive for them.

- Payment Delays: Their finance team will hold your payment until you issue a corrected, compliant invoice.

- Legal Penalties: According to India’s CGST Act, incorrect invoicing can attract a penalty of Rs. 10,000 or the amount of tax evaded, whichever is higher.

- Damaged Reputation: Consistently issuing faulty invoices signals unprofessionalism and can destroy business relationships.

In 2026, with the GST Network (GSTN) using AI to flag discrepancies, your margin for error is zero. It’s time to treat every invoice with the precision it deserves.

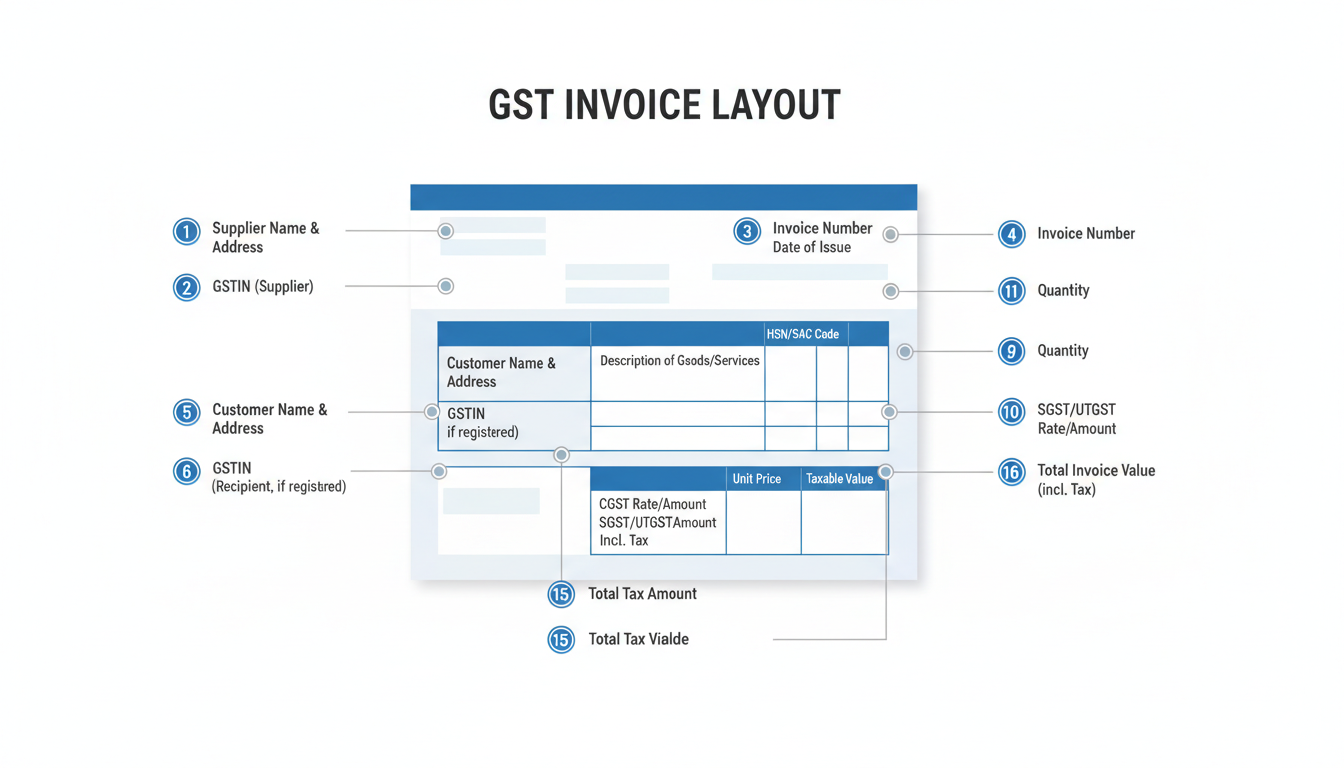

The Non-Negotiable Checklist: 16 Mandatory Fields for a Perfect GST Invoice

The law is crystal clear about what a tax invoice must contain. Missing even one of these fields can render it invalid. We’ve broken down the 16 essential components into logical groups to make them easier to digest and implement.

Part A: The Parties Involved

- Supplier’s Details: Your legal business name, full address, and your Goods and Services Tax Identification Number (GSTIN). This is non-negotiable.

- Recipient’s Details: Their legal name, address, and GSTIN (if they are registered).

- Delivery Address: If the goods are being delivered to a different location than the billing address, this must be stated clearly, along with the State and its code.

Part B: The Invoice Identity

- Invoice Number: A unique serial number for the financial year. It must be consecutive and can be up to 16 characters, including letters, numbers, hyphens, and slashes.

- Date of Issue: The date the invoice is created. Not the date of payment, not the date of delivery. The issue date.

Part C: The Transaction Details

- HSN/SAC Code: The Harmonized System of Nomenclature code for goods or the Services Accounting Code for services. We’ll dive deeper into this below.

- Description of Goods/Services: A clear description of what you’ve sold. Avoid vague terms.

- Quantity & Unit: The exact quantity of goods (e.g., 10 units, 50 kgs) and the unit of measurement (e.g., pcs, kg, ltr).

- Total Value: The total value of the goods or services supplied.

- Taxable Value: The value after deducting any discounts. This is the amount on which tax is calculated.

Part D: The Tax Breakdown

- Tax Rate: The applicable rate of CGST, SGST, IGST, UTGST, and/or Cess.

- Tax Amount: The amount of tax charged, broken down into each component (CGST, SGST, etc.).

- Place of Supply: The state where the supply is considered to have taken place. This determines whether you charge CGST/SGST (for intra-state) or IGST (for inter-state).

Part E: The Legal Formalities

- Reverse Charge Declaration: A clear “Yes” or “No” indicating if the tax is payable on a reverse charge basis.

- Signature: A physical or digital signature of the supplier or their authorized representative.

- QR Code (for E-invoices): If your business falls under the e-invoicing mandate, a digitally signed QR code from the Invoice Registration Portal (IRP) is mandatory.

⚠️ Watch Out

A common and costly mistake is mismatching the ‘Place of Supply’ with the tax type. If your business is in Maharashtra and you supply to a client in Karnataka (inter-state), you must charge IGST. Charging CGST + SGST by mistake will lead to ITC denial for your client and a compliance nightmare for you.

Decoding HSN and SAC Codes: The Compliance Deal-Breaker

Of all the fields, the HSN/SAC code causes the most confusion. Think of these codes as a universal language for classifying goods and services. The Harmonized System is an international standard, and getting it right is critical for tax calculation.

Here are the rules for 2026:

| Annual Aggregate Turnover (Previous FY) | HSN/SAC Code Requirement | Applies To |

|---|---|---|

| Up to ₹5 Crores | 4 digits (mandatory for B2B supplies) | Small & Medium Businesses |

| Above ₹5 Crores | 6 digits (mandatory for all supplies) | Larger Businesses |

| Exports & Imports | 8 digits (generally required) | International Trade |

Using the wrong HSN code can mean applying the wrong tax rate. From real-world campaigns, we’ve seen businesses undercharge GST due to a wrong code, only to be hit with a demand notice for the differential tax plus interest and penalties months later. It’s a silent killer of cash flow.

💡 Pro Tip

Don’t guess your HSN/SAC codes. Use the official GST portal’s search tool or a reliable third-party HSN lookup service. Maintain a master list of HSN codes for all your products/services and integrate it directly into your invoicing software to eliminate manual entry errors.

Tax Invoice vs. Bill of Supply: Know Your Document

Not every document you issue is a “Tax Invoice.” The type of document depends on what you’re selling and your GST registration status. Issuing the wrong type is a major compliance failure.

| Feature | Tax Invoice | Bill of Supply |

|---|---|---|

| Who Issues It? | Regular registered taxpayers. | Composition scheme dealers OR suppliers of exempted goods/services. |

| Can GST be Charged? | Yes. CGST/SGST/IGST is shown separately. | No. You cannot charge tax on this document. |

| Can Recipient Claim ITC? | Yes. This is its primary purpose for the buyer. | No. Since no tax is charged, no ITC can be claimed. |

| Key Phrase on Document | “Tax Invoice” | “Bill of Supply” and “Composition taxable person, not eligible to collect tax on supplies” (if applicable). |

Trust me on this one, sending a “Tax Invoice” when you’re a composition dealer is a red flag for tax auditors. It shows a fundamental misunderstanding of the law.

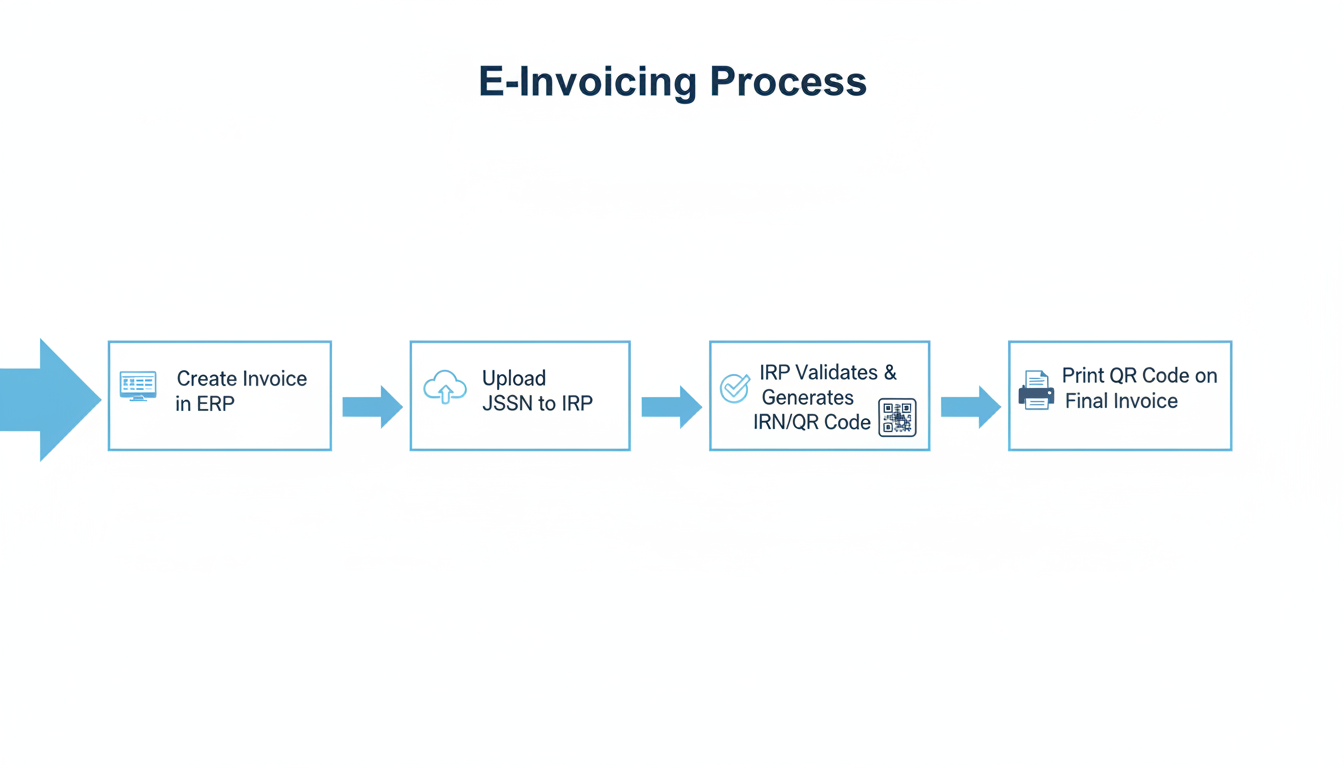

The E-Invoicing Revolution: Are You Compliant?

For many businesses, the era of manual invoicing is over. As of 2026, e-invoicing is mandatory for all businesses with an aggregate annual turnover exceeding ₹5 crores. This isn’t just about sending a PDF; it’s a complete digital transformation. 10 Crucial Facts About NRI Taxation in India: The 2025 Comprehensive Guide

Here’s how it works in a nutshell: How to File ITR-1 Online India: A Complete Step-by-Step Guide for Salaried Employees

- Generate a Standard Invoice: You create an invoice in your own accounting/ERP software using the standard schema.

- Upload to IRP: The invoice data (in JSON format) is uploaded to the government’s Invoice Registration Portal (IRP).

- Validation & Digital Signature: The IRP validates the data and, if correct, generates a unique Invoice Reference Number (IRN) and digitally signs the invoice with a QR code.

- Receive & Print: The digitally signed JSON with the IRN and QR code is sent back to you. You MUST print the QR code on your final invoice.

⚠️ Watch Out

If e-invoicing applies to you, any invoice issued without a valid IRN is legally considered not an invoice at all. It’s just a piece of paper. Your client cannot claim ITC on it, and you could face severe penalties for non-compliance. There are no excuses.

🎯 Key Takeaway

A compliant GST invoice is not an administrative burden; it’s a strategic asset. It accelerates your cash flow by ensuring faster payments, protects you from crippling penalties, and strengthens your relationships with clients by making their tax compliance seamless.

A 5-Step Guide to Auditing Your Invoices Today

Don’t wait for a notice from the department. Be proactive. Here’s a simple, step-by-step guide to audit your current invoicing process.

- Gather Your Data: Pull a random sample of 10-15 invoices you’ve issued in the last quarter. Include different types of clients (B2B, B2C, inter-state, intra-state).

- The 16-Point Check: Create a checklist of the 16 mandatory fields discussed above. Go through each sample invoice and tick off every field. Is anything missing or incorrect?

- Verify GSTINs: Use the official GST Portal’s “Search Taxpayer” feature to verify that the recipient GSTINs on your invoices are active and correct. A single wrong digit can invalidate the invoice.

- Cross-Check HSN & Tax Rates: Double-check the HSN/SAC codes for your top-selling products/services. Are you applying the correct tax rates? A 12% item billed at 18% is a common error.

- Automate or Standardize: Based on your findings, take action. If you’re finding frequent manual errors, it’s time to invest in good accounting software. If you use templates, ensure your master template is 100% compliant and lock it down to prevent unauthorized changes.

💡 Pro Tip

Implement a “maker-checker” process for high-value invoices. One person creates the invoice, and a second person reviews it against the compliance checklist before it’s sent to the client. This simple step can save you from costly mistakes.

Conclusion: From Compliance Burden to Business Advantage

Look, navigating GST compliance can feel overwhelming. But mastering your invoice format is one of the highest-leverage activities you can undertake. It’s the foundation of your financial integrity.

By implementing the checklists, understanding the nuances of HSN codes, and embracing digital tools like e-invoicing, you transform compliance from a reactive chore into a proactive strategy. You’re not just avoiding penalties; you’re building a reputation for reliability and professionalism. You’re making it easy for people to do business with you.

Your next step is simple. Take the 5-step audit guide from this article and apply it to your business this week. Don’t put it off. The peace of mind that comes from knowing every invoice you send is perfect is invaluable. It’s time to stop just sending bills and start issuing documents that build your business.

❓ Frequently Asked Questions

What’s the penalty for not following the GST invoice format in 2026?

The penalty for issuing an incorrect invoice is steep: ₹10,000 or 100% of the tax due, whichever is higher. More importantly, your client will be denied their Input Tax Credit (ITC), which could damage your business relationship.

Is a physical signature mandatory on a GST e-invoice?

While a signature is a mandatory field, for e-invoices, the IRN and the digitally signed QR code serve as the primary methods of authentication. A physical signature is not required on a digital copy, but it’s still best practice to include a digital signature or a printed signature on physical copies.

Can I issue one invoice for both taxable and exempt items?

Yes, you can. In such cases, you should issue an “Invoice-cum-Bill of Supply.” This single document must clearly list the taxable items with their respective GST details and the exempted items separately, ensuring all mandatory fields for both are present.

How do I correct a mistake on a GST invoice that’s already been issued?

You can’t edit or delete an issued invoice. The correct procedure is to issue a supplementary document. Issue a Debit Note to increase the taxable value or tax amount, or a Credit Note to decrease it or cancel the original invoice entirely. This maintains a clear audit trail.

My turnover is below ₹5 crores. Do I still need to worry about HSN codes?

Absolutely. If your turnover is below ₹5 crores, you are still required to use a 4-digit HSN code for all your B2B (business-to-business) transactions. It’s optional for B2C (business-to-consumer) invoices, but it’s a good practice to include it anyway for consistency.