Imagine this: you’ve spent two years building your brand. Your logo is everywhere, customers love your name, and sales are finally taking off. Then, one morning, you get a cease-and-desist letter. A competitor, who registered a similar name six months ago, now legally owns the identity you built. Everything grinds to a halt.

Sounds like a nightmare, right? I’ve seen this exact scenario play out more times than I can count. It’s a costly, soul-crushing mistake that stems from one simple question entrepreneurs often ask too late: “What’s the real trademark registration cost in India?“

Here’s the thing. The government fee is just the starting line. The real cost is a mix of official fees, strategic choices, and avoiding costly blunders. This guide isn’t just a price list; it’s your strategic roadmap to securing your brand’s future in 2026 without breaking the bank. We’ll break down every single expense, from the application form to long-term protection.

The Official Government Fees: A 2026 Breakdown

Let’s get the basics out of the way first. The Government of India, through the Controller General of Patents, Designs and Trade Marks, has a tiered fee structure. The goal is to make brand protection accessible, especially for new and small businesses. Your cost depends entirely on who is applying.

The biggest factor? Whether you’re filing online (e-filing) or physically. E-filing is faster, more efficient, and cheaper. Honestly, in 2026, there’s almost no reason to file physically.

Here’s a clear breakdown of the baseline trademark registration cost in India per class of goods or services.

| Applicant Type | E-Filing Fee (Per Class) | Physical Filing Fee (Per Class) |

|---|---|---|

| Individual / Sole Proprietor | ₹4,500 | ₹5,000 |

| Startup (DPIIT Recognized) | ₹4,500 | ₹5,000 |

| Small Enterprise (MSME with Udyam Certificate) | ₹4,500 | ₹5,000 |

| All Others (Companies, LLPs, Partnerships, etc.) | ₹9,000 | ₹10,000 |

As you can see, the government offers a massive 50% concession to individuals and small businesses. This is a deliberate move to encourage entrepreneurship. If you’re a larger entity, the cost doubles. It’s that simple.

💡 Pro Tip

If you run a small business but haven’t registered it as an MSME yet, do it now! Getting an Udyam Registration certificate is free on the official government portal and instantly makes you eligible for the ₹4,500 fee, potentially saving you thousands. It’s the easiest money you’ll ever save in this process.

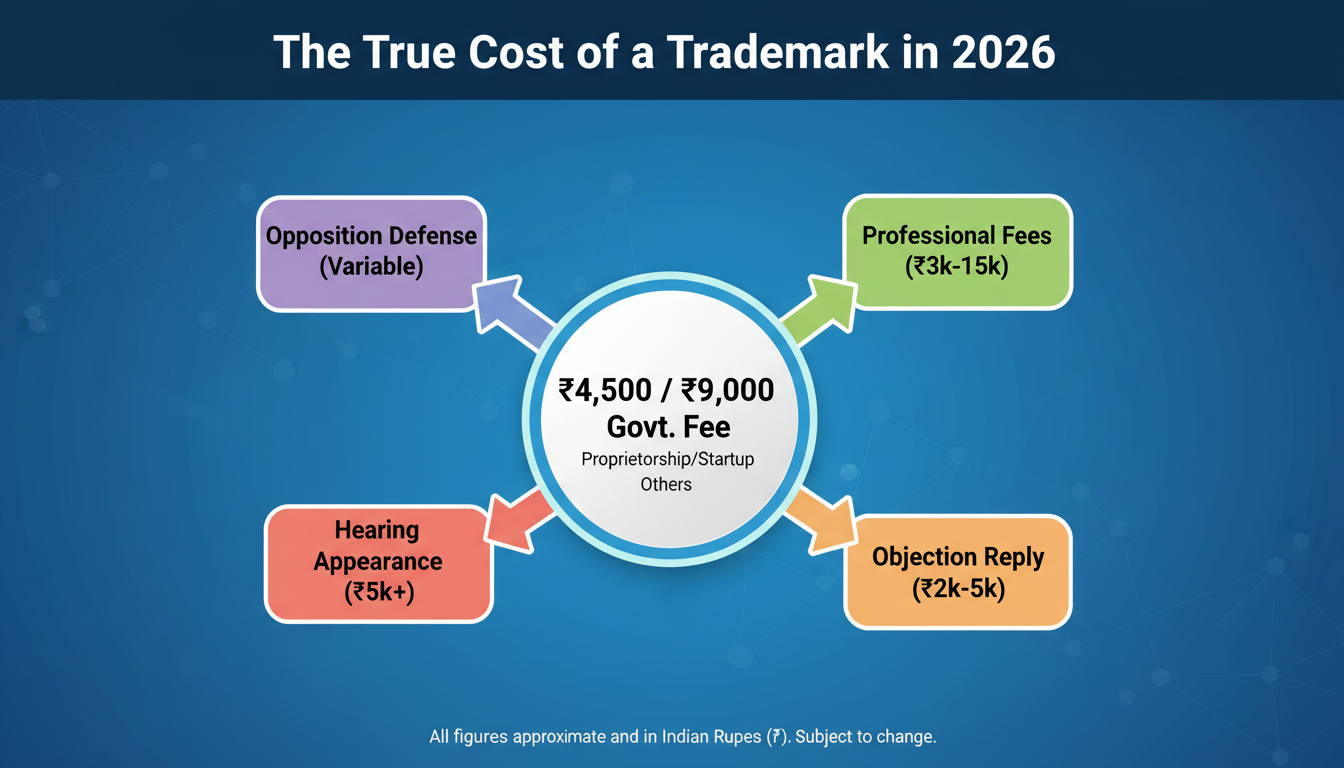

Beyond the Application: Unpacking the Hidden Costs

This is where most people get tripped up. The ₹4,500 or ₹9,000 fee is for a smooth, unopposed application. But the trademark journey can have twists and turns, each with a potential price tag. Think of the initial fee as your ticket to the game; you might still need to pay for drinks and snacks along the way.

Here are the “hidden” costs you must budget for:

- Professional Fees: While you can file a trademark yourself, it’s like performing minor surgery after watching a YouTube video. A good trademark attorney or agent charges a professional fee (typically ranging from ₹3,000 to ₹15,000) but their expertise is invaluable. They conduct deep searches, draft the application correctly, and handle legal objections—saving you money and headaches down the line.

- Objection Response: About 30-40% of applications receive an office objection from the Trademark Examiner. This could be because your mark is too generic (e.g., “Best Computers”) or too similar to an existing one. Replying to this requires a formal legal response, which can cost extra if you’re using a professional.

- Show-Cause Hearings: If the examiner isn’t satisfied with your written response, they may call for a hearing. This involves appearing (often virtually) before the officer to argue your case. This is an additional, and more significant, professional expense.

- Opposition Proceedings: After your mark is approved by the examiner, it’s published in the Trademark Journal for four months. During this time, anyone from the public can oppose it. Defending against an opposition is a complex legal battle and can become the most expensive part of the process.

⚠️ Watch Out

The biggest hidden cost is re-filing. If your application is abandoned because you chose a weak name or failed to respond to a notice, your initial government fee is gone forever. You have to start over and pay again. This is why a thorough initial search is non-negotiable.

DIY vs. Hiring a Professional: A Cost-Benefit Analysis

The temptation to save a few thousand rupees by filing yourself is strong. But is it smart? Based on our experience handling hundreds of applications, the small upfront saving often leads to much larger costs later. Let’s break it down.

| Factor | DIY (Do-It-Yourself) Filing | Hiring a Professional (Attorney/Agent) |

|---|---|---|

| Upfront Cost | Low (Only Government Fee) | Higher (Govt. Fee + Professional Fee) |

| Time Investment | Very High (Learning curve, paperwork) | Low (They handle everything) |

| Success Rate | Lower. High risk of errors in classification, description, or search. | Significantly Higher. Experts know how to avoid common pitfalls. |

| Handling Objections | Difficult. Requires legal knowledge to draft a convincing reply. | Included or handled for a standard fee. This is their expertise. |

| Peace of Mind | Low. Constant worry about deadlines and correctness. | High. You have an expert in your corner managing the entire process. |

Trust me on this one: paying a professional isn’t an expense; it’s an insurance policy against failure. The fee you pay them is for their experience in navigating a complex system you’re seeing for the first time.

🎯 Key Takeaway

The true trademark registration cost in India isn’t just the initial government fee. It’s a calculation of that fee plus the strategic cost of professional help, weighed against the massive financial risk of rejection, opposition, or future litigation.

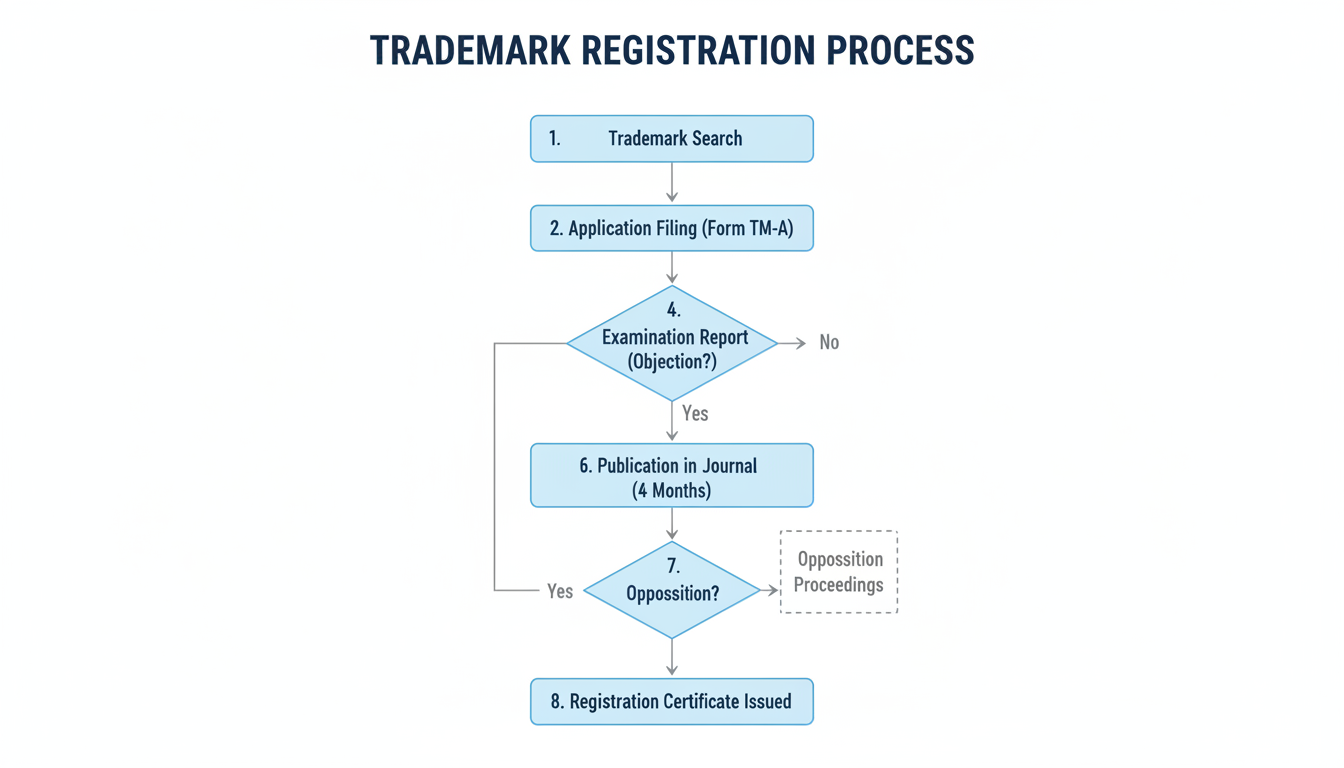

The Step-by-Step Registration Process & Timeline in 2026

So, you’re ready to move forward. What does the journey actually look like? While the Indian Trademark Office has become much more efficient, it’s still a marathon, not a sprint. Here’s the typical path your application will take.

- Step 1: The Trademark Search (1-2 Days). Before you even think about paying the fee, you or your attorney must conduct a comprehensive search of the official IP India database. This checks for identical or deceptively similar marks in your chosen classes. A thorough search is the single best way to prevent future objections.

- Step 2: Application Filing (1 Day). Your application is prepared and filed online in Form TM-A. Once submitted and the fee is paid, you get an application number instantly. You can, and should, start using the ™ symbol next to your brand name immediately.

- Step 3: Examination (1-3 Months). A Trademark Examiner is assigned to your case. They will review your application to ensure it complies with the Trademarks Act, 1999. They’re checking for distinctiveness and ensuring it doesn’t conflict with existing marks.

- Step 4: Publication in the Journal (4 Months). If the examiner finds no issues (or if you’ve successfully overcome their objections), your mark is published in the official Trademark Journal. This is a public notice period.

- Step 5: Registration (1-2 Months after publication). If no one opposes your mark during the 4-month publication window, congratulations! The registrar will issue the registration certificate. You can now officially use the coveted ® symbol.

Total Estimated Timeline (smooth process): 6 to 8 months.

💡 Pro Tip

Don’t get confused between ™ and ®. You can use the ™ (Trademark) symbol as soon as your application is filed. It signals your claim to the brand. The ® (Registered) symbol can ONLY be used after you have received the official registration certificate.

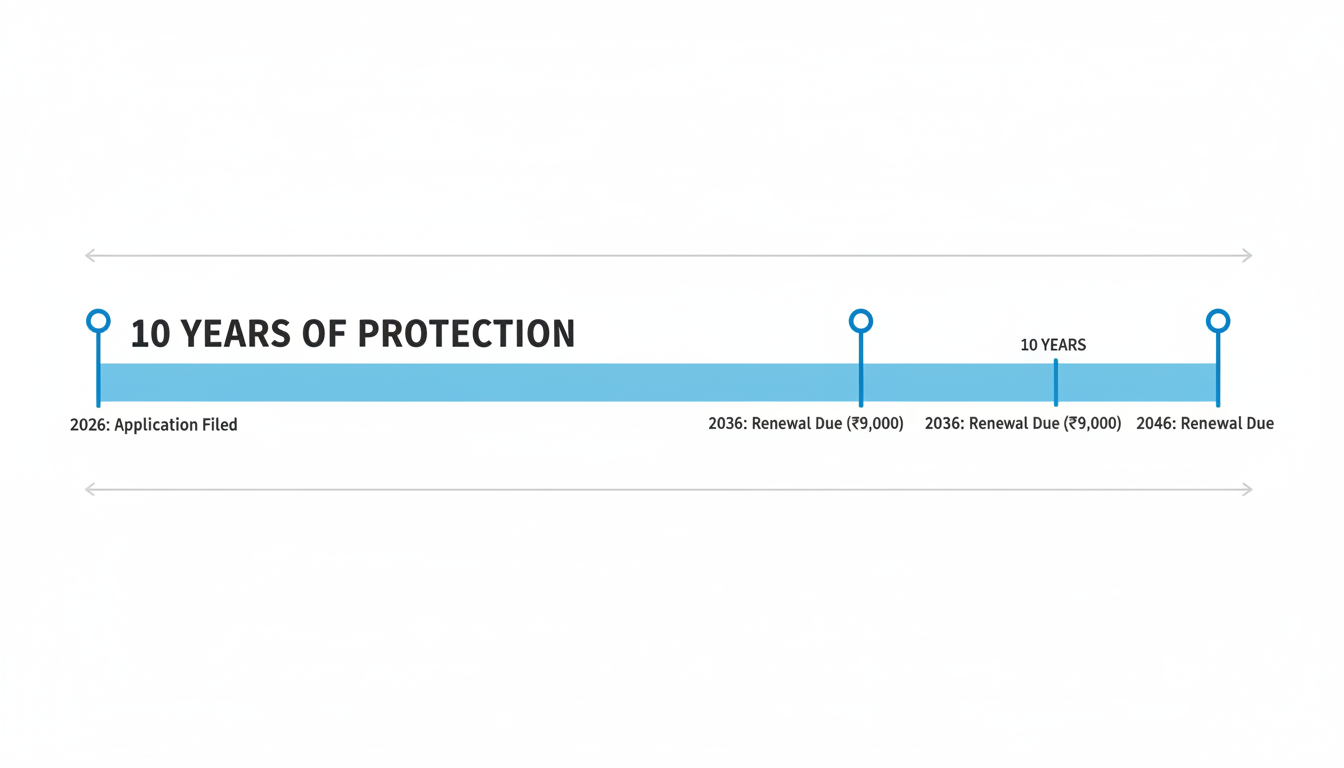

Keeping Your Brand Safe: Renewal Costs & Long-Term Strategy

Your trademark registration isn’t for life. It’s valid for 10 years from the application date. To keep it active, you must file for renewal. Forgetting to renew is like forgetting to pay your insurance premium—your protection vanishes.

The current e-filing fee for trademark renewal in 2026 is ₹9,000 per class. You can file for renewal up to one year before the expiry date. There’s also a grace period of six months after expiry, but it comes with a surcharge.

⚠️ Watch Out

If you fail to renew your trademark even within the grace period, it will be removed from the Register. Restoring an abandoned mark is a far more expensive and legally complicated process than a simple renewal. Set a calendar reminder for year nine!

Your Brand Is Your Most Valuable Asset. Protect It.

Calculating the trademark registration cost in India is more than just looking up a government fee. It’s about making a strategic investment in your business’s identity. For a startup, that initial ₹4,500 is one of the highest-ROI investments you can make, securing a decade of legal protection for your most valuable asset.

Don’t be penny-wise and pound-foolish. Understand the full scope of costs, invest in a thorough search, and seriously consider professional guidance. By taking the right steps now, you’re not just buying a certificate; you’re building a defensible brand that can grow securely for years to come.

Your next step? Don’t wait. Conduct a preliminary search today to see where your brand stands.

❓ Frequently Asked Questions

What is the absolute minimum trademark registration cost in India for an individual in 2026?

The rock-bottom cost is ₹4,500. This is the government’s e-filing fee for one application in one class, assuming you file it yourself and face no objections or oppositions.

Can I get a refund if my trademark application is rejected?

No. All government fees paid to the trademark registry are non-refundable. This is a critical reason why getting the application right the first time is so important.

How many classes should I file for?

This depends entirely on your business. A t-shirt brand would file in Class 25 (clothing). If they also sell online, they might add Class 35 (retail services). According to the World Intellectual Property Organization’s (WIPO) NICE Classification, you should cover all current and near-future areas of your business.

What’s the difference between a wordmark and a logo registration?

A wordmark protects the name itself, regardless of font or design (e.g., “GOOGLE”). A logo (or device mark) protects the specific visual design. The government fee is the same for both. For comprehensive protection, many businesses register both.

Do I have to pay the trademark fee every year?

No, thankfully! The initial registration fee and subsequent renewal fees each provide 10 years of protection. There are no annual maintenance fees.

My company is an LLP. What is my trademark filing cost?

If your LLP has a valid Udyam Certificate as a Small Enterprise, your e-filing cost is ₹4,500 per class. If not, you fall under the “Others” category, and the cost is ₹9,000 per class. You can learn more about business structures from the Ministry of Corporate Affairs.