Understanding the Scope of TDS on rent payment section 194I

In the complex landscape of Indian taxation, managing cash flows and compliance is paramount for businesses and professionals. One of the most significant provisions that every tenant (other than small-scale individuals) must understand is the TDS on rent payment section 194I. This section of the Income Tax Act, 1961, mandates that any person (excluding individuals or HUFs not subject to tax audit) who pays rent to a resident must deduct tax at source. This mechanism ensures a steady flow of tax revenue to the government and helps track high-value transactions effectively.

Rent, as defined under this section, is not just limited to the payment for a building or land. It encompasses a wide variety of lease, sub-lease, or tenancy agreements. Whether you are renting a small office space, a large warehouse, or even heavy industrial machinery, the provisions of TDS on rent payment section 194I likely apply to your financial dealings. Understanding these nuances is the first step toward avoiding hefty penalties and ensuring smooth business operations.

What Qualifies as Rent?

Under Section 194I, rent includes payments for the use of land, buildings (including factories), machinery, plant, equipment, furniture, and fittings. It applies regardless of whether the payee owns the property or not.

Who is the Deductor?

Any person making a rent payment to a resident is liable, except for individuals and HUFs who were not required to get their accounts audited under Section 44AB in the preceding financial year.

Who is the Payee?

The recipient must be a resident of India. If the rent is paid to a non-resident, the provisions of Section 195 apply instead of Section 194I.

Threshold Limits and Exemptions for TDS on rent payment section 194I

One of the most common questions surrounding this topic is: “At what point do I start deducting tax?” The government has set a specific threshold to reduce the compliance burden on small-scale transactions. Currently, the threshold limit for TDS on rent payment section 194I is INR 2,40,000 per financial year. If the total rent payable to a single payee during the year does not exceed this amount, no tax needs to be deducted at source.

It is important to note that this limit applies per payee, not per property. If you rent two different properties from the same landlord, and the combined annual rent exceeds INR 2.4 lakh, you must deduct TDS. Conversely, if you rent one property owned by two people (co-owners) and pay them separately, the limit applies to each individual share. Staying updated with these limits is crucial, as seen in the latest updates from the Income Tax Department.

Who is Liable to Deduct TDS on rent payment section 194I?

Liability is a key factor in compliance. Most corporate entities, including private limited companies, public companies, and partnership firms, are mandatory deductors. However, for individuals and Hindu Undivided Families (HUFs), the liability is linked to their business turnover. If an individual’s turnover exceeded INR 1 crore (for business) or INR 50 lakhs (for profession) in the previous financial year, they must comply with TDS on rent payment section 194I.

If you find the process of managing these deductions and filings overwhelming, you might consider professional TDS Filing Services to ensure accuracy and timeliness. This is especially relevant for businesses that deal with multiple vendors and landlords simultaneously.

Applicable Rates for TDS on rent payment section 194I

The rate of deduction under Section 194I is not uniform across all types of assets. The law distinguishes between immovable property and movable equipment to reflect the different economic natures of these assets. For land, buildings, and furniture, the rate is significantly higher than for plant and machinery.

2% Rate

This applies to the use of any plant, machinery, or equipment. This lower rate is designed to facilitate industrial growth and reduce the working capital burden on manufacturing units.

10% Rate

This applies to the use of any land or building (including factory buildings), furniture, or fittings. This is the standard rate for office and residential rentals for business use.

20% (Penalty Rate)

If the landlord or the payee does not provide their Permanent Account Number (PAN), the deductor is required to deduct tax at a flat rate of 20% regardless of the asset type.

In certain scenarios, such as when a landlord has a lower income or is eligible for exemptions, they can apply for a certificate for lower deduction or non-deduction under Section 197. This provides relief to the payee and ensures that excess tax is not blocked with the government. For those opting for simplified taxation, the Presumptive Taxation Scheme 2024 might offer additional insights into how income is calculated and taxed.

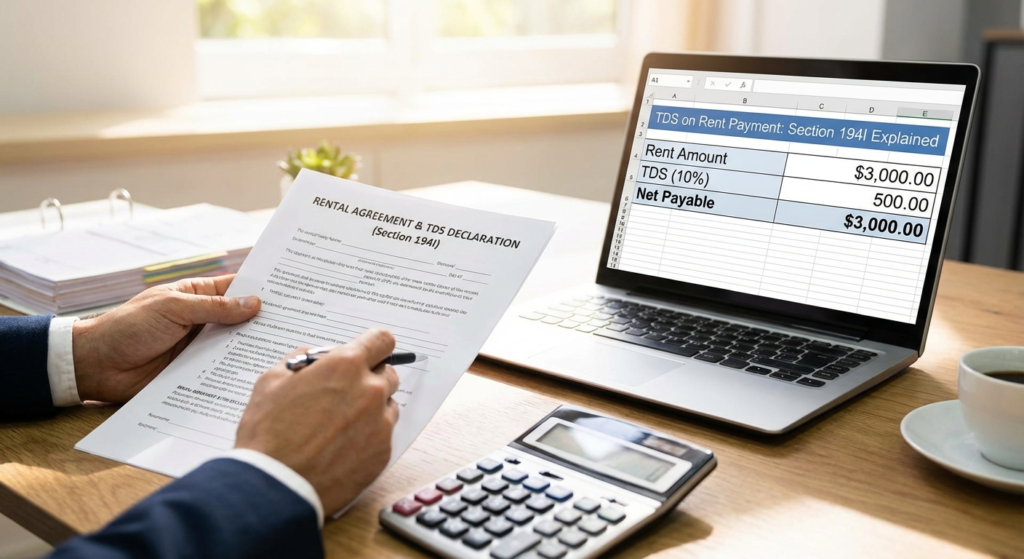

Practical Calculation of TDS on rent payment section 194I

To understand the practical application, let us look at a few examples. Suppose a company, Alpha Pvt Ltd, rents an office space for INR 30,000 per month. The annual rent totals INR 3,60,000. Since this exceeds the INR 2,40,000 threshold, Alpha Pvt Ltd must deduct TDS on rent payment section 194I at 10%.

- Monthly Rent: INR 30,000

- TDS Amount (10%): INR 3,000

- Net Payment to Landlord: INR 27,000

Now, consider another scenario where a construction firm rents a crane (machinery) for INR 25,000 per month. The annual payment is INR 3,00,000. Here, the rate is 2%.

- Monthly Rent: INR 25,000

- TDS Amount (2%): INR 500

- Net Payment to Owner: INR 24,500

Compliance and Filing for TDS on rent payment section 194I

Deducting the tax is only half the job. The deductor must also deposit this tax with the Central Government and file quarterly returns. Failure to do so can lead to interest charges and heavy penalties. The tax deducted during a month must be deposited by the 7th of the following month (except for March, where the deadline is April 30th).

The return filing is done using Form 26Q on a quarterly basis. After successful filing, the deductor must issue Form 16A to the landlord. This certificate serves as proof of tax paid and allows the landlord to claim the credit when filing their personal income tax return. More details on the broader implications of rental income can be found on The Economic Times.

Step 1: Deposit

Use Challan ITNS 281 to deposit the deducted amount online or at authorized bank branches within the prescribed due dates.

Step 2: Quarterly Return

File Form 26Q every quarter (July 31, Oct 31, Jan 31, and May 31) detailing the payments made and tax deducted.

Step 3: Issue Form 16A

Download the TDS certificate from the TRACES portal and provide it to the payee within 15 days of the return filing due date.

It is also worth noting that if the rent includes service charges or maintenance fees, these are generally considered part of the rent for the purpose of TDS on rent payment section 194I. However, if GST is charged on the rent, TDS is only calculated on the base amount, excluding the GST component, as per circulars issued by the CBDT.

Consequences of Non-Compliance

The penalties for neglecting TDS on rent payment section 194I can be severe. If you fail to deduct the tax, you are liable to pay interest at 1% per month from the date the tax was deductible to the date it is actually deducted. If you deduct the tax but fail to deposit it, the interest rate jumps to 1.5% per month. Additionally, under Section 40(a)(ia), 30% of the rent expense may be disallowed as a deduction from your business income, significantly increasing your tax liability.

Late filing of TDS returns also attracts a fee of INR 200 per day under Section 234E, subject to a maximum of the TDS amount. Therefore, maintaining a strict calendar for these activities is not just good practice—it is a financial necessity.

Conclusion

Navigating the rules of TDS on rent payment section 194I is a fundamental skill for modern business owners and accountants. By understanding the threshold of INR 2.4 lakh, identifying the correct rates (2% vs 10%), and adhering to the strict deposit and filing timelines, you can ensure your business remains compliant and avoids unnecessary litigation. Remember, the goal of TDS is transparency; by fulfilling your role as a deductor, you contribute to a more organized and tax-compliant economy. Always keep documentation handy and consider using digital tools or professional services to streamline your tax workflow.

FAQs

No, payments made to the government, local authorities, or statutory bodies are generally exempt from TDS under Section 194I, as these entities are not liable to pay income tax.

If the landlord is a Non-Resident Indian (NRI), Section 194I does not apply. Instead, the tenant must deduct tax under Section 195 at a much higher rate (usually 31.2% including cess), and there is no threshold limit of INR 2.4 lakh.

TDS is not applicable on refundable security deposits because they do not constitute income in the hands of the landlord. However, if the deposit is non-refundable or adjusted against future rent, it is subject to TDS.

No, as per CBDT Circular No. 23/2017, if the GST component on the services is indicated separately in the invoice, no tax shall be deducted on the GST amount.

Landlords can submit Form 15G (for individuals below 60) or Form 15H (for senior citizens) to the tenant to request non-deduction of tax if their total annual income is below the basic exemption limit.

Read Also:

- The Definitive Guide to LLP to Private Limited Company Conversion: Process and Requirements

- Proprietorship to Private Limited: Understanding the Benefits and Process of Company Conversion

- Filing DPT-3 Form (MCA): Return of Deposits Guide

- Director KYC Filing: DIR-3 KYC Due Date and Penalty 2026 Compliance Guide