In today’s business landscape, understanding the intricacies of tax compliance is paramount. One crucial aspect of this is Goods and Services Tax (GST) registration. Many businesses rely on the expertise of Chartered Accountants (CAs) to navigate the complexities of GST registration. In this article, we will delve into the world of GST registration fees when availed through a CA’s services. Let’s break it down step by step.

Introduction to GST Registration

GST, introduced in India in 2017, is a comprehensive tax levied on the supply of goods and services. Every business exceeding a specified turnover threshold is required to register under GST. The registration process can be intricate, making the expertise of a CA highly valuable.

Why Opt for CA Assistance?

The labyrinth of GST regulations and paperwork can be daunting for many business owners. CAs are well-versed in the intricacies of taxation and can provide invaluable guidance to ensure seamless GST registration.

GST Registration Process

Step 1: Documentation

The first step involves gathering essential documents such as PAN, Aadhar card, bank statements, and business-related documents. CAs excel at organizing these documents efficiently.

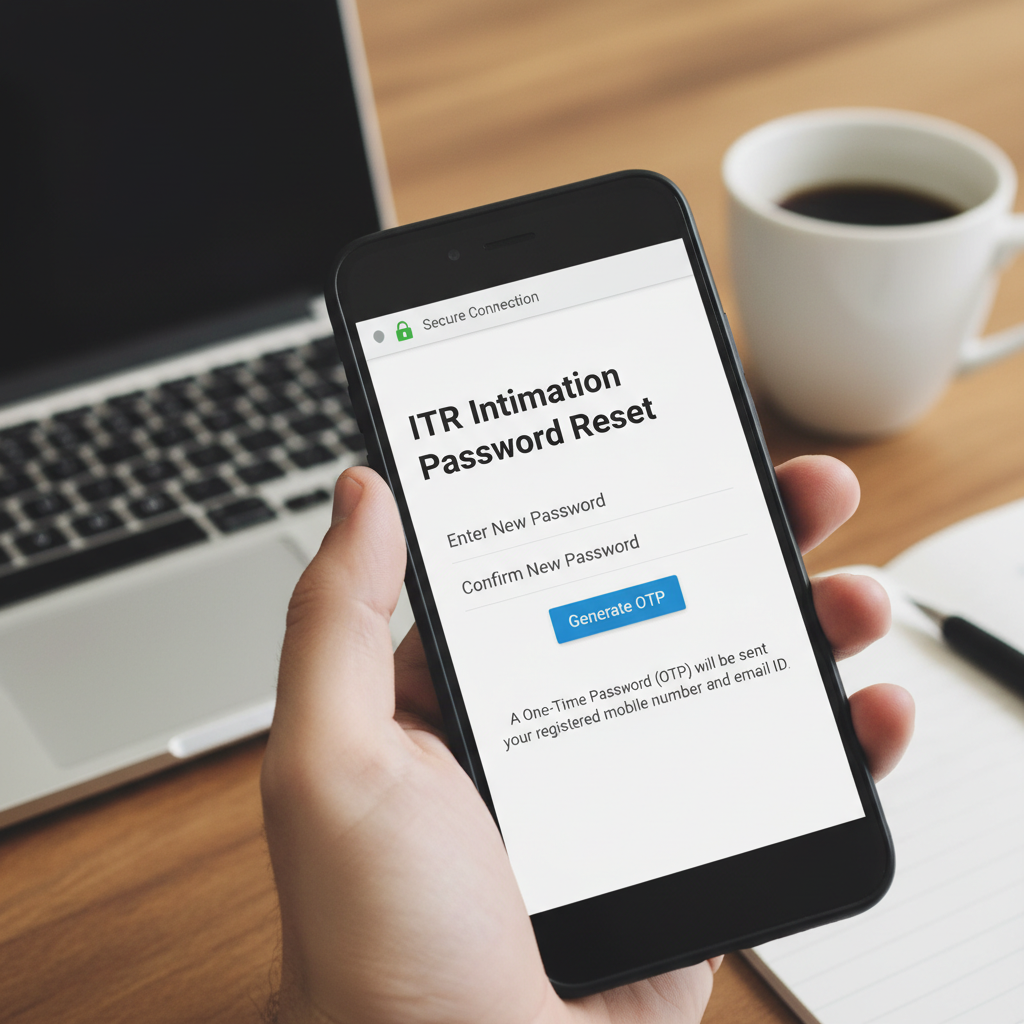

Step 2: Online Application

CAs leverage their expertise to accurately fill out the GST registration form, reducing the chances of errors or rejections.

Step 3: Verification

After submission, the GST authorities verify the application. CAs play a vital role in ensuring that the application meets all regulatory requirements.

GST Registration Fees by CA

Factors Influencing CA Fees

Several factors influence the fees charged by CAs for GST registration services:

- Business Type: The complexity of the business structure impacts fees.

- Turnover: Larger turnovers may incur higher fees.

- CA’s Experience: More experienced CAs may charge more.

- Geographical Location: Fees can vary by region.

Typical Fee Structure

While fees may vary, a typical fee structure for GST registration services by CAs includes:

- Professional Fees: The CA’s service charge.

- Government Fees: Fees payable to the government for registration.

Comparing CA Fees

It’s advisable to obtain quotes from multiple CAs to compare fees. Keep in mind that while cost is important, expertise and reliability should also be considered.

Benefits of Hiring a CA for GST Registration

Hiring a CA for GST registration offers several advantages:

- Expertise: CAs are well-versed in tax laws.

- Error Reduction: CAs minimize errors during the registration process.

- Time Efficiency: Professional assistance speeds up the registration.

- Compliance Assurance: CAs ensure adherence to all regulations.

Discover MyDigitalFiling.in

Looking for an economical alternative for your GST registration needs? Explore MyDigitalFiling.in, where you can avail of the following benefits:

Affordable GST Registration Fees

At MyDigitalFiling.in, we understand the importance of cost-effectiveness for businesses. Our GST registration fees start at just Rs. 300/-. This budget-friendly option ensures that you can fulfill your GST registration requirements without breaking the bank.

Expert CA Assistance

Worried about navigating the GST registration process alone? MyDigitalFiling.in offers expert CA assistance to guide you through every step. Benefit from the experience and knowledge of seasoned CAs without the hefty price tag.

Conclusion

In conclusion, understanding GST registration fees when availing CA services is essential for businesses. While cost is important, it’s equally crucial to explore budget-friendly options like MyDigitalFiling.in. This platform combines affordability with expert CA assistance, making GST registration accessible to all.

Frequently Asked Questions (FAQs)

GST registration is mandatory for businesses with a certain turnover. It is essential for legal compliance and seamless tax operations.

GST registration fees by CA depend on factors like business type, turnover, the CA’s experience, and geographical location.

No, in addition to CA fees, there is no government fees payable for GST registration.

Yes, businesses can choose to register for GST independently, but CA assistance is often recommended for accuracy and compliance.

Incorrect GST registration can lead to legal issues, penalties, and tax liabilities. It’s crucial to get it right from the beginning.

For a seamless and budget-friendly GST registration experience, visit MyDigitalFiling.in today and get started on your compliance journey. Your business deserves expert guidance at an affordable price.

Please Rate this post

Click to rate