In the dynamic landscape of Indian taxation, maintaining financial discipline is not just a best practice—it is a legal mandate. For businesses operating within the subcontinent, TDS compliance India stands as one of the most critical pillars of the fiscal framework. Whether you are a startup founder, a CFO of a multinational corporation, or a small business owner, understanding the nuances of Tax Deducted at Source (TDS) is non-negotiable.

TDS is essentially a mechanism introduced by the Income Tax Department to collect tax at the very source of income. It prevents tax evasion and ensures a steady flow of revenue for the government. However, for the deductor (the business), it brings a set of rigorous responsibilities. Failing to adhere to tds compliance India norms can lead to severe financial penalties, legal repercussions, and a tarnished business reputation. This comprehensive guide will walk you through the essential steps, forms, and strategies to master tds compliance India effectively.

Understanding the Scope of TDS Compliance India

To navigate the tax waters smoothly, one must first understand what tds compliance India entails. It is not merely about deducting a portion of the payment; it is a cycle that involves deduction, deposition, filing, and certification. The concept rests on the principle of "pay as you earn."

Under the Income Tax Act, 1961, any person responsible for making specified payments such as salary, commission, rent, interest, or professional fees is required to deduct a certain percentage of tax before making the payment in full to the receiver (deductee). This deducted amount must then be deposited with the Central Government.

Ensuring robust tds compliance India requires businesses to stay updated with the latest threshold limits and rate charts. For instance, the rates for TDS on technical services differ from those on contractor payments. Ignorance of these specificities is often the root cause of non-compliance.

Deduction

Tax must be deducted at the time of credit to the payee’s account or actual payment, whichever is earlier.

Deposition

The deducted amount must be deposited to the government via Challan 281 by the 7th of the following month.

Reporting

Quarterly returns must be filed detailing the deductions and PAN of deductees to ensure transparency.

Why TDS Compliance India is Crucial for Business Health

Many businesses view tax compliance as a burden, but accurate tds compliance India is actually a safeguard. The Income Tax Department has digitized its operations, making it incredibly easy to track discrepancies between the tax deducted and the tax deposited. If your business fails in its duties, the consequences go beyond simple fines.

Firstly, expenses on which TDS was applicable but not deducted (or deducted but not paid) are disallowed as business expenses under Section 40(a)(ia). This artificially inflates your taxable profit, leading to higher income tax liabilities. For a deeper understanding of how this impacts your overall tax filing, you can refer to our guide on income tax return filing in India.

Secondly, strict adherence to tds compliance India builds credibility. Vendors and employees trust organizations that issue Form 16 and Form 16A on time, as these certificates are essential for them to claim tax credits.

Key Steps to Master TDS Compliance India

Implementing a flawless compliance system requires a structured approach. Here is a step-by-step breakdown to ensure your organization remains compliant.

1. Obtaining a TAN (Tax Deduction Account Number)

The journey of tds compliance India begins with obtaining a TAN. This 10-digit alphanumeric number is mandatory for all persons responsible for deducting or collecting tax. Quoting the TAN in all TDS documents, challans, and correspondence with the Income Tax Department is compulsory. Without a TAN, you cannot deposit the tax deducted, leading to immediate non-compliance.

2. Determining Liability and Rates

Not every payment attracts TDS. You must verify if the payment exceeds the threshold limit specified under relevant sections (e.g., Section 194C for contractors, 194J for professionals). Furthermore, you must apply the correct rate. Applying a lower rate without a valid certificate (Form 15G/15H or Lower Deduction Certificate) is a common error in tds compliance India.

Navigating Forms and Returns in TDS Compliance India

Documentation is the backbone of tax compliance. In the realm of tds compliance India, specific forms serve specific purposes. Using the wrong form can result in your return being termed ‘defective’.

It is vital to categorize your payments correctly to choose the right return form. For broad categories of law and regulations regarding taxation, keeping these forms organized is key.

Form 24Q

Purpose: Used for preparing quarterly TDS returns for salary payments.

Key Details: Includes employee salary details and tax deductions under Section 192.

Form 26Q

Purpose: Used for quarterly returns for all payments other than salary.

Key Details: Covers professional fees, rent, interest, and contractor payments.

Form 27Q

Purpose: Used for TDS on payments made to Non-Resident Indians (NRIs) and foreigners.

Key Details: Crucial for cross-border transactions and foreign vendor payments.

Common Pitfalls in TDS Compliance India

Even well-intentioned businesses can falter. Awareness of common mistakes can save you from paying interest under Section 201(1A) or late fees under Section 234E.

- Late Deduction: Deducting tax later than the date of credit/payment attracts interest at 1% per month.

- Late Payment: Deducting on time but depositing late attracts interest at 1.5% per month.

- PAN Errors: Furnishing an incorrect PAN for the deductee is a critical error. If the PAN is invalid or not provided, TDS must be deducted at a flat rate of 20% (or the applicable rate, whichever is higher).

- Mismatched Challans: Quoting the wrong Challan Identification Number (CIN) in the TDS return creates a mismatch, leading to demand notices from the TRACES portal.

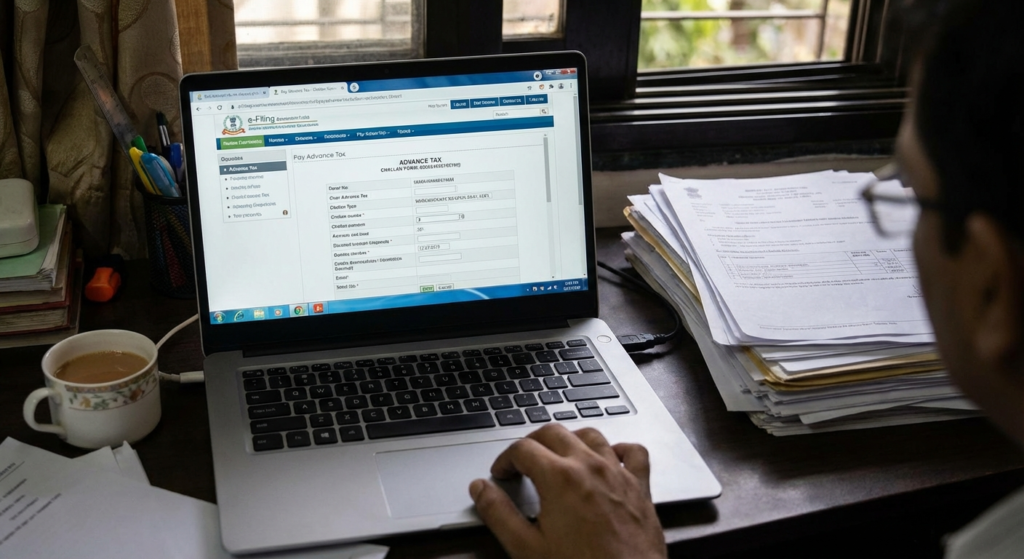

The Role of Technology in Compliance

Modern tds compliance India is heavily reliant on technology. The government’s TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal is the central hub for all TDS activities. Businesses must regularly log in to TRACES to check for defaults, download consolidated files for corrections, and issue Form 16/16A.

Automation software has also become indispensable. Manual calculation of TDS, especially for payroll with varying tax slabs, is prone to human error. Using validated software ensures that rates are updated automatically and returns are generated in the required file formats.

Penalties: The Cost of Non-Compliance

The Income Tax Department is stringent regarding tds compliance India. Section 234E imposes a late filing fee of ₹200 per day until the return is filed (capped at the TDS amount). More severely, Section 271H allows the Assessing Officer to levy a penalty ranging from ₹10,000 to ₹1,00,000 for failure to file returns within the due date.

Furthermore, for cases of intentional evasion where tax is deducted but not deposited, prosecution can be initiated under Section 276B, which entails rigorous imprisonment. Therefore, treating tds compliance India as a priority is not optional.

For authoritative information on penalty structures, you can refer to the Income Tax Department of India website.

Conclusion

Mastering tds compliance India is a continuous process that requires vigilance, accuracy, and timely action. By obtaining a TAN, adhering to deduction timelines, depositing taxes promptly via correct challans, and filing accurate quarterly returns, businesses can ensure seamless operations. It protects the organization from litigation and contributes to the nation’s economy.

Remember, tax compliance is an integral part of corporate governance. Whether you are dealing with domestic vendors or international clients, understanding the intricacies of TDS will serve as a foundation for sustainable business growth. Stay updated, use the right tools, and consult experts when in doubt to navigate the complex yet structured world of Indian taxation. For more insights on financial regulations, visit reliable sources like ClearTax for detailed breakdowns.

Frequently Asked Questions

If you fail to deposit the deducted tax by the 7th of the following month, you are liable to pay interest at 1.5% per month or part of the month from the date of deduction until the date of actual payment.

Yes, obtaining a Tax Deduction and Collection Account Number (TAN) is mandatory for all entities responsible for deducting tax at source. You cannot file TDS returns or deposit tax without it.

Yes, you can file a correction return. You need to download the justification report or the consolidated file from the TRACES portal to identify the errors and then file a revised return to correct discrepancies.

Under Section 234E, a late fee of ₹200 per day is levied for every day the default continues, up to the total amount of TDS deductible. Additionally, a penalty under Section 271H ranging from ₹10,000 to ₹1 lakh may apply.

TDS is only applicable if the payment exceeds the specific threshold limits defined in the Income Tax Act for that category (e.g., ₹30,000 for single contractor payments). If the amount is below the limit, no TDS is required.