India has emerged as the third-largest startup ecosystem in the world, a testament to the country’s vibrant entrepreneurial spirit. From fintech innovators to agritech disruptors, the Indian market is teeming with ideas waiting to transform into reality. However, the bridge between a brilliant idea and a legally recognized business entity is the process of startup company registration India.

Navigating the legal landscape can often feel overwhelming for new founders. Questions about business structures, compliance, and government schemes are common. Yet, registering your startup is not just a legal formality; it is the foundation upon which trust, funding, and scalability are built. Whether you are looking to raise venture capital or simply want to protect your brand, understanding the nuances of startup company registration India is the first step toward long-term success.

In this comprehensive guide, we will walk you through everything you need to know—from choosing the right business structure to obtaining DPIIT recognition under the Startup India scheme.

Why Startup Company Registration India is Crucial for Growth

Many entrepreneurs start as sole proprietors or unregistered partnerships to test the waters. While this approach works for small-scale operations, it poses significant risks for high-growth startups. Formalizing your business through startup company registration India offers distinct advantages that go beyond mere compliance.

A registered entity, particularly a Private Limited Company, is treated as a separate legal person. This means the founders’ personal assets are protected in case of business losses. Furthermore, investors invariably prefer registered companies because it ensures transparency and legal accountability.

Limited Liability Protection

Registration separates your personal assets from business liabilities. If the startup faces debt, your personal savings, house, or car remain safe, providing financial security to founders.

Easy Fundraising

Venture Capitalists (VCs) and Angel Investors only invest in registered entities (specifically Private Limited Companies). Registration allows you to issue equity shares in exchange for capital.

Tax Benefits

Once registered and recognized by DPIIT, startups can avail themselves of a 3-year tax holiday and exemptions on Angel Tax, significantly aiding early-stage cash flow.

Choosing the Right Structure for Startup Company Registration India

Before diving into paperwork, you must decide on the legal structure of your business. In India, the most popular forms for startups are Private Limited Company (Pvt Ltd), Limited Liability Partnership (LLP), and One Person Company (OPC). However, for the purpose of startup company registration India under the government’s Startup India scheme, a Private Limited Company is the most preferred route.

- Private Limited Company: Ideal for startups seeking external funding. It offers limited liability and is easily scalable.

- Limited Liability Partnership (LLP): Good for bootstrapped businesses or professional services. It has lower compliance costs but is less attractive to investors.

- One Person Company (OPC): Suitable for solo founders who want limited liability but do not plan to raise equity funding immediately.

Prerequisites for Startup Company Registration India

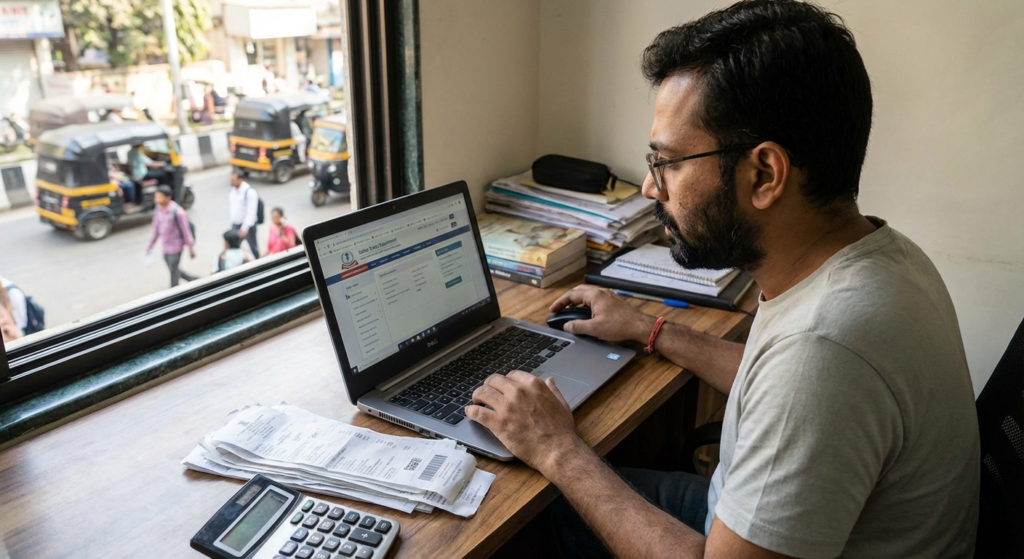

To ensure a smooth registration process, you must have your documentation in order. The Ministry of Corporate Affairs (MCA) has digitized the process, making it faster, but accuracy is key. Missing a single document can lead to rejection or delays.

You will need to gather identity proofs (PAN card, Aadhaar card, Passport), address proofs (Bank statement, Electricity bill), and a registered office address. Additionally, sound financial planning is essential before incorporation. It is advisable to understand effective cash flow strategies to manage the initial capital requirements and registration fees efficiently.

Step-by-Step Process of Startup Company Registration India

The process of incorporating a company has been streamlined via the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) web form on the MCA portal. Here is the detailed workflow.

Step 1: Obtain Digital Signature Certificates (DSC)

Since the entire startup company registration India process is online, physical signatures are not used. All directors must obtain a Class 3 Digital Signature Certificate. This is a secure digital key used to sign electronic documents.

Step 2: Director Identification Number (DIN)

Previously, DIN was applied for separately. Now, it can be applied for within the SPICe+ form for up to three directors. This unique number identifies the director in the government database.

Step 3: Name Reservation (SPICe+ Part A)

Choosing a unique name is critical. The name must not resemble existing companies or trademarks. You can use the ‘RUN’ (Reserve Unique Name) service or apply directly in Part A of the SPICe+ form. Ensure your name reflects your brand and complies with MCA naming guidelines.

Step 4: Incorporation Application (SPICe+ Part B)

This is the core of the startup company registration India process. Part B involves submitting details regarding the registered office, shareholders, and directors. You will also need to draft the Memorandum of Association (MOA) and Articles of Association (AOA).

Step 5: PAN and TAN Application

The SPICe+ form is an integrated application. Along with incorporation, it automatically applies for the company’s Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN). This integration saves significant time.

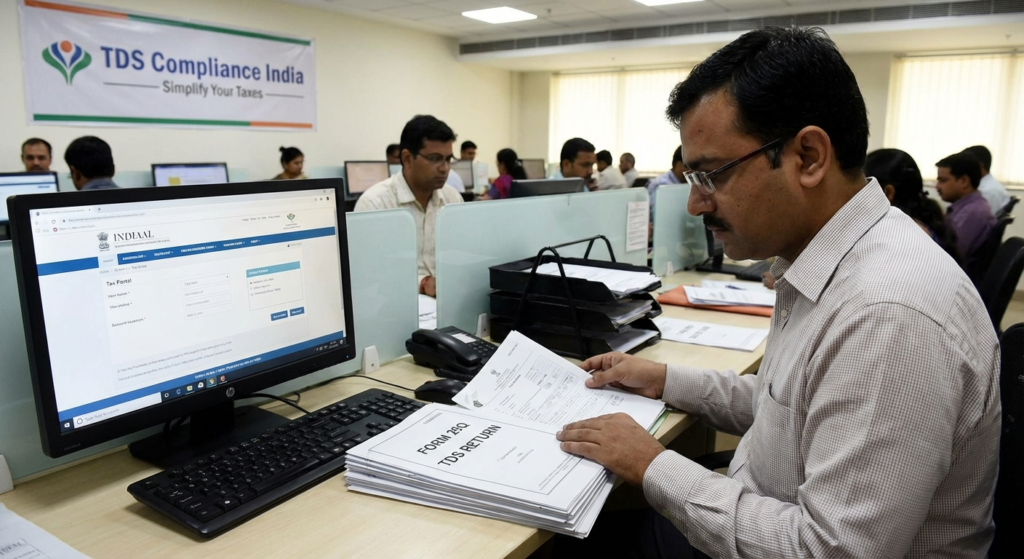

Post-Incorporation Compliance and DPIIT Recognition

Once you receive your Certificate of Incorporation (COI), the legal entity is born. However, the journey of startup company registration India doesn’t end here. To be officially recognized as a “Startup” under the Startup India initiative and avail of government benefits, you must apply for DPIIT (Department for Promotion of Industry and Internal Trade) recognition.

Furthermore, you must open a current bank account within 180 days and deposit the subscription money. Ongoing compliance is also vital; failing to file returns can lead to penalties. For instance, timely TDS returns filing is mandatory if your startup makes specific payments like salaries or professional fees.

Benefits of DPIIT Recognition

Getting recognized by DPIIT unlocks the true potential of the Startup India scheme. This includes:

- Self-Certification: Compliance with labor and environmental laws via self-certification for 3 to 5 years.

- Patent Rebates: Startups get an 80% rebate on patent filing fees, fostering innovation.

- Tax Exemption (Section 80IAC): Eligible startups can apply for income tax exemption for 3 consecutive years.

For more detailed information on government initiatives, you can visit the official Startup India portal.

Cost Analysis of Startup Company Registration India

The cost of registration varies based on the authorized capital and the number of directors. Government fees for incorporation have been reduced for small companies, often being waived for authorized capital up to Rs. 15 Lakhs. However, you will still incur costs for:

- Digital Signature Certificates (approx. ₹1,500 – ₹2,000 per director).

- Stamp Duty (State-dependent).

- Professional Fees (CA/CS charges for drafting MOA/AOA and filing).

Common Mistakes to Avoid During Registration

Even with a simplified process, founders often make errors that lead to rejection. A common mistake is choosing a business name that infringes on a trademark. Always conduct a thorough search on the Ministry of Corporate Affairs website before applying.

Another error is incorrect capital structure planning. Founders sometimes authorize too little capital, requiring costly amendments later, or too much, leading to high stamp duty fees initially. Expert guidance is recommended to balance these factors.

Conclusion

Completing the startup company registration India process is a significant milestone. It transitions your project from a concept to a credible commercial entity ready for the market. While the paperwork may seem tedious, the benefits of limited liability, fundraising capability, and government incentives make it a non-negotiable step for serious entrepreneurs.

By following the steps outlined above and maintaining strict compliance, you position your startup for sustainable growth. Remember, a strong legal foundation allows you to focus on what you do best—innovating and scaling your business.

FAQs

Typically, the process takes 7 to 10 working days, provided all documents are in order and the proposed name is unique and available.

Yes, you can use your residential address as the registered office of the company. You will need to provide a utility bill and a No Objection Certificate (NOC) from the owner (even if it is your parents).

Yes, a minimum of two directors is required for a Private Limited Company. However, if you are a solo founder, you can opt for a One Person Company (OPC) or register a Pvt Ltd company with a family member as the second director.

Incorporation creates the legal entity (like a Pvt Ltd company) with the MCA. Startup India registration is a separate recognition by DPIIT that grants specific benefits like tax holidays and patent rebates to eligible incorporated entities.

No, a physical commercial space is not mandatory immediately. You can start with a residential address or a virtual office address, provided it can receive official correspondence.