When filing your Income Tax Return (ITR), most taxpayers focus heavily on their salary or business profits. However, there is a catch-all category that often trips up even the most diligent filers: the residual head of income. Understanding the nuances of income from other sources tax is crucial to avoid notices from the tax department and to ensure you aren’t paying more than you owe. Whether it is interest from your savings account, a family pension, or a lucky win at the lottery, this category covers it all.

In the Indian taxation system, income is classified into five specific heads. If an income does not fit into Salary, House Property, Profits from Business/Profession, or Capital Gains, it automatically falls into the "Other Sources" bucket. In this comprehensive guide, we will decode the complexities of the income from other sources tax, helping you navigate deductions, exemptions, and the latest compliance requirements.

1. What Constitutes Income from Other Sources Tax?

The Income Tax Act, 1961, specifically Section 56, governs this head of income. To master the income from other sources tax, you first need to identify what flows into this stream. It is essentially the residual category—if it is income, and it is not taxed elsewhere, it is taxed here.

Many taxpayers mistakenly assume that small amounts of interest or one-time gifts are tax-free. This assumption can lead to penalties. The scope of income from other sources tax is broad, covering everything from passive income to windfall gains.

Dividend Income

Since April 1, 2020, dividends are taxable in the hands of the shareholder at their applicable slab rates. The old Dividend Distribution Tax (DDT) is no longer applicable.

Interest Income

This includes interest earned on Savings Accounts, Fixed Deposits (FDs), Recurring Deposits (RDs), and interest on income tax refunds.

Casual Income

Winnings from lotteries, crossword puzzles, races (including horse races), card games, gambling, or betting fall here.

Gifts

Any sum of money or property received without consideration by an individual or HUF, exceeding ₹50,000 in aggregate, is taxable.

2. Key Components of Income from Other Sources Tax

To ensure you are calculating your income from other sources tax liability correctly, let’s break down the most common components in detail. Each has its own set of rules regarding taxability and Tax Deducted at Source (TDS).

Taxation of Dividends

Previously, companies paid the tax on dividends before distributing them. Now, the burden has shifted to the investor. If your dividend income exceeds ₹5,000 in a financial year, the company may deduct TDS at 10%. You must report this income under ‘Other Sources’ and pay tax according to your income slab. This highlights the importance of tracking your Annual Information Statement (AIS) carefully.

Interest Income and Exemptions

Interest is the most common component subject to income from other sources tax. While interest on FDs is fully taxable, interest on savings accounts enjoys a small exemption.

- Section 80TTA: Individuals (below 60 years) and HUFs can claim a deduction up to ₹10,000 on savings account interest.

- Section 80TTB: Senior citizens can claim a deduction up to ₹50,000 on interest from both savings and deposits (FD/RD).

It is important to note that while business income requires complex compliance, such as GST return filing and compliance checklists, income from other sources is generally simpler but requires precise reporting in your ITR.

3. The Complex Rules of Gifts

One of the most misunderstood areas of income from other sources tax is the taxation of gifts (Section 56(2)(x)). Not all gifts are taxable. Gifts received from "relatives" (as defined in the Act) are fully exempt, regardless of the amount. Relatives include spouses, siblings, and lineal ascendants or descendants.

However, gifts from non-relatives (friends, colleagues) are taxable if the aggregate value exceeds ₹50,000 in a year. If the value is ₹51,000, the entire ₹51,000 is taxable, not just the excess ₹1,000. This rule applies to monetary gifts, immovable property, and specified movable property like jewelry or shares.

4. Deductions Allowed on Income from Other Sources Tax

The Income Tax Act allows specific deductions under Section 57 to lower your tax burden. When calculating your income from other sources tax, ensure you claim these if applicable.

- Family Pension: A standard deduction of 33.33% of the pension or ₹15,000, whichever is less, is allowed.

- Interest on Compensation: If you receive interest on delayed compensation (e.g., motor accident claims), a flat 50% deduction is allowed.

- Expenses to Earn Income: Any reasonable expenditure incurred solely to earn income (like collection charges for dividends) can be claimed. However, this does not apply to casual income like lotteries.

5. Calculating Your Income from Other Sources Tax Liability

The calculation methodology depends on the nature of the income. For most streams like interest and family pension, the income is added to your total income and taxed at your slab rates. However, "Casual Income" is treated differently.

The Flat Rate for Casual Income

Winnings from lotteries, betting, gambling, or game shows are taxed at a flat rate of 30% (plus cess), regardless of your income slab. No deductions for expenses are allowed against this income. Even if you spent ₹10,000 on lottery tickets to win ₹50,000, you pay tax on the full ₹50,000.

Furthermore, the basic exemption limit (e.g., ₹2.5 lakh or ₹3 lakh) is not available to offset casual income. This is a critical aspect of income from other sources tax that surprises many winners.

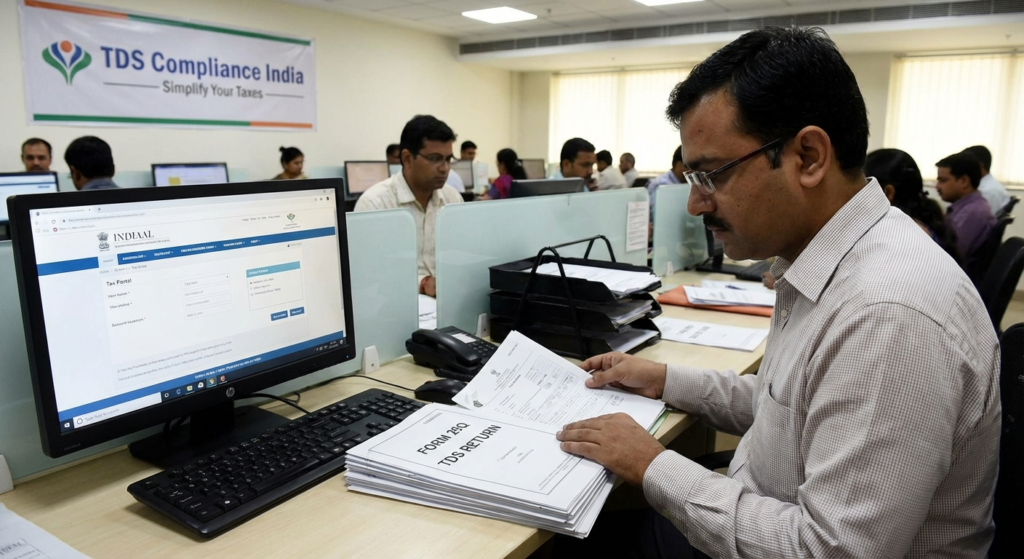

6. TDS and Compliance Requirements

Tax Deducted at Source (TDS) plays a massive role in this head of income. Banks deduct TDS at 10% on FD interest if it exceeds ₹40,000 (₹50,000 for seniors) in a year. Similarly, TDS is deducted at 30% on lottery winnings exceeding ₹10,000.

It is vital to reconcile your Form 26AS and AIS with your bank statements. If TDS has been deducted, you must file your return to adjust it against your total liability or claim a refund. Missing these deadlines can be costly. For detailed schedules on tax filings, referring to resources like the TDS return filing due dates for FY 2025-26 can ensure you stay compliant.

7. Avoiding Common Mistakes

When dealing with income from other sources tax, errors are common. Here are a few to avoid:

- Ignoring Savings Interest: Many believe savings interest is tax-free. It is not; it is only deductible up to a limit.

- Misclassifying Gifts: Receiving a large cash gift from a friend for your wedding is exempt, but receiving it a month later is not.

- Forgetting Clubbing of Income: Income generated from money gifted to a spouse or minor child may be clubbed with your income.

- Not Reporting Exempt Income: Even if income like PPF interest is tax-free, it should be reported in the ‘Exempt Income’ schedule of your ITR for transparency.

Conclusion

Navigating the landscape of income from other sources tax requires attention to detail. It is not just about paying taxes; it is about understanding what is exempt, what is deductible, and what attracts special rates. From the flat 30% tax on winnings to the nuanced rules of gift taxation, this residual head of income significantly impacts your final tax liability.

By keeping accurate records of your investments, reconciling your TDS certificates, and taking advantage of available deductions like Section 80TTA/TTB and Section 57, you can optimize your tax outgo. Remember, in the world of taxation, ignorance is never bliss—it usually results in a penalty. Stay informed, file on time, and ensure every rupee earned from ‘other sources’ is accounted for.

Frequently Asked Questions (FAQs)

Yes, the interest received on an income tax refund is taxable. It falls under the head ‘Income from Other Sources’ and is taxed according to your applicable slab rates.

If you receive gifts (cash or property) from non-relatives exceeding ₹50,000 in a financial year, the entire value is added to your income and taxed at your slab rate. Gifts from defined relatives are exempt.

Yes, but only interest expenditure. You can claim a deduction for interest paid on loans taken to invest in shares, capped at 20% of the dividend income received. No other administrative expenses are allowed.

Lottery winnings, betting, and gambling income are taxed at a flat rate of 30% plus cess (effectively 31.2%). No slab benefits or expense deductions apply to this income.

No, gifts received specifically on the occasion of the marriage of the individual are fully exempt from tax, regardless of the value or who gave them (friends or relatives).