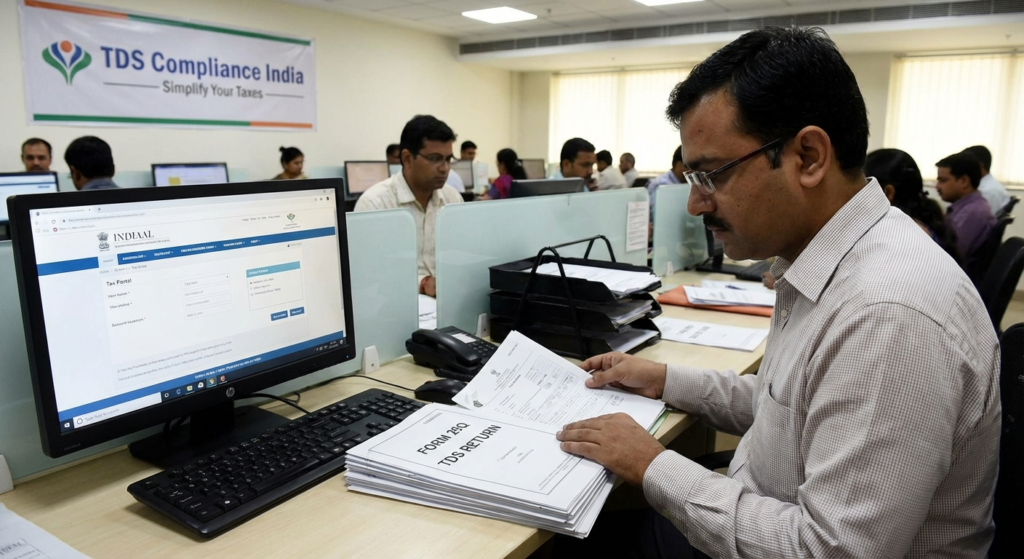

Running a business in India involves juggling numerous responsibilities, from product development to customer acquisition. However, one aspect that demands unwavering attention is financial regulation, specifically TDS compliance India. For many entrepreneurs and finance managers, the concept of Tax Deducted at Source (TDS) can seem like a labyrinth of sections, rates, and deadlines. Yet, mastering this is not just about following the law; it is about maintaining the financial health and reputation of your enterprise.

TDS is a mechanism introduced by the Income Tax Department to collect tax at the very source of income. Whether you are paying a salary, a contractor, or rent, knowing the nuances of TDS compliance India is non-negotiable. Failing to adhere to these norms can lead to hefty penalties, disallowed expenses, and stressful legal notices.

In this comprehensive guide, we will break down the complexities of TDS compliance India into actionable insights. We will explore the rates, the filing process, and the critical mistakes to avoid, ensuring your business remains compliant and audit-ready.

Why TDS Compliance India is Crucial for Your Business

Understanding the importance of TDS compliance India is the first step toward financial discipline. The government relies on TDS to prevent tax evasion and ensure a steady stream of revenue throughout the year. For a business, acting as a deductor is a fiduciary responsibility entrusted by the state.

When a business adheres to TDS compliance India, it signals operational efficiency and transparency. Conversely, negligence can trigger a domino effect of financial setbacks. For instance, if you fail to deduct tax or deposit it on time, the expense associated with that payment may be disallowed under Section 40(a)(ia) of the Income Tax Act. This effectively increases your taxable income, leading to a higher tax outflow than anticipated.

Moreover, in the broader business compliance landscape, maintaining a clean TDS record is vital for safeguarding your credit rating and business valuation.

The Core Objectives of TDS

The system is designed with specific goals that benefit the economy:

- Prevention of Tax Evasion: By collecting tax at the time of payment, the government captures income trails effectively.

- Widening the Tax Base: It brings more people into the tax net who might otherwise not file returns.

- Steady Revenue Flow: It provides the government with funds throughout the year rather than waiting for year-end assessments.

Key Components of Successful TDS Compliance India

To navigate TDS compliance India effectively, you must be familiar with the specific sections of the Income Tax Act that apply to your transactions. Different payments attract different rates and threshold limits.

Section 192: Salaries

Applicable to employers paying salaries. Tax is deducted based on the employee’s estimated income tax slab for the financial year. There is no specific flat rate; it depends on total income.

Section 194C: Contractors

Applicable for payments to contractors/sub-contractors. The rate is 1% for individual/HUF deductees and 2% for others. This covers advertising, catering, transport, and labor contracts.

Section 194J: Professional Fees

Covers fees for professional or technical services. The standard rate is 10%. However, for technical services (since 2020) and call centers, the rate is often reduced to 2%.

Section 194Q: Purchase of Goods

Applicable when purchase value exceeds ₹50 Lakhs in a year. The buyer must deduct TDS at 0.1% of the sum exceeding ₹50 Lakhs. Crucial for large trading businesses.

It is important to consult the official Income Tax Department website or a tax professional for the most current rates, as these are subject to change during the annual Union Budget.

Mastering the TDS Compliance India Process: A Step-by-Step Guide

Achieving flawless TDS compliance India requires a systematic approach. It is not just about deducting the money; it is about the entire lifecycle of that deduction.

1. Obtain a TAN (Tax Deduction and Collection Account Number)

Before you can deduct tax, you must have a TAN. This 10-digit alphanumeric number is mandatory for all deductors. Quoting an incorrect TAN in TDS returns results in a penalty of ₹10,000.

2. Deduct Tax at the Correct Rate

Whenever an invoice is booked or a payment is made (whichever is earlier), TDS must be deducted. Ensure you are applying the correct section. For example, confusing a professional service (194J) with a contract (194C) can lead to short deduction notices.

3. Deposit the TDS (Challan 281)

Deducted tax stays with you only for a short period. It must be deposited to the government via Challan ITNS 281. The due date is usually the 7th of the following month. For the month of March, the deadline extends to April 30th.

4. File TDS Returns Quarterly

Depositing the tax isn’t enough; you must tell the government whose tax you deducted. This is done by filing quarterly returns (Form 24Q for salaries, Form 26Q for non-salaries). Late filing attracts a fee of ₹200 per day under Section 234E.

5. Issue TDS Certificates

After filing, you must issue certificates to the deductees (Form 16 for employees, Form 16A for vendors). This serves as proof that their tax has been paid, allowing them to claim credit when they file their income tax returns.

Common Pitfalls in TDS Compliance India to Watch Out For

Even seasoned accountants can slip up. Here are common errors that disrupt TDS compliance India:

- Non-deduction due to ignorance: Assuming a transaction doesn’t attract TDS without verification.

- Late Payment: Missing the 7th of the month deadline results in interest at 1.5% per month.

- PAN Errors: If the deductee does not provide a valid PAN, TDS must be deducted at a flat rate of 20% (or the applicable rate, whichever is higher). Failing to do this is a major compliance gap.

- Mismatch in Returns: If the data in your TDS return doesn’t match the Challan deposited, the system will generate a default notice.

For businesses structured as LLPs, integrating these checks with your annual filing requirements ensures a holistic approach to regulatory adherence.

Consequences of Non-Compliance with TDS Regulations

The Income Tax Department has become increasingly vigilant regarding TDS compliance India. The digitization of tax records means discrepancies are flagged almost instantly.

Interest on Late Payment

If you deduct but don’t pay, interest is charged at 1.5% per month. If you fail to deduct entirely, interest is 1% per month from the date it was deductible.

Late Filing Fees

Under Section 234E, a mandatory fee of ₹200 per day continues until the return is filed. This cannot be waived.

Penalty (Section 271H)

For failure to file returns within a year of the due date, penalties can range from ₹10,000 to ₹1,00,000.

Prosecution

In severe cases of rigorous non-compliance, particularly where tax is deducted but used for business purposes instead of being deposited, the person responsible can face rigorous imprisonment.

How Automation Enhances TDS Compliance India

In the modern digital era, relying on manual spreadsheets for TDS compliance India is risky. Automated accounting software can track threshold limits, apply the correct rates automatically, and generate Challans. This reduces human error significantly.

Furthermore, checking the status of your deductee’s PAN is crucial. Tools provided by NSDL (Protean) allow businesses to verify if a PAN is operative. This is particularly relevant given recent rules linking PAN with Aadhaar; inoperative PANs attract higher TDS rates.

Conclusion

Navigating TDS compliance India is a continuous process that requires diligence, awareness, and punctuality. It is not merely a statutory obligation but a reflection of your business’s governance standards. By obtaining a TAN, adhering to deduction schedules, filing timely returns, and utilizing technology, you can insulate your business from punitive actions and financial loss.

Remember, in the realm of tax, ignorance is never an excuse. Stay updated, stay compliant, and let your business thrive on a foundation of financial integrity.

FAQs

If you fail to deduct TDS, you are liable to pay interest at 1% per month from the date the tax was deductible until the date it is actually deducted. Additionally, the expense may be disallowed for tax purposes.

Generally, individuals are not required to deduct TDS unless they are liable for a tax audit. However, specific sections like 194IB (Rent > ₹50k/month) and 194M require individuals to deduct tax even without a TAN.

You can view your Form 26AS by logging into the Income Tax e-filing portal. This form reflects all TDS deducted and deposited against your PAN.

Form 24Q is used for filing TDS returns on salaries (Section 192), while Form 26Q is used for all other payments like professional fees, interest, rent, and contractor payments.

Yes, if you notice errors in your filed return, you can file a correction statement (revised return) to rectify details like PAN, challan amounts, or deduction amounts.