In the dynamic landscape of Indian taxation, the Goods and Services Tax (GST) introduced a seamless flow of tax credits to eliminate the cascading effect of taxes. At the heart of this system lies the concept of input tax credit GST. For businesses, understanding ITC is not just about compliance; it is a vital strategy for managing working capital and reducing costs. If you are running a business, the tax you pay on purchases can effectively be subtracted from the tax you owe on sales, provided you follow the rules diligently.

However, the path to claiming this credit is paved with specific conditions, time limits, and restrictions. Many businesses lose money simply because they miss a deadline or misunderstand a clause under Section 17(5). This comprehensive guide will walk you through the critical rules, documentation, and strategies to ensure you never miss out on a valid input tax credit GST claim.

What is Input Tax Credit GST and Why It Matters

Input Tax Credit (ITC) is the backbone of the GST regime. Simply put, it is the tax you pay when purchasing goods or services for your business. When you sell your own goods or services, you collect tax from your customers. The government allows you to adjust the tax you paid on your purchases (Input Tax) against the tax you have collected on sales (Output Tax). You only pay the balance liability to the government.

For example, if you are a manufacturer who bought raw materials worth ₹1,00,000 attracting a GST of ₹18,000, and you sold the finished product for ₹1,50,000 attracting a GST of ₹27,000, you don’t pay the full ₹27,000. You can claim the input tax credit GST of ₹18,000 and pay only the difference (₹9,000). This mechanism ensures that tax is levied only on value addition.

4 Mandatory Eligibility Conditions for Input Tax Credit GST

According to Section 16 of the CGST Act, claiming ITC is not an automatic right; it is a conditional benefit. To successfully avail of the input tax credit GST, a registered dealer must satisfy four fundamental conditions. Failing to meet even one of these can lead to the denial of credit and potential penalties.

Before you start claiming, ensure you have completed your registration. For those new to the ecosystem, understanding the basics is key. You can read more about getting started with GST registration to ensure your foundation is solid.

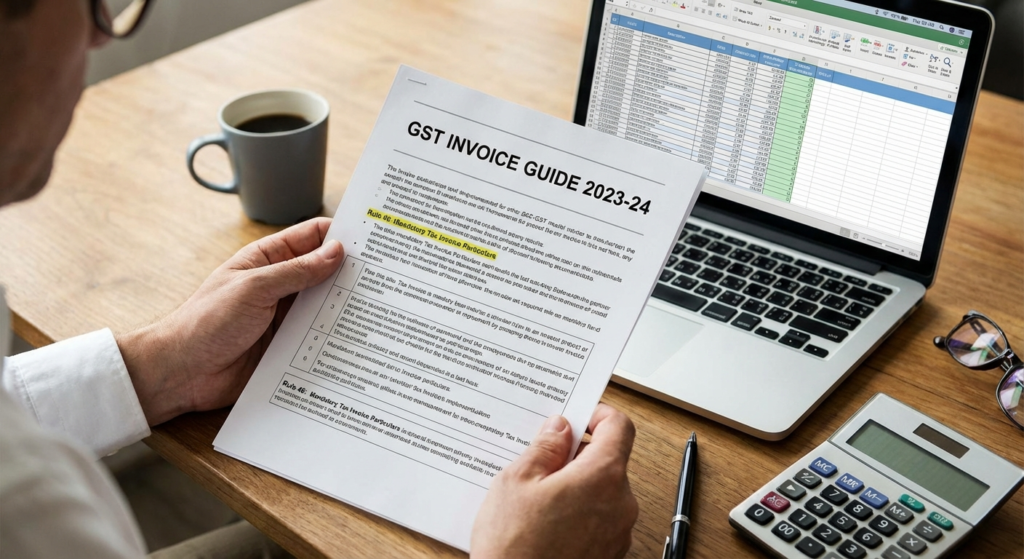

1. Possession of Tax Invoice

You must hold a valid tax invoice or debit note issued by a registered supplier. This document is the primary evidence required to claim credit.

2. Receipt of Goods/Services

You must have physically received the goods or services. If goods are received in lots, credit can be claimed only upon receipt of the last lot.

3. Tax Paid to Government

The supplier must have actually paid the tax charged to the government, either in cash or through their own ITC utilization.

4. Filing of Returns

You must have filed your GST returns (GSTR-3B). Unfiled returns mean the system cannot validate your claim.

The Critical Role of GSTR-2B in Input Tax Credit GST

Gone are the days when businesses could claim ITC based solely on their physical invoices. The introduction of GSTR-2B has revolutionized the process. GSTR-2B is an auto-drafted statement that reflects the ITC available to you based on the returns filed by your suppliers (GSTR-1/IFF).

Currently, you can only claim input tax credit GST if the invoice details appear in your GSTR-2B. If your supplier delays filing their return or misses uploading an invoice, you cannot claim that credit in the current month. This makes vendor compliance management a crucial part of your accounting process.

Impact of Vendor Non-Compliance on Input Tax Credit GST

If a vendor fails to upload invoices, your working capital gets blocked. It is advisable to withhold payments of the GST component to vendors until the invoices reflect in your GSTR-2B. This practice ensures that you are not paying tax out of pocket that you cannot immediately claim back from the government.

Understanding Blocked Credits under Section 17(5)

Even if you meet all the eligibility criteria mentioned above, there is a specific list of goods and services on which the government explicitly restricts ITC. This is known as “Blocked Credit” under Section 17(5). Claiming input tax credit GST on these items is illegal and will invite interest and penalties during an audit.

List of Ineligible Items for Input Tax Credit GST

- Motor Vehicles: ITC is generally blocked for passenger vehicles with a seating capacity of 13 or fewer persons, unless you are in the business of selling cars, transporting passengers, or driving training.

- Food and Beverages: Expenses on food, beverages, outdoor catering, beauty treatment, and health services are blocked unless used for making an outward taxable supply of the same category.

- Personal Use: Goods or services used for personal consumption are strictly ineligible for input tax credit GST.

- Construction of Immovable Property: ITC is not available for goods/services used for the construction of immovable property (like an office building) on your own account, except for plant and machinery.

- Gifts and Free Samples: If you write off goods or give them away as gifts or free samples, you must reverse the ITC claimed on them.

For detailed legal text and official notifications regarding blocked credits, you can refer to the Central Board of Indirect Taxes and Customs (CBIC) website.

Time Limits for Availing Input Tax Credit GST

The GST law imposes a strict timeline for claiming credits. You cannot claim old credits indefinitely. According to Section 16(4), the deadline to claim input tax credit GST for a financial year is the 30th of November of the following financial year, or the date of filing the Annual Return, whichever is earlier.

For example, for invoices dated within the Financial Year 2023-24, the last date to claim ITC is 30th November 2024. If you miss this window, the credit lapses, and it becomes a direct cost to your business. This deadline highlights the importance of regular reconciliation. When preparing for your year-end filings, ensure all credits are accounted for. For a deeper dive into annual compliances, check our guide on the GST Annual Return (GSTR-9) filing process.

Reversal of Input Tax Credit GST

There are scenarios where you might have validly claimed ITC, but subsequent events require you to reverse it (pay it back). This usually happens by adding the amount to your output tax liability.

Non-Payment to Supplier (180 Days)

If you do not pay your supplier within 180 days from the date of the invoice, the ITC claimed must be reversed along with interest. You can reclaim it once payment is made.

Exempt Supplies

If you use inputs for both taxable and exempt supplies, the portion of ITC attributable to exempt supplies must be reversed under Rules 42 and 43.

Capital Goods Sale

If you sell capital goods on which ITC was taken, you must pay an amount equal to the ITC reduced by percentage points (depreciation) or the tax on transaction value, whichever is higher.

Documentation and Best Practices

To ensure your input tax credit GST claims stand the scrutiny of tax authorities, maintaining proper documentation is non-negotiable. The burden of proof lies with the taxpayer. Ensure you maintain:

- Tax Invoices: Original copies containing all mandatory particulars like GSTIN, HSN code, and tax breakout.

- Debit Notes: For any upward revision in invoice value.

- Bill of Entry: For imports of goods.

- ISD Invoice: If you are receiving credit from an Input Service Distributor.

Furthermore, regular reconciliation between your Purchase Register and GSTR-2B is essential. Automated accounting software can help highlight mismatches, allowing you to follow up with vendors before the time limit expires. For authoritative updates and to access the filing portal, always use the official GST Portal.

Conclusion

Navigating the rules of input tax credit GST can be challenging, but it is a fundamental aspect of running a tax-efficient business in India. By ensuring you meet the four eligibility conditions, avoiding blocked credits under Section 17(5), and adhering to the strict timelines, you can significantly improve your cash flow. Remember that GST is a technology-driven tax; your ability to claim credit depends heavily on your supplier’s compliance. Stay vigilant, reconcile monthly, and keep your documentation pristine to enjoy the full benefits of the Input Tax Credit system.

Frequently Asked Questions

No, you cannot claim ITC on goods or services used for personal consumption. Input tax credit is available only for goods and services used or intended to be used in the course or furtherance of business.

If your supplier does not file their GSTR-1, the invoice will not appear in your GSTR-2B. Consequently, you cannot claim the input tax credit for that invoice until the supplier files the return and it reflects in your GSTR-2B of the subsequent month.

Generally, ITC on motor vehicles for transportation of persons with a seating capacity of 13 or less is blocked under Section 17(5). Exceptions exist if you are in the business of selling cars, providing passenger transport, or driving training.

You can claim missed ITC for a financial year up to the 30th of November of the following financial year, or the date of furnishing the relevant Annual Return, whichever is earlier.

Yes, if you fail to pay your supplier the value of supply along with tax within 180 days from the date of invoice, you must reverse the ITC availed along with interest. You can re-avail the credit once the payment is made.