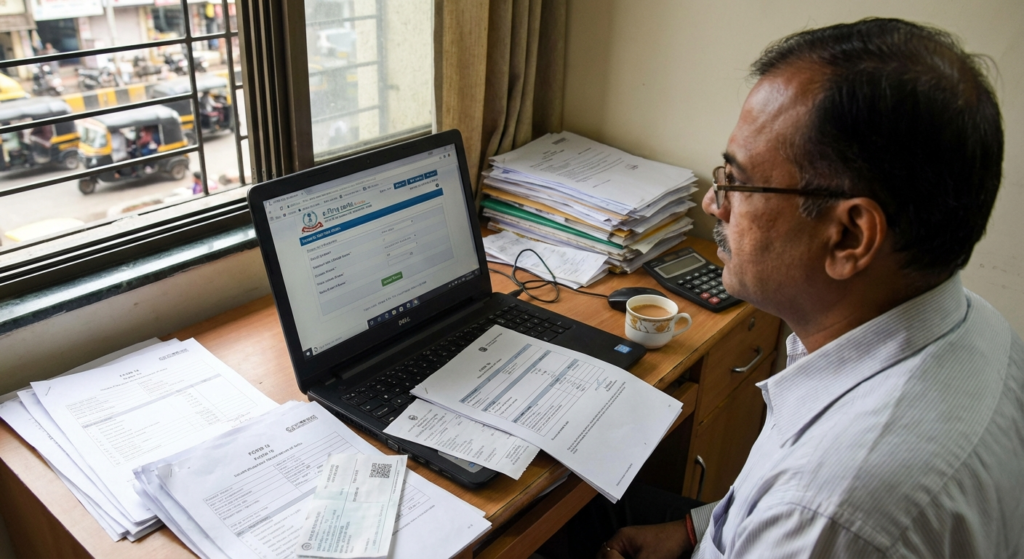

For millions of taxpayers, the tax season often brings a mix of anxiety and urgency. At the center of this financial whirlwind is one specific day that dictates your compliance status: the income tax filing due date. Whether you are a salaried individual, a freelancer, or a business owner, adhering to this deadline is not just about following the law; it is about maintaining your financial health and peace of mind.

Missing the deadline can lead to unnecessary penalties, interest accumulations, and the inability to carry forward losses. In this comprehensive guide, we will break down everything you need to know about the income tax filing due date for the Assessment Year 2024-25 (Financial Year 2023-24), ensuring you stay ahead of the curve and file your returns with confidence.

Why the Income Tax Filing Due Date is Critical

The income tax filing due date is essentially the deadline set by the government by which taxpayers must submit their Income Tax Returns (ITR). Filing on time is crucial for several reasons beyond mere compliance. It serves as proof of income for loan applications, visa processing, and claiming tax refunds.

When you file by the income tax filing due date, you avoid the hassle of notices from the tax department. Furthermore, it reflects responsible financial behavior. As experts often say, “Taxes are the price we pay for a civilized society, but filing them on time is the price we pay for a peaceful life.”

Key Benefits of Timely Filing

- Faster Refunds: Early filers often receive their tax refunds much faster than those who wait until the last minute.

- Carry Forward of Losses: If you have incurred losses in the stock market or business, you can only carry them forward if you file by the due date.

- Avoid Interest: Filing late attracts interest under Section 234A at 1% per month on the unpaid tax amount.

Categorization of Income Tax Filing Due Date by Taxpayer

Not everyone shares the same deadline. The Income Tax Act classifies taxpayers into different categories, assigning a specific income tax filing due date to each. Understanding which category you fall into is the first step toward compliance.

Individuals & HUF

Date: July 31st

For salaried employees, non-audit businesses, and freelancers whose accounts do not require auditing.

Audit Required

Date: October 31st

For businesses and working partners of a firm whose accounts are required to be audited under the Income Tax Act.

Transfer Pricing

Date: November 30th

For taxpayers who are required to furnish a report under Section 92E regarding international transactions.

For the vast majority of individual taxpayers, the income tax filing due date is July 31st of the assessment year. It is vital to mark this date on your calendar to avoid the last-minute rush that often leads to errors in filing.

Consequences of Missing the Income Tax Filing Due Date

What happens if life gets in the way and you miss the deadline? The Income Tax Department has stringent rules for late filings. Missing the income tax filing due date triggers a series of consequences that can be financially draining.

1. Late Filing Fees (Section 234F):

If you file after the due date but before December 31st, a penalty of up to ₹5,000 can be levied. However, for small taxpayers with a total income typically below ₹5 lakh, this penalty is capped at ₹1,000.

2. Penal Interest (Section 234A):

Apart from the penalty, if you have any unpaid tax liability, you will be charged simple interest at 1% per month or part of a month for the delay in filing the return of income.

3. Loss of Carry Forward Benefits:

Perhaps the most significant hidden cost of missing the income tax filing due date is the inability to carry forward losses (except house property loss). This can impact your tax planning for future years significantly.

How to Prepare Before the Income Tax Filing Due Date Arrives

Preparation is key to a smooth filing experience. Waiting until the week of the income tax filing due date often results in panic because certain documents might be missing or portals might be slow due to high traffic.

To ensure you are ready, start by gathering all necessary financial statements. For a detailed breakdown of what you need, you can refer to our ITR documents checklist. Having these ready beforehand streamlines the process significantly.

Additionally, ensure your identity documents are in order. If you do not have a Permanent Account Number yet, or need to update it, it is essential to apply for a PAN card well in advance, as it is mandatory for filing returns.

Belated Returns After the Income Tax Filing Due Date

If you have unfortunately missed the primary income tax filing due date, all is not lost. The Income Tax Department allows for the filing of a “Belated Return.” A belated return can be filed anytime before three months prior to the end of the relevant assessment year or before the completion of the assessment, whichever is earlier.

For the current assessment year, the deadline for filing a belated return is usually December 31st. While this gives you a buffer, remember that the late fees and interest mentioned earlier will still apply. It is a safety net, not a recommended strategy.

According to the Income Tax Department of India, filing a belated return also restricts you from opting for the New Tax Regime in certain cases, forcing you to stick to the Old Regime which might not be beneficial depending on your deductions.

Common Myths About the Income Tax Filing Due Date

There is a lot of misinformation circulating regarding taxes. Let’s debunk a few myths surrounding the income tax filing due date.

Myth: “I paid my taxes, so I don’t need to file.”

Fact: Paying taxes (via TDS or Advance Tax) and filing a return are two different obligations. You must file the return by the due date to declare that the taxes paid are accurate.

Myth: “The deadline always gets extended.”

Fact: While extensions happen occasionally due to technical glitches or pandemics, relying on an extension is risky. The government has been strict about adhering to the income tax filing due date in recent years.

Strategic Tips for Business Owners

For business owners, the stakes are higher. The income tax filing due date for businesses requiring audits is generally October 31st. However, this does not mean you should wait until October to finalize your accounts. The audit process takes time, and chartered accountants are extremely busy during this period.

Effective tax planning involves reviewing your financials quarterly. By keeping your books updated, you ensure that when the income tax filing due date approaches, your audit report can be filed smoothly without a last-minute scramble to find invoices or reconcile bank statements.

Conclusion

The income tax filing due date is a critical milestone in your financial calendar. It is not merely a bureaucratic requirement but a gateway to financial discipline and legal compliance. Whether you are an individual filer aiming for July 31st or a business targeting October 31st, the key to success is early preparation.

By understanding the deadlines, penalties, and procedures outlined in this guide, you can navigate the tax season with ease. Remember, filing on time protects you from penalties, allows you to carry forward losses, and speeds up your refund process. Don’t wait for the deadline to knock on your door—start your preparations today. For more detailed insights on economic policies affecting your taxes, sources like The Economic Times Wealth offer excellent daily updates.

Frequently Asked Questions (FAQs)

The due date for salaried individuals and taxpayers whose accounts do not require auditing is July 31, 2024.

Yes, you can file a Belated Return up to December 31st of the assessment year, but it attracts late filing fees under Section 234F and penal interest on unpaid taxes.

Yes, even if you have no tax payable, a late filing fee can still be levied if your income is above the basic exemption limit. It is mandatory to file if your gross total income exceeds the exemption limit.

A Revised Return can be filed if you discover an error in your original return. The deadline for filing a Revised Return is also December 31st of the relevant assessment year.

Banks require the last 2-3 years of ITRs to process loans. Filing by the due date ensures your ITR generated is a ‘valid’ return filed under Section 139(1), which increases your credibility with lenders.