The gig economy in India is witnessing an unprecedented boom. From graphic designers and content writers to software developers and consultants, more professionals are ditching the 9-to-5 grind for the flexibility of self-employment. However, with this freedom comes the complex responsibility of managing your own finances. Understanding freelancing tax implications India is not just about compliance; it is about maximizing your earnings and avoiding hefty penalties from the Income Tax Department.

Unlike salaried employees who have their taxes deducted at source and handled largely by their employers, freelancers are essentially micro-entrepreneurs. You are responsible for calculating your liability, filing your returns, and paying advance tax. Whether you are a seasoned independent contractor or just starting out, navigating the maze of freelancing tax implications India is the first step toward financial stability.

Understanding the Basics of Freelancing Tax Implications India

In the eyes of the Income Tax Act, 1961, income earned through freelancing is classified as “Profits and Gains from Business or Profession.” This is distinct from “Income from Salary.” As a freelancer, you are considered a sole proprietor unless you have registered a separate legal entity like an LLP or a Private Limited Company. This means your personal income and your business income are treated as one for tax purposes, but you get the benefit of deducting business expenses.

The core of freelancing tax implications India revolves around two major types of taxes:

- Direct Tax (Income Tax): Tax paid directly on the income you earn.

- Indirect Tax (GST): Tax collected from clients and deposited with the government if your turnover exceeds a specific limit.

Income Tax Slabs and Filing Methods

Freelancers are taxed according to the same slab rates as individual salaried taxpayers. If your total income exceeds the basic exemption limit (currently ₹2.5 Lakhs for the old regime or ₹3 Lakhs for the new regime), you are liable to pay tax. However, the method of calculating this income is where the strategy lies.

The Presumptive Taxation Scheme (Section 44ADA)

For many professionals, the complexities of maintaining detailed books of accounts can be overwhelming. To simplify freelancing tax implications India, the government introduced Section 44ADA. This is a game-changer for freelancers engaged in specified professions (like IT, legal, medical, engineering, architectural, accountancy, technical consultancy, and interior decoration).

Normal Taxation Scheme

Under this method, you calculate your taxable income by subtracting all actual business expenses (rent, internet, travel) from your gross receipts. You must maintain detailed books of accounts and proof of every expense.

Presumptive Scheme (44ADA)

You can simply declare 50% of your gross receipts as your income. The remaining 50% is assumed to be your expense. No need to maintain detailed books or audit accounts if your gross receipts are up to ₹75 Lakhs (enhanced limit subject to cash receipt conditions).

Choosing Section 44ADA significantly reduces the compliance burden associated with freelancing tax implications India. However, if your actual expenses are more than 50%, opting for the normal scheme might be more beneficial.

GST Registration and Freelancing Tax Implications India

Goods and Services Tax (GST) is another critical component. Many freelancers are confused about whether they need to register. The general rule is based on your aggregate turnover.

- Inter-state Supply: Earlier, inter-state supply required mandatory registration. However, relief was provided for service providers with a turnover up to ₹20 Lakhs.

- Turnover Limit: If your total revenue from freelancing exceeds ₹20 Lakhs in a financial year (₹10 Lakhs for special category states), GST registration is mandatory.

Once registered, you must issue GST-compliant invoices. To ensure you are doing this correctly, it is vital to understand the GST invoice format requirements. Proper invoicing not only keeps you compliant but also projects professionalism to your clients.

Do Freelancers Need to Pay GST on Foreign Clients?

This is a major aspect of freelancing tax implications India for those working on platforms like Upwork or Fiverr. Export of services is generally treated as a “Zero-Rated Supply.” This means you do not have to charge GST to your foreign clients, provided you have a Letter of Undertaking (LUT). Without an LUT, you might have to pay IGST and claim a refund later. Always file your LUT at the start of the financial year to ensure smooth cash flow.

TDS: The Hidden Cash Flow Impact

Tax Deducted at Source (TDS) is often a surprise for new freelancers. Under Section 194J of the Income Tax Act, clients (other than individuals/HUFs not liable for tax audit) must deduct TDS at 10% (or 2% in some technical services cases) if the payment exceeds ₹30,000 in a year.

This deducted amount is not a cost; it is tax paid on your behalf. You can claim this against your final tax liability when filing your ITR. If your total tax liability is lower than the TDS deducted, you can claim a refund. In scenarios where your income is below the taxable limit, knowing the difference between Form 15G and Form 15H can be useful to request clients not to deduct TDS, although this is more common for interest income.

Deductible Expenses to Lower Your Taxable Income

If you are not opting for the Presumptive Taxation Scheme, maximizing your deductions is key to managing freelancing tax implications India effectively. Since you are running a business, expenses incurred to earn that revenue are deductible.

Office Expenses

Rent for your workspace, electricity bills, and internet charges. If working from home, a proportionate amount can be claimed.

Depreciation

Wear and tear on assets like laptops, printers, cameras, and office furniture used for your work.

Professional Fees

Domain hosting, software subscriptions (Adobe, Zoom), and fees paid to other freelancers or consultants.

Client Meetings

Meal and travel expenses strictly incurred for meeting clients can be claimed (keep the bills!).

Advance Tax: Don’t Wait Until March

A common misconception regarding freelancing tax implications India is that taxes are paid only when filing the return. If your total tax liability for the year exceeds ₹10,000, you are required to pay Advance Tax. This is paid in four installments (June, September, December, and March). Failure to pay advance tax results in interest penalties under Sections 234B and 234C. Keeping track of your quarterly earnings is essential to estimate this liability accurately.

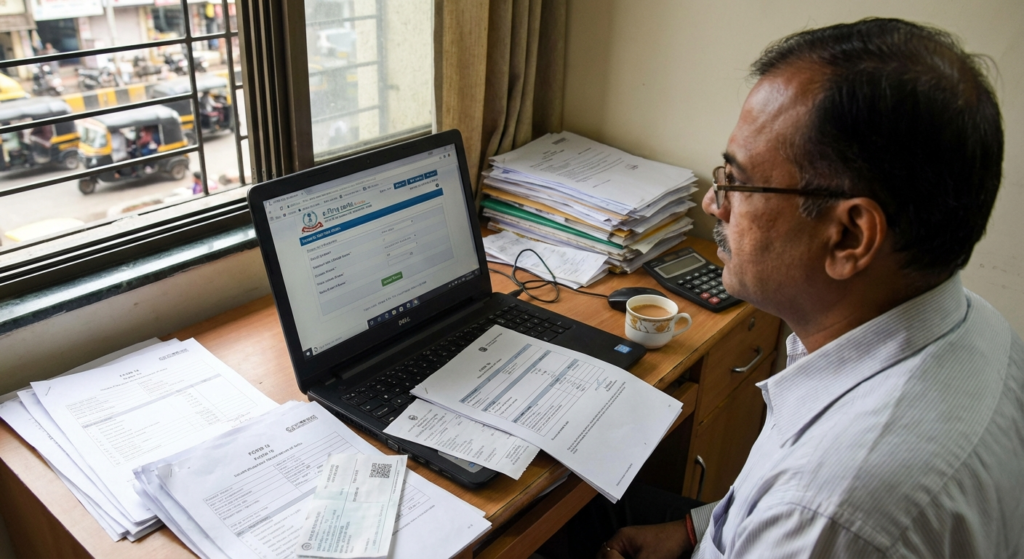

Choosing the Right ITR Form

Filing the correct Income Tax Return form is the final step in the cycle. Using the wrong form can lead to a defective return notice.

- ITR-3: Applicable if you have income from business or profession and are not opting for presumptive taxation (claiming actual expenses).

- ITR-4 (Sugam): Applicable if you are opting for the Presumptive Taxation Scheme under Section 44ADA. This form is much simpler and requires less data entry.

For more detailed guidelines on tax filings and compliance, you can refer to the Income Tax Department of India website.

Strategic Financial Planning for Freelancers

Addressing freelancing tax implications India goes beyond just paying the government. It involves strategic investment. Utilize Section 80C deductions (PPF, ELSS, LIC) to reduce your taxable income by up to ₹1.5 Lakhs. Additionally, buying health insurance allows for deductions under Section 80D. Since freelancers do not have employer-provided cover, this is a dual benefit of safety and tax saving.

Furthermore, staying updated with global finance trends is helpful. For instance, understanding concepts like the Reserve Bank of India regulations regarding foreign inward remittances is crucial if you have international clients, as you need a FIRC (Foreign Inward Remittance Certificate) to prove the income is from exports.

Conclusion

Mastering freelancing tax implications India transforms you from a gig worker into a business owner. By understanding Section 44ADA, registering for GST when necessary, and filing your Advance Tax on time, you can operate stress-free. Remember, tax planning is legal and smart; tax evasion is illegal and costly. Start maintaining your digital records today, separate your personal and business finances, and consult a Chartered Accountant if your finances get complex. Your financial discipline today will define your business growth tomorrow.

FAQs

Technically, income up to ₹2.5 Lakhs (or ₹3 Lakhs under the new regime) is exempt. However, if your income is up to ₹5 Lakhs (or ₹7 Lakhs in the new regime), you can claim a rebate under Section 87A, making your tax liability zero. You should still file an ITR to claim refunds or for loan processing.

If you opt for the Presumptive Taxation Scheme (Section 44ADA), you should file ITR-4. If you wish to claim actual expenses and maintain books of accounts, or if you have capital gains, you generally need to file ITR-3.

Yes, but as a capital asset. You cannot deduct the full cost in one year. Instead, you claim depreciation (usually 40% for computers/laptops) every year, which reduces your taxable income.

No, GST registration is not mandatory if your aggregate turnover is below ₹20 Lakhs (₹10 Lakhs for specific states). However, you may voluntarily register if you want to claim Input Tax Credit or work with clients who mandate GST registration.

If your tax liability is over ₹10,000 and you fail to pay Advance Tax, you will be liable to pay interest under Sections 234B and 234C of the Income Tax Act when you finally file your return.