In the dynamic landscape of Indian finance, staying compliant with tax regulations is not just a legal obligation but a cornerstone of sound financial planning. One of the most misunderstood aspects for many taxpayers is the concept of advance tax payment India. Unlike the standard practice of paying taxes at the end of the year, the Indian Income Tax Act mandates a "pay as you earn" scheme. This ensures a steady flow of revenue for the government and reduces the financial burden of a lump-sum payment for the taxpayer at year-end.

Whether you are a salaried individual with other income sources, a freelancer, or a business owner, understanding the nuances of advance tax payment India is crucial to avoid unnecessary interest penalties under sections 234B and 234C. In this comprehensive guide, we will navigate through the eligibility criteria, critical deadlines, calculation methods, and the online payment process to help you stay ahead of your tax liabilities.

Understanding the Basics of Advance Tax Payment India

Advance tax refers to the income tax that must be paid in installments during the financial year, rather than paying it all at the end of the year. The underlying principle is simple: if you are earning income throughout the year, your tax liability should also be discharged periodically. This system helps the government maintain liquidity and helps taxpayers manage their finances better.

According to Section 208 of the Income Tax Act, 1961, any individual whose estimated tax liability for the year exceeds INR 10,000 (after deducting TDS/TCS) is liable to make advance tax payment India. This rule applies to:

- Salaried individuals (if they have significant income from interest, capital gains, or rent).

- Freelancers and professionals.

- Business owners and corporations.

However, strictly salaried employees without other income usually do not need to worry about this, as their employers deduct tax at source (TDS). The liability arises primarily when your non-salary income pushes your tax dues above the INR 10,000 threshold.

Critical Deadlines for Advance Tax Payment India

Missing deadlines is the most common reason taxpayers face penalties. The Income Tax Department has set specific due dates by which a certain percentage of your estimated tax must be paid. Adhering to this schedule is vital for compliant advance tax payment India.

Here is a visual breakdown of the installment schedule:

On or before June 15

You must pay at least 15% of your estimated annual tax liability.

On or before Sept 15

You must pay at least 45% of your estimated annual tax liability (less tax already paid).

On or before Dec 15

You must pay at least 75% of your estimated annual tax liability (less tax already paid).

On or before Mar 15

You must pay 100% of your estimated annual tax liability.

Note: For taxpayers opting for the Presumptive Taxation Scheme under Section 44AD or 44ADA, the entire 100% of advance tax can be paid in a single installment on or before March 15th.

How to Calculate Your Advance Tax Payment India Liability

Calculating your liability accurately is the first step toward compliance. Many individuals find this daunting, but it follows a logical sequence. To ensure your advance tax payment India is accurate, follow these steps:

- Estimate Total Income: Sum up income from all heads—Salary, House Property, Capital Gains, Business/Profession, and Other Sources (like interest on savings or FDs).

- Subtract Expenses: Deduct allowable expenses relevant to your business or profession.

- Apply Deductions: Subtract investments under Chapter VI-A (Section 80C, 80D, etc.).

- Calculate Tax: Apply the relevant tax slab rates to the net taxable income.

- Deduct TDS/TCS: Subtract the tax that has already been deducted at source or collected at source.

- Check Threshold: If the remaining amount exceeds INR 10,000, you are liable to pay advance tax.

For those managing complex portfolios, it is often advisable to consult resources regarding general financial planning to ensure no deductions are missed.

Exemptions: Who is Excused?

While the rules are stringent, the Income Tax Department provides relief to certain categories. Senior citizens (individuals aged 60 years or above) who do not have any income from a business or profession are exempt from paying advance tax. They can discharge their tax liability at the time of filing their Income Tax Return (ITR). This exemption eases the compliance burden on the elderly, acknowledging that their income streams (pension, interest) are generally fixed.

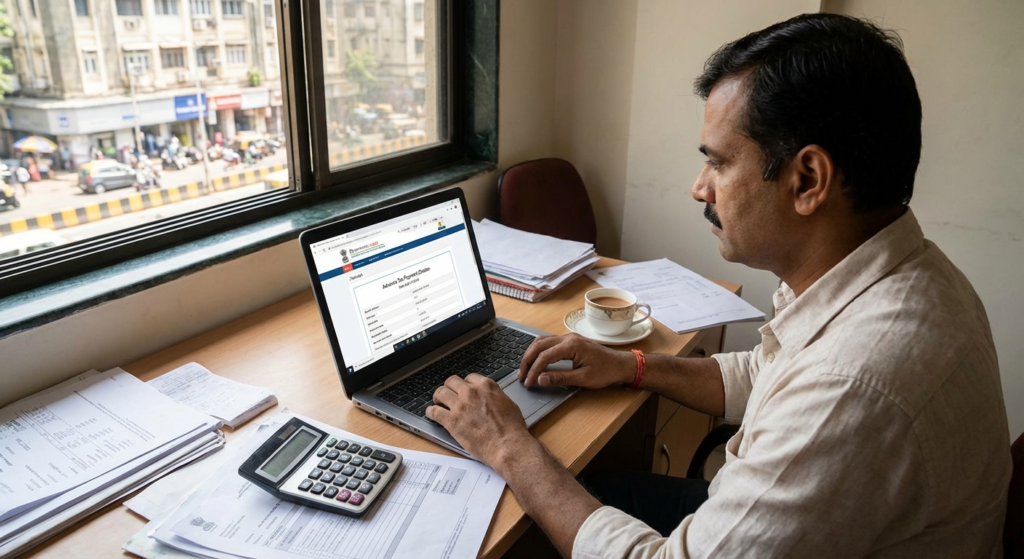

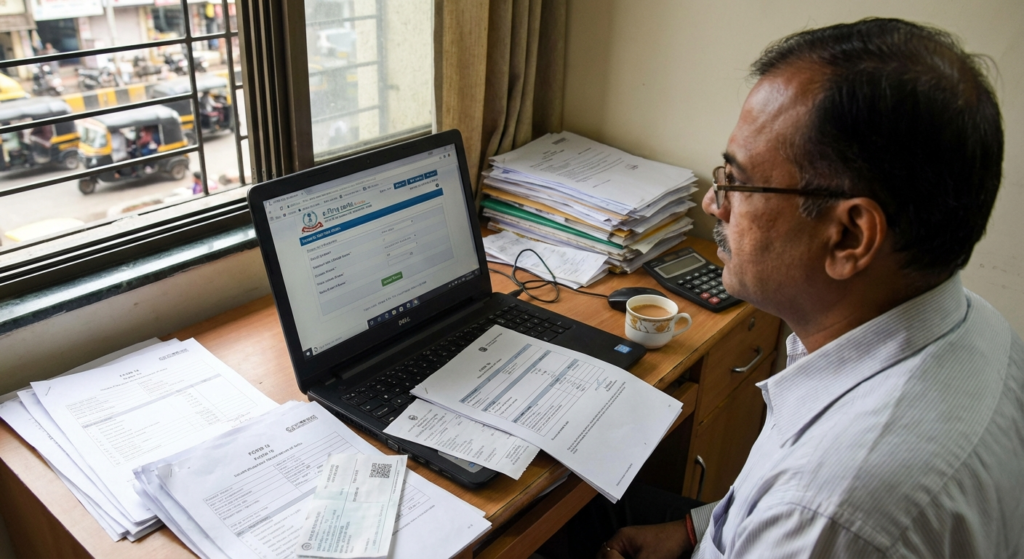

Methods to Make Advance Tax Payment India Online

Gone are the days of standing in long queues at bank branches. The Income Tax e-filing portal has streamlined the process significantly. Making an advance tax payment India is now a matter of a few clicks.

Step-by-Step Online Payment Process

- Visit the official e-filing portal and navigate to the ‘e-Pay Tax’ section.

- Enter your PAN and confirm it. Enter your mobile number for OTP verification.

- Select the ‘Income Tax’ tile and click ‘Proceed’.

- Select the Assessment Year (e.g., for FY 2024-25, select AY 2025-26).

- Under ‘Type of Payment’, select ‘Advance Tax (100)’.

- Enter the tax details and choose your payment gateway (Net Banking, Debit Card, UPI, etc.).

- Once payment is successful, download the Challan receipt for your records.

Penalties for Delaying Advance Tax Payment India

The government enforces discipline through interest penalties under Sections 234B and 234C. If you fail to adhere to the advance tax payment India schedule, these penalties can accumulate quickly.

- Section 234C: Levied if you fail to pay the required percentage of tax by the quarterly deadlines (15%, 45%, 75%, 100%). The interest is charged at 1% per month for the period of delay on the shortfall.

- Section 234B: Levied if you have paid less than 90% of your total assessed tax as advance tax by the end of the financial year (March 31). Interest is charged at 1% per month from April 1 of the assessment year until the tax is paid.

For businesses ensuring compliance, understanding these penalties is as critical as understanding GST annual returns, as both impact the entity’s financial health.

Strategies to Manage Tax Cash Flows

Managing liquidity for tax payments requires foresight. Here are some strategies to ensure you are never caught off guard:

Recurring Deposits

Open a recurring deposit specifically for tax purposes. Estimate your annual liability and divide it by 12. This ensures the money is available when the quarterly deadline hits.

Conservative Estimates

When in doubt about capital gains or variable income, it is safer to overestimate slightly and claim a refund later than to underestimate and pay interest penalties.

Quarterly Reviews

Review your P&L statement every quarter before the installment date. Adjust your payment based on actual income earned rather than just projections.

Special Considerations for Capital Gains

Capital gains (from the sale of stocks, property, or mutual funds) are often hard to predict. The Income Tax Act provides a relaxation here. If you incur capital gains after a specific installment date, you are not penalized for not paying advance tax on that amount in previous quarters, provided you pay the tax in the remaining installments or by March 15th.

For more detailed insights on tax laws, you can refer to the official Income Tax India website.

Conclusion

Navigating the rules of advance tax payment India does not have to be overwhelming. By understanding your income flow, keeping track of the four major deadlines (June, September, December, and March), and utilizing online payment facilities, you can ensure full compliance. Remember, paying advance tax is not just about avoiding penalties; it is about contributing to the nation’s development in a timely manner while maintaining your own financial peace of mind. Stay proactive, calculate wisely, and pay on time.

Frequently Asked Questions

If you pay more advance tax than your final tax liability, the Income Tax Department will refund the excess amount when you file your Income Tax Return (ITR). You may also earn interest on this refund under Section 244A.

Technically you can, but you will be liable to pay interest under Section 234C for deferring the payments due in June, September, and December. It is financially wiser to follow the quarterly schedule.

Yes, Non-Resident Indians (NRIs) are liable to pay advance tax if they have income accruing in India exceeding INR 10,000 in a financial year.

Yes, winnings from lotteries, crossword puzzles, and similar games are subject to tax. However, tax is usually deducted at source (TDS) at a flat rate. If your liability exceeds the TDS deducted, you must pay the balance as advance tax.

If you make a mistake in the challan (like selecting the wrong Assessment Year), you can approach your bank for correction within 7 days. After that, you may need to contact the assessing officer or correct it while filing your ITR.