Starting a business is often seen as a solitary pursuit, but the truth is that some of the world's most successful ventures were built by dynamic duos and teams. If you are planning to start a business with one or more partners, structuring your entity correctly is the first step toward long-term success. While Limited Liability Partnerships (LLPs) and Private Limited Companies gain a lot of traction, the traditional partnership model remains a favorite for small to medium-sized businesses due to its simplicity and ease of formation.

However, operating without a formal structure can lead to disputes and legal hurdles down the road. This is where partnership firm registration India becomes crucial. Although registration is optional under the Indian Partnership Act, 1932, the benefits of registering your firm far outweigh the convenience of skipping it. From legal protection to the ability to enforce contracts, a registered firm holds significantly more weight in the commercial ecosystem.

In this comprehensive guide, we will walk you through everything you need to know about partnership firm registration India, ensuring your venture is built on a solid legal foundation.

Understanding Partnership Firm Registration India

A partnership firm is a popular business structure where two or more individuals come together to manage a business and share its profits and losses according to a pre-agreed ratio. In India, this is governed by the Indian Partnership Act, 1932. The individuals who own the partnership are individually called "partners," and collectively, they are known as the "firm."

When we talk about partnership firm registration India, we refer to the process of recording the firm’s existence with the Registrar of Firms (RoF) of the respective state where the business is located. While you can technically run a partnership firm without registration (known as an unregistered firm), doing so restricts your legal rights significantly.

Registered vs. Unregistered Firms

Many entrepreneurs ask, "Is it mandatory to register?" The answer is no, but it is highly recommended. An unregistered firm is like a car without insurance; it works fine until something goes wrong. If disputes arise between partners or with a third party, an unregistered firm finds itself legally handicapped.

Why Partnership Firm Registration India is Essential

To truly understand why you should go through the partnership firm registration India process, you must look at the disadvantages of remaining unregistered. The law disables unregistered firms from filing suits against third parties or even against their own partners in a court of law. To visualize the advantages, let’s look at the key benefits.

Legal Capacity to Sue

Only a registered firm can file a case against third parties for breach of contract. Unregistered firms cannot enforce their claims in court, though third parties can still sue them.

Dispute Resolution

Registration allows partners to file suits against each other or the firm to enforce rights arising from the partnership deed. This is vital for internal conflict resolution.

Credibility & Loans

Banks and financial institutions prefer lending to registered entities. Partnership firm registration India acts as a proof of existence, making it easier to open bank accounts and secure credit.

Documents Required for Partnership Firm Registration India

The documentation process is the backbone of partnership firm registration India. Ensuring you have the correct paperwork ready can save weeks of back-and-forth with the Registrar. The documents serve as proof of the identity of the partners and the physical existence of the business.

Documents of Partners

- Identity Proof: Self-attested copies of PAN Cards (Mandatory) and Aadhar Cards/Voter IDs/Passports of all partners.

- Address Proof: Recent bank statements, electricity bills, or telephone bills driving license of the partners.

- Passport-sized Photographs: Usually, two recent photos of each partner are required.

Documents of the Firm

- Proof of Principal Place of Business: If the property is owned, a property tax receipt or electricity bill. If rented, a rent agreement along with a No Objection Certificate (NOC) from the landlord.

- Partnership Deed: The most critical document, printed on stamp paper of appropriate value (varies by state) and signed by all partners.

Step-by-Step Process for Partnership Firm Registration India

Navigating the bureaucracy can be daunting, but breaking it down into steps makes it manageable. Here is the detailed procedure for partnership firm registration India.

Step 1: Choosing a Unique Name

The first step is selecting a name for your firm. The name should not be identical or deceptively similar to an existing firm doing the same business. Unlike companies where you might use a formal company name reservation principles, partnership naming is slightly more flexible but still requires due diligence to avoid trademark infringement. Ensure the name does not contain words like “Crown,” “Emperor,” or “Empire” which imply government sanction unless authorized.

Step 2: Drafting the Partnership Deed

The Partnership Deed is the constitution of your firm. It outlines the rules of engagement between partners. A well-drafted deed prevents future conflicts. It must include:

- Name and address of the firm and partners.

- Nature of the business.

- Date of commencement of business.

- Capital contribution by each partner.

- Profit and loss sharing ratio.

- Salaries or interest on capital payable to partners.

Step 3: Execution of the Deed

Once drafted, the deed must be printed on non-judicial stamp paper. The value of the stamp paper depends on the capital contribution and the state in which the firm is located. All partners must sign the deed in the presence of witnesses.

Step 4: Application to the Registrar of Firms

For partnership firm registration India, you must file an application in Form 1 with the Registrar of Firms of your jurisdiction. This application includes the firm’s details and partners’ information. This is often accompanied by an affidavit verifying the details.

Step 5: Payment of Fees and Approval

Pay the requisite government fees. Once the Registrar is satisfied with the documents and the application, they will enter the firm’s name into the Register of Firms and issue a Certificate of Registration. This certificate is conclusive proof that the firm has undergone partnership firm registration India.

Post-Registration Compliances

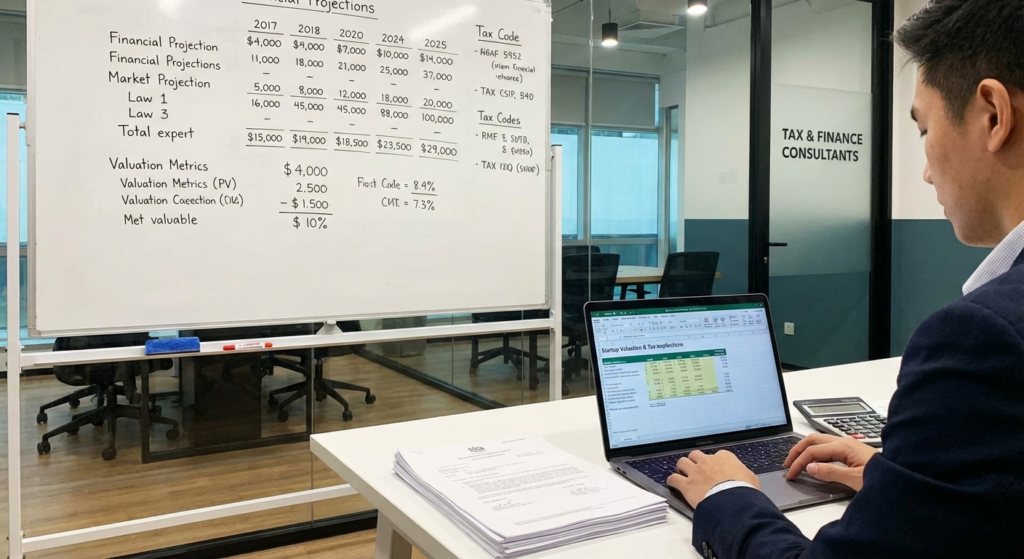

Receiving your certificate is a milestone, but the journey doesn’t end there. A registered partnership firm must adhere to various tax and regulatory compliances to operate smoothly.

PAN and TAN Application

Immediately after registration (or even with just the notarized deed), the firm must apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN). The firm is a separate legal entity for tax purposes.

GST Registration

If your turnover exceeds the threshold limit (usually ₹20 lakhs or ₹40 lakhs depending on the state and nature of business) or if you are involved in interstate trade, you must obtain GST registration. For more insights on taxation for sellers, you can read about specific tax implications in our guide on GST for eCommerce sellers.

Taxation and TDS

Partnership firms are taxed at a flat rate (currently 30% plus cess). Additionally, the firm must deduct tax at source (TDS) when making specific payments. For instance, if the firm hires consultants, understanding TDS on professional fees is essential to avoid penalties.

Common Mistakes to Avoid During Registration

Even with a straightforward process, errors can cause delays in partnership firm registration India. Here are common pitfalls:

Incomplete Documentation

Failing to notarize the partnership deed or missing the NOC from the landlord are frequent reasons for rejection.

Incorrect Stamp Duty

Using stamp paper of insufficient value renders the deed legally weak and can lead to penalties during registration.

Vague Business Objectives

The Registrar requires a specific description of the business activity. Terms like “general trading” are often rejected without specifics.

Conclusion

Completing the partnership firm registration India process is a vital step for any serious business venture involving multiple owners. It transforms a casual agreement into a legally recognized entity capable of enforcing rights and building market credibility. While the process involves drafting deeds, visiting the Registrar, and handling paperwork, the security it provides to your business assets and personal interests is invaluable.

By following the steps outlined in this guide—from choosing a unique name to obtaining your final certificate—you set your venture on a path of compliance and growth. For detailed statutory provisions, you can always refer to the Indian Partnership Act, 1932 on India Code or visit the Ministry of Corporate Affairs for related corporate guidelines.

FAQs

No, registration is not mandatory under the Indian Partnership Act, 1932. However, it is highly advisable because unregistered firms cannot sue third parties to enforce rights, whereas third parties can still sue the firm.

The timeline varies by state. Generally, it takes between 10 to 15 days after the submission of the application and documents to the Registrar of Firms, provided all paperwork is in order.

Yes, many states in India, such as Maharashtra and Tamil Nadu, have moved the process online. You can upload documents and pay fees via the respective state’s Registrar of Firms portal.

The cost includes the government fee (which varies by state, typically ranging from ₹1,000 to ₹3,000) and the cost of stamp paper for the deed. Professional fees for drafting the deed and filing will be extra.

Yes, as your business grows, you can convert a registered partnership firm into a Private Limited Company or an LLP under the provisions of the Companies Act, 2013, to enjoy limited liability and better funding opportunities.