Securing funding is often the most exhilarating phase of a startup’s journey. It validates your idea, fuels growth, and signals market confidence. However, amidst the champagne toasts and term sheets, there lurks a complex financial hurdle that many founders overlook until it is too late: the startup valuation tax. Understanding how the taxman views your company’s worth is just as important as convincing investors of it.

In the evolving landscape of tax laws, particularly in jurisdictions like India, the difference between the price an investor pays and the "Fair Market Value" (FMV) determined by tax authorities can lead to hefty tax bills. This phenomenon, often termed "Angel Tax," turns capital receipts into taxable income. In this comprehensive guide, we will dissect the nuances of startup valuation tax, exploring how it affects your fundraising, the methods to calculate FMV, and strategies to ensure compliance without stifling your growth.

Understanding the Startup Valuation Tax Landscape

The core of the startup valuation tax issue lies in the discrepancy between commercial valuation and tax valuation. Commercial valuation is driven by potential, market sentiment, and negotiation power. Tax valuation, however, is grounded in specific formulas prescribed by law. When a startup issues shares to investors at a premium (a price higher than the face value), tax authorities scrutinize whether this premium is justified.

If the tax department deems the share price to exceed the Fair Market Value (FMV), the excess amount is treated as "income from other sources" and taxed accordingly. This is the fundamental premise of startup valuation tax under regulations like Section 56(2)(viib) of the Income Tax Act in India. The intent is to curb money laundering, but genuine startups often get caught in the crossfire.

Founders must realize that a high valuation on paper for PR purposes might trigger a startup valuation tax notice if it isn’t backed by a robust valuation report from a Merchant Banker or Chartered Accountant.

The Mechanics of Section 56(2)(viib) and Startup Valuation Tax

Section 56(2)(viib) is the primary legislative tool governing startup valuation tax. Historically known as the "Angel Tax," it applies when a privately held company issues shares to residents (and recently extended to non-residents in certain contexts) at a price exceeding the FMV.

For example, if your share’s face value is $10, and you raise funds at $100 per share based on future projections, the $90 premium is scrutinized. If the tax-determined FMV is only $60, the difference of $40 per share is treated as income. This phantom income is taxed at the corporate tax rate, leading to a significant cash flow hit. This startup valuation tax can effectively erode a significant portion of the capital you just raised.

It is crucial to note that startups registered with the Department for Promotion of Industry and Internal Trade (DPIIT) may be exempt from this provision, provided they meet specific criteria. For smaller entities, ensuring you have the right registrations is key. You might want to explore MSME registration regarding small business benefits which often complement startup exemptions.

The Taxable Event

The tax is triggered only when shares are issued. Secondary transfers (investors selling to other investors) generally attract Capital Gains Tax, not the Section 56(2)(viib) startup valuation tax.

The Rate of Tax

The differential amount (Investment Price minus FMV) is added to the company’s income. The tax rate is usually the effective corporate tax rate (approx 25% to 30% plus surcharge/cess).

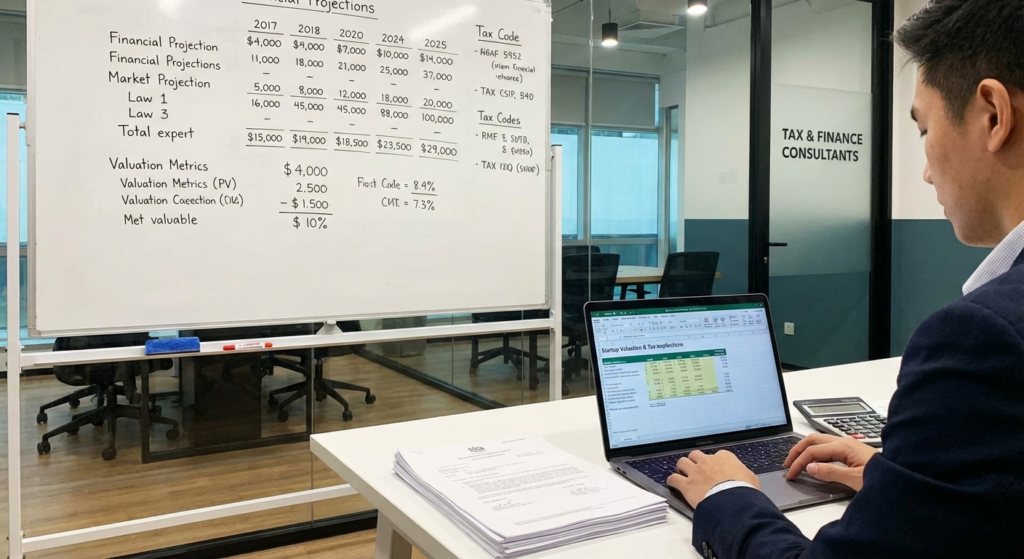

Valuation Methods to Mitigate Startup Valuation Tax Risks

To defend your share price against startup valuation tax scrutiny, you must use an authorized valuation method. The Income Tax Rules generally prescribe two main methods for determining FMV:

- Net Asset Value (NAV) Method: This is based on the book value of assets minus liabilities. For startups with low tangible assets and high intellectual property, this method often results in a very low FMV, leading to a higher risk of startup valuation tax.

- Discounted Cash Flow (DCF) Method: This is the preferred method for startups. It values the company based on future cash flow projections. Since startups rely on future growth, DCF usually yields a higher FMV, bridging the gap between tax value and investment price.

Why DCF is Critical for Startup Valuation Tax

Using the DCF method allows you to justify a high premium. However, the projections used must be realistic. If a startup projects massive revenues to get a high valuation report but fails to meet them significantly, the tax officer may treat the valuation report as flawed and demand startup valuation tax retrospectively.

It is mandatory to obtain a valuation report from a Merchant Banker for the DCF method (Chartered Accountants are restricted to NAV in certain contexts). This adds a layer of credibility but also cost.

The Impact of Foreign Investment on Startup Valuation Tax

Historically, the "Angel Tax" provision applied primarily to investments from Indian residents. However, recent amendments have widened the net. Now, even investments from non-resident investors can fall under the ambit of startup valuation tax if the pricing is not aligned with Foreign Exchange Management Act (FEMA) guidelines and Income Tax norms.

While FEMA sets a "floor price" (you cannot sell below this to foreigners), the Income Tax Act sets a "ceiling price" (you cannot sell above this without tax consequences under Section 56). Navigating the narrow corridor between these two regulations is essential to avoid startup valuation tax.

Documentation and Compliance Strategies

Avoiding startup valuation tax disputes requires meticulous documentation. Tax officers often look for discrepancies in the data provided during the valuation exercise versus the actual performance. While business unpredictability is understood, wild variances without justification can be problematic.

Furthermore, general compliance hygiene is vital. Errors in other filings can trigger a wider audit. For instance, ensure you are aware of common income tax filing mistakes to avoid, as a clean record builds trust with tax authorities.

Checklist to Avoid Startup Valuation Tax Issues

1. Merchant Banker Report

Always obtain a DCF valuation report from a SEBI-registered Merchant Banker before allotting shares.

2. DPIIT Recognition

Apply for Startup India recognition. Recognized startups are often exempt from Section 56(2)(viib) upon filing Form 2.

3. Justifiable Projections

Ensure your financial projections are grounded in market reality, not just wishful thinking.

4. Board Minutes

Maintain detailed minutes of board meetings where the valuation and share price were discussed and approved.

Section 68: The Other Side of Startup Valuation Tax

While Section 56 focuses on valuation, Section 68 focuses on the source of funds. If a startup cannot satisfactorily explain the source of the investor’s funds, the entire investment can be taxed at a flat rate of 60% (plus surcharge), which is far more punitive than the standard startup valuation tax.

To mitigate this, startups must maintain a “valuation folder” containing KYC documents of investors, their ITR acknowledgments, and bank statements proving creditworthiness. This is often referred to as establishing the Identity, Genuineness, and Creditworthiness (IGC) of the transaction.

Conclusion

The ecosystem of startup valuation tax is intricate, balancing the need for capital against the government’s need to prevent tax evasion. For a founder, the key takeaway is that valuation is not just a commercial negotiation; it is a statutory compliance exercise. By utilizing the Discounted Cash Flow method, engaging reputable Merchant Bankers, and securing DPIIT recognition, you can significantly reduce the risk of your capital being eroded by taxes.

Always consult with a specialized tax advisor before closing a round. The cost of compliance is always lower than the cost of litigation. For more detailed regulatory frameworks, you can refer to the Income Tax Department of India or the Startup India Hub.

Frequently Asked Questions

The primary trigger is issuing shares at a price that exceeds the Fair Market Value (FMV) as determined by tax rules. The excess amount is treated as income and taxed.

Startups can avoid Angel Tax by registering with DPIIT and filing Form 2 for exemption. Additionally, ensuring the share price is backed by a valid Merchant Banker valuation report using the DCF method helps justify the premium.

Yes, recent amendments have brought non-resident investors under the scrutiny of valuation norms. The price issued to them must align with FMV to avoid tax implications, although specific exemptions exist for certain notified entities.

NAV (Net Asset Value) is based on historical book value, often resulting in lower valuations. DCF (Discounted Cash Flow) is based on future earnings potential, usually allowing for higher valuations which helps in avoiding tax on share premiums.

If the Assessing Officer rejects your valuation report, they may recalculate the FMV (often using NAV), treat the difference as income, and demand tax along with interest and potential penalties.