Running a successful business is about more than just revenue models and marketing strategies; it is deeply rooted in adhering to the legal framework of the land. For any registered entity, maintaining roc compliance India is not just a statutory obligation but a badge of credibility. The Registrar of Companies (ROC), under the Ministry of Corporate Affairs (MCA), mandates specific reporting standards to ensure transparency and accountability in the corporate sector.

Whether you are running a Private Limited Company, a One Person Company (OPC), or a Public Limited Company, navigating the labyrinth of roc compliance India can be daunting. Missing a deadline doesn’t just result in financial penalties; it can lead to the disqualification of directors and even the striking off of the company’s name. In this comprehensive guide, we will break down the essential rules, forms, and due dates you need to know to keep your business on the right side of the law in 2026.

Why ROC Compliance India is Non-Negotiable for Businesses

Many entrepreneurs view compliance as a tedious administrative burden. However, adhering to roc compliance India regulations serves a much higher purpose. It builds trust among stakeholders, including investors, banks, and customers. When a company’s master data is up-to-date on the MCA portal, it signals operational health and legal integrity.

Furthermore, the government has become increasingly vigilant. With the automation of the MCA 21 portal, non-compliance is detected almost immediately. The primary goal of roc compliance India norms is to protect the interests of shareholders and ensure that the company is not being used for illegal activities. A compliant company finds it easier to secure loans, attract venture capital, and participate in government tenders.

The Annual ROC Compliance India Checklist for 2026

Every company registered in India must follow a strict calendar of events. Unlike event-based compliance, which happens only when a specific change occurs, annual compliance is mandatory regardless of turnover or activity status. Below are the key components of the annual roc compliance India framework.

1. First Board Meeting

For newly incorporated companies, the first meeting of the Board of Directors must be held within 30 days of registration. For existing companies, at least four board meetings must be conducted annually, with a gap of not more than 120 days between two consecutive meetings. Proper minutes must be recorded to satisfy roc compliance India standards.

2. Disclosure of Interest by Directors (MBP-1)

Every director is required to disclose their interest in other entities. This is done using Form MBP-1 at the first board meeting of every financial year. This ensures transparency and prevents conflict of interest, a core tenet of roc compliance India.

Form AOC-4

Purpose: Filing of Financial Statements.

Deadline: Within 30 days of the Annual General Meeting (AGM).

Key Content: Balance Sheet, Profit & Loss Account, Directors’ Report.

Form MGT-7 / MGT-7A

Purpose: Filing of Annual Returns.

Deadline: Within 60 days of the Annual General Meeting (AGM).

Key Content: Shareholding pattern, debentures, turnover details.

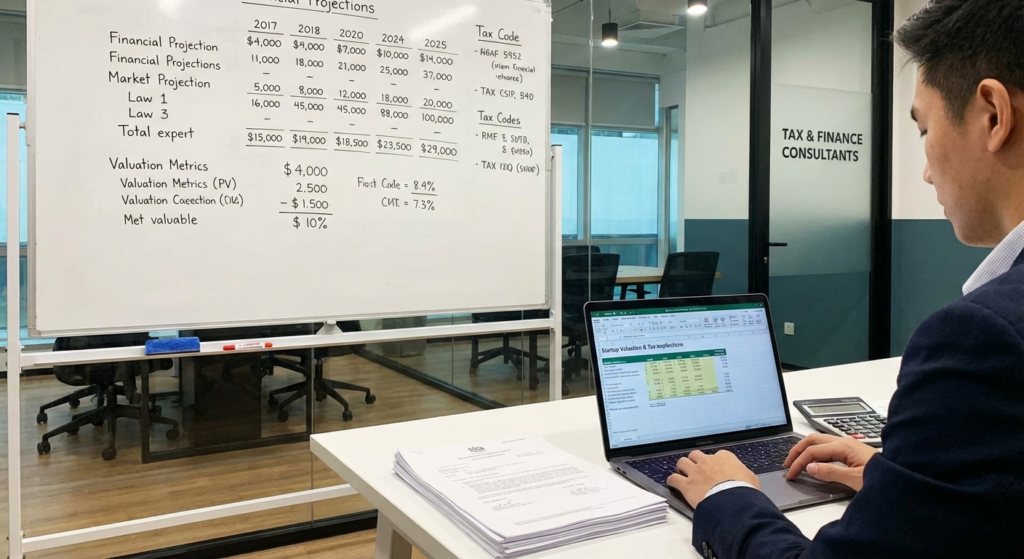

3. Filing Financial Statements (AOC-4) in ROC Compliance India

One of the most critical steps in roc compliance India is the filing of financial statements. Form AOC-4 is used to file the Balance Sheet, Statement of Profit and Loss, and the Directors’ Report with the ROC. This provides a financial snapshot of the company to the public and regulators.

It is important to note that these financial statements must be audited by a practicing Chartered Accountant before filing. If you are a startup, ensuring your accounts are in order helps in leveraging various government schemes. You can learn more about how these registrations help in our guide on Startup India registration benefits and online application.

4. Annual Return (MGT-7) in ROC Compliance India

While AOC-4 focuses on financials, Form MGT-7 (or MGT-7A for small companies and OPCs) focuses on the management structure and shareholding pattern. This form validates the current standing of the company’s ownership. Accurate filing of MGT-7 is vital for maintaining roc compliance India status.

Event-Based ROC Compliance India: What You Need to Know

Apart from the annual rituals, companies must file returns whenever specific events occur. Ignorance of these triggers is a common reason for penalties in the roc compliance India ecosystem.

- Appointment or Resignation of Directors (DIR-12): Whenever a director joins or leaves the board, Form DIR-12 must be filed within 30 days.

- Change of Registered Office (INC-22): Moving your office? You must inform the ROC within 30 days using Form INC-22.

- Increase in Authorized Capital (SH-7): If you plan to issue more shares than your current limit allows, you must first increase the authorized capital and file SH-7.

- Creation or Satisfaction of Charges (CHG-1/CHG-4): When a company takes a secured loan from a bank, a ‘charge’ is created on its assets. This must be registered with the ROC.

Consequences of Failing ROC Compliance India Norms

The Ministry of Corporate Affairs has become stringent with roc compliance India enforcement. The consequences of non-compliance are no longer just monetary; they threaten the very existence of the business.

Monetary Penalties

Late filing fees have increased significantly. For example, if you delay filing the annual return, the additional fee is calculated per day. For small companies, this might be manageable initially, but for larger entities or prolonged delays, the costs can run into lakhs.

Director Disqualification

Under Section 164(2) of the Companies Act, 2013, if a company fails to file financial statements or annual returns for three consecutive years, the directors of that company are disqualified from being appointed in other companies for five years. This is a severe blow to any professional’s career, highlighting the gravity of roc compliance India.

Strike Off and Asset Freezing

The ROC has the power to strike off (remove) a company’s name from the register if it believes the company is not carrying on any business. Once struck off, the bank accounts are frozen, and the directors become personally liable for the company’s debts.

Additionally, financial discipline extends beyond just filing forms. For instance, companies must ensure they pay their MSME vendors on time to avoid tax disallowances. Understanding rules like the MSME 45 days rule and Section 43B(h) compliance is just as crucial as filing your ROC forms.

Best Practices for Maintaining ROC Compliance India

To ensure you never falter on your roc compliance India obligations, consider adopting the following best practices:

Maintain a Compliance Calendar

Set alerts for all due dates (AGM, Board Meetings, Filing Dates) at the start of the financial year.

Professional Assistance

Engage a Company Secretary (CS) or a CA. Professional oversight minimizes errors in roc compliance India.

Digital Signature Validity

Ensure the Digital Signature Certificates (DSC) of all directors are active and not expired.

Conclusion

Navigating the waters of roc compliance India requires vigilance, discipline, and a proactive approach. It is not merely a legal mandate but a strategic advantage that enhances your company’s reputation and operational longevity. By adhering to the checklists provided and understanding the severe implications of non-compliance, you safeguard your business against avoidable legal hurdles.

Remember, the cost of compliance is always lower than the cost of non-compliance. Stay updated with the latest notifications from the Ministry of Corporate Affairs and ensure your business remains a law-abiding corporate citizen. For detailed legal text, you can always refer to the Companies Act, 2013.

FAQs

The penalty for late filing of annual forms like AOC-4 and MGT-7 includes an additional fee of ₹100 per day of delay. This applies continuously until the form is filed, and there is no maximum cap on this additional fee.

Yes, if a company fails to commence business within one year of incorporation or does not carry out business for two preceding financial years without applying for dormant status, the ROC can strike off the company name from the register.

Yes, ROC compliance is mandatory for OPCs. However, they have certain relaxations, such as not being required to hold an Annual General Meeting (AGM). They must still file Form AOC-4 and MGT-7A annually.

For the first year, the AGM must be held within 9 months from the closing of the first financial year. For subsequent years, it must be held within 6 months from the end of the financial year (i.e., by September 30th) and not more than 15 months after the previous AGM.

While small companies are not mandated to employ a full-time Company Secretary, all companies must sign their annual returns (MGT-7) via a practicing Company Secretary if they meet certain paid-up capital or turnover thresholds. Professional guidance is highly recommended to ensure accuracy.